Looking back at the "gains and losses" of the crypto market in 2024, where will it be in 2025?

Reprinted from panewslab

12/28/2024·4MWritten by: Gyro Finance

2024 is undoubtedly an important year in the history of encryption.

This year, centered on the two core narratives of ETFs and the US election, with Bitcoin as the main lever, the encryption industry successfully achieved a breakthrough this year. Listed companies, traditional financial institutions and even national governments poured in, and its mainstreaming and recognition increased significantly. , the regulatory environment has also moved towards a clear and relaxed path with the new government taking office. Mainstream collision, path differentiation and regulatory evolution have become the main theme of the industry this year.

01 Review of 2024: Bitcoin reaches the top, Ethereum is being chased,

MEME Casino attracts attention

Looking at the major developments in the industry this year, Bitcoin is undoubtedly the core narrative.

ETFs and national reserves allowed Bitcoin to successfully reach US$100,000, officially announcing that Bitcoin has surpassed the connotation of cryptocurrency and has become a global strong anti-inflation asset. The value store has been recognized, and BTC has begun to gradually move from digital gold to a super-sovereign currency. , marking the initial victory of this grand financial experiment that began with Satoshi Nakamoto. On the other hand, the Bitcoin ecology has expanded this year. Although Inscription, Rune and even L2 are in a state of fire and ice, Bitcoin's diverse ecology has initially taken shape, and applications such as BTCFi, NFT, games, and social networking continue to Development, Bitcoin DeFi TVL has soared from US$300 million at the beginning of the year to US$6.755 billion, growing more than 20 times throughout the year. Among them, Babylon has become the largest protocol on the Bitcoin chain. As of December 20, Babylon TVL has reached US$5.564 billion, accounting for 82.37% of the total. The broad BTCFI has performed particularly well this year. The share of Bitcoin spot ETFs has soared, and MicroStrategy, which was selected to be included in the Nasdaq 100, has been imitated, all reflecting Bitcoin's overwhelming success in the Cefi field.

Returning to the public chain field, this year's leader Ethereum is not having an easy time. Compared with other assets, the performance is poor, value capture and user activity have declined, and the narrative is not as good as before. The "theory of value" has caused Ethereum to suffer. Although the slogan of Defi renaissance is ringing as the consensus has taken shape, except for the TVL matryoshka craze caused by re-staking, it seems that only Aave is responsible for everything, and the actual investment is obviously insufficient. However, the emergence of Hyperliquid, a dark horse derivatives product, at the end of the year not only revolutionized the half-life of CEX, but also sounded the clarion call for DeFi to counterattack. On the other hand, after the Dencun upgrade, the involution of Ethereum Layer 2 accelerated and continued to eat up the main network share, so that the market started a big discussion about the Ethereum mechanism, and there were endless doubts. Even the rapid growth of Base made the market With rumors that the future of Ethereum is Coinbase.

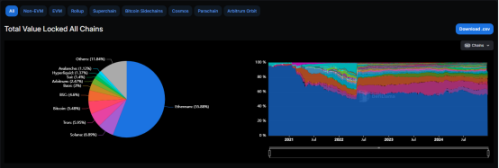

The strong rise of Solana is in sharp contrast. From the perspective of TVL, Ethereum's market share in the public chain has dropped from 58.38% at the beginning of this year to 55.59%, but Solana has jumped from no such person at the beginning of the year to the end of the year. 6.9%, becoming the second largest public chain after Ethereum. SOL has created a growth miracle, soaring from US$6 two years ago to US$200 today. This year alone, it has also increased by more than 100%. From the perspective of recovery path, with the unique advantages of low cost and high efficiency, Solana aims at the core liquidity positioning, relying on Degen culture to rise to the well-deserved king of MEME, becoming this year's retail investor concentration camp. This year, Solana’s daily on-chain fees have exceeded Ethereum many times, and the growth of new developers has also surpassed Ethereum, which is a significant catching-up trend.

TON and SUI also stand out this year. Telegram, with 900 million users, has single-handedly ignited the field of blockchain games, opened up a new entrance for Web3 traffic, and strongly stimulated the market that had been dormant for a long time before September. TON, which had been backed by a big tree to enjoy the shade, finally emerged from its long-standing On the eve of the dawn of the outbreak, China entered the fast lane of growth. According to Dune data, TON currently has more than 38 million cumulative on-chain users, and its cumulative transaction volume exceeds US$2.1 billion. SUI is completely convinced by its popularity. The Move language public chain is progressing rapidly, with a three-pronged approach of hardware development, protocol diversification, and the introduction of airdrops. The future seems bright. Compared with the price-driven SUI, the public chain Aptos, despite its relatively weak price performance during the same period, was more favored by traditional capital. This year, it successfully established cooperation with BlackRock, Franklin Templeton, and Libre. Its compliance with regulations may allow it to win in the new era. The RWA and BTCFI cycles are ushering in the dawn.

