RaaS and Eigenlayer: Exploring emerging re-staking services

Reprinted from jinse

01/02/2025·3MAuthor: kn ower Source: substack Translation: Shan Ouba, Golden Finance

RaaS is a controversial topic, given the views on rollups (L2 and L3). You either support platforms like Caldera and Conduit that make rollup extremely easy, or you think we already have so much block space that these tools are pointless. My view is somewhere in between, but there are strong arguments on both sides. I think rollup infrastructure is a net positive for the space (no matter how small), but I also understand why some think the technology won't drive cryptocurrency adoption.

L2 Beat shows there are approximately 55 running rollups - with the top five (Arbitrum, Optimism, Base, Blast and Mantle) accounting for 82.74% of the market share. I'm not sure whether we should interpret this as us being in the early stages of cryptocurrency, a symptom of the homogenization of rollup designs, or a lack of interest in the vast majority of rollups - maybe it's a combination of all three.

Arbitrum and Optimism are clearly the most mature rollups and are now more like "real" chains (rather than Ethereum affiliated chains). Base has a very active community and despite its smaller TVL is probably the most promising rollup out there - similar situation applies to Blast, but I don't think their higher TVL is better than Base's without a gamified points program Communities built with help are more engaging. Base even made it clear that there would be no tokens, but no one minded since this was the first rollup to see organic activity – even Arbitrum and Optimism were heavily farmed before the airdrop announcement.

Mantle is a rollup I'm very unfamiliar with, but I briefly browsed their ecosystem and think they have advantages over the likes of Mode, Manta, and even Scroll. Their development is entirely dependent on TVL inflow and new application deployment, both pending further notice.

Even worse than the 55 active rollups is the 44 upcoming rollups listed by L2 Beat . These 44 used a variety of different designs (like Optimiums and Validiums), but ultimately they were all competing for the same market. There are very few running rollups that make the jump from "modular execution layer/Ethereum affiliate chain" to "just happen to be the L2 dominant chain".

L1’s success stems from years of developer talent building up into a largely stable bottom layer, giving the community a chance to form and create an ecosystem around it (think Solana’s memecoin casino days, Ethereum’s DeFi mania summer, and even Bitcoin ordinals on it). The usefulness of rollup comes from its shared security with the underlying layer — which 99% of the time is Ethereum, unless you’re talking about Solana L2 — and its relatively low transaction costs.

I don't think technology alone is enough for rollup to gain significant awareness or market share , as evidenced by the fact that some of the "strongest" technologies like Scroll, Taiko, and Polygon zkEVM have failed to even move an iota in TVL games. Maybe these teams do see an increase in TVL in the long term, but based on the current sentiment and lack of pursuit of that goal so far, I see no signs of that happening. No, your eight users don't want another Galxe campaign, and they certainly don't want points that can be redeemed for non-transferable tokens.

If you put yourself in the shoes of a brand new investor who knows nothing about cryptocurrencies, how would a rollup make you feel? I'm not sure you'll be jumping for joy at seeing the 15th zero-knowledge rollup with the EVM equivalent of zkEVM, unless it has some memecoins you can earn money from.

Most of the analysis from a simple glance at L2Beat appears quite pessimistic, but as long as I'm not the one putting liquid funds into L2 or L3, I'm fine with it. I also don’t think more and more rollups are necessarily a bad thing for the field, but we should be more forthright about the utility this brings. Over the past few months, many applications have become specific application chains (e.g. Lyra, Aevo, ApeX, Zora, Redstone) and I suspect this trend will continue until everyone from Uniswap to Eigenlayer becomes L2.

So, while we can’t stop the number of new rollups being deployed, we can at least have an honest discussion about its impact on cryptocurrencies. We have too much block space, and the Ethereum mainnet doesn’t even need any additional block space – it might only cost $10 to make a transaction now, and this has been going on for weeks.

There is almost no difference between RaaS providers like Conduit and Caldera (don't attack me), and the reason I say so confidently is in the hope that someone can correct me. Here is a brief overview of their respective rollup deployment processes:

-

Conduit offers OP Stack and Arbitrum Orbit; Caldera offers Arbitrum Nitro, ZK Stack and OP Stack

-

Conduit offers Ethereum, Arbitrum One, and Base as settlement layers; Caldera doesn’t list a settlement layer, but I imagine it’s similar

-

Conduit’s data availability (DA) options include Ethereum, Celestia, EigenDA, and Arbitrum’s AnyTrust DA; Caldera offers Celestia and Ethereum, with plans to integrate Near and EigenDA soon

-

Conduit allows the use of any ERC-20 as the native gas token; Caldera allows the use of DAI, USDC, ETH, WBTC and SHIB (???)

Overall, the two platforms are very similar. I think the only difference might come from the actual consulting experience the team provides. I haven't spoken to either team yet, so I'm sorry if this seems sloppy or uninformative, but I imagine they would appreciate an honest look at RaaS and its current state. We'll know the results soon.

