Meme is dead? Find new opportunities at the bottom of the emotions

Reprinted from panewslab

03/11/2025·2MOriginal title: "Of nadirs and bidding death in memecoins"

Original author: @Ga__ke

Compiled: Scof, ChainCatcher

I haven't written anything for a long time. Looking back at my trading ideas in 2024, some of the views on meme coin selection still apply, but now we seem to have entered a completely new field. In 2024, we have experienced market evolution such as pure meme coins > celebrity coins > art tokens > AI/technology/functional tokens. At that time, the replacement of mainstream hot spots in the market was still relatively clear - when and what topics became the market trend, there were often clear boundaries and timelines.

However, fast forward to 2025, we see a chaotic token scene: hot projects in the past struggled for market attention – they were once glorious, and now most of them have experienced a 70-90% retracement. Unfortunately, there are often only some "last buyers" or veteran players who are repeatedly in and out, looking forward to the next wave of shipments. Of course, these projects are not necessarily scams, but more like a game of "beating the drum and passing the flowers" - the market (or players) always chase the latest hot spots unless there is a good reason to refocus on past projects.

At the same time, the brand new meme track and technology concept are fiercely competing, and the market structure is even more complex. 2024 has laid the foundation for "attention tokenization" in all walks of life, and Trump's "official" token has given the green light to the entire market (whether good or bad). In this chaos, we began to see multiple tokens of different themes and different life cycles coexist at the same time. However, it must be realized that market liquidity, like our attention, is cyclical. Today’s headline hot topics may not be cared about tomorrow, and tomorrow’s hot topics are something that no one can predict (laugh).

