Opinion: Bitcoin Reserve Bill Could Break Cryptocurrency’s Four-Year Cycle

Reprinted from panewslab

12/23/2024·5MAuthor: Daniel Ramirez-Escudero, CoinTelegraph

Compiled by: Deng Tong, Golden Finance

As speculation mounts that incoming President Donald Trump may sign an executive order declaring a Bitcoin reserve on day one or pass legislation to establish a reserve during his term, many want to Know if this move will lead to a cryptocurrency super cycle.

Since Wyoming Senator Cynthia Lummis introduced the Bitcoin Reserve bill earlier this year, similar proposals have been introduced in states such as Texas and Pennsylvania. Russia, Thailand and Germany are reportedly considering proposals of their own, further increasing pressure.

If governments race to protect their Bitcoin stocks, will we say goodbye to the four-year boom-bust cycle in cryptocurrency prices?

Iliya Kalchev, an analyst at cryptocurrency lender Nexo, believes that “the Bitcoin Reserve Act could be a landmark moment for Bitcoin, marking its “recognition as a legitimate global financial instrument.”

“Every Bitcoin cycle has a narrative that tries to push the idea that ‘this time it’s different.’ Conditions have never been more ideal. The cryptocurrency space has never had a pro-crypto U.S. president controlling the Senate and Congress.”

The Bitcoin Act of 2024 proposed by Lummis would enable the U.S. government to include Bitcoin as a reserve asset in its treasury, purchase 200,000 Bitcoins per year within five years, accumulate 1 million Bitcoins, and hold them for at least 20 years.

Strike founder and CEO Jack Mallers believes it’s “possible that Trump will issue an executive order to buy Bitcoin on day one,” though he cautions that wouldn’t equate to buying 1 million Bitcoin.

Dennis Porter, co-founder of the Satoshi Act Fund, a non-profit organization that supports Bitcoin’s U.S. policy bill, also believes that Trump is exploring enabling a Bitcoin strategic reserve through executive order.

Dennis Porter announces that Trump is working on an executive order for a strategic Bitcoin reserve. Source: Dennis Porter

So far, Trump’s team has not directly confirmed claims about the executive order, but Trump was asked on CNBC whether the United States would build a BTC reserve similar to an oil reserve (which could mean legislation).

Executive orders lack stability, however, as subsequent presidents often overturn such orders. The only way to ensure the long-term future of Bitcoin’s strategic reserve is to pass legislation with majority support.

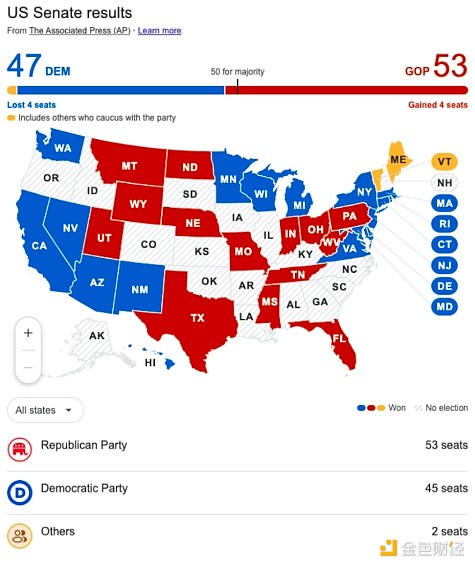

With Republicans dominating Congress and holding a slim majority in the Senate, Bitcoin advocates on Trump’s team have a solid base to push Lummis’ bill. However, just a handful of Republican defectors could derail the bill amid growing outrage over handing government wealth to Bitcoin supporters.

U.S. Senate and Congressional results following the 2024 elections. Source: Associated Press

“Stop comparing this cycle to previous cycles”

Earlier this month, Alex Krüger, an economist and founder of macro digital asset advisory firm Asgard Markets, said the election results convinced him that “Bitcoin is very likely in a supercycle.”

