PENDLE of DeFi renaissance: Pendle ecological progress

Reprinted from jinse

12/26/2024·4MAuthor: defizard, encryption researcher; Translation: Golden Finance xiaozou

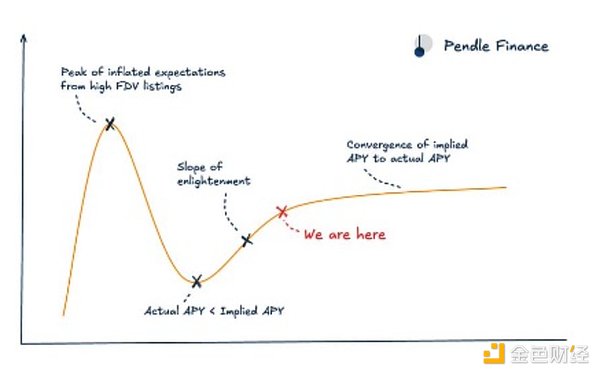

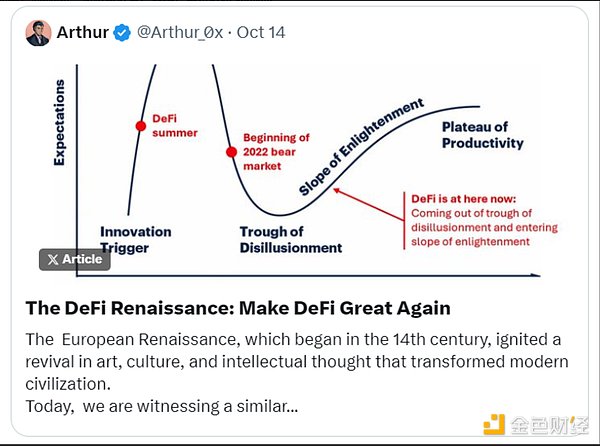

From “nobody” to “Binance-backed” to achieving trillion-dollar opportunities, let’s take a look at how PENDLE can bring DeFi back to its glory.

December's Pendle has quite a few Easter eggs you might have missed.

(1) PendleSwap: an aggregator within an aggregator.

(2) Boros will be launched in 2025: long/short funding rates (hedging is easy).

(3) Issue airdrops to vePENDLE holders.

"What? Airdrop?"

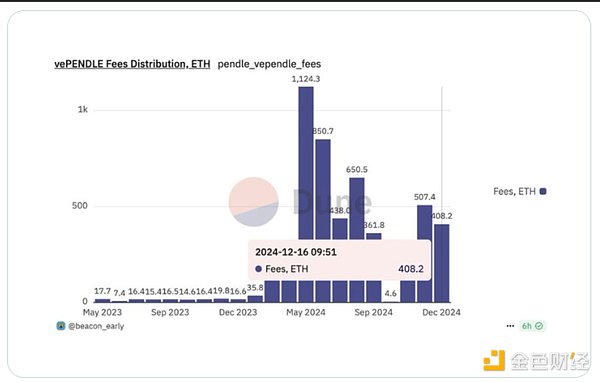

Yes, my dear friend, it is. Pendle charges a 3% fee from all accumulated earnings of YT and all SY earnings (including points) of expired unredeemed PT. These are all owned by vePENDLE holders.

“How many tokens will be distributed?”

Approximately US$8 million at current prices. The snapshot will be generated on December 31st.

"But... not that much. Why would anyone hold a vePENDLE?"

Pendle’s average daily trading volume is approximately $150 million. Just last month 408 ETH was distributed. Its new product, Boros, will launch next year, offering margin rate swap trading.

The value obtained from Boros will flow to PENDLE and vePENDLE holders. There are no new coins.

Imagine trading perpetual funding rates in a Boros market with a daily trading volume of $150 billion to $200 billion.

"Wait a minute... Boros supports trading capital interest rate leverage trading??"

