North Korean hackers targeted Hyperliquid, causing more than $7 billion in market value to evaporate. How to prevent possible attacks?

Reprinted from panewslab

12/26/2024·4MTechnical analysis of Hyperliquid hot events from the perspective of

blockchain security

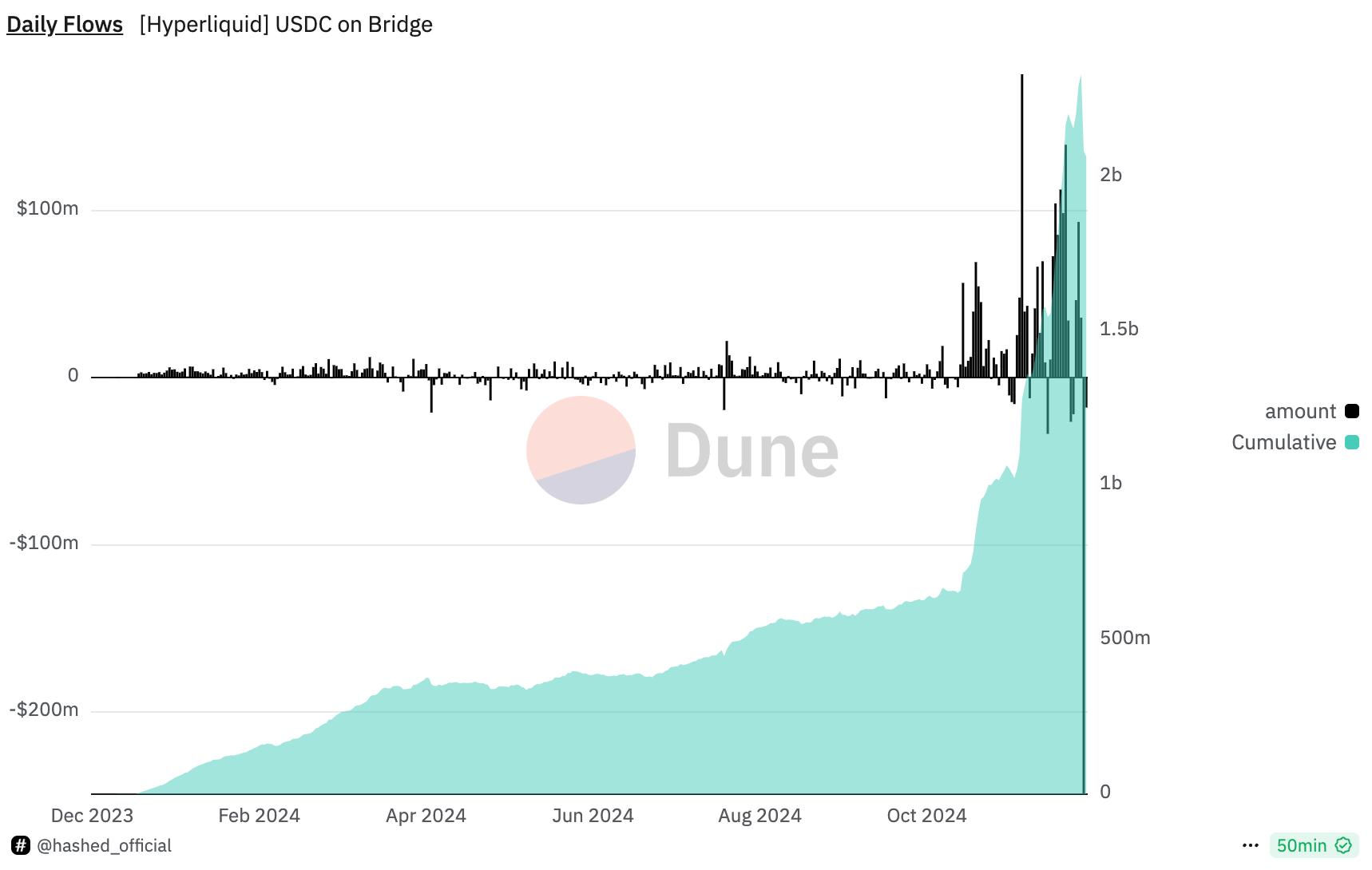

The main reason why Hyperliquid is widely discussed in the community today is the potential security risks in its bridge contract - USD 2.3 billion in USDC assets rely on 3/4 of the 4 validators for protection by the multi-signature mechanism , and at the same time, there have been multiple Known North Korean hacker addresses have recently been active in the transaction records of its platform. This led to some panic selling in the community. Hype's highest decline on the day was more than 25%, the market value evaporated by more than 7 billion US dollars, and more than 150 million US dollars of ecological funds on the chain fled.

This conflict between the technical and ecological levels is very typical in current DeFi security.

Below, we will conduct an in-depth analysis from three levels: the risks of the verifier mechanism , North Korean hacker behavior patterns , and potential mitigation measures :

1. **Core issues of the verifier mechanism: over-centralized design and

potential attack scenarios**

Currently, there are only 4 validators of the Hyperliquid bridge contract, which is an extreme multi-signature architecture in DeFi projects. $2.3 billion of USDC assets rely on a rule agreed by 3/4 validators . This design exposes two obvious risks:

(1) The verifier is hacked

-

Result of the attack Once the hackers took control of 3 validators, they were able to sign malicious transactions and transfer $2.3 billion USDC to the attacker's address. This risk is extremely serious and almost impossible to intercept through conventional firewalls and other means. Unless the transaction is rolled back from the Arbitrum cross-chain assets, all the meaning of decentralization will be lost.

