OSL trading moment: Market forecasts BTC may fall to $77,000 and return to the bull market, altcoins are expected to rebound

Reprinted from panewslab

02/24/2025·2M

1. Market Observation

Keywords: ETF, ETH, BTC

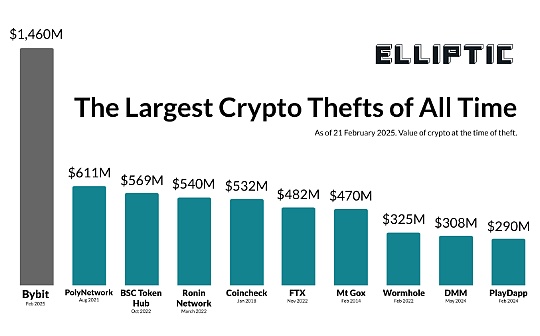

In the cryptocurrency space, Bitcoin (BTC) continues to attract attention. CryptoQuant's CEO predicts that the price of Bitcoin will fall to $77,000 and may resume bull market. However, the recent conversion of stolen assets in Bybit vulnerabilities to Bitcoin by cybercriminals has sparked concerns about the relationship between cybercrime and cryptocurrency.

In contrast, Strategy's Michael Saylor put forward a more optimistic view at CPAC 2025, emphasizing the transformational potential of Bitcoin in corporate finance and personal economic independence. Against this backdrop, Ethereum (ETH) also shows bullish signs, especially after Bybit's large ETH repos.

Meanwhile, business intelligence company Strategy updated its profile picture, which sparked speculation that it might soon buy Bitcoin. Previously, Michael Saylor hinted that Strategy's 21/21 plan is making progress, aiming to further amass Bitcoin. While Bitcoin’s price remains fixed below $100,000, some altcoins have also shown growth potential.

Although Bitcoin faces selling pressure, with prices falling 3% and stabilizing above $95,500, key indicators show the possibility of a rebound. However, the sharp drop in prices after the Bybit hack suggests that holders may have chosen to give up in the near term. Ethereum has also experienced death-crossing turmoil, but some analysts are optimistic about its long-term continued rise.

In addition, Bitcoin’s role in the US economy has also become the focus of discussion. VanEck said that by 2049, strategic bitcoin reserves have the potential to eliminate $21 trillion in debt. This view resonates with Bitcoin’s expectations of being ready to break through its latest all-time high of $108,824. However, as gold prices approach $3,000, Bitcoin appears to be lagging in performance, raising concerns about the world's largest cryptocurrency.

2. Key data (as of 10:10 HKT on February 24)

-

S&P 500: 6,013.13 points (+2.24% within the year)

-

Nasdaq: 19,524.01 points (+1.10% within the year)

-

10-year US Treasury yield: 4.430% (-14.60 basis points within the year)

-

US dollar index: 106.20 (-2.10% within the year)

-

Bitcoin: $96,178 (+2.96% during the year), daily spot trading volume is $18.45 billion

-

Ethereum: $2,794.17 (-16.46%), daily spot trading volume is $22.35 billion

3. ETF flow (EST, February 21)

-

Bitcoin ETF: -$62.9 million

-

Ethereum ETF: -$8.9 million

4. Important date (Hong Kong time)

The second estimate of GDP quarterly growth rate (21:30 on February 28)

- Actual: None/Previous value: 3.1% / Expected: 2.3%

Core PCE price index month-on-month (21:30 on February 28)

- Actual: None/Previous value: 0.2% / Expected: 0.3%

Personal consumption expenditure month-on-month (09:30, February 28)

- Actual: None/Previous value: 0.7% / Expected: 0.2%

5. Hot News

Bybit CEO: Completely fills the ETH gap

Georgia proposes second Bitcoin reserve bill

Pump.fun is suspected of internal testing of AMM liquidity pool, adding a new Swap section

A multi-signature wallet associated with Mantle bought 200 million WLFI 6 hours ago

Arkham Exchange will offer spot transactions to users in 17 U.S. states starting March 1

Bybit hackers surpass Fidelity and Vitalik to become the 14th largest ETH holder in the world

Franklin Templeton submits spot Solana ETF S-1 document to US SEC

Powered by OSL - Hong Kong's largest over-the-counter trading platform, continuing to provide regulated digital asset services to the market since 2018.

chaincatcher

chaincatcher

jinse

jinse