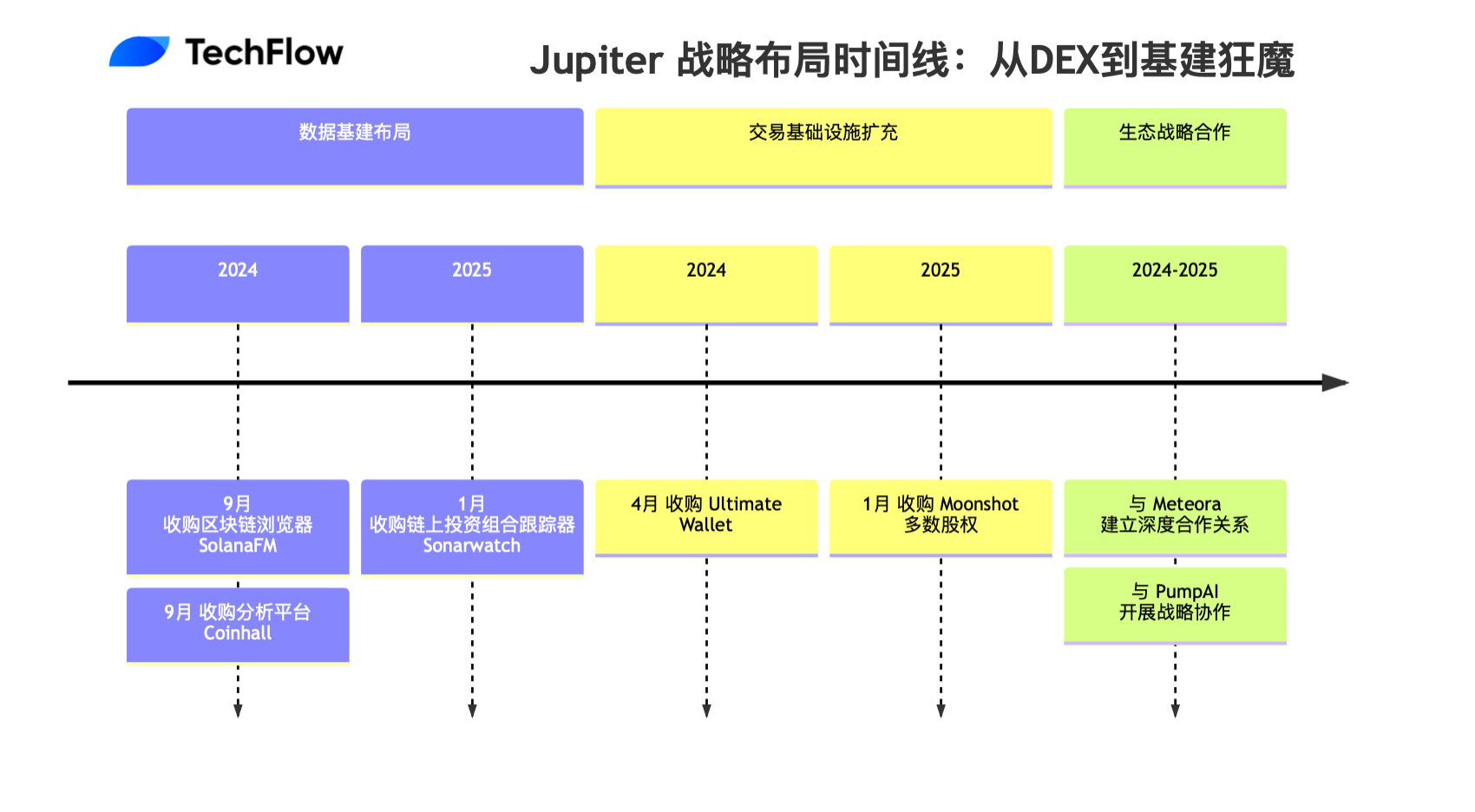

Repeated Jupiter's acquisition timeline: from Dex to infrastructure madness's ambitions

Reprinted from panewslab

01/26/2025·3M

Written by: Shenchao TechFlow

Amid the turmoil in the crypto market, projects in the Solana ecosystem are thriving.

For example, Jupiter, when you received the recent airdrop and happily expressed how delicious the pig's trotter rice is, did you also smell a hint of Jupiter's wealth?

Sometimes the generosity of a project to you comes from the coordination and careful layout behind it.

Jupiter, the hottest DEX protocol in the Solana ecosystem, has quietly started a wave of acquisitions in the past 1-2 years, incorporating multiple projects into its territory.

For example, a recent piece of news that has attracted much attention is that Jupiter has acquired a majority stake in Moonshot .

