Return to Trump: Who can solve the dilemma of US debt?

Reprinted from panewslab

01/24/2025·5MAuthor: Hedy Bi , Jason Jiang | OKG Research

introduction

Trump’s re-election will push the close intertwining of politics and economics to an unprecedented level. This " Trump phenomenon " is not only a reflection of his leadership style, but also symbolizes the comprehensive reshaping of economic interests and political power. In the context of economics, this complex structural shift is called " political economy intertwining " . As the world 's largest economy and the issuer of reserve currency, every policy adjustment in the United States will be a benchmark for global capital flows. Looking forward to 2025 , with the Trump administration’s acceptance of the encryption field, the chain reaction of “ Trumpomics ” will extend to the on-chain world more quickly, and the encryption market is rapidly leaping from fringe innovation to an important market in global finance. one.

OKG Research has specially planned to launch a series of special topics on " Trump Economics " to provide in-depth analysis of the core logic and future trends of this process. The first article "Trump Re-elected: Bitcoin, Oil and Gold in the New Deal Economic Era" focuses on the impact of Bitcoin on the international financial landscape. This article starts with U.S. debt, a traditional financial core asset, and provides an in-depth analysis of the U.S. debt market with a scale of up to 36 trillion U.S. dollars. How to use blockchain technology and tools in the encryption field to further consolidate and expand the role of the U.S. dollar in the global financial system. dominant position.

Coinbase CEO Brian Armstrong said in a recent interview during the World Economic Forum in Davos, Switzerland that the upcoming U.S. Stablecoin Act may require issuers to fully support U.S. dollar-denominated stablecoins with U.S. Treasury bonds. Although we believe that unless excess reserves are required, the possibility of requiring 100% U.S. debt based on the role of cash reserves is not high, Armstrong's expression still reflects the crypto market's demand and favor for U.S. debt.

The "growth rate" of the U.S. debt market is astonishing: it took more than 200 years to go from zero to the first trillion US dollars, but it only took 40 years to grow from US$1 trillion to US$36 trillion. The root cause of this astonishing change was the abolition of the gold standard by the Nixon administration in 1971, which led to the decoupling of the U.S. dollar from gold and the beginning of an era of unlimited money printing. The U.S. debt problem also spiraled out of control.

While U.S. debt is rapidly "expanding", OKG Research has observed that investors who have long been accustomed to " paying " for the 36 trillion U.S. debt market are gradually losing interest in investing. The chain may be the key to revitalizing U.S. debt in the future. New markets.

U.S. debt HARD model begins in 25 years

In 2025, the U.S. debt market will enter HARD mode, with nearly $3 trillion in government bonds expected to mature, most of which will be short-term government bonds. In 2024, the U.S. Treasury Department’s net issuance has reached US$26.7 trillion, a year-on-year surge of 28.5%.

Especially in the context of Trump's return to the political stage, his stance toward loose monetary policy may exacerbate market uncertainty. Trump has repeatedly pressured the Federal Reserve to cut interest rates during his tenure, viewing interest rate policy as a core tool to stimulate the economy and boost market confidence. If he succeeds in pushing for an interest rate cut, it may not only significantly lower U.S. bond yields and weaken the attractiveness of U.S. bonds to overseas investors, but may also intensify the pressure on the dollar to depreciate, thereby impacting the global foreign exchange reserve allocation pattern. At the same time, Trump’s policy orientation centered on economic growth may push the government to increase fiscal spending and further expand the fiscal deficit, putting pressure on the supply side of U.S. debt.

