Market value is close to the previous high, and in-depth analysis of the fundamental factors of Sonic's counter-trend rise

Reprinted from panewslab

02/24/2025·2MIntroduction: At the beginning of 2025, optimism in the US stock market pushed the S&P 500 to hit a new high, while the crypto market was under pressure and the meme currency fluctuated violently. Against this backdrop, Sonic ($S) stands out with its price increase and technology upgrades and becomes the focus of the market. This article will analyze its performance and potential.

This Monday coincides with the Presidents' Day, and the U.S. stock market is closed. After the opening on Tuesday, market sentiment was generally optimistic, with the S&P 500 rising 0.24%, setting a new record high, and the Nasdaq Composite also rose slightly by 0.07%.

In contrast to the strong performance of US stocks, the cryptocurrency market is under pressure and pullback.

Recently, the entire cryptocurrency market has continued to experience a round of downward fluctuations, and the overall market sentiment seems to be sluggish, and trading volume and investor confidence have been impacted to a certain extent. At the same time, the meme currency market is like a roller coaster, with prices jumping up and down, and the fluctuations are so large that many investors feel at a loss in such uncertainty. However, in such a weak and variable market environment, the token of S has emerged and demonstrated remarkable growth momentum. Not only has the steadily increased price performance, but the activity and support of the community behind it have also added a lot of highlights to this token. Compared with the ups and downs of other tokens, S's outstanding performance undoubtedly injects a little vitality into the current sluggish crypto market and has become one of the focus of investors' attention.

1. The price of $S is brewing and has promising potential

Sonic is an EVM layer 1 blockchain platform evolved from Fantom, focusing on providing high performance and scalability for decentralized applications. The platform supports native tokens $S for transaction fees, staking, governance and running validators. Once the new network is launched, users holding the old FTM token will be able to convert it to $S in a 1:1 ratio.

Main functions:

High Performance: Sonic has the ability to process more than 10,000 transactions per second and has a completion time of sub-seconds, so it is suitable for high-demand applications in various fields such as gaming and finance.

Interoperability: The platform emphasizes seamless interactions between different blockchains.

Developer Incentives: Sonic Labs plans to implement various incentive programs to attract developers and promote innovation within their ecosystem.

2. Fantom upgrades to Sonic, and the fundamentals are comprehensively

optimized.

Three aspects of upgrade

-Fantom Virtual Machine (FVM)

-Storage storage system (DataBase)

-Bridge (Sonic Gateway)

- On-chain internal optimization:

-

Blockchain scalability challenge: There is a trade-off between decentralization, security and scalability in existing blockchains, and Fantom plans to achieve a balance between the three.

