OKG Research: From the "black box" of Fort Knox to the transparency of on-chain, will Bitcoin repeat the fate of gold being absorbed by the US dollar?

Reprinted from panewslab

03/27/2025·1MText/Hedy Bi

Planning/Lola Wang

Produced by OKG Research

On March 24, Bo Hines, executive director of the Digital Assets Advisory Board of U.S. President Trump, made a controversial suggestion - using the proceeds of gold reserves to buy Bitcoin and boost the country's Bitcoin reserves in a "budget-neutral" way. Just a few days ago, the International Monetary Fund (IMF) officially included Bitcoin in the global economic statistical system. As Bitcoin is included in the Balance of Payments and International Investment Positions Manual (BPM7), central banks and statistical agencies of various countries need to record Bitcoin transactions and positions in the Balance of Payments and Investment Positions Report. This move is not only a formal recognition of Bitcoin's influence in the international financial system, but also means that it is gradually evolving from a speculative asset to a more institutionalized financial instrument. From an international level, Bitcoin can become a country's foreign exchange reserve option from March 20.

However, the most intriguing thing about this proposal back to the United States is that the United States proposes to exchange gold, which is regarded by the market as the "ultimate safe-haven asset" for Bitcoin. This proposal itself raises the fundamental question of whether gold is really still an undisputed safe-haven asset? If the answer is yes, then from the gold coins era in ancient Greece and Roman times to the present tens of centuries, why hasn’t any company adopted a radical model similar to Strategy in the Bitcoin market to increase its holdings of gold for a long time? As policymakers from countries around the world re-examine the positioning of this emerging asset in the financial system, the United States has taken the lead in expressing its attitude. Can Bitcoin become the first shot in the transfer of financial paradigm?

OKG Research launched a special topic "Trump Economics" in 2025, which will continue to track the impact on the crypto industry and global markets under the Trump 2.0 era. This article will start from the comparison between Bitcoin and gold, and what is the profound meaning of this intriguing proposal from the United States?

Isn 't the United States selling real gold?

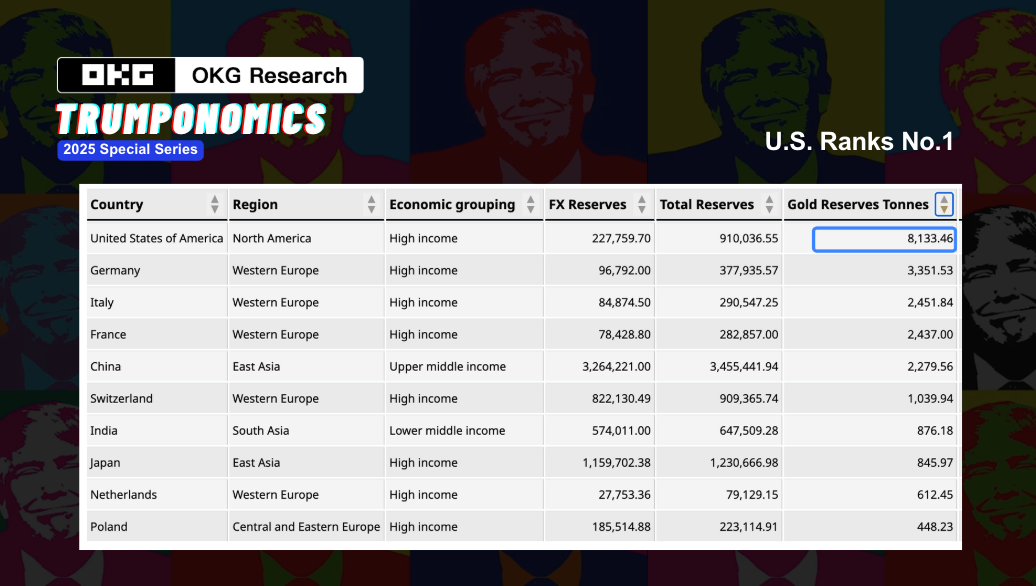

The United States ranks first in the world for 70 years with its official gold reserves of 8133.5 tons. But a notable fact is that these golds have not been circulated in the market for a long time, but are stored in Kentucky Gold Reserves, Denver, the New York Fed and other places. Since the end of the Bretton Woods system in 1971, the US gold reserves are no longer used to support the US dollar, but are generally not sold directly as strategic reserve assets.