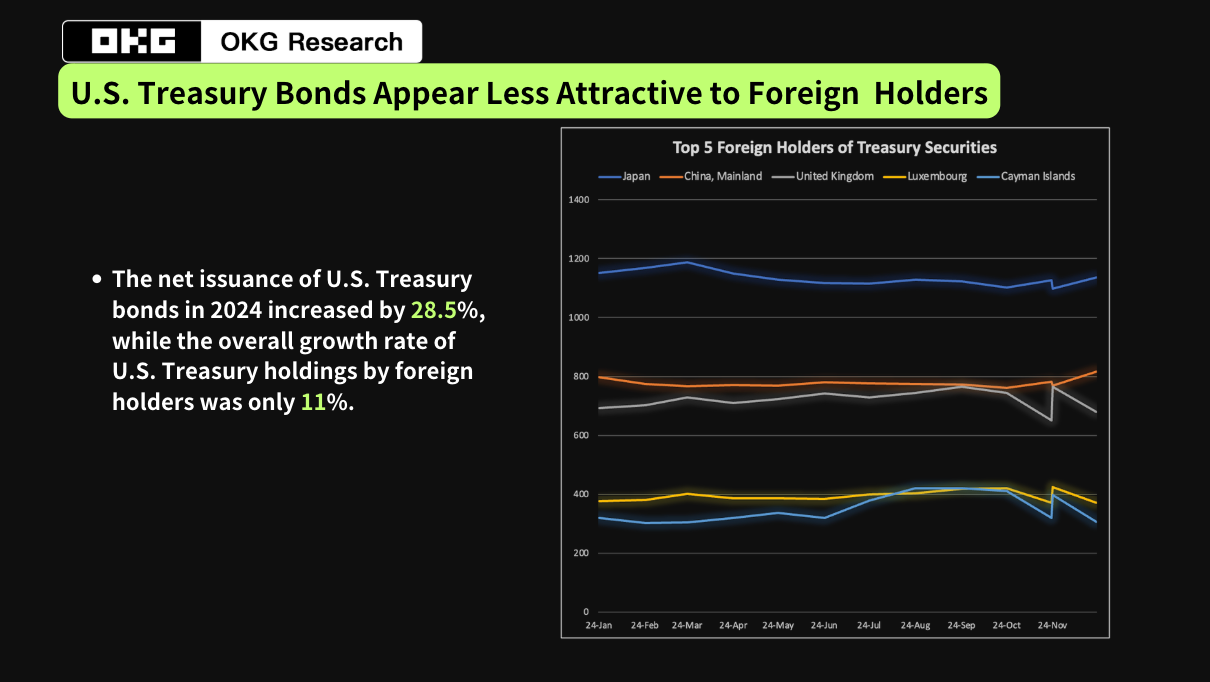

However, on the demand side, especially from overseas central banks, U.S. Treasuries appear to be becoming less attractive. According to the latest statistics from OKG Research , the growth rate of overseas central banks ' increase in U.S. bond holdings only reached 11% , which did not exceed the growth rate of U.S. bond issuance ( 28.5% ). Among the top 20 countries that hold U.S. debt, only France (35.5%), Singapore (31%), Norway (40%), and Mexico (33%) have increased their holdings of U.S. debt faster than the amount of U.S. debt issued in 24 years. speed.

Not only that, some overseas central banks are taking the initiative to reduce their holdings of U.S. debt. Since April 2022, China's U.S. bond holdings have continued to fall below US$1 trillion, and in September 2024 they will reduce their holdings by another US$2.6 billion to US$772 billion. In the same month, Japan reduced its holdings by US$5.9 billion to US$1,123.3 billion. Although it is still the largest overseas creditor of US debt, its holdings also declined again. As the demand for diversification of foreign exchange reserves in various countries increases, overseas demand for U.S. debt has weakened significantly.

The combination of rapid growth in debt scale and continued weakening of overseas demand will make the U.S. debt market face dual challenges , and an increase in risk premiums is almost inevitable. In the future, if the market fails to effectively absorb these debts, it may trigger larger financial fluctuations.

Crypto markets may be providing innovative answers on how to effectively absorb this debt.

Stablecoins may become the world’s top 10 **U.S. debt

holders** in 2025

As one of the safest assets in the world, U.S. Treasuries are playing an increasingly important role in the crypto market. Among them, stablecoins are the main vehicle for U.S. debt to penetrate the crypto market. Currently, more than 60% of on-chain activities are related to stablecoins, and most mainstream stablecoins choose U.S. debt as their main collateral.