But its action goes beyond that. Through a series of precise acquisitions, Jupiter is weaving an ecological network covering multiple dimensions such as transactions, data, and wallets.

From its initial focus on token swaps as a DEX aggregator to its current comprehensive deployment of ecological infrastructure, Jupiter's ambitions have long gone beyond simple decentralized transactions.

Why did this DEX, which once focused on providing optimal slippage, suddenly transform into an "infrastructure maniac"?

Shenzhen TechFlow took a look at Jupiter's development and acquisition timeline, and combined with its recent cooperation dynamics, tried to restore the strategic layout behind these scattered acquisitions.

Starting from DEX: The origin of Jupiter

In 2021, when the Solana ecosystem is booming, a project called Jupiter was quietly born. At first, it was just a new face among many DEX aggregators, but its innate technical genes quickly made it stand out in the highly competitive DeFi track.

Jupiter’s first breakthrough is to solve a common pain point in the DeFi world: slippage. Through innovative routing algorithms, Jupiter is able to find the optimal transaction path in complex liquidity pools, saving users a lot of transaction costs.

The project's development speed is impressive. By 2023, public data shows that it has become the largest DEX aggregator in the Solana ecosystem, accounting for more than 50% of the token swaps on the chain.

The simple interface design, convenient cross-chain support, and precise grasp of institutional-level trading needs have made Jupiter quickly become the preferred platform for professional players.

But what really makes Jupiter stand out from the competition may be their forward-thinking approach to ecological construction.

In today's encryption landscape where competition is fierce and projects are homogenized and involuted, you can clearly feel:

A successful DEX must not only provide high-quality trading services, but also become a hub connecting the entire ecosystem.

Thus, the acquisition drama belonging to Jupiter began.

Acquisitions underway: Expansion of infrastructure landscape

Meow, the founder of Jupiter, previously stated in a podcast interview, "Our vision is not just to make a good DEX, but to build a complete DeFi infrastructure ecosystem."

So what else is needed for a complete ecosystem?

If I am a user, then the answer is obvious---it is best to be in the same place that can support all my DeFi activities, from data analysis to transaction execution to asset management, forming a closed loop.

Of course these things cannot be accomplished by a DEX. Therefore, acquisition and cooperation have become a feasible path.

Looking at some of Jupiter's recent acquisitions together, everything is moving around this closed loop.

Data Infrastructure: Acquisition of SolanaFM, Sonarwatch and Coinhall

Before making transactions, users need accurate market data, on-chain activity analysis and real-time price monitoring to assist decision-making. Perhaps based on such strategic considerations, Jupiter has launched its data sector layout in the past two years.

- September 2024: Acquisition of blockchain explorer SolanaFM

SolanaFM was previously one of the more distinctive blockchain browsers in the Solana ecosystem, providing users with fast, simple and user-friendly on-chain data access capabilities. The most important effect is to simplify transaction information and reduce the complexity of fund flow visualization. sex.

As early as 2022, SolanaFM has completed a US$4.5 million seed round of financing, with participation from VCs such as Spartan Group. Public data shows that Jupiter itself is also one of the investors in the project, paving the way for subsequent acquisitions.

This acquisition not only enhances Jupiter's data analysis capabilities, but also provides users with a more transparent on-chain activity tracking service. In addition to a mature data analysis engine, more importantly, it has acquired a technical team with rich experience in on-chain data processing.

- September 2024: Acquisition of analytics platform Coinhall

At the 2024 Solana Breakpoint conference, Jupiter announced the acquisition of Coinhall, a well-known transaction analysis platform. As a platform focused on trading data analysis, Coinhall is known for its powerful market data analysis capabilities and user-friendly interface, providing traders with real-time market trends, price movements and trading volume analysis.

This acquisition has important strategic significance for Jupiter: First, by integrating Coinhall's analytical tools, Jupiter has significantly enhanced its capabilities in market data analysis; in addition, Coinhall's one-click trading capabilities and intuitive data visualization tools will be Fully integrated into Jupiter's trading platform to further optimize users' trading experience.

- January 2025: Acquisition of on-chain portfolio tracker Sonarwatch

Just yesterday (25th), Jupiter DAO officially announced the acquisition.

From a business perspective, the integration with Sonarwatch can obviously enhance Jupiter’s portfolio tracking capabilities. Sonarwatch's portfolio tracking tools will be fully integrated into Jupiter's web and mobile platforms to provide users with a full range of asset monitoring services.

The significance of this cooperation is that it complements Jupiter's shortcomings in real-time market monitoring.

It is worth noting that SonarWatch positions itself as a "multi-chain" open source tracking tool to facilitate the adoption of DeFi on different chains. This business positioning may coincide with Jupiter's recently announced Omnichain Network --- Jupnet .