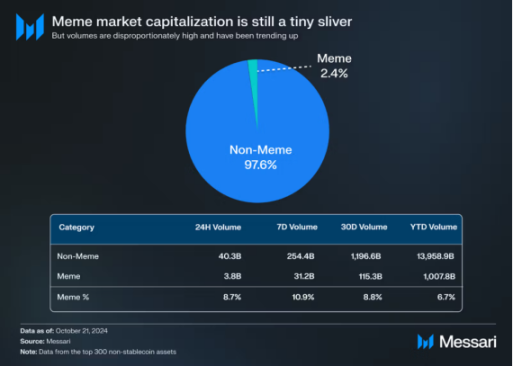

From an application perspective, MEME is the main driver of the market this year. In essence, the rise of MEME is a symbol of the current change in the market structure. VC tokens are not being bought up, and excess liquidity has no bid. Ultimately, it is poured into fairness. and sectors that are more profit-seeking. Amidst this, the connotation of MEME is also constantly expanding, gradually developing from a single subject of speculation to a typical representative of cultural finance. "Everything can be MEME" is happening in reality. Although MEME only accounts for less than 3% of the top 300 cryptocurrencies (excluding stablecoins) in terms of market capitalization, its trading volume continues to account for 6-7%, and recently reached 11%. It is liquidity. The most concentrated main track. According to data from Coingecko, MEME accounted for 30.67% of investors’ attention this year, ranking first among all tracks. Where the attention is, the money will naturally be there, and this is indeed the case. Looking at this year's MEME, pre-sale fundraising, celebrity tokens, Zoo Wars, PolitFi and AI, all of them are top-notch in the industry.

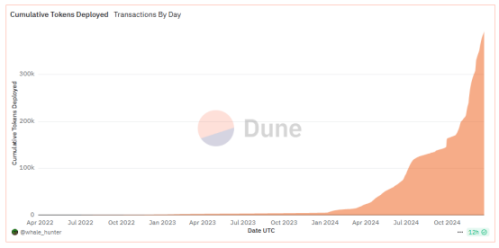

Against this background, the infrastructure around MEME continues to be consolidated, and the fair launch platform Pump.fun came into being. It not only reshaped the MEME landscape, but also successfully became one of the most profitable and successful applications this year. In November, Pump.fun. fun became “the first-ever Solana protocol to surpass $100 million in monthly revenue.” According to Dune data, as of December 22, pump.fun’s cumulative revenue exceeded US$320 million, and the total number of deployed tokens was approximately 4.93 million.

Of course, making money on the platform does not mean that retail investors make money. Considering the one in 100,000 golden dog probability, and only 3% of users can make a profit of more than 1,000 US dollars on Pump.fun, coupled with the increasingly prominent MEME institutional trend , from the user's perspective, no matter how fair it seems, cutting and being cut are inevitable. Perhaps it is precisely because of this that adding fundamentals to MEME has become a new development model for projects. Most relatively long-term projects such as Desci and AIMEME have adopted this model, but from the current point of view, short-lived is still the mainstream. The value of "Run fast to live well" is still rising.

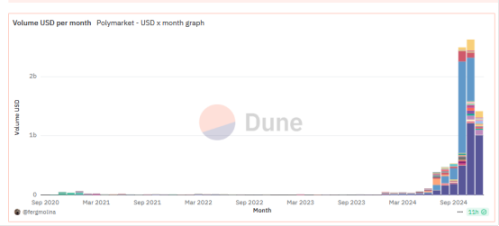

Affected by the US election, another god-level application has surfaced. Polymarket surpassed all betting platforms on the market and became an instant success in the prediction market with high accuracy. In October alone, the Polymarket website received 35 million visits, twice that of popular betting sites such as FanDuel, and its monthly transaction volume surged from $40 million in April to $2.5 billion. A wide range of users and real needs equal clear value applications, and V God is full of praise for it. The only pity is that it has not achieved large-scale encryption user conversion. But the new integration of media + gaming is undoubtedly coming slowly.

At the end of the year, big models have leapt from technology to application, and competition has become fierce. After a year of wandering in the Web3 hot spots, AI finally counterattacked again and became the dark horse of the year. MEME was the first to detonate, and Truth Terminal came quickly with golden dogs GOAT, ACT, and Fartcoin. The myth reappeared a hundred times, and launched the niche application craze of AI Agent. At present, almost all mainstream institutions are optimistic about AI Agent, believing it to be the second phenomenal track after Defi. But as of now, the infrastructure in this field is not perfect, and applications are mostly concentrated on the surface such as MEME and Bot. There is less in-depth integration of AI and blockchain, but newness also means opportunities. Cyber-style currency speculation remains to be seen. .