-

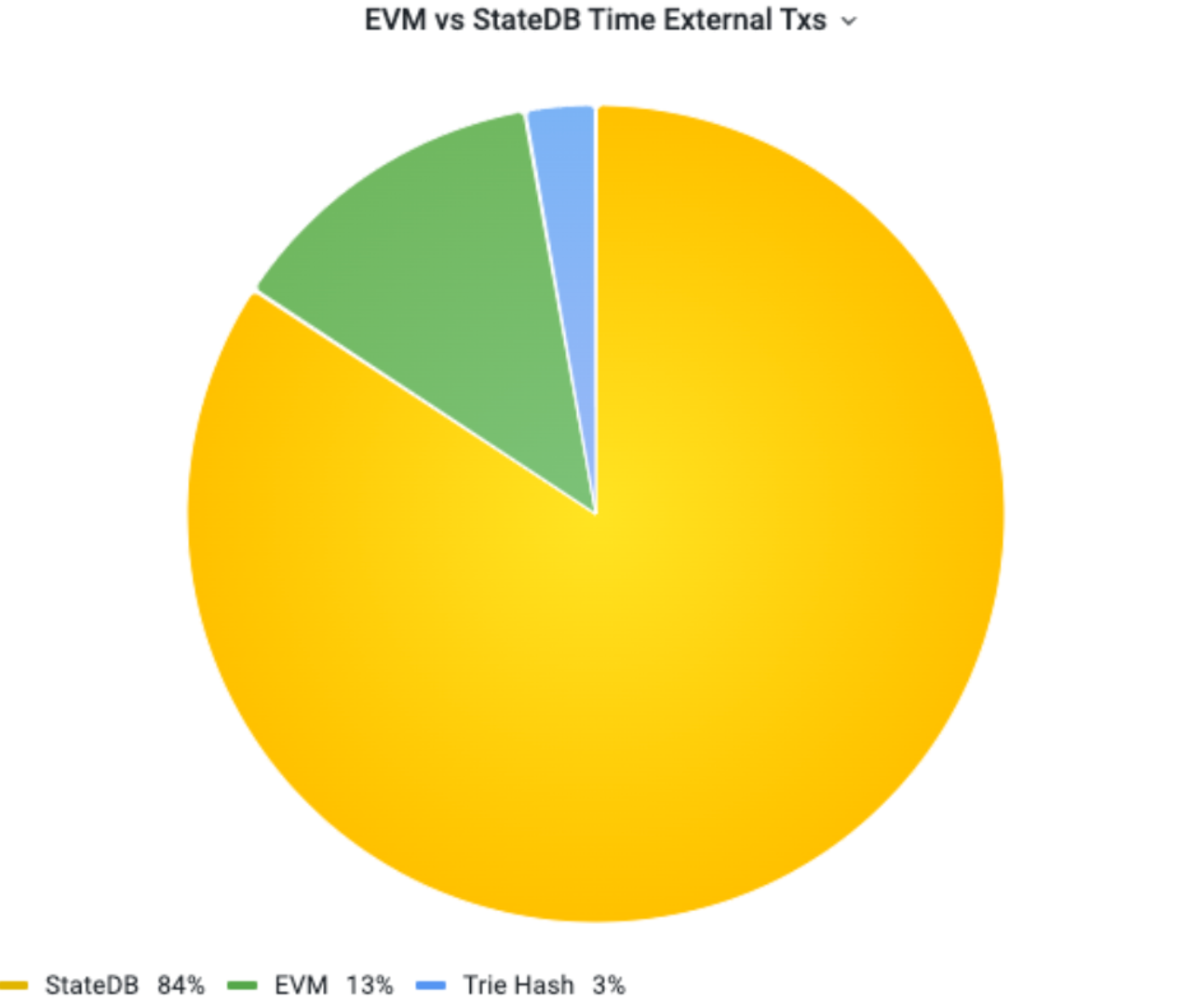

Bottleneck Analysis (Aida Project): After testing 40 million blocks, it was found that EVM accounts for only 13% of the processing time, while StateDB accounts for 84%, and the storage system is the main bottleneck.

-

Storage Upgrade (Carmen Project): There is a performance bottleneck in the existing Merkle Patricia Trie (MPT) solution, and Fantom adopts a new file-type StateDB to optimize storage efficiency.

-

Fantom Virtual Machine Upgrade (Tosca Project): FVM replaces EVM, supports Solidity and Vyper compatibility, and uses "super instructions" to improve execution efficiency.

Test results:

-

The FVM solution increases transaction speed by 8.1 times, reduces storage usage by 98%, significantly optimizing network performance.

-

Fantom further enhances on-chain scalability by upgrading storage and virtual machine systems, improving transaction processing capabilities and reducing node operation costs.

- Off-chain optimization:

