Quick look at the key points of the White House Crypto Summit: New Ways to Accumulate BTC Stablecoin Legislation

Reprinted from jinse

03/08/2025·2MWritten by: 0xjs@Golden Finance

The White House previewed the crypto summit a week in advance was officially held at the White House on March 8.

During this week, the crypto market has performed many times under the performance of US President Trump. There are social media posts announcing SOL, XRP, ADA, BTC and ETH as US crypto reserves, as well as warm-ups from guests at the crypto summit , and the issuance of the executive order "Strategic BTC Reserves and US Digital Asset Reserves" .

Because many key information of the White House Encryption Summit was revealed in advance by Trump's executive order, there is not much new information added to this White House Encryption Summit. So during the summit, the price of Bitcoin fell from $90,000 to around $86,000.

This article Golden Finance summarizes some important information about the White House Crypto Summit, as follows:

Trump's speech: Explore new ways to accumulate more Bitcoin accelerate US

dollar stablecoin legislation

I know many of you have been fighting for this for years.

In 2024, I promise to make the United States the world’s Bitcoin superpower and global cryptocurrency capital, and we are taking historic action to fulfill this commitment.

Bitcoin reserves will become the virtual Fort Knox for digital gold kept by the U.S. Treasury Department.

My government is working to end the bureaucracy’s “Operation Chokepoint 2.0” war on cryptocurrencies.

The federal government is already one of the largest holders of Bitcoin, and has obtained up to 200,000 Bitcoins through civil law and various other laws and law enforcement actions, and these current holdings will form the basis of the new reserves. Unfortunately, in recent years, most of BTC has been sold during Biden's administration.

Starting today, the United States will follow a very clear principle and never sell your Bitcoin.

The government is currently setting up a list of crypto assets, and the crypto assets held will be stored in a new U.S. digital asset library and properly managed. I also want to express my strong support for the efforts of lawmakers and Congress as they are working on bills that provide regulatory certainty for the dollar stablecoins and digital asset markets . They work very hard on this. This is a huge opportunity for economic growth and innovation in our financial field.

The Ministry of Finance and Commerce will explore new ways to accumulate more Bitcoin for crypto reserves and do not want taxpayers to pay any price. I ordered federal agencies to take stock of digital assets currently held by the U.S. government and determine how they can be transferred to the Treasury Department, which will be kept in a new U.S. digital assets reserve.

It is hoped that stablecoin legislation will be passed before the recession in August and to promote federal regulatory reforms on cryptocurrencies by the federal government, and hope that the US dollar will "maintain dominance for a long time."

Finance Minister Scott Besent: In-depth thinking on the stablecoin system

We will think deeply about the stablecoin system, and as President Trump directs, we will maintain the United States as the world's dominant reserve currency, and we will use stablecoins to achieve this. Technology is the foundation of the Trump administration and will use technology to drive the United States forward.

The Trump administration will terminate the “weaponization of regulation” against digital assets.

We will position the United States as a leader in digital asset strategy. It is very important for the United States to recognize this fact and be ahead of other countries in the digital age.

I intend to work with agencies and regulators including the Regulatory Commissioner and the IRS to update and revise previous guidelines.

U.S. Commerce Secretary Howard Lutnick: Utilizing Bitcoin, Digital Assets

and Blockchain to drive the United States forward

Technology is the basis of President Trump’s presidency. This administration will use bitcoin, digital assets and blockchain to drive the United States forward and maintain its leading position in the global economy. I am proud to work with President Trump and other leaders in the cryptocurrency field to push our country forward in this new field.