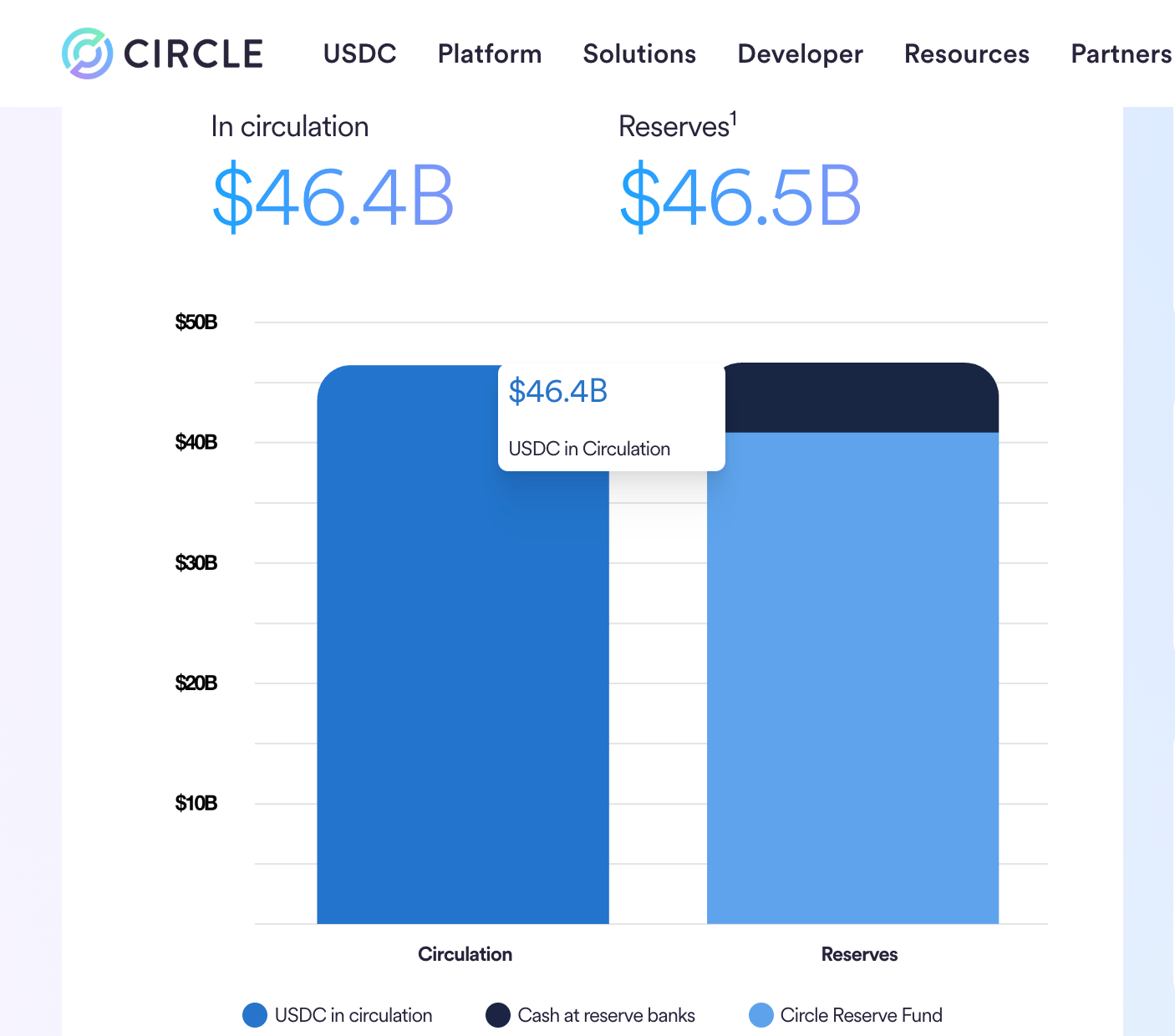

Take the world's two largest stablecoins USDC and USDT as examples. Their issuance mechanisms require 1:1 mortgage of high-quality assets, among which U.S. debt occupies a major position. As of now, the scale of U.S. debt pledged by USDC has reached more than 40 billion U.S. dollars, and the scale of U.S. debt pledged by USDT has exceeded $100.7 billion. The current scale of stablecoins alone absorbs about 3% of the short-term U.S. debt that is about to mature. This proportion has surpassed Germany and Mexico and is enough to rank 19th in the ranking of U.S. debt holdings by overseas central banks .

