Research Report on the Public Chain Industry in January 2025: Bitcoin’s Dominance Strengthens

Reprinted from panewslab

02/18/2025·2MAuthor: Stella L ( stella@footprint.network )

Data source: Footprint Analytics Public Chain Research Page

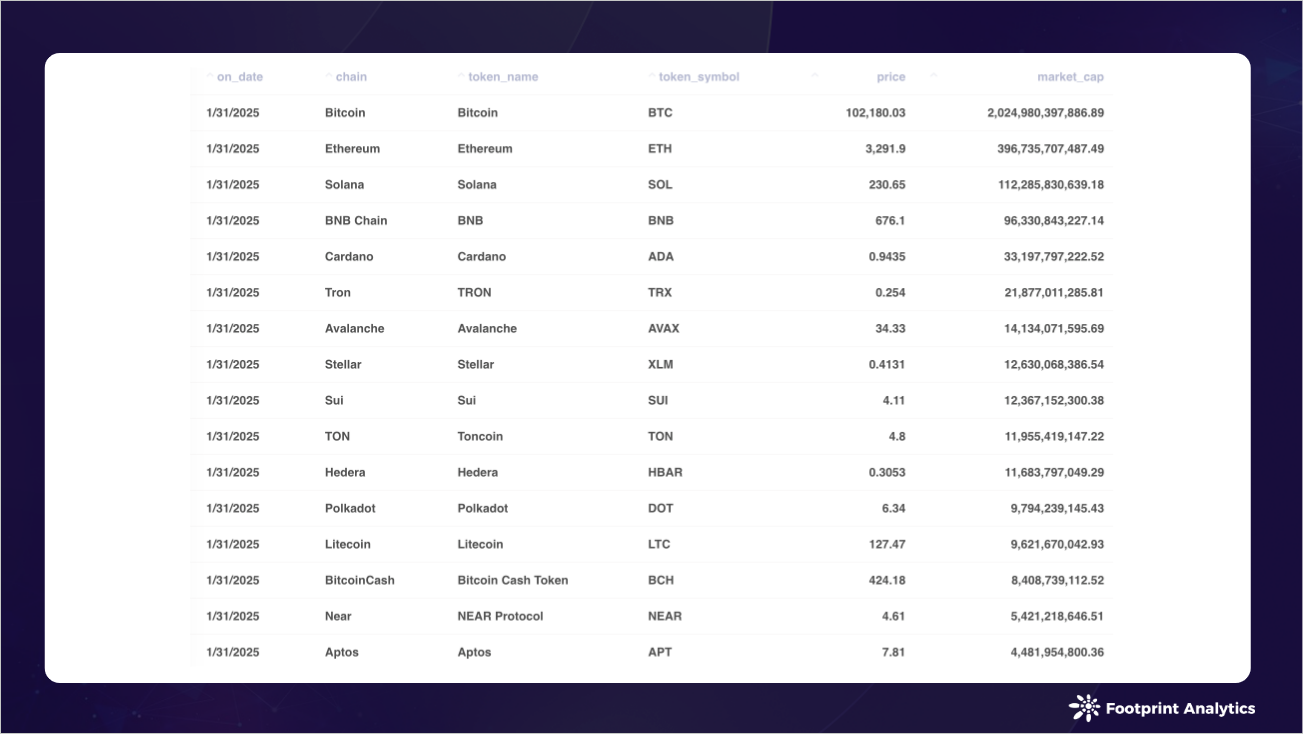

In January 2025, the total market value of the crypto market increased by 7.2% to US$2.8 trillion, with major blockchain platforms performing differentiatedly. Under the dual influence of new regulatory policies and breakthroughs in artificial intelligence infrastructure technology, Bitcoin strengthens its market dominance to 71.3%.

Market Overview

Bitcoin rose from $94,577 to $102,180, an increase of 8.0%. Ethereum, while its performance was weak, fell from $3,353 to $3,292, a drop of 1.8%, with the ETH/BTC ratio hitting a new low since September 2024.