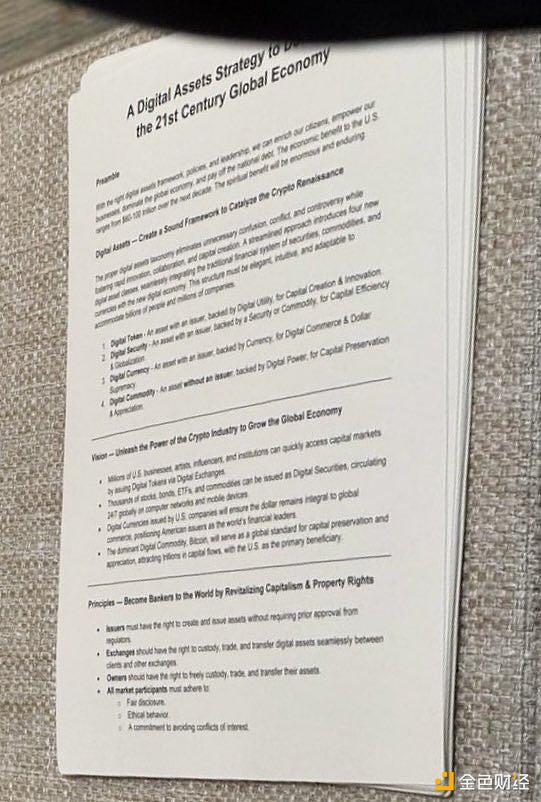

**Michael Saylor, CEO of MicroStrategy, shares file: $60-100 trillion in

benefits to repay state debt**

Topic: Digital asset strategy for the global economy in the 21st century.

Preface: With the right digital asset framework, policies and leadership, we can unlock the economy, empower businesses, stimulate traditional economies and repay national debt. In the next decade, the United States will gain $60-100 trillion in economic benefits. The spiritual benefits will be huge and lasting.

Digital Assets – Create a Sound Framework to Catalyze the Crypto Revival

A proper digital asset framework can eliminate unnecessary chaos, conflict and disputes while balancing competition, cooperation and capital creation. A streamlined system of social, economic models and regulatory categories that can easily integrate traditional financial systems, intuitively and suitable for digital asset classes, is the guarantee of the economy. This structure must be elegant in order to achieve capital creation and innovation, and to accommodate billions of people and millions of companies.

1. Digital Token – With the issuer’s assets, powered by digital utilities, used for commodities, for capital efficiency.

2. Digital Securities – Have the assets of the issuer, backed by securities or commodities.

3. Digital Currency – With the issuer’s assets, backed by currency, used for digital commerce and US dollar hegemony.

4. Digital Commodities – The assets of the issuer are supported by digital powers for capital preservation.

Vision: Unleash the power of the crypto industry and promote global economic development

Millions of American businesses, artists, influencers and institutions can issue digital tokens through digital exchanges to quickly enter the capital market.

Thousands of stocks, bonds, ETFs and commodities can be issued as digital assets and circulate on computer networks and mobile devices around the world.

Digital currencies issued by U.S. companies will ensure that the U.S. dollar remains an indispensable position in global trade, making U.S. assets a world financial leader.

The dominant digital commodity Bitcoin will become the global standard for capital preservation and appreciation, attracting billions of dollars in capital flows, and the United States is the main beneficiary.

Principle: Become a World Banker by revitalizing capitalism and property rights

-

The issuer must have the right to create and issue assets without prior approval from the regulatory authority.

-

Exchanges shall have the right to seamlessly store, trade and transfer digital assets between customers and other exchanges.

-

The owner shall have the right to freely keep, trade and transfer their assets.

-

All market participants must comply with: Fair disclosure. Moral behavior. Commitment to avoid conflicts of interest.

-

No one has the right to engage in fraud, and everyone must bear civil and criminal liability for their actions.

-

The industry should be responsible for disclosing and complying with regulations to make the market run organically.

-

Digital assets should flow freely on the Internet, at the speed allowed by the computing process, without being hindered by censorship or regulation.

-

By establishing superior financial agreements, the United States can lead the world in the field of digital finance, attract global capital, and lay the foundation for the future economy.

Urgent - End the cryptocurrency war and promote digital transformation of the economy

-

Hostile and unfair tax policies for crypto miners, holders and exchanges hinder industry growth and should be eliminated, while arbitrary, capricious and discriminatory provisions should be eliminated.

-

The government should encourage and support major banks to custody, trade and finance Bitcoin assets. Cryptocurrency industry participants should not be tolerated.

-

To enable the industry to reach its full potential, it needs to be recognized as legal and treated fairly by traditional banks, insurance and financial institutions, as well as government agencies.

