Pseudo-decentralization Trap: Analyzing the Three Structural Defects of CDP Stablecoins on HyperEVM

Reprinted from panewslab

05/12/2025·20DOriginal title: What's wrong with CDP stablecoins on HyperEVM?

Original author: @stablealt

Original translation: zhouzhou, BlockBeats

Editor's Note: CDP "stablecoins" on HyperEVM such as feUSD and USDXL are unable to maintain the anchor price of USD 1 due to the lack of strong arbitrage mechanism, weak demand in Hyperliquid and low borrowing costs, causing their prices to fall below USD 1. Hyperliquid natively provides leveraged trading, and users do not need CDP stablecoins. As airdrops and points rewards are exhausted, CDP tokens will lose value and ultimately cannot last.

The following is the original content (to facilitate reading comprehension, the original content has been compiled):

Disclaimer: This article is not FUD or attacks against HyperEVM's CDP protocol.

In short: CDP stablecoins, such as feUSD and USDXL, are not actually stable or capital efficient. They lack strong arbitrage mechanisms, have limited usage scenarios, and are mainly used for leveraged trading, while Hyperliquid already provides better user experience and liquidity natively. Therefore, these tokens are trading below their $1 anchor price, and without incentives like airdrops, they are likely to fade away.

Collateralized Debt Positions (CDP) stablecoins promise to provide a decentralized alternative to replacing USD-backed stablecoins (such as USD and USDT) or centralized synthetic dollar (such as USDe), but reality is often not as expected. feUSD, USDXL and KEI are some of the latest examples of trying to emulate Liquity, but they all face serious issues such as anchor stability, scalability, or incentive design flaws.

This article will analyze what these problems are, what paid KOLs don’t tell you, and why these problems are not just pain in growth—they are structural issues.

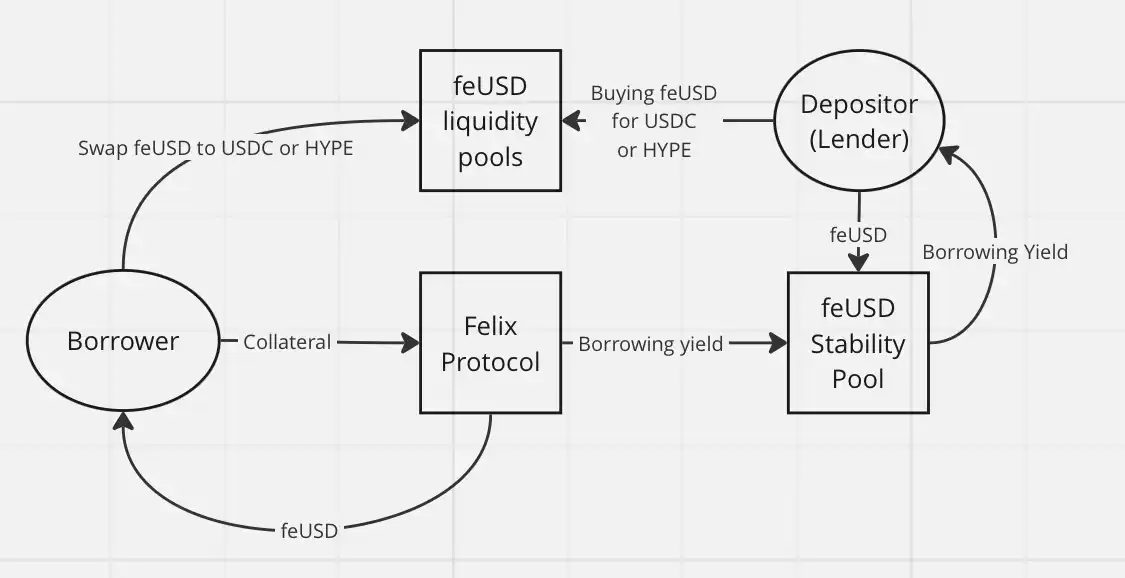

CDP Design Overview

First, let’s understand the basic concept: CDP “stablecoin” is not actually a real stablecoin or “dollar” token. This is why DAI is called "DAI" instead of USDD or other names. It is wrong to name CDP stablecoins with the "USD" prefix and may mislead DeFi newbies. They have no arbitrage mechanism and no direct guarantee. Each CDP token is minted out of thin air and may be well below the value of $1.

To mint a CDP token, users must lock in collateral worth more than 100% in order to lend the token. This reduces capital efficiency and limits growth. In order to mint 1 token, you need to lock in value over $1. Depending on the loan to value ratio, this ratio may be higher.

Without adding a mechanism of heavy means, like Felix’s redemption (when an arbitrager can steal someone’s collateral, provided the borrowing rate is too low) or Dai’s PSM module, CDP tokens simply cannot maintain a 1:1 anchor with the US dollar, especially when their main use case is leveraged trading.

In DeFi, CDP is just another form of lending. Borrowers mint CDP stablecoins and use them to exchange for other assets or income strategies they believe can exceed the agreed lending rate.

what happened?