He believes that Bitcoin's unique situation can be compared to that of gold, which surged from $35 an ounce in 1971 to 1981 when former U.S. President Richard Nixon took the U.S. off the gold standard, ending the Bretton Woods system. of $850.

Krüger does not rule out the possibility of Bitcoin experiencing a bear market like it has in past cycles. However, he urged cryptocurrency investors to “stop comparing this cycle to previous cycles” as this time may be different.

Trump’s actions thus far certainly point to an administration that is well positioned for the future. After Gary Gensler resigned, he nominated pro-cryptocurrency and pro-deregulation Paul Atkins to serve as Securities and Exchange Commission chairman.

He also nominated pro-cryptocurrency Scott Bessent as Treasury Secretary and appointed former PayPal COO David Sacks as artificial intelligence and cryptocurrency czar, responsible for the cryptocurrency industry Develop a clear legal framework.

Super cycle theory has never had super results

However, the notion that “this cycle is different” has appeared in every past Bitcoin bull run, each time supported by a narrative surrounding mainstream and institutional adoption.

During the 2013-2014 bull market, the supercycle theory was supported by the theory that Bitcoin would gain international attention as an alternative asset to fiat currencies.

In the 2017-2018 cycle, rapid price appreciation was considered a sign of mainstream financial adoption and the beginning of Bitcoin's mainstream acceptance, and institutional interest would flourish.

In the 2020-2021 cycle, when technology companies such as MicroStrategy, Square, and Tesla enter the Bitcoin market, they believe that many technology-related companies will follow suit.

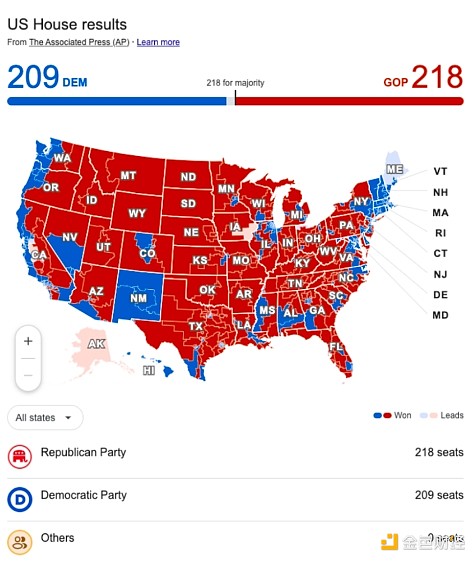

Bitcoin’s price performance has seen peaks and lows in previous cycles. Source: Caleb & Brown

However, in each cycle, the supercycle narrative failed to materialize, ultimately causing prices to plummet and wipe out supporters as they entered a secular bear market.

Su Zhu, co-founder of Three Arrows Capital, is the most famous supporter of the super cycle theory since 2021. He believes that the encryption market will continue to be in a bull market without a sustained bear market, and Bitcoin will eventually reach a peak of $5 million.

Three Arrows certainly borrowed money, as if the supercycle theory were real, and when it was finally liquidated, the cryptocurrency market cap fell by nearly 50% after the news broke, a collapse that saw crypto companies including Voyager Digital, Genesis Trading, and BlockFi of lenders going into bankruptcy and financial difficulty.

Therefore, super cycles are a dangerous theory to bet your life savings on.

For Chris Brunsike, a partner at venture capital firm Placeholder and former head of blockchain products at ARK Invest, the Bitcoin supercycle is just a myth.

“The super cycle is undoubtedly a collective delusion.”

However, the U.S. election results overwhelmingly provide unprecedented, extremely bullish conditions for Bitcoin, given the support of the U.S. President, who appears to be following through on his pro-crypto promises, which include never selling U.S. Bitcoin Bitcoin in inventory.

Potential global domino effect

If the Bitcoin Reserve Act is passed, it could spark a global race to hoard the currency, with other countries following suit to avoid falling behind.