Opportunities—U.S. economic transformation and development in the next decade

-

Digital Tokens – expand the capital base of US companies by $10 trillion, dominating global products and services. We output our ideas to the world.

-

Digital Security – Increases the value of U.S. securities by $20 trillion, building leadership in the global stock, bond and derivatives markets. We export securities to all over the world.

-

Digital Currency – Increases U.S. Treasury bonds by $10 trillion, consolidating its dominance in global banking, credit and money markets. We export our currency to all parts of the world.

-

Digital Commodities – Increase US long-term capital assets by $20 trillion, increasing the wealth of American households and businesses. We export our values to the world.

Strategic Bitcoin Reserves – Win the Contest to Dominate Cyberspace and Master the Future

-

Between 2025 and 2035, 5-25% of Bitcoin web trusts will be acquired for the country through continuous programmatic daily purchases, by which time 99% of BTC will be issued.

-

The Strategic Bitcoin Reserve (SBR) has the potential to create $16-81 trillion in wealth for the U.S. Treasury by 2045, providing a viable way to offset national debt.

-

Never sell your Bitcoin! By 2045, Bitcoin reserves should generate more than 10 trillion US dollars in revenue each year and continue to grow, becoming a permanent source of prosperity for future generations of American people.

Conclusion - Call for Action

Now is the time to take action. By embracing digital assets and promoting innovation, the United States can ensure its global leader in the 21st century economy. Policy makers, regulators and industry leaders must work together to establish a regulatory framework that promotes responsible growth while ensuring market integrity. A strong, visionary strategy will unleash trillions of dollars in economic value, strengthen national security, and make the United States an undisputed leader in the digital age.

Ripple CEO: Resolution clearness through Congressional action, as well as

BTC reserves and crypto reserves

In the cryptocurrency space, some weeks feel like months… There has been a lot of discussion about the crypto agenda that the White House has and will be prioritized – most importantly, regulatory clarity through Congressional actions, as well as BTC and crypto reserves, support for stablecoin innovations backed by U.S. Treasury bonds, and more. I am very happy to see the strong support given by this government. We will bring the industry together and promote much-needed legislation in the United States.

Gemini Co-founder Tyler Winklevoss: The United States now has strategic

Bitcoin reserves

A year ago, people thought it was impossible. The United States now has strategic Bitcoin reserves with an initial reserve of 200,000 BTC (to be audited). Thanks to Donald Trump and David Sacks for their leadership and keeping their promises. This is the United States' priority.

Some other progress during the White House crypto summit

FIFA President Announces FIFA Coin Plan

FIFA President Gianni Infantino announced the "FIFA Coin" plan at the White House crypto summit, hoping to launch its own cryptocurrency, aiming to leverage football's $17 billion industry and 5 billion fans around the world, and will invite cryptocurrency experts to cooperate to help realize the project.

US Currency Complaint: Federally regulated banks can participate in

crypto custody and certain stablecoin activities

The U.S. Currency Complaints Agency (OCC) issued a new letter announcing the revocation of the Explanatory Letter No. 1179 issued on November 18, 2021, and reiterated that the cryptoasset custody, distributed ledger and stablecoin activities discussed in the previous letters are allowed.

The OCC confirmed in its letter: "The Federal Bank and the Federal Savings Association can conduct crypto asset custody, certain stablecoin activities, and participate in independent node verification networks."

"The U.S. Currency Complaint hopes that banks can adopt equally strong risk management control measures as strong as traditional banking operations to support new banking operations," said Rodney E. Hood, acting director of the U.S. Currency Complaint.

The agency also said it also withdraws the agency's requirement to implement restrictive controls before engaging in crypto activities.

Bloomberg: Gemini has secretly submitted an IPO application in the United

States

People familiar with the matter revealed that crypto trading platform Gemini has secretly submitted an IPO application in the United States and is working with Goldman Sachs and Citigroup. Whether to conduct an IPO in the end is still unclear. The move comes after the Securities and Exchange Commission (SEC) terminated its investigation into Gemini without taking any action. In addition, Gemini also reached a $5 million settlement with the U.S. Commodity Futures Trading Commission (CFTC) in January this year.

panewslab

panewslab