RWA Harvest Year, Harvest and Outlook of a Top Project in a Track

Reprinted from panewslab

02/13/2025·2M

Author: Weilin, PANews

2024 is an important year for the real-world asset (RWA) tokenization field of the real estate industry, especially as this field’s increasingly integrated with Web3 technology. As one of the leading projects in this field, Propy has achieved many achievements. Since launching PropyKeys in Base in March, Propy has successfully minted more than 285,000 property addresses, driving the digital transformation of real-world assets. PropyKeys integrates Chainlink automation on BuiltOnBase to provide secure staking rewards, and there will be more developments in the future.

In addition, PropyCoinbase jointly launched a hosting service, providing a safer and more efficient solution for real estate transactions.

Looking ahead to 2025, Propy is accelerating its global strategic plan. Propy has launched a new on-chain real estate loan product that allows buyers to obtain instant on-chain loans by using BTC as collateral, thereby unlocking scalability. This move removes barriers for consumers to own real estate and enables buyers to buy real estate using USDC, ETH or BTC, while also offering the option of 100% instant cryptocurrency-enabled loans. This product makes real estate transactions more convenient and smooth, and is true to Propy's founding mission.

Building on this success, Propy is currently actively seeking loan partners to further expand its crypto-backed loan model. Through collaboration with innovative lenders, Propy aims to create more opportunities for buyers and make real estate ownership more popular, making it possible through blockchain technology.

2024 transcript: Launch PropyKeys, reach multiple cooperations, and lead

the team to add heavyweights

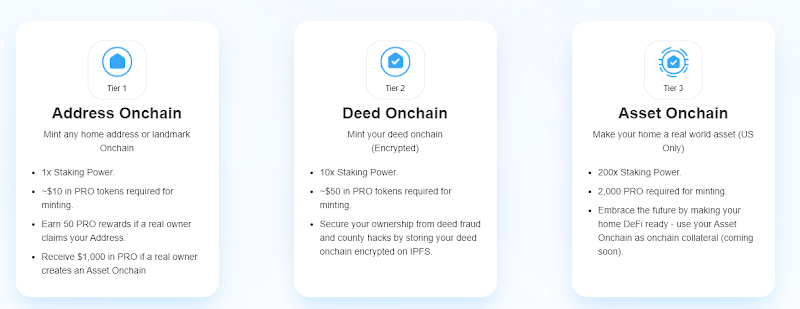

In 2024, Propy made breakthroughs in multiple fields. In March, Propy's innovative product PropyKeys was officially launched on Base, allowing users to cast digital addresses and contracts for real-world real estate, and has been cast more than 285,000 times so far. The landmark NFT casting and a novel pledge mechanism generated by PropyKeys AI create a gamified experience that makes home ownership more accessible, safe and interactive.

Subsequently, Propy successfully deployed Chainlink Automation technology to distribute staking rewards. After PropyKeys integrates Automation, Automation allows developers to automate functions on key chains at fixed time intervals or in response to external events. Based on Chainlink Automation, Propy implements highly reliable, high-performance and decentralized automation, and transactions can be quickly identified and confirmed even during periods of severe network congestion.

In addition, Propy has also announced a strategic partnership with decentralized real estate derivatives agreement Parcl to enhance the quality of on-chain real estate analysis and valuation. Propy uses Parcl's API to improve valuation and analysis capabilities related to PropyKeys.

In terms of user experience, Propy and Coinbase have partnered to launch third-party custody services for cryptocurrency. If a home buyer holds Bitcoin, he or she can safely put it in custody through Propy's certified property custody service to conduct real estate transactions and redeem it only when the transaction is completed. This avoids unnecessary fees and taxes.

Propy is also constantly strengthening team building, and the board welcomes two heavyweights: former SEC specialist, financial regulatory expert Dr. Michael Piwowar and Coindesk Chief Content Officer, Blockchain pioneer and media veteran Michael Casey.

Over the past year, Propy has been widely recognized by the industry. Propy was cited by the Messari blockchain report and participated in several high-spec events, triggering discussions on blockchain property rights by Vitalik Buterin at the EthCC meeting. Through technological innovation and leadership, Propy CEO Natalia Karayaneva won the 2024 Inman Best Real Estate Technology Award "Entrepreneur" award.

Propy also hosted Propy Summit 2024. This is not just a summit, but also a microcosm of jointly building the future. The event brings together leading innovators and visionaries in blockchain and real estate, including Senator Cynthia Lummis, Mayor Francis Suarez, Tim Draper, Anthony Scaramucci and many other industry leaders.