Everyone exchanges their CDP stablecoins for other assets, usually more stable centralized assets such as USDC or USDT, or for more volatile assets such as HYPE for leveraged trading. It doesn't make sense to hold these tokens, especially if you need to pay the borrowing rate: feUSD's annualized yield (APY) on Felix, USDXL's annualized yield on HypurrFi.

Take USDXL as an example: it has no local usage scenarios, and there is no reason for users to hold it. That's why it can fluctuate at $0.80, $1.20, etc. – the price is not anchored by any actual arbitrage mechanism. Its price only reflects the user's demand for lending HYPE. When the USDXL is trading above $1, the borrower can borrow more USD; when the USDXL is trading above $1, the borrower can borrow less—that's that simple.

feUSD is slightly better. Felix provides users with a stable pool where users can earn 75% of their borrowing fees and liquidation bonuses, with an annualized rate of return of approximately 8%. This helps reduce price volatility, but like USDXL, there is still no strong arbitrage mechanism to keep feUSD firmly at $1. Its price will still fluctuate based on borrowing demand.

The core issue is: users who buy feUSD and put it into a stable pool are essentially lending their USDC or HYPE (via Felix) to the person who casts feUSD. These CDP tokens have no intrinsic value. They are valuable only when paired with valuable tokens like HYPE or USDC in a liquidity pool.

This introduces third-party risks, where without airdrops or other incentives, DeFi users don’t have any reason to borrow tokens that are not liquid, without anchors, such as feUSD or USDXL, or purchase them as borrower exit liquidity. Since you can borrow stablecoins like USDT or USDe directly, why do you still do this? Anyway, the stablecoins you borrow will eventually be converted into other tokens, so you don’t need to worry about the decentralization of your borrowing assets.

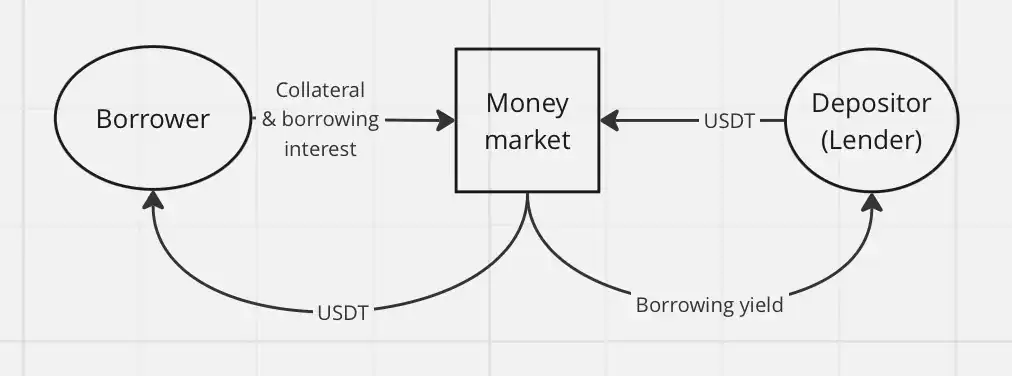

Classic lending is much simpler through the flywheel mechanism of the money market, such as Hyperlend, and has the same economic effect on the end user.