-

Technical Intrusion Paths The North Korean hacker team possesses the top attack capabilities in the encryption industry. Its classic intrusion paths include:

-

Social Engineering Attack : Planting a RAT (Remote Access Trojan) by sending phishing emails with malicious links disguised as partners or trusted entities.

-

Supply chain attacks : If a validator device relies on unsigned binaries or third-party components, hackers can gain control by planting malicious update packages.

-

Zero-day vulnerability attack : exploit zero-day vulnerabilities in Chrome or other commonly used software to directly execute malicious code on the verifier device.

-

(2) Credibility and distribution issues of verifiers

The current validator architecture of Hyperliquid seems to have the following weaknesses:

-

Is the code run by the validator exactly the same? Is there a decentralized build and run environment?

-

Is there physical distribution concentration among validators? If validator nodes in the same area are physically attacked or disconnected, it may be easier for attackers to target the remaining nodes.

-

Is the security of validators' personal devices subject to unified enterprise management? If the verifier uses personal devices to access critical systems and security monitoring methods such as EDR (Endpoint Detection and Response) are not deployed, the attack surface will be further amplified.

2. **North Korean hacker attack methods: from traces to potential

threats**

The hacker behavior pattern disclosed by the famous overseas blogger Tay deserves high vigilance. The logic behind it implies a systematic attack strategy:

(1) Why do hackers choose Hyperliquid?

-

High-value target : $2.3 billion in USDC is enough to attract any top hacker team, and an asset of this size already has enough motivation to attack.

-

The validator mechanism is too weak : only three validators are needed to control all assets. This low-threshold attack path is extremely attractive.

-

Transaction activities as a testing method : Hackers test system stability by executing transactions, possibly to collect behavioral patterns of the Hyperliquid system, such as transaction processing delays, anomaly detection mechanisms, etc., to provide data support for the next attack.

(2) Expected path of attack

A hacker is likely to take the following steps:

-

Collect the identity information and social activities of the verifier and send targeted phishing emails or messages.

-

Implant a RAT on the verifier's device and gain control of the device through remote access.

-

Analyze Hyperliquid's transaction logic and submit a fund withdrawal request through a forged transaction signature.

-

Finally, the fund transfer is executed, and USDC is sent to mixing services on multiple chains for cleaning.

(3) Expansion of attack targets

Although Hyperliquid's assets have not yet been stolen, the hackers' active transaction traces indicate that they are conducting "latent" or "exploratory attacks." The community should not ignore these warnings, as they are often an important preparation stage for hacking teams to carry out attacks.

3. **Currently feasible mitigation measures: How to prevent attacks from

landing?**

To address this risk, Hyperliquid needs to implement the following improvements as soon as possible:

(1) Decentralization of the verifier architecture

-

Increase the number of validators : from the current 4 validators to 15-20, which can significantly increase the difficulty for hackers to defeat most validators at the same time.

-

Adopt a distributed operating environment : ensure that validator nodes are distributed in multiple regions around the world and that the physical and network environments are isolated from each other.

-

Introducing different code implementations : In order to avoid single points of failure, the verifier's running code can use different implementations (such as dual versions of Rust and Go).

(2) Improve the device security of verifiers

-

Dedicated device management : All key operations of the verifier must be completed on dedicated devices managed by Hyperliquid, and a complete EDR system deployed for monitoring.

-

Disable unsigned binaries : All files running on the verifier device must be verified by Hyperliquid's unified signature to prevent supply chain attacks.

-

Regular security training : Educate and train validators on social engineering attacks to improve their ability to identify phishing emails and malicious links.

(3) Protection mechanism at the bridging contract level

-

Delayed transaction mechanism : Set up a delayed execution mechanism for large-amount fund withdrawal operations (such as more than 10 million US dollars) to provide response time for the community and team.

-

Dynamic verification threshold : Adjust the number of validators required based on the withdrawal amount. For example, when a certain amount is exceeded, 90% of the validator signatures are required.

(4) Improve attack detection and response capabilities

-

Blacklist mechanism : Cooperate with Circle to directly reject transaction requests marked as malicious addresses.

-

On-chain activity monitoring : Real-time monitoring of all abnormal activities on Hyperliquid, such as a sudden increase in the frequency of large-value transactions, abnormal signature behavior of verifiers, etc.

Summarize

The problem that Hyperliquid exposed today is not an isolated case, but a systemic risk that is common in the current DeFi ecosystem: the emphasis on the verifier mechanism and off-chain security is far lower than the contract level .

There has been no actual attack yet, but this incident is a strong warning. Hyperliquid not only needs to rapidly strengthen the decentralization and security of validators at the technical level, but also needs to promote comprehensive community discussions and improvements on the risks of bridging contracts. Otherwise, these potential risks may be exploited in the future, causing irreversible losses.

jinse

jinse

chaincatcher

chaincatcher