Yes. Traders, protocols or market makers will have the ability to hedge funding rates at scale. Fees will be allocated as follows:

- 80% goes to vePENDLE holders.

- 10% goes to the treasury.

- 10% for operations.

"I smell money...and what about PENDLE? What about inflation?"

PENDLE is the core of the Pendle ecosystem and has no maximum supply cap.

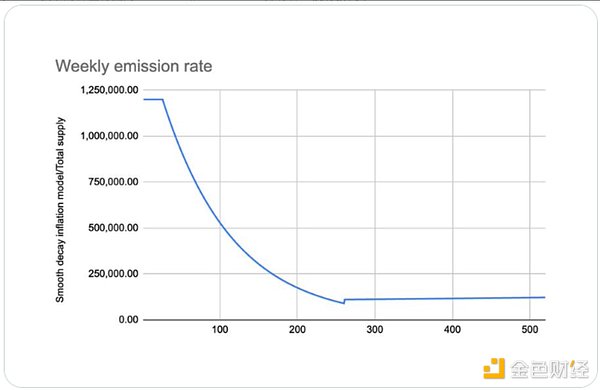

Its mixed inflation model sees weekly emissions falling by 1.1% each week until April 2026. Thereafter, a terminal inflation rate of 2% per year will be implemented.

"So...how's its valuation?"

At the time of writing, PENDLE's FDV (fully diluted valuation) is $1.4 billion. The following data can be compared:

- UNI: Number one swap token: FDV at $14.5 billion.

- AAVE: #1 Lending Token: FDV at $6 billion.

- EIGEN: No. 1 staking token: FDV at $6.6 billion.

- ENA: Basis deal number one: FDV $16 billion.

PENDLE will become the number one in funding interest rate trading.

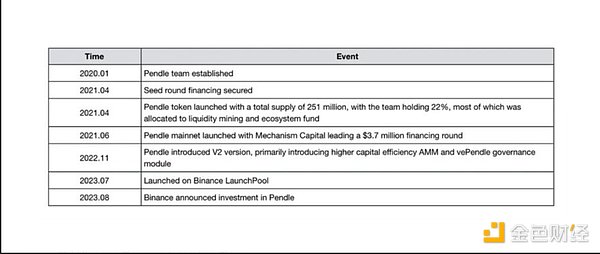

Pendle’s journey began in 2021 with a $3.7 million funding round from Mechanism Capital. The initial TVL was not promising and has remained below $10 million in the past two years. But the team refused to give up. They are developing and creating all the time.

"Pendle's current status?"

Its TVL is US$4.9 billion (historical peak is US$6.7 billion).

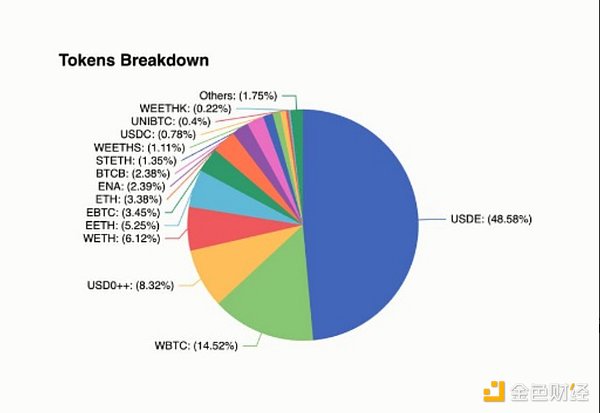

In general, Pendle benefits greatly from stablecoins: currently mainly USDe/USD0++.

TVL is followed by LRT/LST such as EETH/WETH.

The bull market is in full swing, and Pendle's upside potential is huge.

Pendle has everything you want: innovation, unique product-market fit, adaptability, real-world utility, and exceptional team and community support.

If you identify the best bet, don't let it go. And PENDLE is undoubtedly one of them.

chaincatcher

chaincatcher

panewslab

panewslab