Therefore, if the United States wants to use the "surplus of gold reserves" to buy Bitcoin, the most likely way is to use gold-related financial tools rather than sell physical gold.

Historically, the US Treasury Department can create US dollar liquidity out of thin air by adjusting the book value of gold without increasing its actual gold reserves. This method is essentially a "revaluation" operation of assets, but in fact, it can also be regarded as an alternative debt monetization.

Currently, the US Treasury Department has fixed the book value of gold at $42.22 per ounce on its balance sheet, which is far lower than the current market price of gold - $2,200 per ounce. If Congress approves the increase in the book price of gold, the Treasury’s gold reserves will increase significantly on the book value. Based on this new price, the Treasury Department can apply for more gold certificates from the Fed, while the Fed provides the Treasury with the corresponding new dollar.

This means that the United States can implement an "invisible dollar devaluation" by adjusting the book value of gold without consulting with other countries, while creating large-scale fiscal revenue. These new US dollar funds can be used to purchase Bitcoin, further increasing the US Bitcoin reserves. The fiscal revenues from gold revaluation not only provide financial support for Bitcoin purchases, but may also drive increased demand for Bitcoin in a broader financial context. Stephen Ira Miran, economic adviser to the Trump 2.0 administration, quoted the "Triffen puzzle" and pointed out that the US dollar's status as a global reserve currency has caused the United States to face a long-term trade deficit, and gold revaluation will help break this vicious cycle and avoid interest rates soaring. Bitcoin will benefit from this adjustment without releasing too much liquidity.

However, this approach can on the surface promote the followers of other institutions and investors, thereby attracting more liquidity to inject into the Bitcoin market. But it cannot be ignored that if the market believes that the loss of credit in the US dollar is a long-term trend, the global asset pricing system may change, and the price discovery mechanism of Bitcoin may become more uncertain.

The gold market has never been free

If the US Treasury revaluates gold and uses the "book value" of surplus to exchange for US dollars to buy Bitcoin, the Bitcoin market may usher in short-term fanaticism, but at the same time faces the risks of regulatory tightening and liquidity control, just as gold once entered the era of "free pricing" due to the collapse of the Bretton Woods system - price fluctuations under the coexistence of opportunity and uncertainty.

But the gold market has never been truly free.

