Miners' selling pressure hits a new cycle low + Sino-US tariff exemption, Bitcoin $100,000 is just a new starting point?

Reprinted from panewslab

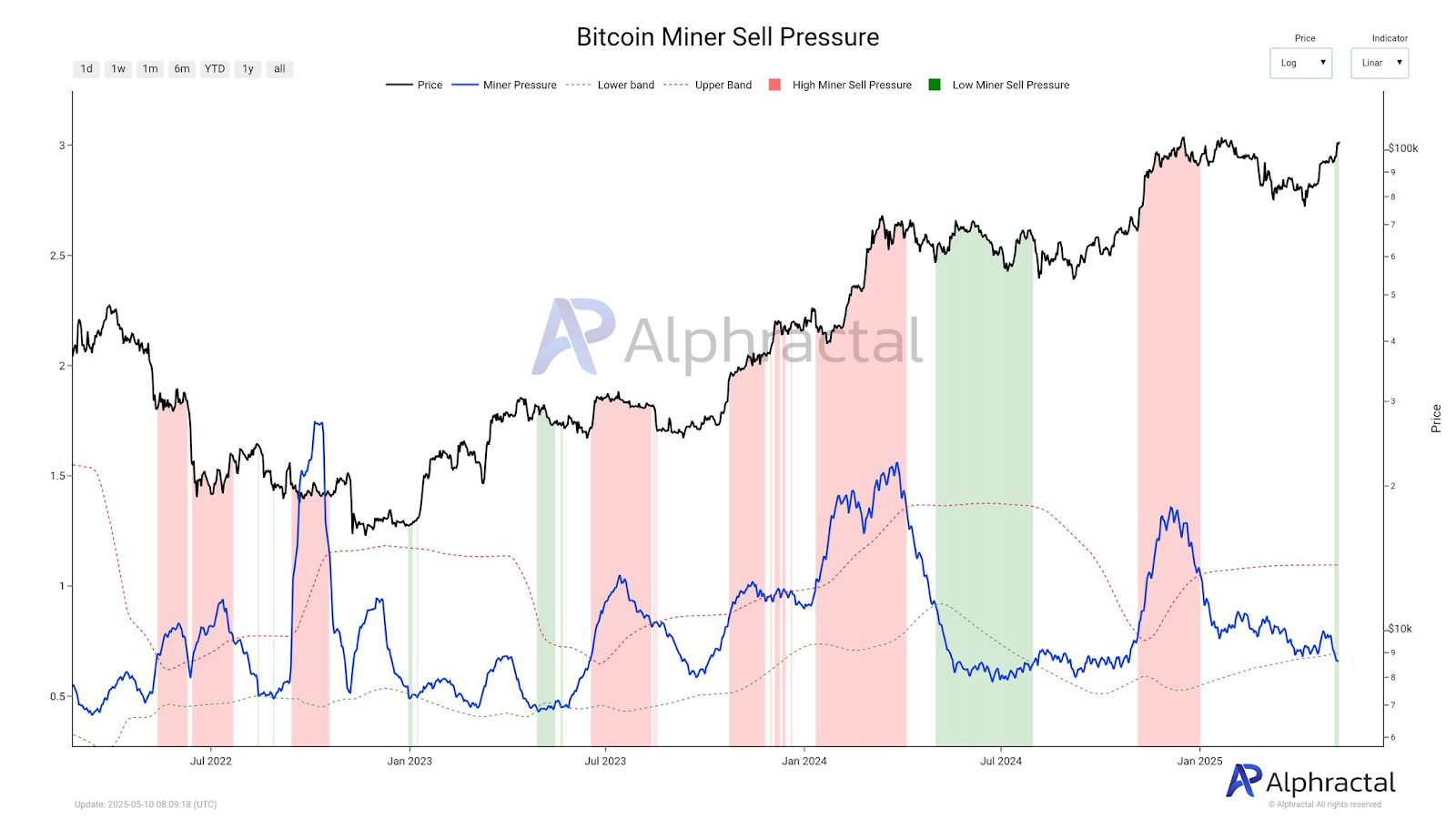

05/12/2025·26DPart 1: The selling pressure of Bitcoin miners dropped to the lowest since

2024 - the market has accumulated strength to hit another new high?

1. Miner behavior change: from selling to holding

According to the latest data from cryptocurrency analysis platform Alphractal, the Bitcoin miner selling pressure indicator (a ratio that measures miners’ outflow to reserves in 30 days) has fallen below the lower track, reaching its lowest level since 2024. This phenomenon shows that miners are shifting from the past model of "selling to cover operating costs" to strategic hoarding.

This is in sharp contrast to the dilemma of miners' income halving after halving in 2024 (at that time, miners' daily sales increased from 900 to 1,200), but changes in the current market environment prompted miners to adjust their strategies:

- Earnings expectations drive hoarding: As Bitcoin prices recently broke through $100,000 and approached an all-time high, miners prefer to hold Bitcoin to wait for higher returns rather than cash out in the short term.

- Industry structural optimization: The scale-based development of mining industries led by listed companies (such as Bitfarms and CleanSpark) reduces the exit risk of inefficient miners, and the increase in industry concentration alleviates selling pressure.