Attorney George S. Georgiades, who switched from advising Wall Street firms on financing to working with the cryptocurrency industry in 2016, told Cointelegraph that enacting the Bitcoin Reserve Act “could mark a turning point in global Bitcoin adoption” and could “trigger other events.” Countries and private institutions are following suit, driving wider adoption and increasing market liquidity. "

Basel Ismail, CEO of crypto investment analysis platform Blockcircle, agreed, saying the approval would be “one of the most optimistic events in the history of cryptocurrencies” as “it will spark a race to grab as many Bitcoins as possible.”

"Other countries will not have a say and they will be forced to act. Either pivot and compete or die."

He believes "most G20 countries will follow suit and build their own reserves."

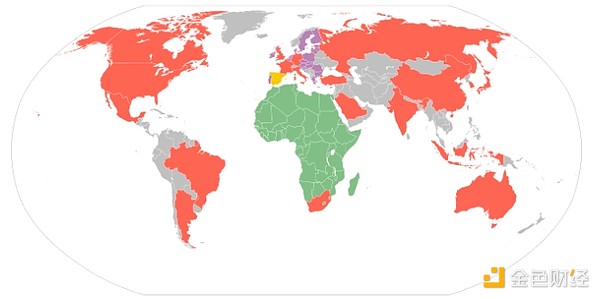

2024 G20 map. Red: G20, purple: European Union representative countries, green: African Union representative countries. Yellow: Countries permanently invited. Source: Wikipedia

Veteran crypto investor and Bitcoin educator Chris Dunn points out that this FOMO-based competitive buying boom among countries could completely change the current crypto market cycle.

“Bitcoin could trigger FOMO if the U.S. or other major economic powers start accumulating Bitcoin, which could create market cycles and supply and demand dynamics unlike anything we have seen to date.”

The OKX exchange president noted that other countries may be ready for such a competition.

"Game theory may well have quietly come into play."

However, Ismail said that most Bitcoin purchases will be done through OTC brokers and settled in the form of block trades, so "it may not have an immediate and direct impact on the price of Bitcoin," but will create a long-term impact . Persistent demand forces will ultimately drive Bitcoin’s price higher.

New Wave of Cryptocurrency Investors Could Change Cryptocurrency Market

Dynamics

If countries become market buyers, the Bitcoin market could fundamentally change. A new wave of new investors from global financial centers will flood into the cryptocurrency market, changing market dynamics, psychology and reactions to certain events.

Nexo analyst Kalchev said that while it is still speculative to assume that this legislation could disrupt Bitcoin’s well-known four-year halving cycle, some dynamics may change.

Bitcoin is a unique market that has so far been driven by retail buying and selling, with prices highly sensitive to market psychology. The emergence of new types of investors may change market dynamics and alter historical cycles.

Ismail believes that "stock market investors will behave differently than retail investors who overreact." Institutional investors have deep pockets and advanced risk management strategies that allow them to treat Bitcoin differently than retail investors.

"Over time, Wall Street's involvement could help create a more stable, less reactive market environment."

Stable is another way of saying less volatile, which logically means bear markets will be less aggressive than past cycles.

Georgiades believes that "price cycles are here to stay" but that "continued demand from large buyers such as the United States may reduce the volatility and volatility we have witnessed in past cycles."

Ismail also pointed out that the performance of the Bitcoin market has been different from the previous four-year cycle. The price of Bitcoin in the current cycle fell below the previous cycle’s all-time high (ATH), which “everyone thought was impossible,” and then Bitcoin reached a new ATH before the official halving.

“The four-year cycle has now been debunked and broken many times.”

Bitcoin has only experienced four halvings so far, with nearly thirty more halving events yet to occur. “It’s hard to imagine that all of these halvings will follow the same predictable four-year pattern,” Kalchev said, especially as broader macroeconomic and political factors, such as central bank policy and regulatory developments, have a greater impact on Bitcoin’s market trajectory. significant impact.

Kalchev believes that Bitcoin’s price movements will no longer be affected by internal mechanisms such as halving, but more by external factors such as institutional adoption and geopolitical events.

chaincatcher

chaincatcher