PA Daily | CZ calls on the market to need more dapps than chains; BitGo considers IPO as early as the second half of 2025

Reprinted from panewslab

02/12/2025·2MToday's news tips:

Jiangsu High Court: Overseas virtual currency investment is not protected by our country's laws

LinksDAO plans to launch community token LINKS on Base Chain and use it for golf course acquisition

BitGo considers IPO as early as the second half of 2025, with a valuation of over $1.75 billion

FTX/Alameda redeems 184,000 SOLs 6 hours ago and distributed them to 23 addresses

Regulatory/Macro

According to OKG Research data, 21 states in the United States have proposed bills related to Strategic Bitcoin Reserve (SBR). Among them, Utah, Oklahoma and Arizona are the fastest progress. Utah is expected to be the first state to implement SBR. Its Bitcoin Reserves Act passed a vote from the House Economic Development Committee on January 28 and is currently awaiting review by the Senate. If passed, it will take effect as early as May 7 this year. . In addition, the relevant legislative process in Oklahoma and Arizona is also closely followed.

Jiangsu High Court: Overseas virtual currency investment is not protected by our country's laws

According to the official account of the Jiangsu High Court, the Jiangsu High Court released typical cases of foreign-related commercial trials, pointing out that overseas virtual currency investment is not protected by my country's laws. In related cases, Singaporean citizen Pan and Chinese citizen Tian signed a cooperation agreement with non-parties to jointly operate the "MFA blockchain" project. Pan transferred 15.74 million yuan to Tian to purchase MFA virtual currency. However, afterwards, the virtual account involved in the case was locked and the principal could not be traded was completely lost, and Pan filed a lawsuit with the court. The Jiangsu High Court held in the second instance that Pan Moumou is a Singaporean citizen and this case has foreign factors. According to the application of laws and regulations of our country, if it involves my country's financial security and social public interests, the mandatory provisions of our country's laws and regulations should be directly applied, which are prohibited by my country's laws and regulations. Virtual currency investment. In this case, the parties signed a contract to speculate overseas virtual currencies, which violated the mandatory provisions in the field of financial supervision in my country. The investment losses claimed by the parties shall not be protected according to law, and the losses caused by this shall be borne by the parties themselves.

According to The Block, the U.S. Securities and Exchange Commission (SEC) has officially accepted the listing application for spot Solana (SOL) ETF submitted by Cboe BZX exchange, and the applicants include 21Shares, Bitwise, Canary Capital and VanEck. In addition, Franklin Templeton has also registered the Franklin Solana Trust in Delaware, showing that it plans to join the Solana ETF competition. Previously, the ETF conversion application submitted by Grayscale Solana Trust has entered the SEC public comment phase, taking a path similar to Bitcoin ETFs. Bloomberg ETF analysts James Seyffart and Eric Balchunas expect the probability of Solana ETF approval is 70%. However, how regulators define SOL as a commodity or securities may still be a key issue in the approval process.

Powell says it won't push forward central bank digital currency during his term

According to CoinDesk, the House Digital Assets Subcommittee held a hearing on February 11 to explore the future development of the crypto industry in the United States and to promote legislation to provide regulatory clarity. The hearing, with the theme of “The Golden Age of Digital Assets,” demonstrates the Republican-led committee’s support for the crypto industry. Committee chairman Bryan Steil, Republican of Wisconsin, said the Trump administration plans to establish a reasonable regulatory framework for responsible digital asset businesses. Industry representatives stressed that Congress should formulate basic laws as soon as possible to provide a clear market structure for the crypto industry. Former CFTC Chairman Timothy Massad suggested that lawmakers give SEC and CFTC greater decision-making power in regulatory details. Meanwhile, Democratic lawmakers took the opportunity to criticize Trump's personal support for $TRUMP memecoin, accusing it of possible involvement in conflicts of interest and constitutional violations. Federal Reserve Chairman Powell also said on the same day that he would not promote the central bank digital currency (CBDC) during his term.