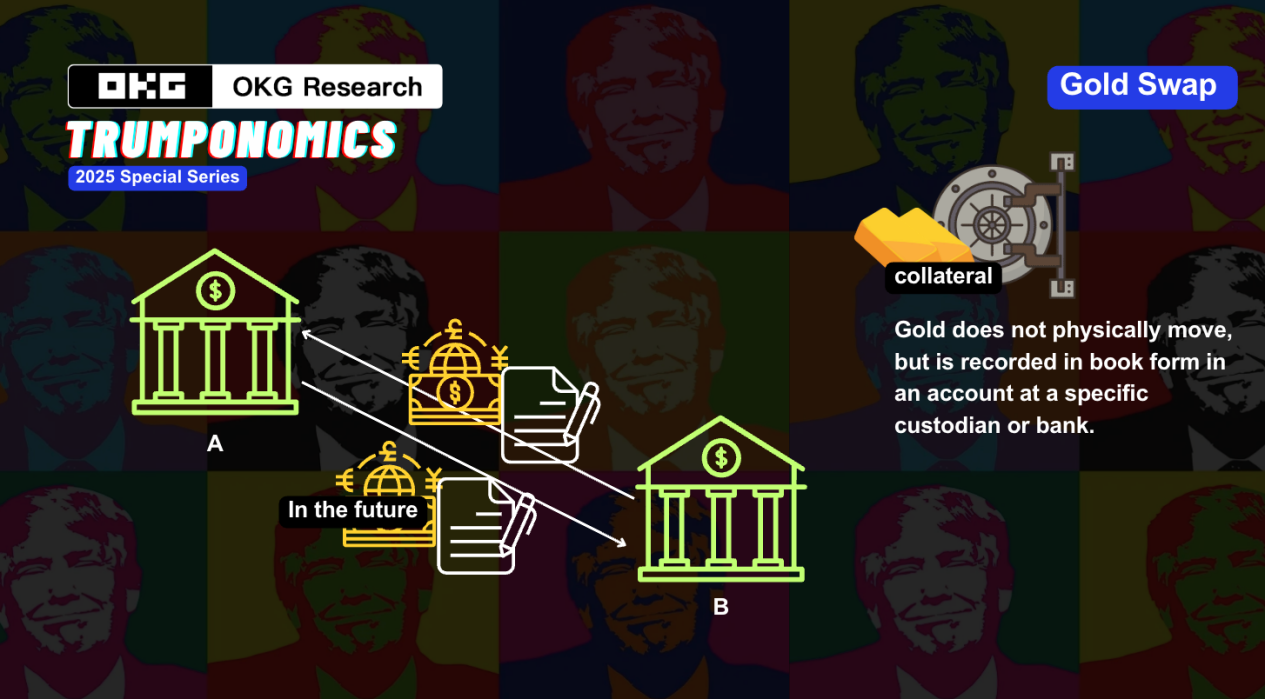

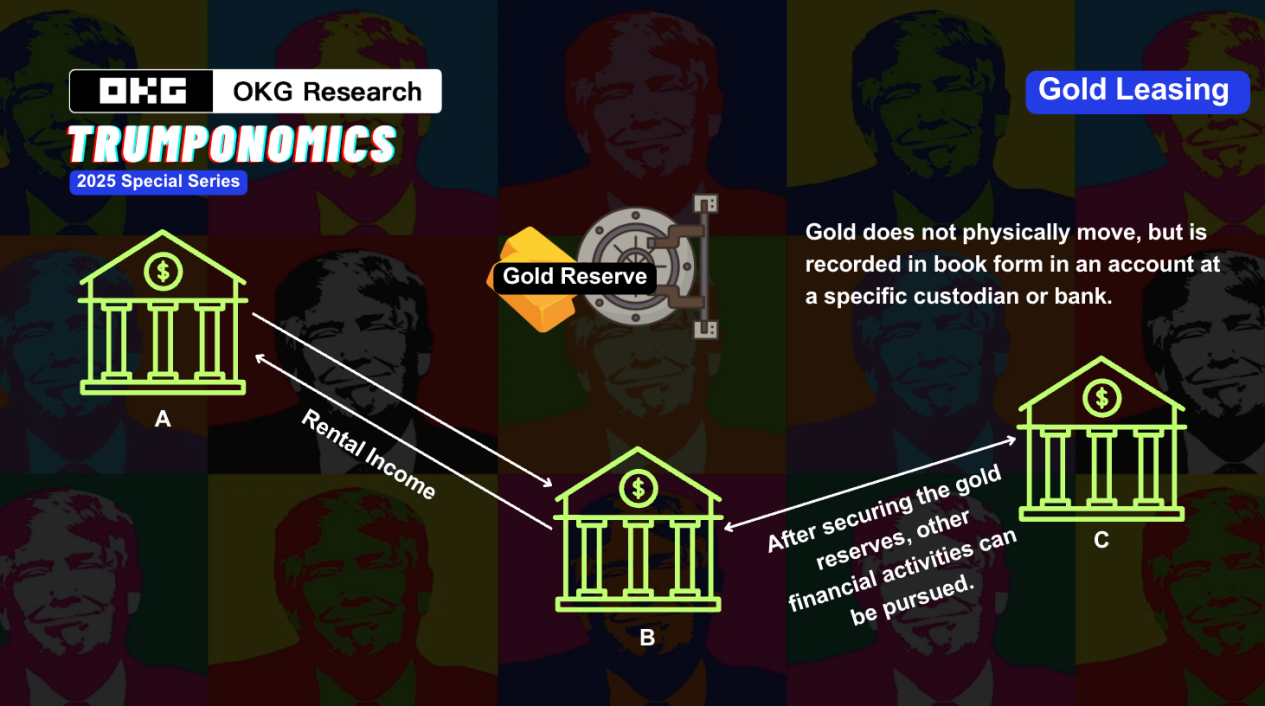

Historically, in addition to safe-haven assets, gold also played the role of "shadow leverage" in the monetary system. There are many examples of using gold for geopolitical games. One of the most famous cases is the "Golden Gate Incident" in the 1970s. During that period, the international reputation of the US dollar was impacted by the Vietnam War and other internal and external factors. In order to stabilize global market confidence in the US dollar, the US protects the US dollar by raising the relative price of gold. In addition, in the 1980s, the Reagan administration indirectly interfered in market prices through the "Gold Swap" operation; in the 2000s, the Federal Reserve released liquidity through the gold rental market to maintain the strong position of the US dollar.

In addition, the credit of gold is not unbreakable. The 8133.5 tons of data is a number that has never been independently audited for decades. Whether the gold in Fort knox (Knox Vault, located in Kentucky) is intact has always been a hotly debated "black box" issue in the market. More importantly, although the US government does not sell gold directly, it may manipulate its value through financial derivative means such as the "book adjustment" mentioned above to achieve shadow monetary policy operations.

The deeper question is how will the market redefine credit if gold is revalued to free up US dollar liquidity and Bitcoin becomes a US dollar hedge? Will Bitcoin really become "digital gold", or will it be absorbed and re-controlled by the US dollar system like gold?

Will Bitcoin become a part of the US shadow monetary policy Play?