Source: [Bitcoin and Ether price trends](https://www.footprint.network/@KikiSmith/BTC-ETH-Decentralized-Stablecoin-Market-Analysis?date_filter=2023-10-01~2025-01-31)

The development of a number of important policies has significantly affected the trend of the crypto market. The Trump administration’s executive order on cryptocurrency regulation provides unprecedented clear guidance for the industry, emphasizing the protection of self-custodial rights and supporting stablecoin development. However, Trump's remarks on international trade tariffs at the end of the month sparked concerns about global economic growth and market sentiment cooled down.

The Trump family’s $TRUMP and $MELANIA tokens launched on Solana have triggered drastic fluctuations in the Memecoin sector. This speculative boom has significantly distracted the market from other crypto sectors, including the blockchain gaming sector.

DeepSeek's breakthrough progress in the field of artificial intelligence has also affected market dynamics. This progress has accelerated the focus on decentralized AI infrastructure in the crypto ecosystem, with AI-related tokens rising this month.

Layer 1

In January 2025, the total market value of blockchain climbed 7.2% to US$2.8 trillion, and the dominance of the Bitcoin market further increased to 71.3%. Ethereum share continued to decline to 14.0%, while Solana once again surpassed BNB chains (3.4%) with a market share of 4.0%. Other public chains collectively account for 7.4% of the market share.

Data source: [Public chain token price and market value](https://www.footprint.network/@Higi/All-Chain-Overview?series_date=2025-01-01~2025-01-31)

Solana continued its strong performance, with market cap rising 22.0% to $112.3 billion, consolidating its position as the third largest blockchain in market cap.

Among the top 20 chains in market cap, Stellar performed well, with a sharp increase of $12.6 billion, while Litecoin and Monero rose 23.5% and 21.6% respectively. Cardano's market capitalization grew 11.9% to $33.2 billion.

Emerging platforms maintain their development momentum, and their market value is stable at US$12.4 billion in an environment of intensifying competition. TON's market value fell 14.0% to $12 billion, but it still maintained its top ten position. Hedera showed good growth, with market value rising 14.2% to $11.7 billion.

Traditional Layer 1 platforms such as Polkadot, Near and Aptos are under pressure, with market capitalization falling between 3.7% and 7.5%.

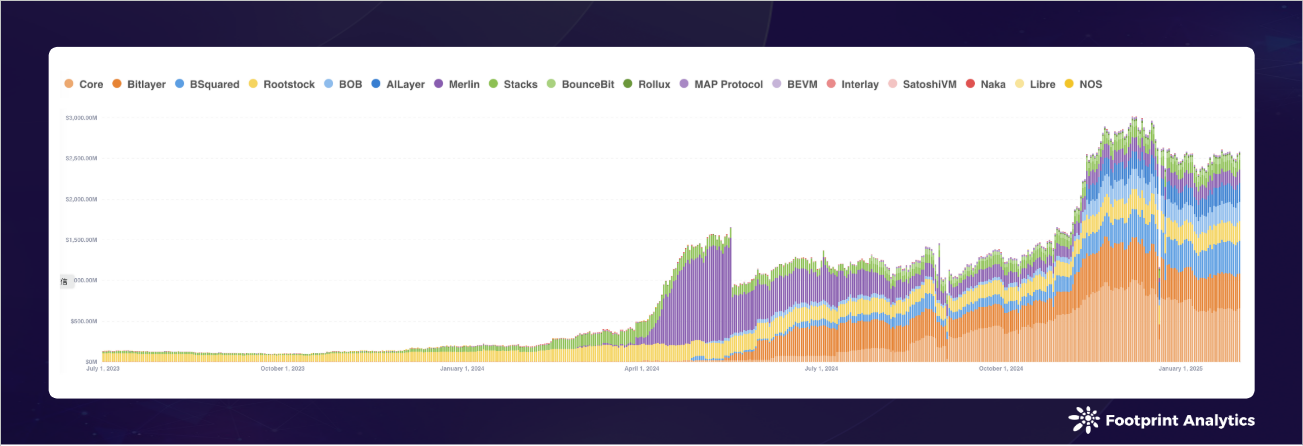

Bitcoin Layer 2 & Side Chain

In January 2025, Bitcoin Layer 2 and sidechains maintained growth trend, with total locked positions reaching US$2.6 billion, an increase of 5.2% from December.