|

|

---|---

Although the Trump administration is expected to establish a strategic reserve of Bitcoin, attract international capital to flow into Bitcoin through government bets, push the price of Bitcoin to continue to rise, and then make profits through market operations to reduce debt pressure. This method can theoretically contribute to specific financial plans or interest payments, but even if the price rises to 200,000 US dollars in the future, the total market value of Bitcoin exceeds 4 trillion, and the United States will continue to purchase 1 million coins from now on. The future revenue is only about 100 billion US dollars.

Unlike Bitcoin’s indirect debt, stablecoins such as USDT and USDC are creating direct demand for U.S. debt. The market value of stablecoins exceeded US$210 billion on January 22, setting another record high. Thanks to the acceleration of U.S. legislation and the continued increase in the adoption rate of global stablecoins, OKG Research optimistically estimates that the market value of stablecoins will exceed US$ 400 billion in 2025 , and the resulting demand for new US debt will exceed US$ 100 billion. Therefore, stablecoins may Become one of the top 10 U.S. debt holders in the world by 2025 .

If this development trend can be maintained, stablecoins will become the most important " invisible pillar " of the U.S. debt market , and the direct demand for U.S. debt they create will exceed the indirect returns that investing in Bitcoin can bring . Bitwise senior investment strategist once stated on social media that the holdings of U.S. Treasury bonds in stablecoins may soon grow to 15%. A previous report released by the U.S. Department of the Treasury also pointed out that the continued growth of stablecoins will create structural demand for U.S. short-term Treasury bonds.

As Trump's policies to stimulate the economy are implemented, stablecoins and a small portion of the U.S. dollar and most of the U.S. debt anchored behind them will also become a new type of U.S. dollar expansion. Since the U.S. dollar is the global reserve currency, overseas central banks and institutions generally hold U.S. debt. The act of issuing U.S. debt actually uses U.S. credit to " export inflation , " indirectly making the world pay for its debt, thus achieving an effect similar to " expanding money supply . " This will not only strengthen the dollar's position, but will also pose challenges to other countries' regulation, especially taxation.