If Bitcoin may be heading towards a fate similar to the fate of gold being absorbed and controlled by the US dollar system, as the US interest in Bitcoin increases, the market may enter the stage of "Bitcoin becoming a shadow asset" - the official recognition of the value of Bitcoin, but limits its direct impact on the existing system through policies and financial tools.

Suppose the U.S. government includes Bitcoin as a strategic asset and begins hoarding Bitcoin. As a decentralized asset, unlike traditional gold, it is impossible for the government to directly control the supply or price of Bitcoin. However, the government can conduct market operations through shadow institutions (such as financial instruments such as Bitcoin ETFs or Bitcoin Trusts), indirectly affecting the price and market sentiment of Bitcoin.

These shadow institutions can take advantage of the liquidity and volatility of the Bitcoin market to incorporate a large number of Bitcoin into the "hoarding" state in order to release these Bitcoins at a specific opportunity, thereby affecting market supply, demand and price trends. This operation is similar to the "gold swaps" and "gold leasing" in the gold market. It does not involve actual Bitcoin transactions, but achieves its purpose through financial instruments and market strategies.

Not to mention the "bubble" of gold derivatives or the real existence of gold: In 2011, some analysts estimated that the ratio of COMEX's paper gold to physical gold might be as high as 100:1. Or maybe the 2013 German gold return has lasted for seven years, causing speculation that the Federal Reserve may not have enough physical gold, or that part of the gold has been leased or mortgaged.

But will Bitcoin repeat the same mistake? Judging from the current development trend of blockchain technology, the answer may be no.

