Retail investors sell American institutions to buy "secretly"

Reprinted from jinse

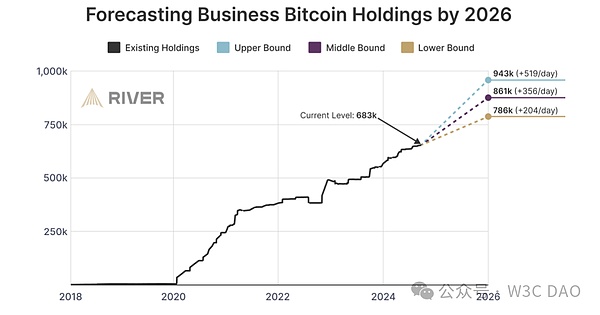

04/28/2025·14DA new report by Bitcoin technology and financial services company River predicts that some U.S. companies will increase their investment in Bitcoin (BTC) in the next 18 months.

American company entry

It is reported that about 10% of U.S. companies are expected to convert 1.5% of their treasury reserves (about $10.35 billion) into Bitcoin within the next year and a half.

River analysts also noted that traditional corporate financial strategies rely on cash and other short-term cash equivalents, and these assets have poor storage capacity. For this reason, River's analysis believes that:

“These investments can produce modest returns close to the federal funds rate (currently over 5%). However, even these short-term investments often fail to outperform inflation, reducing the value of Treasury bonds.”

The report notes that inflation erosion has also caused Apple (currently a trillion-dollar market capitalization) to lose $15 billion in bond holdings over the past decade.

MicroStrategy 's Corporate Financial Strategy

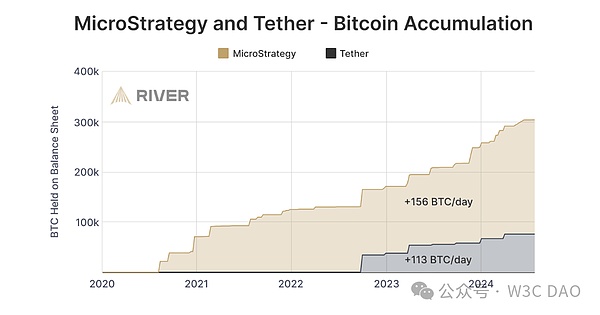

The analyst's forecast suggests that corporate financial strategies promoted by Michael Saylor, founder of MicroStrategy, will be adopted by more and more people.

In June 2024, MicroStrategy completed an additional $800 million in priority convertible notes debt sale at 2.25% interest rate, with maturity date of 2032. MicroStrategy purchased an additional 11,931 BTC using corporate debt funds.

Sailer defines Bitcoin as an asset that guarantees "economic immortality" for businesses and companies because the supply of Bitcoin is limited and there is no counterparty risk inherent in other storage means of value, such as real estate or stocks.

MicroStrategy's second-quarter financial report showed it currently holds 226,500 BTC, which was worth about $14.7 billion at the time.

Banks in the United States enter the market

Earlier, U.S. banking giant Wells Fargo disclosed investments in multiple Bitcoin ETFs, making it the latest big financial institution to join the cryptocurrency space.

The bank has purchased shares in Grayscale's GBTC spot Bitcoin exchange-traded fund (ETF) and also holds shares in Bitcoin ATM provider Bitcoin Depot Inc., according to filings with the U.S. Securities and Exchange Commission (SEC).

But the exposure is small, Wells Fargo invested $141,817 in GBTC, while its investment in ProShares is less than $1,200. Bitcoin Depot has exposure of only $99.

Not only that, BNP Paribas and Bank of New York Mellon have also invested heavily in Bitcoin ETFs. This shows that despite the small exposure, investment trends in traditional financial institutions are still growing.

Beyond Warren Buffett – a new era of corporate finance?

Saylor's BTC financial strategy allowed MicroStrategy to far outperform Warren Buffett's investment firm Berkshire Hathaway. MicroStrategy has risen more than 1,000% since adopting the Bitcoin financial strategy. By comparison, Berkshire Hathaway's share price rose 104.75% during the same period.

Buffett refuses to add Bitcoin to his portfolio or recommends Bitcoin as a means of preserving value against fiat inflation.