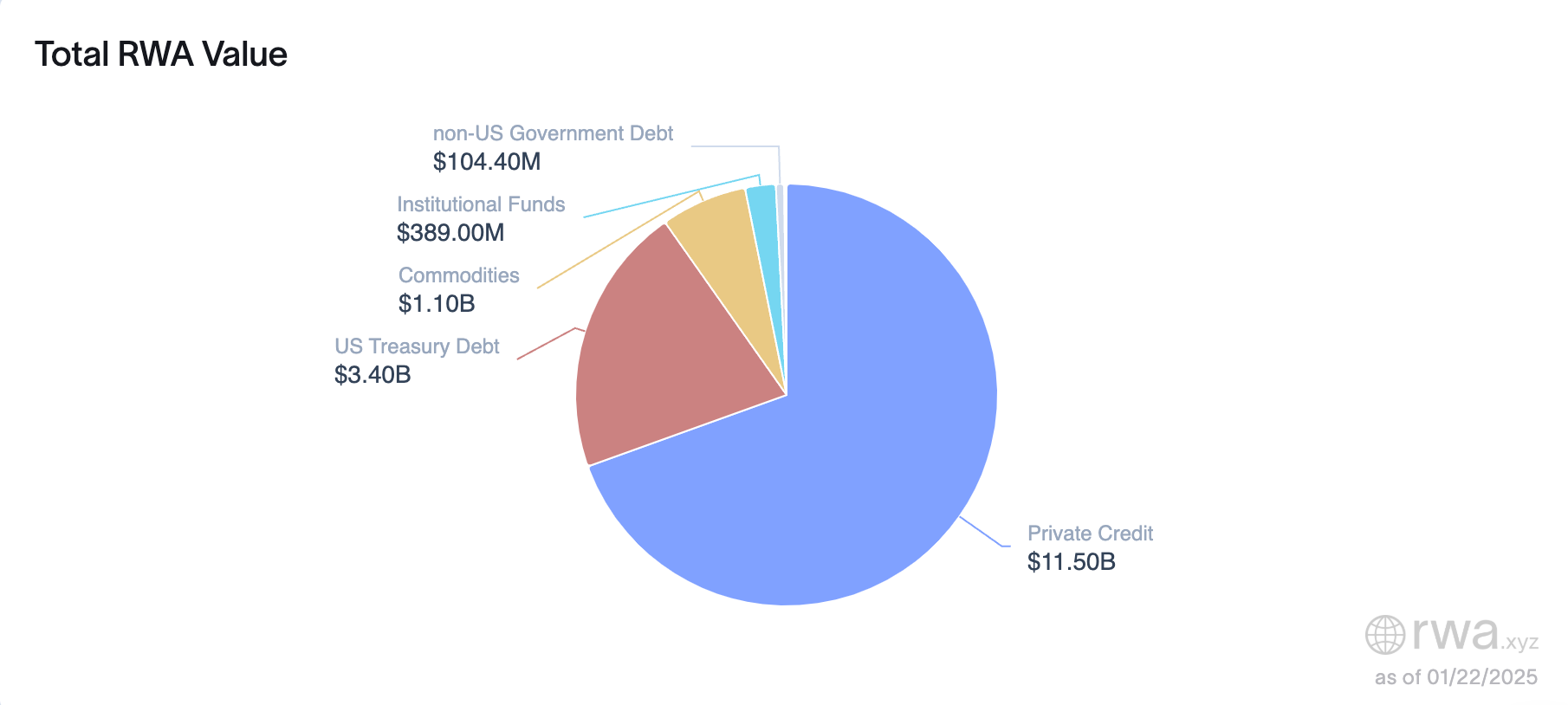

Massive tokenization brings global liquidity to U.S. debt

In addition to becoming the preferred underlying asset for mainstream stablecoins, U.S. Treasuries are also one of the most popular asset classes in the current wave of tokenization. According to RWA.xyz data, the size of the tokenized U.S. Treasury bond market was US$769 million at the beginning of 2024. By the beginning of 2025, the size had reached US$3.4 billion, achieving a growth of more than 4 times. This rapid growth not only reflects the potential of on-chain financial innovation, but also highlights the market’s recognition and demand for the tokenized form of U.S. debt.

Through tokenization, U.S. debt is rapidly penetrating DeFi. Whether it is using U.S. debt as an asset to generate risk-free returns on the chain, or conducting derivative transactions through pledges, loans, etc., the DeFi ecosystem is becoming more and more "down-to-earth". These tokenized U.S. bonds not only bring more reliable underlying assets, but also capture solid returns from reality and distribute the returns directly to on-chain investors. The short-term U.S. Treasury Bond Fund (OUSG) previously launched by Ondo once had a yield of 5.5%.

More importantly, after U.S. debt is put on the chain, it will provide traditional investors with a more familiar asset class, which will help attract continued inflows of institutional funds and further accelerate the maturity and institutionalization of the DeFi ecosystem. Projects that use tokenized U.S. debt can generally be considered “ low-risk innovation ” and will be more likely to obtain regulatory approval.

For U.S. debt, tokenization provides a new tool to alleviate debt pressure. Not only can U.S. debt enter the on-chain world, realize convenient cross-border transactions and cross-chain flows, and break the geographical restrictions of traditional financial markets; it can also open up a new buyer's market for U.S. debt and further enhance the global liquidity and attractiveness of U.S. debt. . The spread of this new on-chain liquidity may promote U.S. debt to become a core asset in global financial markets.

As the market generally expects that the frequency of interest rate cuts by the Federal Reserve may slow down in 2025 after Trump takes office, this has further pushed up the yields on short-term U.S. Treasury bonds and reduced market risk appetite, making investors prefer more stable investment targets. In the foreseeable future, we will see a larger scale of U.S. debt being put on the chain, and more projects based on tokenized U.S. debt will emerge in the DeFi ecosystem and gain favor from users and the market, gradually changing on-chain wealth management and investment. Way.

jinse

jinse

chaincatcher

chaincatcher