SEC confirms three spot XRP ETF files. What is the future trend of XRP?

Reprinted from jinse

02/21/2025·2MAuthor: Biraajmaan Tamuly, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

After the cryptocurrency market declines, XRP prices have risen more than 15% since closing at $2.32 on February 6. While most altcoins have difficulty in achieving recovery, XRP’s weekly chart is praised for its bullish outlook.

SEC begins to recognise XRP ETF

XRP's recent bullish activity may be related to its ETF news, and the SEC has confirmed that CoinShares has filed another spot ETF document through Nasdaq. This is the fourth spot XRP ETF document initially approved by the SEC after Grayscale, 21Shares and Bitwise. The committee also confirmed the ETF documents on behalf of WisdomTree and Canary Capital, according to Cointelegraph.

Brazilian Securities Commission Comissão de Valores Mobiliários also approved the country's first spot XRP ETF launched by the Hashdex Nasdaq XRP Index Fund. However, spot ETFs have not yet begun trading, and Hashdex announced that it will release more details soon.

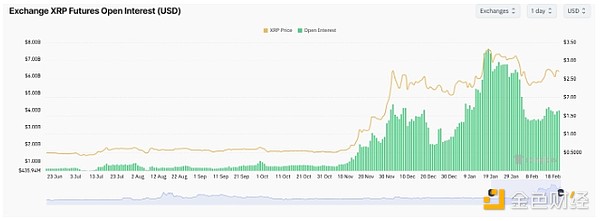

Despite positive catalysts, XRP futures traders have not returned yet. Earlier this month, it was reported that XRP open contracts (OIs) fell more than 78% last week after XRP prices fell 26% in the first week of February.

XRP Futures Open Contract Chart. Source: CoinGlass

While prices have risen nearly 20% since the plunge, XRP Futures OI has risen only $600 million after its nominal value fell by nearly $4 billion. This means that relatively low volume or trading activity controls the current price movement, which may be vulnerable to manipulation and volatility.

Analysts predict XRP will reach $6 "candle"

With XRP recovering faster than other major altcoins, anonymous cryptocurrency commentator Polly believes market makers are preparing for record highs in crypto assets.

The cryptocurrency trader noted that the SEC-Ripple lawsuit will end by the end of February. This will trigger a "candle" for the asset, bringing XRP to a high of $6 in the next 10 days. However, this prediction is based on an important assumption, as neither the SEC nor Ripple formally confirmed any case resolution.

While Polly’s prediction is a bit outrageous, XRP market analyst Dom stressed that XRP’s current resistance range between $2.50 and $2.80 is still a key node. The analyst explained that XRP’s all-time highest volume-weighted average price (VWAP) continues to act as an overhead resistance for the token, currently just above $2.80.

Dom's analysis of XRP for 6 hours. Source: X.com

Therefore, breaking through $2.80 and closing the position is the first hurdle XRP is currently facing, after which XRP aims to hit an all-time high or retest its current high of $3.40.

panewslab

panewslab

chaincatcher

chaincatcher