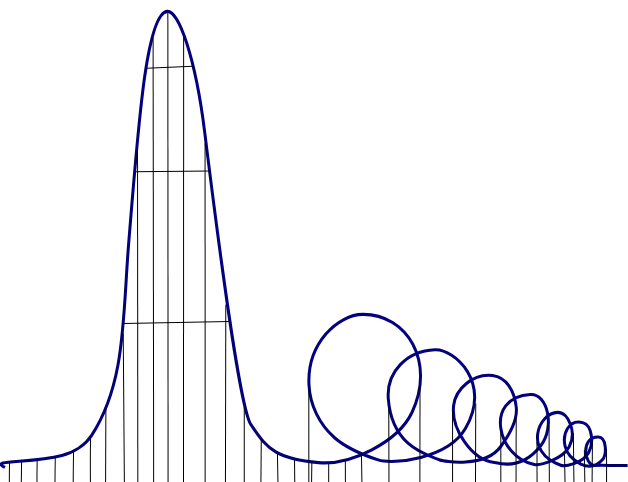

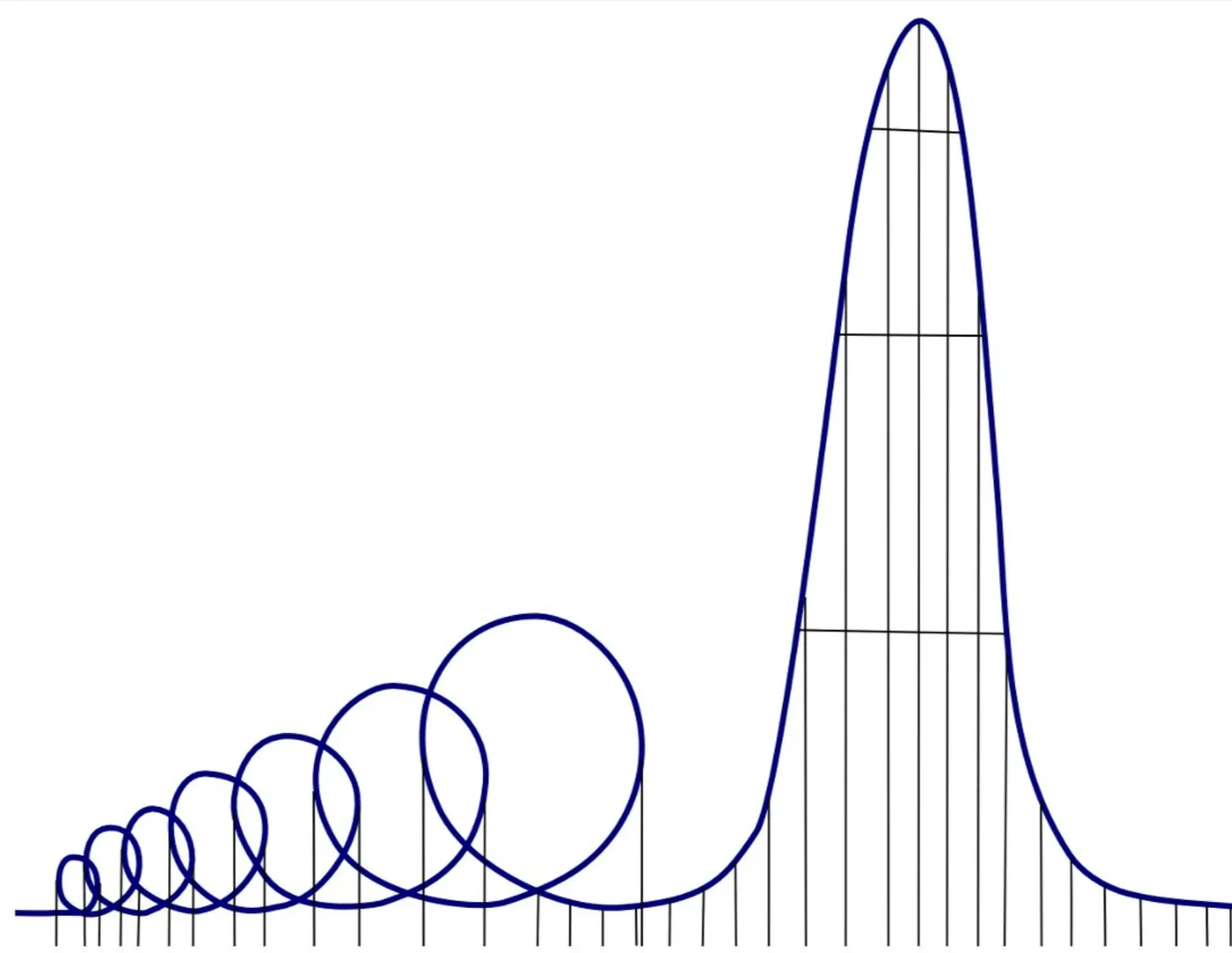

Therefore, tokens of various themes will continue to coexist, and each track will also experience its own liquidity cycle. What's the meaning? Remember this picture?

Now, imagine this is a price chart of a single token; at the same time, you can also flip it over and it becomes a trend chart of another token.

Going further, superimpose these graphs in your mind and realize that there are 112,931,920,482 tokens on the blockchain, each with its own highs and lows; at the same time, the overall trend of each track is also at a different stage - some are just bottoming out (nadir), and some have reached the top (zenith).

My core point is: there are always countless trading opportunities in the market, and the key is to discover those transactions that have not been squeezed out. Of course, most tokens may end up doing nothing, but you can at least put them on the watch list, leave yourself a note, or set a price reminder to look back at the right time.

In 2024, we cover almost all major tokenized attention tracks. I mentioned some key categories before, and now I will talk about it. Some projects last for a week, while some projects that were once glorious have bottomed out.

1. Pure meme coins – These tokens are purely for fun, usually derived from the viral trends of X (Twitter)/TikTok, or the retro nostalgic meme. The “Copypasta” gameplay and viral flywheel effect are most prominent here.

2. Celebrity Coins - This type of token relies on an influential person. The core logic of many projects is to use the fan effect to harvest the market. Although this field is full of "ATM"-style projects, it still provides a window of opportunity - because they can "guise ordinary users into the currency circle."

3. Art Tokens - Tokens supported by art can be regarded as an evolutionary version of the NFT community to some extent.

4. AI/Tech/Utility Tokens – These tokens carry at least some kind of technology or utility. I once said that I would never trade this kind of token, but the market environment is constantly changing and we need to adapt. The market often values "technical prospects" more than actual technology itself—in other words, the selling point is "news expectations" rather than the technology itself.

5. Web2 Community Tokens (Communities / Web2) - This category is similar to celebrity coins, but they rely on the existing Web2 community and use the existing fan base to project into the Web3 field.