AI

据Cointelegraph报道,美国和英国拒绝签署由法国主办的国际AI伦理协议,该协议旨在推动AI技术的包容性、道德性和安全性。 US Vice President JD Vance criticized Europe's excessive intervention in AI regulations at the summit, saying that "overregulation may kill this transformative industry" and opposed AI content censorship, believing it to be "totalitarian censorship".英国政府则表示,该协议与其2023年AI安全峰会的立场存在分歧。 此次AI行动峰会(2月10-11日)吸引了100多个国家,最终有60国签署声明,提出建立公共利益AI平台、AI孵化器及全球AI观察站等倡议。 However, the United States and Britain did not join.分析人士指出,这标志着美国政策的“明确转变”,即优先推动AI创新发展,而非以安全监管为主。此前,特朗普政府上任后已撤销拜登政府的AI监管框架。

According to Fox Business reporter Eleanor Terrett, citing three people familiar with the matter, U.S. President Trump has chosen Brian Quintenz as the official chairman of the Commodity Futures Trading Commission (CFTC). Quintenz is currently the director of a16z encryption policy and has served as a former CFTC committee member. Caroline Pham, the current acting chairman of the CFTC, has congratulated this and said Quintenz has promoted a number of important initiatives during his tenure as a CFTC committee member and is expected to play a leading role in the field of crypto and innovation. The White House has not issued an official statement.

Project News

Binance will remove EDU/BTC, REZ/BTC, USTC/FDUSD spot trading pairs

Binance announced that it will cease trading of the following spot trading pairs: EDU/BTC, REZ/BTC, USTC/FDUSD on February 14, 2025 Beijing time. The removal of the shelves aims to protect users and maintain a high-quality trading market. Decisions are made after regular evaluations of various factors such as liquidity and trading volume.

Binance will support Neutron (NTRN) and Polygon (POL) network upgrades and hard forks. Neutron (NTRN) will undergo a network upgrade at the block height of 19,947,000 (East Eighth District Time on February 12, 2025). Binance is expected to suspend the token recharge and withdrawal services of the Neutron (NTRN) network at 21:00 on February 12, 2025; Polygon (POL) will be blocked at 22,393,043 (East Eight Time is expected to be in 2025 18:00 on February 13) Network upgrade and hard fork will be carried out. Binance is expected to suspend the token recharge and withdrawal services of the Polygon (POL) network at 17:00 on February 13, 2025.

LinksDAO plans to launch community token LINKS on Base Chain and use it for golf course acquisition

According to CoinDesk, LinksDAO announced that it will issue community tokens LINKS to supplement its NFT ecosystem and use it for golf course acquisitions. The token is expected to be online on the Base blockchain, with one-third of the supply being allocated to LinksDAO NFT holders and the rest being allocated to NFT community members such as Pudgy Penguins and BAYC. LinksDAO has previously purchased a golf course in Scotland and plans to partially acquire Hillcrest Golf Club in Kansas City. The transaction requires votes and approval by NFT holders, but its governance rights are not completely decentralized. LinksDAO aims to enable every golf enthusiast to hold LINKS tokens, thereby expanding the influence of crypto clubs.

Binance will conduct wallet maintenance on the Ethereum Network (ETH) on February 13, 2025 at 14:00 (East Eighth Time). To support this maintenance, Binance will suspend the recharge and withdrawal services of Ethereum Network (ETH) at 13:55 on February 13, 2025 (East Eighth District time).维护预计需要1 小时,维护完成后将自动恢复充值、提现业务。

Story will launch token issuance and pledge rewards on March 4, releasing 55,555 IPs per day

According to official news, Story will officially start the issuance of IP tokens on March 4, 2025 (block 1,580,851), releasing 55,555 IPs per day, and simultaneously launching staking rewards. It is currently in the singularity period, and users can pledge but no rewards. It will take effect after the Big Bang Block. The pledge reward mechanism adopts a time-weighted mode, with flexible pledges of 1x, 90 days 1.1x, 360 days 1.5x, and 540 days 2x, while locked pledges only enjoy 0.5x reward (locked for 6 months). Story encourages long-term staking to enhance the security and stability of decentralized AI native IP infrastructure.

BitGo considers IPO as early as the second half of 2025, with a valuation of over $1.75 billion

According to Bloomberg, US crypto custodial company BitGo is considering an initial public offering (IPO) as early as the second half of 2025 and is currently in talks with potential consultants. BitGo completed a US$100 million financing in 2023 with a valuation of US$1.75 billion. Investors include Goldman Sachs, DRW Holdings, Redpoint Ventures and Valor Equity Partners. The company provides crypto asset custody, transaction, lending and other services to more than 1,500 institutional clients in more than 50 countries around the world, and handles about 8% of the global Bitcoin transaction volume. The IPO plan comes as the U.S. government's attitude towards the crypto industry shifts to support, and many crypto companies such as Gemini, Bullish Global, Circle and Kraken are also preparing to go public. In addition, BitGo CEO Mike Belshe supported Trump's campaign fundraisers in July 2024.