Expansion of trading infrastructure: acquisition of stakes in Ultimate

Wallet and Moonshot

In the DeFi ecosystem, trading infrastructure is the key link between users and trading platforms.

As a DEX aggregator, Jupiter must also open up a complete link from user entrance to transaction execution, which prompted it to start a series of strategic layouts at the infrastructure level.

- April 2024: Acquisition of Ultimate Wallet, launch of Jupiter Mobile plan

When it acquired the wallet last year, Jupiter already said on X that its "mobile plans to attract tens of millions of users are launching" and will be "ready for testing in May."

Moving towards mobile, the idea of having its own front-end app surfaced.

Jupiter has also previously stated that the acquisition of Ultimate Wallet is in line with its mobile strategy and will leverage their technology and team to enhance the performance of Jupiter Mobile."

Although dApps such as Phantom wallet are currently commonly used wallet tools, a DEX can obviously also do its own downstream work and build its own front-end trading capabilities, thereby controlling user entrances to seek more traffic and trading profits.

- January 2025: Acquisition of majority stake in Moonshot

In recent days, Jupiter has further expanded its ecological territory and acquired a majority stake in Moonshot, which has been regarded as the "Meme Select" as the Meme currency became popular.

The value of Moonshot itself needs no introduction. This Meme trading platform, launched in July 2024, achieved a transaction volume of nearly US$400 million when Trump issued TRUMP coins this month, and topped the regional APP download list.

More importantly, it provides a legal currency deposit entrance to facilitate the direct purchase of Meme. This alone is an irresistible temptation for projects related to intranet transactions.

Obtaining a majority stake in Moonshot also means strengthening its control over Moonshot. By acquiring Moonshot, Jupiter is not only an aggregator, but also controls some of the underlying liquidity sources.

Other cooperation arrangements

In addition to the above-mentioned acquisitions, projects related to Jupiter also involve Meteora and PumpAI.

- Revenue optimization: synergistic development with Meteora

As an important infrastructure in the Solana ecosystem, Meteora has a close but independent relationship with Jupiter. As a project transformed from the original Mercurial team, Meteora's development in the ecosystem is remarkable.

Its TVL hit a new high of US$1.3 billion in January 2024, once becoming the DEX with the largest daily trading volume in the ecosystem. This rapid growth is due to its innovative liquidity management mechanism and close partnership with Jupiter.

As a project developed by the original Jupiter team, Meteora focuses on building a sustainable revenue layer for the Solana ecosystem. Through integration with Jupiter, users can earn additional income while trading, which greatly improves the efficiency of capital use. It is worth noting that this cooperation model has been verified in recent market hot spots - for example, in Trump's official TRUMP coin transaction, the combination of Jupiter and Meteora provides users with the optimal trading experience.

- Innovation Ecosystem: PumpAI’s Strategic Collaboration

In addition, Pump AI is an AI startup platform on Meteora that uses tools to help users create tokens. Including descriptions, images, tokens and mining pools will be processed by artificial intelligence.

The project has liquidity pool collaborations with other protocols such as Raydium and Jupiter.

Where is the end point?

Jupiter's recent series of acquisitions outline a grand blueprint that goes far beyond a single DEX platform.

Through an in-depth analysis of its acquisition strategy, we can clearly see that this star project of the Solana ecosystem is playing a bigger game: from a single point to a global ecological layout.

Jupiter's acquisition footprint spans multiple strategic areas. From the user portal Ultimate Wallet, to the data analysis tool Coinhall, to the blockchain browser SolanaFM, every acquisition is filling in important puzzle pieces of the ecological landscape.

Especially by acquiring a majority stake in Moonshot, Jupiter not only strengthened its advantages in the field of liquidity aggregation, but also built a complete closed loop of DeFi services.

By integrating core infrastructure such as wallets, data, and transactions , Jupiter is building a self-contained collection of DeFi services. Users can complete the entire process from depositing, trading to profit optimization within this ecosystem. The convenience of experience may be the key to winning the competition.

It is particularly worth mentioning that the Jupnet (a full-chain network) project being developed by Jupiter demonstrates its continuous investment in technological innovation. This is not only a supplement to the existing business, but also a forward-looking layout for the future development of cross-chain DeFi.

Looking to the future, Jupiter’s ambitions may not stop there.

The legal currency entrance and launch platform business it is laying out shows its ambition to create an ecosystem covering the entire life cycle of the project. From project incubation, transaction liquidity to user services, Jupiter is gradually establishing its status as the "infrastructure maniac" of the Solana ecosystem through this series of strategic layouts.

jinse

jinse