I've considered making my own rollup for fun, but I really can't justify spending $3,000 a month on a virtual chain (unless a VC wants to PM me and we can talk).

To summarize, I love RaaS and hope everyone working on it continues to work hard. I really don't see anything wrong with it, and saying "too much rollup" is a silly position to take, especially given the current state of our industry.

Regarding the current state of our industry, it’s time to briefly discuss some of my grievances with restaking, LRT, AVS, and Eigenlayer. I still want to write a larger report, so I'll keep it short here.

A large amount of ETH is deposited in Eigenlayer, approximately 5.14 million as of today. I once thought that most of the funds would disappear after the points program ended, but the most disappointing airdrop announcement in the world did not cause TVL to flee to better places, but instead increased. I thought anyone expecting Eigenlayer’s airdrop to easily multiply deposited funds 20-25 times was probably kidding themselves, but I didn’t expect them to block almost all major countries after this. There were enough tweets expressing displeasure with Eigenlayer's double standards (including one of my own), but I really don't think it's worth discussing anymore.

The team also released a massive white paper explaining the role of EIGEN and introducing a new concept called “subjective mutual benefit.” No one really understood what this meant, and no one wrote posts discussing it, because EIGEN was initially non-transferable, which was a big problem for anyone looking to build a community around its protocol. If you can't make people rich through tokens or the ecosystem around them, people will turn their attention to possible ways to make money (like memecoins).

I have no problem with Eigenlayer or the team. I want to make this clear.

Sadly, I have issues with restaking and the basket of AVS currently on Eigenlayer's whitelist. With over five million staked ETH deposited on Eigenlayer, you would think that people would be able to make a decent profit from that, right? I'm here to tell you that this assumption is wrong. I'll be referencing a specific dashboard multiple times, so here are the links.

If you consider the utility of restaking, you will by default bootstrap economic security from the most economically secure cluster of blockchain validators in the world. You stake various stETH into restaking platforms like Eigenlayer (or Karak and Symbiotic in the future) to earn higher yields than the attractive stETH yields you already have. My problem is that there is no inherent revenue generation in restaking itself - the revenue must come from the AVS in Eigenlayer. If you are a restaker who deposits 10 stETH in Eigenlayer and delegates these restaking ETH to an operator like ether.fi, you want to trust them to choose the right basket of AVS to generate income for you. .

But where do these gains come from?

There are no new terms promised at the Ethereum protocol layer, and if ETH stakers take the risk of using the re-staking protocol, they will receive more rewards. Earnings can only come from one place: tokens issued by AVS (Active Verification Service) itself.

I'm no expert, and I know most of us don't claim to be either, but I'm having a hard time understanding why no one has asked this question on Twitter. Of course, bigger issues like bad airdrops and existential risks to Ethereum security take precedence, but no one has asked what will happen once Eigenlayer launches and finally enables the slashing mechanism?

What incentive do I have to keep depositing mine when a) the team hasn't discussed any real numbers on potential revenue generation, and b) there's no reason to hold over $10M in AVS while holding over $500M in re-staking ETH assets?

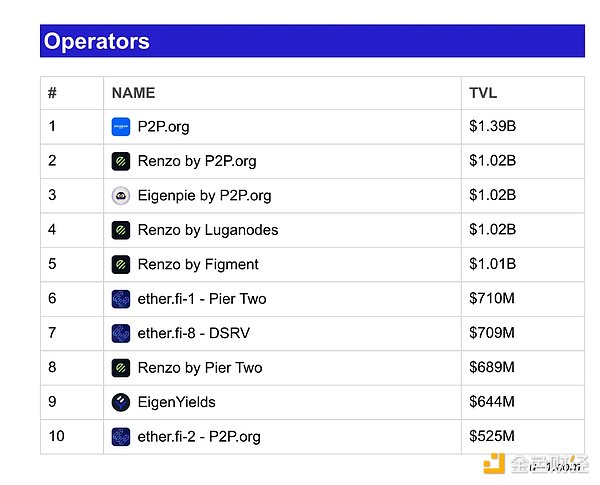

This leaves us in a (let’s call it realistic) scenario where the top ten operators on Eigenlayer each have an average of 5 AVS registrations and have significant overlap with each other. Eigenlayer was smart enough to announce that the slashing mechanism will not be activated for about a year to allow everyone to adapt to the new re-staking reality. Considering that no one except Gauntlet and Mike Neuder has discussed the risk of re-staking, this is a smart move. Although both pieces of writing are of high quality, they don't provide any concrete examples since AVS does almost nothing.

As I said before, the benefits of Eigenlayer are pretty cool - there's no denying it. But is it really necessary to re-stake nearly a billion dollars of user ETH to every emerging protocol and expose them to future risk? The slashing mechanism is not yet live but will be in less than a year – do operators fully understand their re-staking risk and how this risk accrues with each subsequent AVS registration?

I'm not sure.

Perhaps we will see several other restaking platforms slowly chip away at Eigenlayer’s market share, ideally rewarding AVS with less restaking ETH while gradually finding product market fit, rather than the other way around.