6. News/Tweets Tokens - These tokens are often quick speculation on a short-term hot spot and can set a "market direction" in a short time. These tokens usually rise extremely fast and fall equally rapidly, and of course they may have a second chance. But don’t have too many FOMOs (panic chasing highs) when the first surge, otherwise you will be easily buried.

The categories listed above are not comprehensive, they are just a classification attempt I made to simplify the analysis process. So, will new categories appear in the future? Hopefully so - generally speaking, new market trends (metas) are often accompanied by the richest returns. However, as mentioned earlier, as different categories of tokens are gradually gaining footholds and their life cycles are at different stages, the boundaries of the market are becoming increasingly blurred. Coupled with the cooling of the market after the Trump token fanatic period, we see more "bear postings". Indeed, it is hard to imagine what else can surpass that wave of craze in the future. At least for now, I personally cannot see a clear direction for the time being.

Nevertheless, I still welcome this slowdown in the market. As someone who prefers to hold (holder) rather than trader, I benefit more from such a market environment - the market returns to dominate Class 1/3/4 tokens, which are usually slower, community-driven, and more organically growing.

When it comes to choosing meme coins, some ideas for 2024 are still applicable (especially Category 1/3). But as more and more tokens experience more than 90% retracement, this also brings new opportunities to enter. Here are some key factors that may become future catalysts:

1. Community Expansion: Who are the possible supporters of this token in the future? In fact, in most cases, they don’t even need to actually buy, and the mere market expectations of their buying are enough to drive prices up. For example, the MLG token was silent for 7 months until it was picked up again, eventually attracting the attention of big Vs like Faze. Core strategy: tell a good story and use the "sell the story and the idea of an attention flywheel".

2. The Current Community / Team: Is the technology still advancing? (Is the tek still tekking?) Are the developers still maintaining it? (Is dev still devving?) Is the community atmosphere still active? (Is community still vibing?) For traditional meme coins, I would usually recommend evaluating community resilience during market pullbacks; while for Class 4 tokens (tech/functional tokens), it would require a deep dive into project progress to see if there is more capital and attention inflows. This growth is not always directly reflected in market capitalization, so there are also arbitrage opportunities here.

3. Mainstream Coverage: Similar to community expansion, but here emphasizes the traditional media's attention to specific events. For example, the politicized discussion of pnut tokens, the ongoing coverage of moo deng, or the shift of traditional finance (TradFi) toward a specific industry (such as AI/bots). Essentially, this is to lay out news expectations in advance, but the key is: expectations cannot be too obvious, otherwise the transaction will become crowded too early.

As with any transaction, you need to enter before the market becomes crowded and exit in batches when the market becomes gradually crowded. Think at each stage: Who is the marginal buyer? Is this story still a good story?

Potential risks need to be paid attention to:

1. Position management (sizing). You may have found 312,849 reasons to believe that some tokens will surge, but the question is - do you really have enough funds to allocate them reasonably? Be aware that the money you put into these projects may never be repaid, so you still need to keep enough liquidity to participate in mainstream tracks and popular tokens in the current market. The upside is that if you are buying these tokens at the bottom, your retracement is usually not too large even if they fail to explode in the end. But if you spread your money across 1,293 tokens, you realize that this can become a serious problem.

2. Moat/Competition Barrier (Moat/Legitimacy). You may have good reason to believe that a certain token should rise again, and the market trends seem to be developing as you expect. But suddenly - someone issued a brand new token and the market funds all poured into that project! This is the sad reality of the Pump.fun era. Now anyone who does not understand blockchain can easily issue coins. This is why the market is full of 12,312 "broccolis" and 12,903 "neiros". Solution? If you really believe in your investment logic, spread the funds into all possible options and wait patiently for the market to screen out the winners. If your capital distribution is too diversified, you can recover some of the initial investment as soon as possible, and then wait until the market selects the final winner, and then concentrate on increasing positions. My personal examples are chillguy and mnc, and the market will decide which one will win in the end.

I also know that this trading method is not suitable for everyone. There are countless ways to make money and lose money in this market – at best, you’ll be considered a genius; at worst, it’s just a self-comfort. But many experiences have told me that focusing on those forgotten corners of the market and ambushing the tokens after the storm is an effective strategy for me. Just as I was writing this article, a random Fortnite token was the latest case in this model, and we have seen similar situations many times.