- Historical experience reference: In the past cycle, excessive leverage and long-term holding of miners have led to liquidity crises (such as the bear market in 2018), and now it pays more attention to short-term financial stability.

2. Market resilience revealed by on-chain data

Alphractal’s miner selling pressure indicator shows that the current market structure is completely different from the “panic selling” in early 2024:

- Long-term holders dominate: Bitcoin currently holds for more than 6 months accounts for more than 80%, far lower than the short-term holders dominate at the top of the historical cycle 1, providing stable support for prices.

- New low on exchange reserves: Bitcoin exchange reserves continue to decline, indicating that the market is in a "high-speed accumulation period" and the selling pressure is dispersed by over-the-counter trading or institutional holdings.

- Derivatives market risks: Despite the stable spot market, there are a large number of highly leveraged long positions in the range of $100,000 to $110,000. If price fluctuations are made, it may trigger a wave of billions of dollars in liquidation.

3. Price trends and future expectations

As of May 12, 2025, the price of Bitcoin was US$104,250, an increase of 1% in 24 hours, and the cumulative increase of more than 30% in the past month. The focus of the market's differences on subsequent trends is:

- Technical signal: RSI (75) shows overbought, but MACD continues to rise; key support level $10,000 may trigger short-term holders selling if it falls.

- Impact of macro variables: The Fed's expectation of interest rate cuts (if the rate cut exceeds 100 basis points in 2025) may provide Bitcoin with the opportunity of "Davis double-click", but the risk of stagflation may weaken its risk of risk.

- Miner behavior trends: If the price exceeds US$110,000, miners' selling pressure may rebound, but the current low selling level indicates that the market may enter a "cool upward period."

Part 2: Market doubts behind the “substantial progress” of the Sino-US

trade agreement

1. White House Statement and Agreement Profile

On May 11, US Treasury Secretary Scott Besent and Trade Representative Jamison Greer jointly announced that the U.S.-China trade negotiations have made "substantial progress", and the two sides reached a principled consensus on the following areas:

- Market access: China promises to expand imports of US agricultural products, and tariff exemptions for some US technology products are extended.

- Intellectual property protection: Establish a cross-border law enforcement collaboration mechanism to reduce barriers to technology transfer.

- Dispute Resolution Mechanism: Establish a permanent consultation platform to prevent the escalation of trade frictions.

2. Market response and hidden worries

Despite the official positive signals, the lack of details of the agreement has led to cautious optimism among investors:

- Remaining uncertainty: The repetitiveness of Trump administration's policies (such as the "one-day tour" for electronic tariff exemptions in 2024) weakens market trust, and risky assets are still under pressure before the agreement is implemented.

- Structural contradictions are not resolved: China and the United States’ competitive policies in the fields of semiconductors, artificial intelligence, etc. (such as “Trade War 2.0”) may be continued through non-tariff means.

- Liquidity impact differentiation: If the agreement pushes the US dollar index (DXY) to fall, Bitcoin may benefit from the restart of the "anti-fiat currency" narrative; but if the negotiations break down, gold may divert funds.

3. The chain effect of the global economy

The possible systemic impacts of the easing of Sino-US trade include:

- Supply chain reshaping: Agreements may accelerate the trend of "near-sea outsourcing", Mexico and Southeast Asia's manufacturing hub status has increased, and demand for cross-border payments for cryptocurrencies has increased.

- Inflation easing expectations: Tariff cuts are expected to reduce pressure on the US CPI, provide space for the Federal Reserve to cut interest rates, and indirectly benefit risky assets.

- Georological risk transfer: If Sino-US cooperation is strengthened, "alternative crises" such as the Russian-Ukrainian conflict and the Middle East situation may become a new source of market volatility.

Part 3: Market Game and Investment Strategy under the Interweaving of

Double Main Lines

1. The resonance between Bitcoin and macro policy

- Interest rate sensitivity and correlation: Bitcoin and the Nasdaq Index correlation (0.78) show that it has not yet broken away from the traditional risk asset framework. If the Sino-US trade agreement boosts technology stocks, Bitcoin may benefit simultaneously.

- Miner behavior is a leading indicator: Historical data shows that after the miner's selling pressure bottoms out, Bitcoin often enters an upward cycle (such as the bull market after miners surrender in 2023), and the current low selling level may indicate a similar trend.

2. Risk and Opportunity Assessment

- Short-term volatility risk: Unclear details of Bitcoin derivative leverage accumulation and the Sino-US agreement may trigger price fluctuations, with support at $10,000 becoming a watershed for long and short.

- Long-term narrative strengthening: The average daily funding volume of Bitcoin ETFs (800 pieces) is still higher than miners’ output (450 pieces), and the institutionalization process offsets some market impact.

Conclusion: Deterministic logic in complex markets

The global market in May 2025 is standing at the dual node of Bitcoin’s “post-halving cycle” and China-US “rebalancing of trade relations”. The low selling pressure of miners seems independent of the White House agreement, but in fact they point to a core proposition: asset repricing under liquidity reconstruction. Whether Bitcoin breaks through the previous high or the implementation of the Sino-US agreement, the market will eventually verify a truth - in the collision between the macro iron curtain and the crypto narrative, only assets with both elasticity and efficiency can win long-term victories

chaincatcher

chaincatcher