Viewpoint

According to statistics from Messari researcher MONK, since the token generation event (TGE), the token price performance of multi-chain projects has significantly differentiated: Starknet fell 87%, Mode fell 70%, Blast fell 85%, zksync fell 47%, and Scroll fell 50% , Dymension fell 87%, Berachain fell 59%, while Hyperliquid rose 1100% against the trend. In addition, between January and April this year, the market is expected to have $17 billion in tokens unlocked, while the recent long-term liquidation amount has reached nearly $10 billion. Zhao Changpeng, former Binance CEO, commented that the market needs more dapps than chains.

Matrixport: If inflation decline continues, the outlook for gold and Bitcoin remains bullish

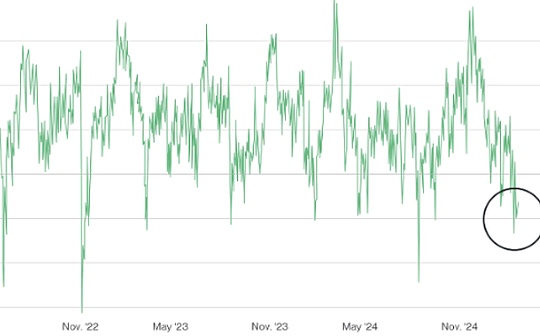

Matrixport said that amid the current inflation uncertainty, market demand for safe-haven assets such as gold and Bitcoin remains strong. If the market expects the Fed to keep interest rates unchanged and liquidity tightened, gold will not theoretically rise, but the actual situation shows that even if inflation is controllable, safe-haven demand will still drive gold to strengthen. Although Bitcoin has recently consolidated, this trend may provide support for it. Matrixport recalled that it had issued a bullish report when gold broke through $2,000 per ounce for the first time, and the price of gold has risen by more than 50%. Although the overall U.S. inflation rate rebounded to 2.9%, Truflation data showed that the actual inflation level was closer to 2.0%. If the inflation decline continues, the outlook for gold and Bitcoin remains bullish.

SEC Commissioner Hester Peirce: Most Memecoin may not be regulated by SEC

According to The Block, Securities and Exchange Commission (SEC) Commissioner Hester Peirce said in an interview with Bloomberg that many Memecoins in the current market may not fall within the scope of SEC regulation. She pointed out that the specific situation depends on the characteristics of individual tokens, but under current regulations, the SEC may not have the authority to regulate most of the Memecoin. Peirce-led SEC crypto task force is working to clarify which tokens can be considered "non-securities" to reduce regulatory uncertainty. This remarks contrast with former SEC chairman Gary Gensler's position that "the vast majority of crypto assets are securities." Although the Memecoin market's market value increased by 500% to $120 billion in 2024, and President Trump even launched his personal Memecoin, there is still a risk of fraud and "pulling shipments". Recently, an investor has filed a class action lawsuit against Memecoin platform pump.fun, accusing it of violating securities laws.

Important data

According to @ai_9684xtpa monitoring, a "giant whale that spent $13.64 million to build positions in $PNUT and $ai16z in the past three months" began to build positions in $arc. So far, the giant whale's cumulative floating losses on these three Memecoins have reached US$6.601 million. Among them, holding 21.46 million $PNUT, the cost is $0.3743, and the floating loss is $4.82 million; holding 7.53 million $ai16z, the cost is $0.7446, and the floating loss is $1.88 million; holding 9.52 million $arc, the cost is $0.2913, The current floating profit is US$99,000.

USDC Treasury adds nearly 100 million USDCs to the Ethereum chain

According to Whale Alert monitoring, USDC Treasury added 97,652,392 USDCs to the Ethereum chain at 15:43.

According to Lookonchain monitoring, a giant whale just deposited 2 million EIGENs into Binance, worth $3.18 million. Two months ago, the giant whale had extracted the same amount of EIGEN from Binance for $4.53, with a total value of $9.07 million. Currently, the price of EIGEN has fallen to $1.59, and the giant whale lost $5.89 million during its two-month holding period.

FTX/Alameda redeems 184,000 SOLs 6 hours ago and distributed them to 23 addresses

According to EmberCN monitoring, FTX/Alameda redeems 184,162 SOLs (about $37.73 million) from the pledge in the past six hours ago and distributed them to 23 addresses. Since November 2023, FTX/Alameda has accumulated redemption and transferred out 4,629,000 SOLs (about $555 million) through similar operations, with an average transfer price of $120. Most of these SOLs flow to Coinbase and Binance. At present, there are still about 6.338 million SOLs (about 1.25 billion US dollars) pledged by FTX/Alameda.

chaincatcher

chaincatcher

jinse

jinse