Pantera Managing Partner: RWA track is ushering in gold rush

Reprinted from jinse

02/17/2025·2MAuthor: Paul Veradittkit, Managing Partner, Pantera Capital, Coindesk; Translated by: Tao Zhu, Golden Finance

The Ondo Summit held in New York City on February 6, 2025 marks an important milestone in the integration of traditional finance and blockchain technology. The guest lineup of this event is star-studded, including but not limited to:

Asset Manager:

-

Goldman Sachs

-

Franklin Templeton

-

BlackRock

-

Fidelity Investment

-

Bank of New York Mellon

Leaders in Blockchain and DeFi:

-

David Schwartz (CTO, Ripple)

-

Sergey Nazarov (Co-founder of Chainlink)

-

Mary-Catherine Lader (Chief Operating Officer, Uniswap)

-

Konstantin Richter (CEO, Blockdaemon)

Regulatory officials:

-

Caroline D. Pham (Acting Chairman of the Commodity Futures Trading Commission)

-

Summer K. Mersinger (Member of Commodity Futures Trading Commission)

-

J. Christopher Giancarlo (Former Chairman of the Commodity Futures Trading Commission)

Industry experts:

-

Dan Morehead (founder of Pantera Capital)

-

Mike Novogratz (CEO of Galaxy Digital)

-

Patrick McHenry (Former Chairman of the House Financial Services Committee)

This may be the first time blockchain leaders, regulatory officials and traditional asset managers have come together to discuss the steps needed to combine blockchain technology with traditional finance, rather than meta- planning.

This has been waiting for a long time.

What excited me the most was the pragmatism in the conversation. Some comments from Sandy Kaul of Franklin Templeton reflect this thoughtfulness:

“Don’t underestimate how hard it is to switch from an account-based system to a wallet-based system…no real portfolio; portfolios are virtual constructs of different accounts, so I can mix assets and use interoperable assets for any People from traditional backgrounds are completely unfamiliar."

“[Regulators] The system proposed in the [1970s] began to have central counterparties [and] central custodians. We started to have liquidation agencies act as buyers for every seller and sellers for every buyer, and we started Net settled portfolio positions, we started order entry and ownership. We had to unpack the entire system to make this new system work.”

Pantera Capital founder Dan Morehead also mentioned the ever-changing political zeitgeist:

“There was a large group of people in Congress who opposed cryptocurrencies… In the 58 controversial elections that supported cryptocurrencies, 54 people who opposed cryptocurrencies left Congress. No one would say bad things about cryptocurrencies in Congress again.”

Ondo's highlight moments

While I may be biased, as Pantera led the seed round of Ondo and co-led the A round, I believe Ondo is the only company that is highly focused on solving the problem of blockchain and traditional finance integration.

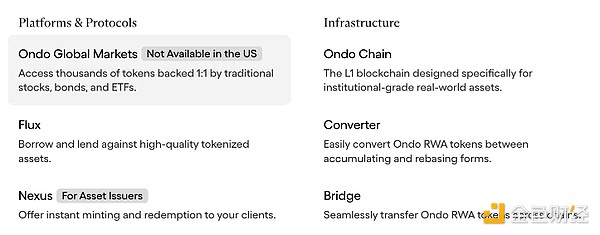

Ondo also announced Ondo Chain, the full-chain network of RWA. This chain solves two problems: making on-chain earnings more attractive/easier to off- chain investors, and linking on-chain users with off-chain products/earnings.

The question is very simple.

The financial pipelines in today’s world are built on assumptions of distrust and often checks and balances. If I want to buy stocks, my money goes through my bank or payment processor, brokerage firm, possible market makers, stock exchanges, clearing companies, custodial banks, and possible transfer agents. These are the 7 intermediaries that buy stocks.

And if I'm not satisfied with the current bank's savings rate, I have to register an account with another bank, which takes several days, and maybe re- examine the anti-money laundering and identity checks, and create new repetitions. document.

On-chain, a single wallet can directly interact with any market without trust, without any intermediaries, and without creating a new account for each transaction.

Ondo’s vision is to let the line between traditional finance and blockchain disappear, powered by Ondo Chain and the broader Ondo infrastructure. Investors will be able to instruct their banks to send SWIFT bank wire transfers to users on the chain, which can be done in one go through Ondo Chain. Similarly, global investors will be able to buy securities on Ondo Chain, which will translate into a payout on the TradFi exchange. Similarly, institutional investors will be able to pledge their Treasury bonds as collateral in the traditional repo market, but convert the generated cash into earnings coin assets they can use in DeFi. The boundaries between the current financial silos will continue to blur, supported by the infrastructure that Ondo Chain and Ondo are building.

Ondo Chain will allow around-the-clock trading, global assets, easier compliance, better interest rates and new investment opportunities.

Man selling shovels during the gold rush

On-chain real-world assets are growing at accelerating ($8.5 billion in early 2024 and $17 billion in early 2025) as it benefits both token creators and buyers.

On-chain users can earn profits from off-chain sources, while RWA creators can hold large amounts of assets, charge small fees, and invest them elsewhere for additional profits. RWA provides strong support for DeFi as it brings some trust guarantees for on-chain RWA gains that can be over-staked, margin trading and packaging to create unlimited derivative tokens. In fact, a dollar RWA can increase the GDP of the on-chain economy several times.

Ondo Global Markets allows access to tokens backed by traditional assets 1:1, Bridge transfers RWA tokens across chains, and Nexus provides instant minting and redemption for customers. Instead of having their own proprietary channels, each bank can use Ondo Chain to eliminate the administrative bloat of traditional finance while allowing users to easily obtain on-chain benefits and provide developers with a single platform to build without having to go with each A bank jointly creates products.

DeFi promises the dream of financial access, interoperability and transparency. More than a decade later, we may finally have the infrastructure to connect the web2 world and web3. - Paul Veradittakit

chaincatcher

chaincatcher

panewslab

panewslab