Data source: [Overall trend of Bitcoin Eco-Public Chain TVL](https://www.footprint.network/@Higi/Bitcoin-Sidechain-TVL?series_date=2023-07-01~2025-01-31)

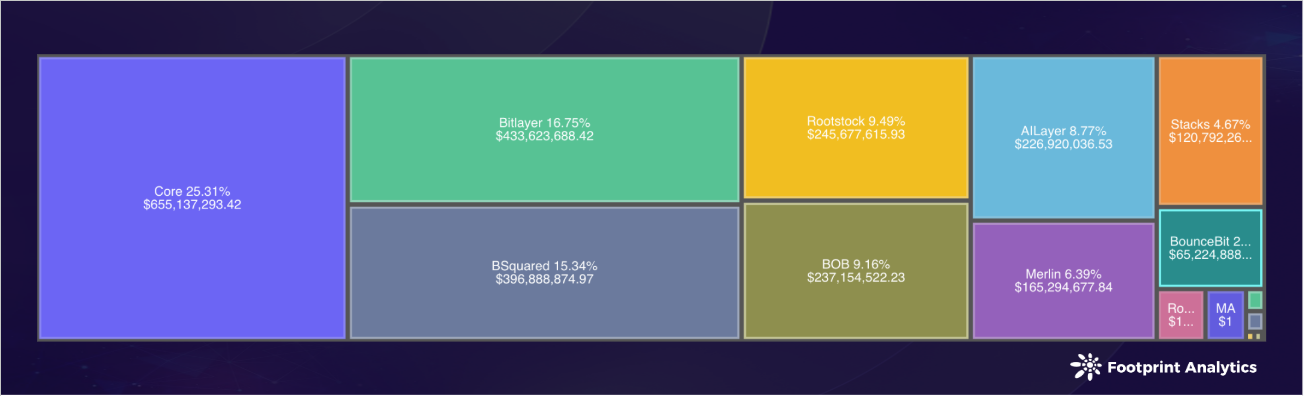

Core maintains its market leadership with a $660 million TVL, and despite a 9.3% drop from December, it still accounts for 25.3% market share. Bitlayer was strong with TVL up 15.2% to $430 million (16.8% market share), while BSquared performed well, with TVL up 19.7% to $400 million (15.3% market share).

Rootstock and BOB ranked fourth and fifth with TVL of $250 million and $240 million, with growth rates of 10.8% and 8.9% respectively. It is worth noting that AILayer TVL grew 13.2% to $230 million.

Data source: [Bitcoin Eco-Public Chain TVL — January 2025](https://www.footprint.network/@Higi/Bitcoin-Sidechain-TVL?series_date=2023-07-01~2025-01-31)

Among the mid-sized platforms, Merlin TVL fell 3.7% to $170 million, while Stacks maintained steady growth, up 4.0% to $120 million. Small platforms performed mixed, with BounceBit growing 7.3%, while new entrants such as SatoshiVM and Naka fell 11.6% and 14.9% respectively.