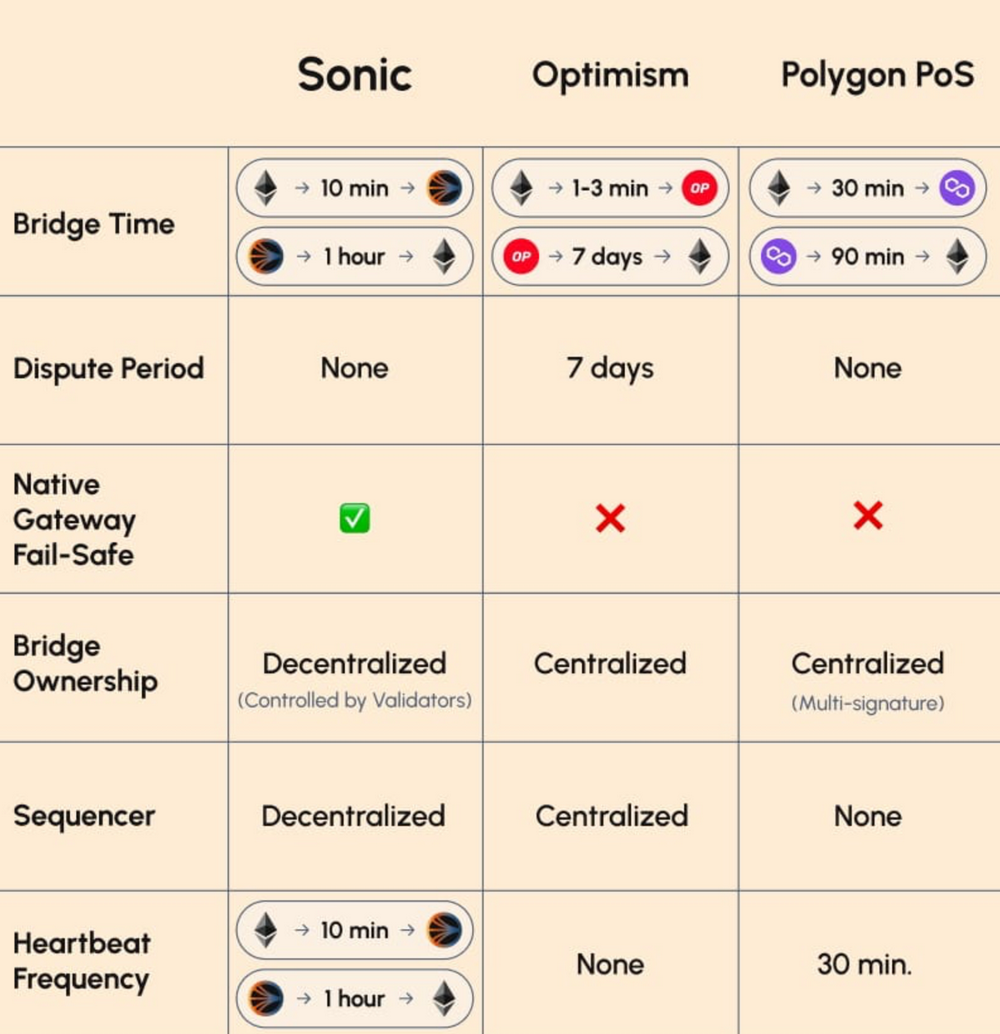

Sonic Gateway is a decentralized cross-chain bridge designed to connect Ethereum to Sonic networks, designed to improve interoperability while eliminating user hosting risks.

Sonic Gateway core features:

-

Allows ERC-20 assets to be safely transferred between Ethereum and Sonic.

-

It takes about 10 minutes to transfer Ethereum to Sonic, and it takes about 1 hour to transfer from Sonic to Ethereum.

Safety mechanism:

-

Built-in failsafe mechanism: If the gateway is unavailable for 14 consecutive days, the user can retrieve the assets on Ethereum.

-

Monitor the gateway status through the inter-chain "heartbeat" signal to ensure the safety of user funds.

Comparison with Layer-2 scheme:

- Sonic provides a faster transfer experience, no challenge periods and instant ending, better than the Optimistic Rollup solution that normally requires a 7-day challenge period.

User income:

- Allows users to access native assets (such as BTC, ETH, SOL) in Sonic without relying on wrapped assets (wrapped assets).

Different from Layer-2's operating mode:

- Sonic operates as Layer-1, not Ethereum's expansion layer. It uses Merkle proof to verify asset status, rather than relying on Ethereum's consensus mechanism.

Efficient data storage:

- Only storing Merkle root hash and block height greatly reduces the data storage burden of Ethereum and improves on-chain efficiency.