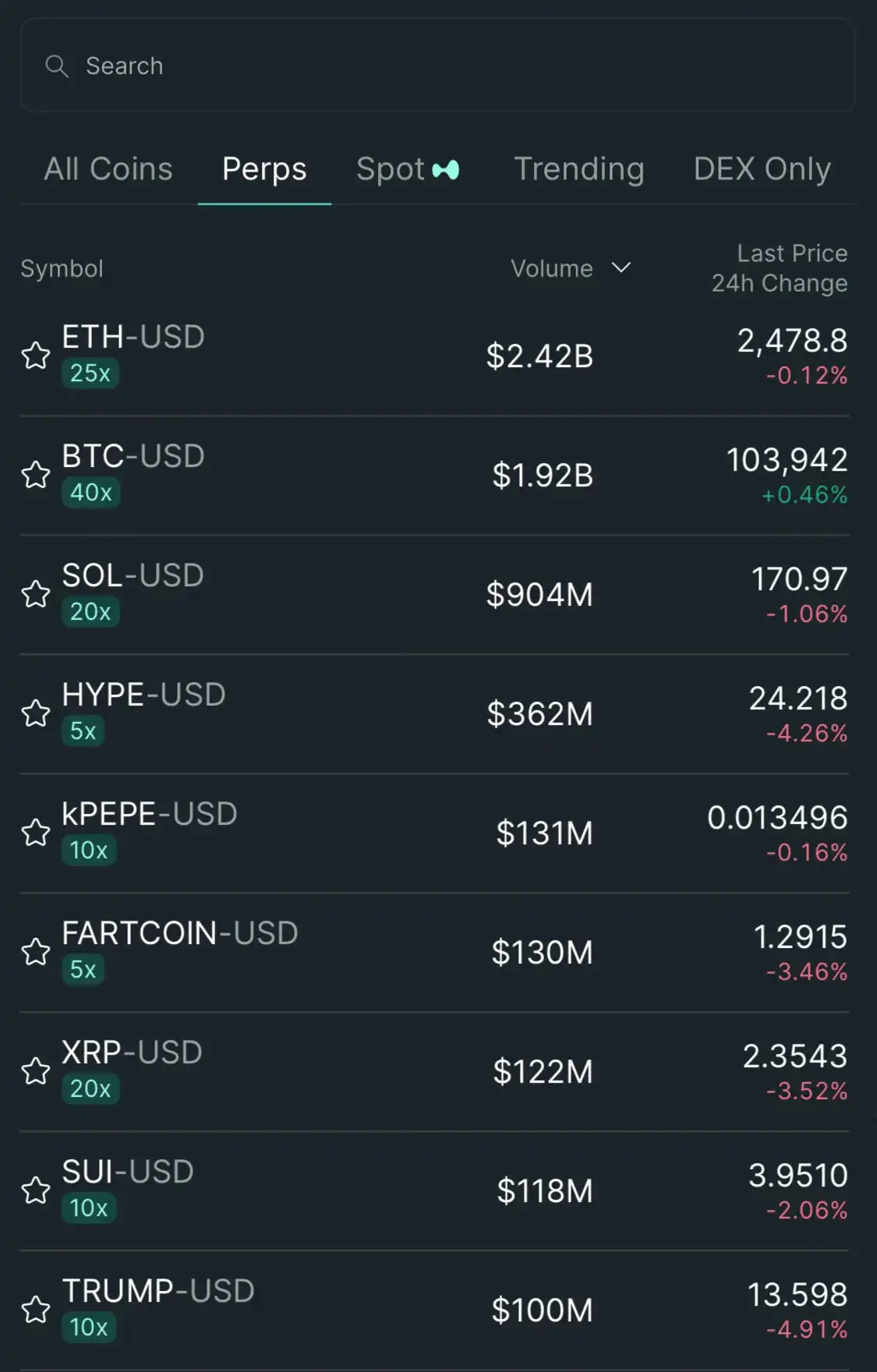

Another reason why CDP is not successful in HyperEVM is that leveraged trading is already a native feature of the Hyperliquid ecosystem. On other chains, CDP provides decentralized leveraged trading. On Hyperliquid, users only need to use the platform itself, leveraged perpetual contracts (perps) and excellent user experience, and they no longer need to rely on CDP stablecoins.

With Hyperliquid, there is no need to trade leveraged through third-party agreements at all. The only use scenario I see for CDP is for loop operations for leverage farms and HLP.

To sum up, the following are the reasons why CDP "stablecoins" performed poorly on HyperEVM:

Lack of powerful arbitrage mechanism

·There is weak demand for CDP products in Hyperliquid

·Low borrowing costs and no reason to hold CDP tokens

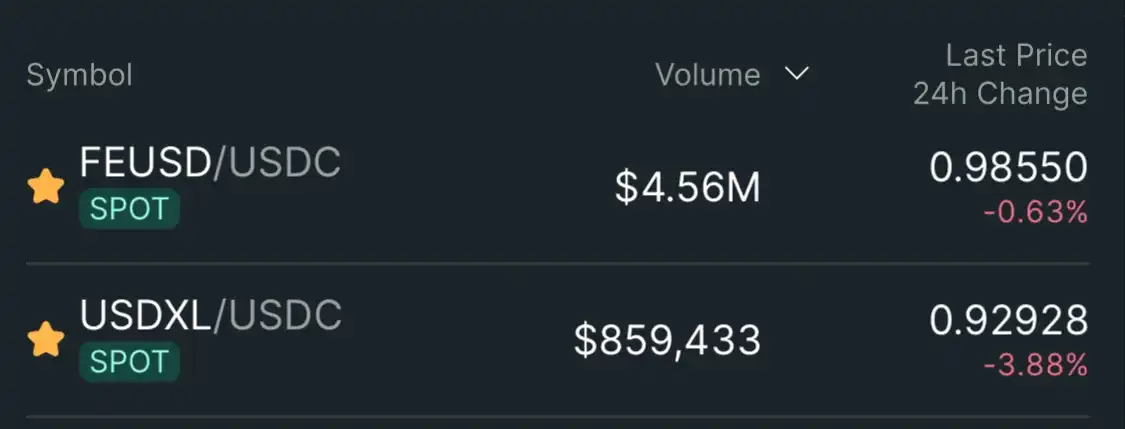

Therefore, CDP "stablecoins" like feUSD and USDXL are trading at soft anchor prices below $1: feUSD is $0.985 (-1.5%) and USDXL is $0.93 (-7%).

Conclusion: I don't think CDP stablecoins have any potential in the Hyperliquid ecosystem. Users don't need them – Hyperliquid already provides a better user experience and deeper liquidity, natively supporting leveraged trading. Once the airdrop and points reward program is exhausted, the CDP tokens will lose their remaining use value.

Hypurrliquid, do not do exit liquidity.

jinse

jinse

chaincatcher

chaincatcher