- The "black box" of gold vs. Bitcoin's transparency

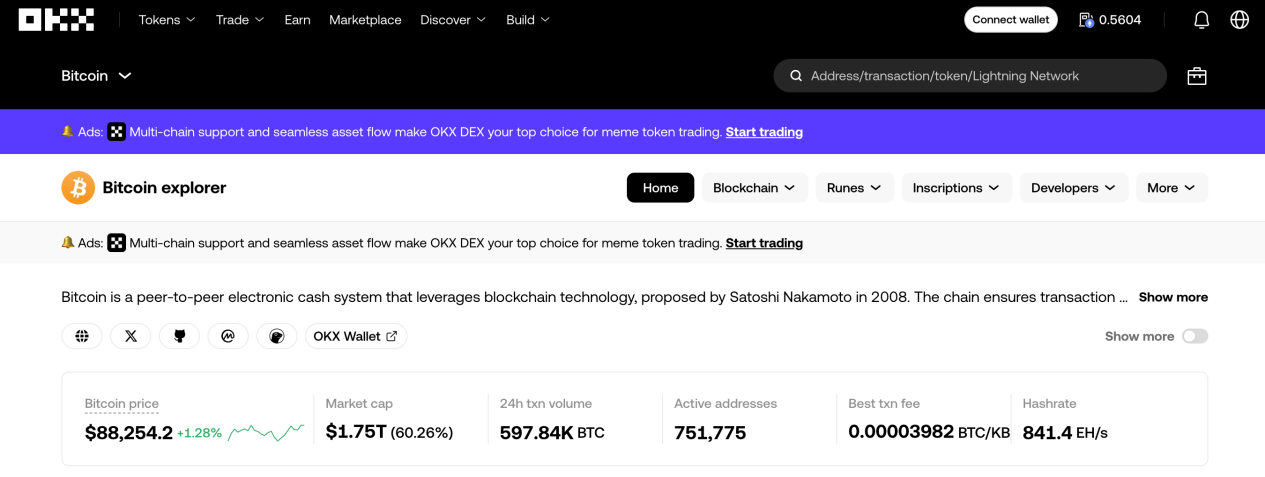

Bitcoin is not a "black box" operation, and it can be followed on all transaction chains. Bitcoin’s decentralized nature makes it better than gold in terms of transparency and auditability. As a native asset on the blockchain, all transactions of Bitcoin are publicly auditable, and anyone can track the circulation of Bitcoin through on-chain data tools such as OKX Explorer.

In addition, the Bitcoin network is composed of decentralized independent nodes, each node holds a complete transaction ledger and jointly verifies transactions. A single institution or country cannot tamper with or operate Bitcoin transaction data. Bitcoin does not need to rely on third-party institutions for auditing. According to OKX Explorer's on-chain data, the total holdings of Giant Whale Wallet (1000+ BTC) remain at 30% to 35%, that is, 6 million to 7 million BTC. This item alone is already higher than the current centralized exchange hot wallet Bitcoin storage and institutional custody and ETF ratio. The capital flow of Bitcoin wallets mainly stored on the chain is completely public and queried globally.

Real-time efficiency is much higher than that of gold reserve reports that are updated in quarterly or annual cycles in most countries, and there will be no recurrence of the United States' seven gold audit reports that have lost. Due to the lag of reserve reports, market responses to these changes tend to lag.

- Financial run risk vs. Bitcoin’s risk resistance

One of the problems with the traditional financial system is the centralized management model of banks and financial institutions, which brings systemic risks. For example, during the 2008 financial crisis, the bankruptcy of Lehman Brothers triggered a ripple effect, and the bankruptcy of Silicon Valley Bank (SVB) in 2023 once again made the market realize the fragility of the banking system. When markets experience liquidity panic, banks may face large-scale runs, while traditional financial systems rely on government emergency relief and Fed monetary policy interventions to maintain stability.

Even if Bitcoin stored in a centralized exchange, there are technical ways to prove the actual storage status of a centralized exchange. OKX officially launched its PoR program (Proof of Reserves) on November 23, 2022 and used it as a core tool for transparency and user protection. Excess PoR (i.e. PoR greater than 100%) means that the assets held by the exchange or custodian not only cover all user deposits, but also reserve a certain proportion of funds. This excess can act as a security buffer to ensure that even in the event of extreme market volatility or unexpected losses of some assets, the institution still has sufficient reserves to meet the withdrawal needs of all users. There will be no "partial reserve" model similar to the traditional banking system. In contrast, the bank reserve ratio in the traditional financial system is usually much lower than 100%, and once a trust crisis breaks out, banks will face serious liquidity problems.

The strategy of the United States revalued gold and created a "new" dollar in this way, and then using these funds to buy Bitcoin is not only a shadow currency operation, but also exposes the fragility of the global financial system. We have yet to know whether Bitcoin can truly become independent and free "digital gold" in the process, rather than just an accessory to the US financial system. But from a technical perspective, whether it is the real-time queryable transactions on the chain or the PoR of centralized institutions, it provides a brand new solution to the traditional financial system. The proposal to trade gold for Bitcoin has opened up a profound dialogue about the future financial system.

chaincatcher

chaincatcher