3. TVL on Sonic chain soars, ecological growth accelerates

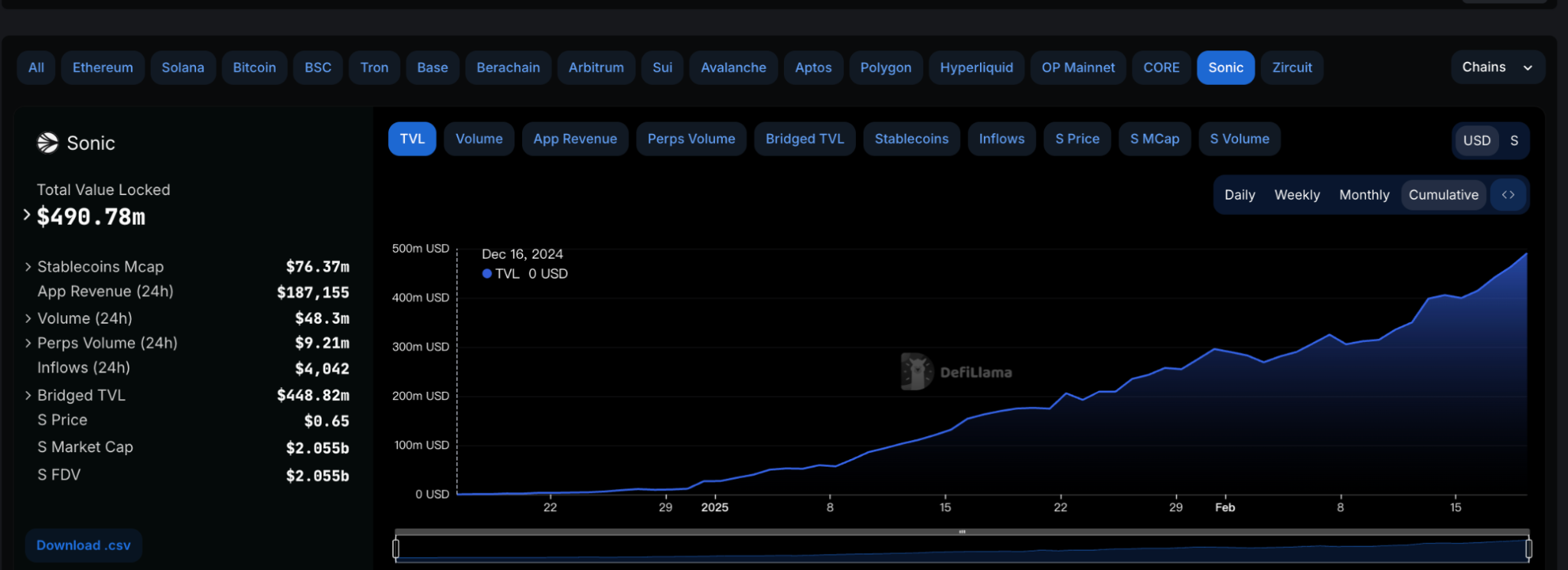

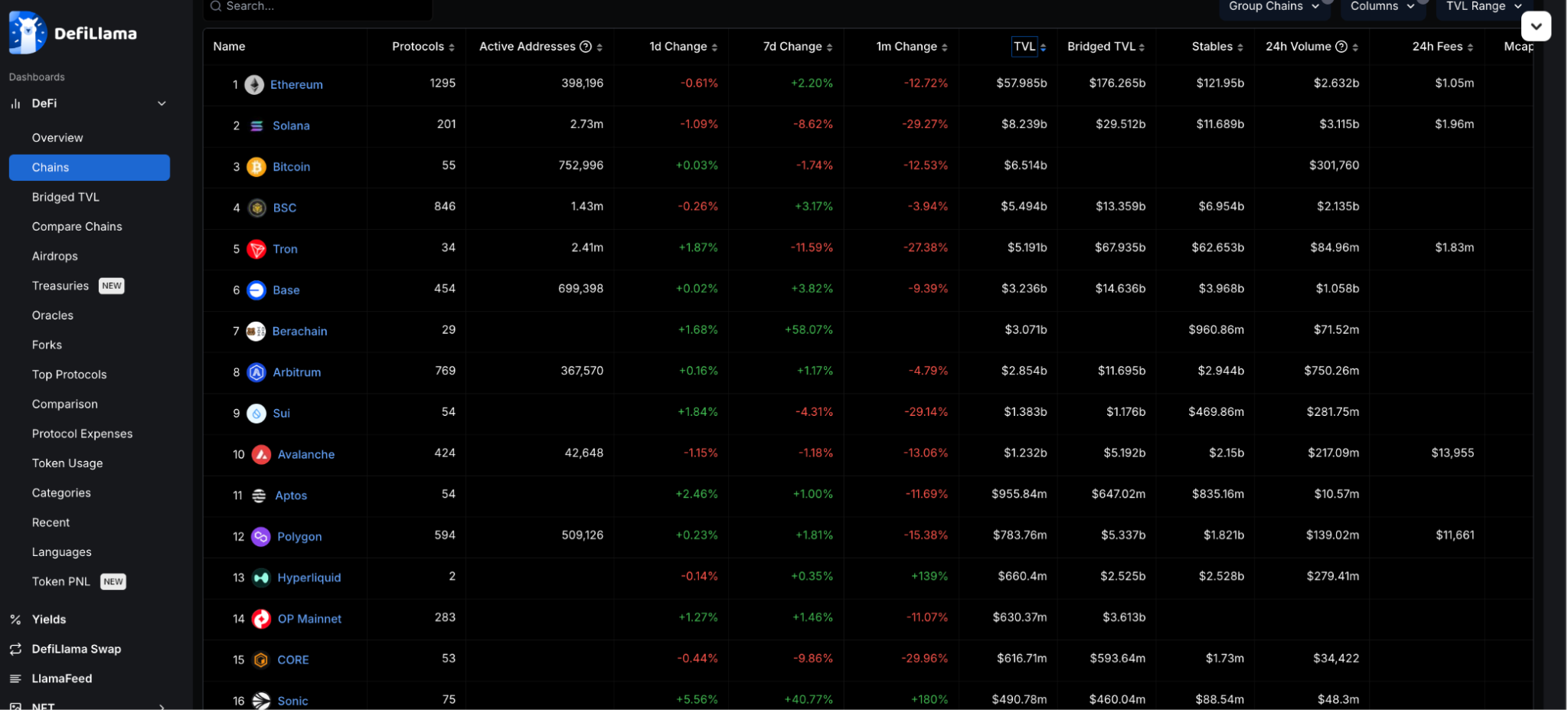

According to the latest data from the DefiLlama platform, Sonic currently ranks 16th in the ranking of total value lockouts (TVLs) of each blockchain, showing its strong performance in the decentralized finance (DeFi) ecosystem. More notably, Sonic's TVL growth has reached an astonishing 180% in the past month, a growth point that shows a significant increase in market confidence in the platform and capital inflows. In addition, Sonic's total value lockout has achieved nearly three times growth compared to TVL levels in December, a performance highlighting its accelerated expansion in the DeFi sector and investors' optimistic expectations for its future prospects . Such growth not only reflects the driving force of the platform's own development, but also shows the continuous inflow of market funds into the Sonic ecosystem, further consolidating its competitive position in the industry.

4. The data on the Sonic chain is active, and the price support is

stable.

According to the transaction volume data provided by SonicSca, we can see:

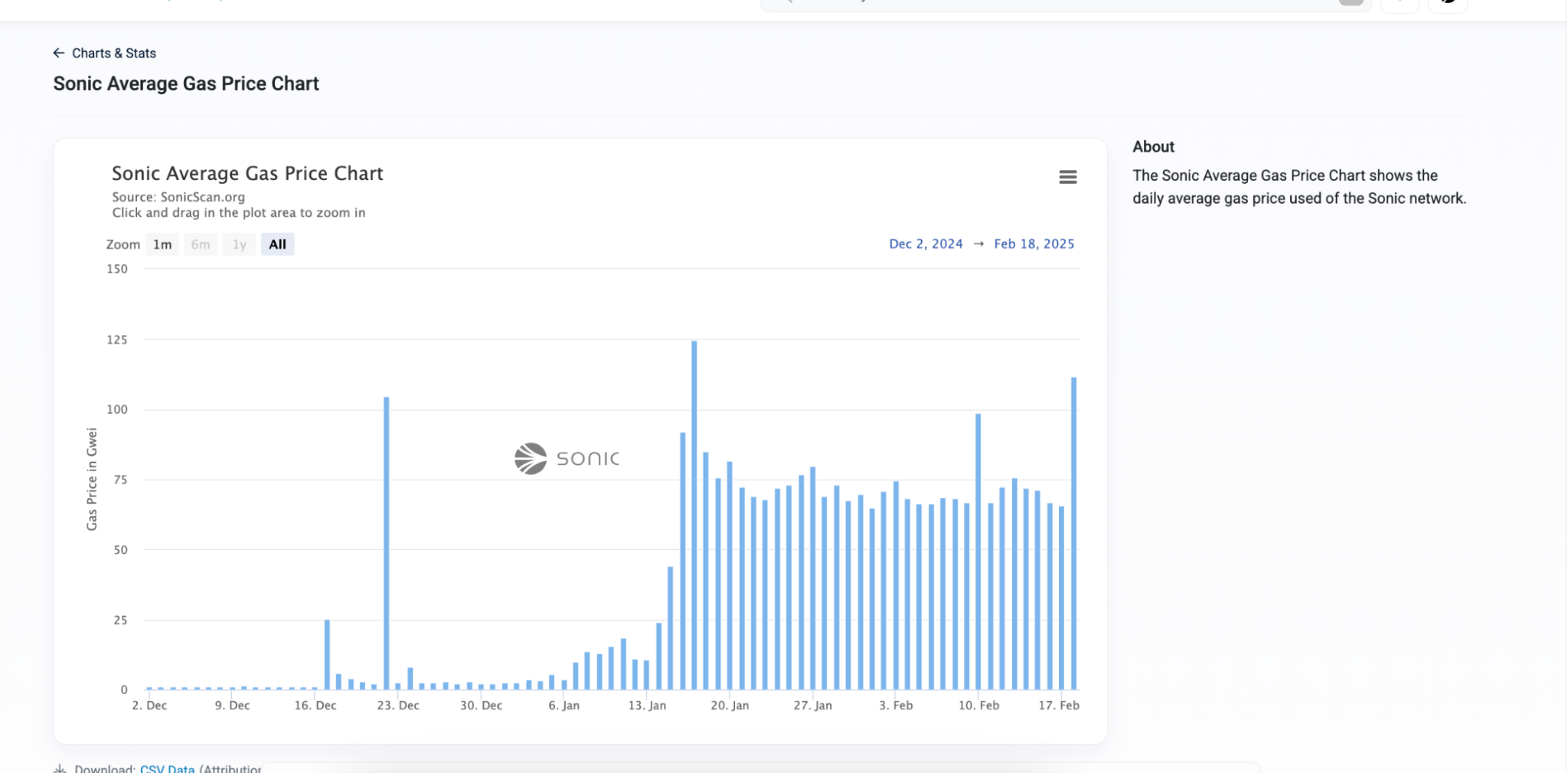

The highest transaction volume on the Sonic chain occurred on January 13, 2025, reaching 975,252 transactions. Trading volume began to grow significantly since December 16, followed by volatility growth; after reaching peak on January 13, trading volume decreased, but remained relatively high; trading volume rebounded slightly in early February, and market activity Increase, return to the growth track, and it is worth paying attention to subsequent developments; similar conclusions can be obtained from the chart of Gas usage, the Sonic network experienced an active growth period from December to January, reaching the peak of Gas usage in mid-January. Starting from February, Gas usage has fluctuated, but remained at a relatively high level, indicating that the network is still active.

Although TVL achieved significant growth and on-chain data performed soundly, the price of $S has been suppressed by moving averages since its launch at the beginning of the year, which has not fully reflected the impact of fundamental improvements. It was not until February 8 that the price ended its downward trend and began to rebound. However, current prices are still well below all-time highs. If $S can maintain above the $0.57 support level and rise steadily along the moving average, the subsequent trend is expected to strengthen further, and the target is near $0.72.

To sum up, Sonic has shown strong development momentum since Fantom's name has been renamed. Its total locked value (TVL) has achieved significant growth in a short period of time, and the on-chain data activity has increased, showing the rapid expansion of the ecosystem and the improvement of user participation. Nevertheless, the price of $S has not yet fully reflected these positive fundamental changes. As the market increases its attention to Sonic and its continued optimization in terms of technology and ecosystem, the price of $S is expected to rise further in the future. Investors should pay close attention to market dynamics and on-chain data in order to seize potential upward opportunities in this rapidly rotating market.