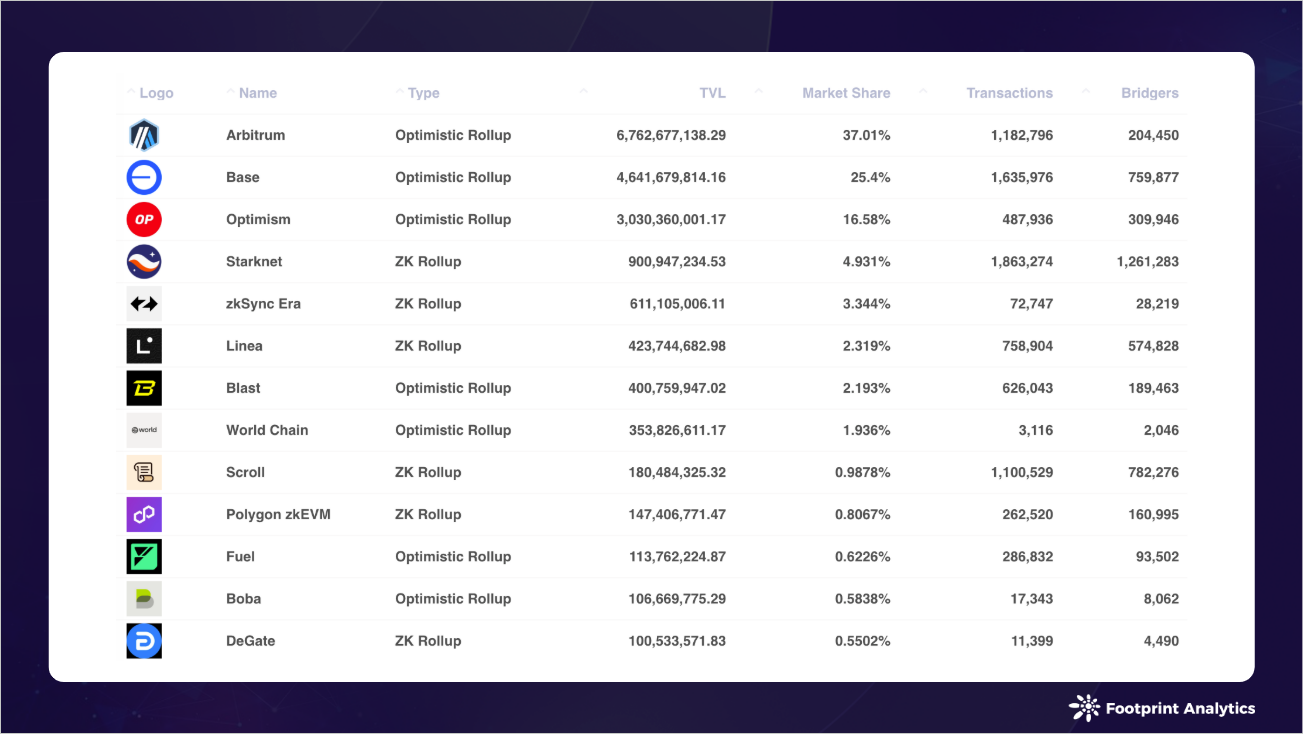

Ethereum Layer2

In January 2025, the Ethereum Layer 2 ecosystem changed significantly, with total locked positions falling to US$18.3 billion, down 6.7% from December. Market leaders perform differentiated.

Data source: [Overview of Ethereum Layer 2 in November 2024 — Rollups (bridge-related metrics)](https://www.footprint.network/research/chain/chain-ecosystem/layer-2-overview?%253E%253D_date-84008=2023-08-01&single_date-86180=2024-11-30&technology-97939=ZK%20Rollup&technology-97939=Optimistic%20Rollup&series_date-97941=past180days~)

Arbitrum maintained its leadership with a $6.8 billion TVL despite a sharp drop of 20.4% from December. Base continues its strong momentum, with TVL growing 14.0% to $4.6 billion, consolidating its second position. Optimism ranked third with a $3 billion TVL, down only a slight 0.5%.

Among the best performing platforms, World Chain performed well, with TVL growing 27.6% to $350 million, while Paradex rose 50.3% to $37.2 million. ZK Rollups showed resilience, with Starknet and zkSync Era growing 7.4% and 12.2% respectively, with TVL reaching $900 million and $610 million.

Some mature platforms face challenges, with Blast TVL down 33.8% to $400 million and Fuel down 47.3% to $110 million. Linea and Scroll also fell 5.7% and 5.2% respectively.

The competitive dynamics of the ecosystem continue to evolve, and Optimistic Rollup and ZK Rollup have shown varying degrees of success. As new entrants join the ecosystem, mature platforms focus on consolidating their market position by improving functionality and user experience.

chaincatcher

chaincatcher