Vision 2025: Launch RWA on-chain assets, launch DeFi loans, expand to

global markets

In this new year, Propy will expand blockchain real estate solutions and has launched its DeFi lending program in the first quarter.

Propy will accelerate the layout of the US market and plans to become a national blockchain property and custody company by the end of the year. By obtaining more licenses and advancing its blockchain-based settlement services, Propy is expected to become the first property and hosting provider in the United States to fully obtain a blockchain license. According to a report by research firm IBISWorld, the U.S. title insurance market is worth $22.6 billion in 2023. Meanwhile, data from software company Debut Infotech predicts that blockchain adoption in real estate is expected to grow at a CAGR of 64.8% until 2028. Propy is ready to lead the industry in this new era, bringing greater efficiency, transparency and innovation.

From the perspective of Propy tokens, PRO will become an asset that receives double positive benefits in the US real estate and crypto markets. With new policies to be introduced by the U.S. government, including proposals to cancel capital gains tax on domestic crypto transactions, the U.S. could become the next major crypto hub. Currently, crypto investors face a 20% long-term capital gains tax or a maximum of 37% short-term capital gains tax, depending on the holding period and income level. According to Investing in the Web, 13.22% of Americans (about 44.96 million) now own cryptocurrencies, and real estate is increasingly seen as a way to diversify crypto portfolios. The elimination of capital gains tax will significantly increase the number of cryptocurrency and real estate transactions.

As the first blockchain-based real estate token in the United States, PRO tokens will drive the adoption of cryptocurrencies in RWA transactions and inspire investors to invest in cryptocurrencies, supporting a wider ecosystem of tokenized real estate.

At the same time, Propy will also launch a global expansion plan to enter the non-US market, and is expected to announce relevant news in the first quarter of 2025. This expansion is just right, especially in areas such as Asia and Latin America where property fraud is rampant. For example, in India, 66% of civil cases are caused by real estate disputes, while in Indonesia, about 40% of real estate documents are affected by fraud. Similarly, Argentina faces long-term property corruption and non-standard documents, with historically unreliable registration systems and bureaucratic transparency issues that weaken property rights and hinder economic progress.

Through blockchain technology, Propy solves the need for trust, efficiency and integrity in real estate governance. For governments facing outdated systems and public distrust, Propy's technology provides a path to modernization and accountability that simplifies processes while protecting civil rights. As countries seek to attract foreign investment, increase transparency, and align with global best practices, they are increasingly willing to work with innovators like Propy.

On January 29, Propy launched a new loan option to support mortgage crypto assets to purchase Hawaiian apartments. The apartment starts at 250,000 USDC, and as an on-chain RWA asset, buyers can skip the traditional 30-day transaction process to enable almost instant transactions by paying for cryptocurrencies. If buyers are reluctant to sell mainstream crypto assets, they can also choose to borrow Bitcoin or Ethereum as collateral to complete payment, and they will pay a 10% loan interest rate.

This is a two-year loan. If the value of the provided cryptocurrency falls by more than 50%, buyers need to add margin; in the worst case, cryptocurrency assets may be liquidated and real estate will be auctioned and resale. However, if the cryptocurrency price doubles, buyers can easily pay off their loan with their earnings. Interest payments and loans themselves can be repaid through Bitcoin, Ethereum or USDC. This provides an attractive option for buyers who want to retain their crypto assets.

On February 2, Propy announced the successful sale of Hawaii's first on-chain real estate asset - through multiple on-chain quotes, and finally completed the transaction through the first Bitcoin-backed loan.

In addition, Propy has expanded its services and is partnering with real estate developers to provide comprehensive property and custody solutions tailored specifically for their residential projects.

In terms of community building, Propy will also launch the "Web3 Property Rights - Trailblazer Spotlight" series, showing industry innovation leaders every week. A series of weekly shows will be launched to highlight pioneers who believe that the world can be changed by putting property rights on the chain. From blockchain innovators and investors to tech thinkers, this series will showcase individuals driving change.

Looking back at 2024, Propy not only achieved many breakthroughs in tokenization in the real estate sector, but also helped the industry redefine the ownership and value of assets. In 2025, with the launch of RWA on-chain assets and the launch of the DeFi loan program, Propy may continue to promote innovation and change in the global real estate market in 2025.

jinse

jinse