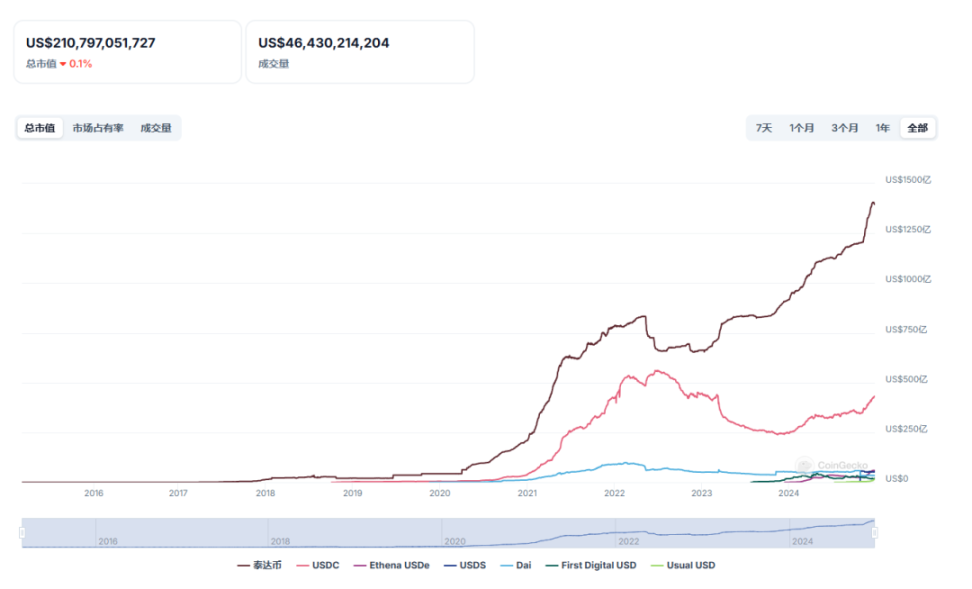

On the other hand, from the perspective of the core driving institutions of this bull market, PayFi, which seamlessly connects traditional finance and Web3, will definitely bear the brunt. Stablecoins and RWA are typical representatives. Stablecoins have really come to the fore this year in the large-scale applications that everyone is looking forward to. Not only are they growing rapidly in the encryption field, they are also beginning to occupy a place in the global payment and remittance market. Sub-Saharan Africa, Latin America and Eastern Europe began to bypass the traditional banking system and directly use stablecoins for transaction settlement, with the scale increasing by more than 40% year-on-year. The current value of stablecoins in circulation exceeds $210 billion, significantly higher than the billions of dollars in 2020. An average of more than 20 million addresses conduct stablecoin transactions on public blockchains every month. In the first half of 2024 alone, the settlement of stablecoins The value alone exceeds $2.6 trillion. From the perspective of new products, Ethena is the most eye-catching stablecoin project this year, and has further spawned the craze for interest-bearing stablecoins. It is also the main driving force for AAVE's revenue this year. RWA, on the other hand, was completely ignited after BlackRock officially announced its entry. RWA, which had a market capitalization of less than US$2 billion three years ago, has expanded to US$14 billion this year, with targets covering lending, real estate, stable coins, bonds, etc. fields.

In fact, PayFi's development is consistent with the pace of the market. It is precisely because the internal market growth has encountered a bottleneck, and the incremental mainstream institutional market is at the beginning of a new cycle. In order to seek incremental space, PayFi has entered a critical process at this stage. . It is worth noting that due to its integration with the traditional financial system, this field is also the Web3 track most favored by government agencies. For example, Hong Kong, China, has listed stablecoins and RWA as important areas for development next year.

Of course, although everything seems to be improving, it cannot be denied that under the dual background of nearly two years of macro tightening and industry downturn, the encryption field has also experienced extremely difficult stress tests. Innovative applications are difficult to implement, internal disputes intensify, restructuring and mergers continue, and the weakening of liquidity has given rise to the path differentiation of the encryption industry, forming a pattern in which Bitcoin core inflows continue to siphon off other currencies. The copycat market has been in garbage time for most of this year. Shenyu's "there are no copycats in this bull market" has been repeatedly confirmed and falsified. It was not until the end of the year that it bottomed out and rebounded under the attention of Wall Street, and the copycat season kicked off. Judging from the current situation, path differentiation will continue in the short term and will become more and more intense.

02 Looking forward to 2025: new cycle, new applications, new directions

Looking back to the present, the New Year's bell is about to ring. Looking forward to 2025, as the Trump administration opens a new era of encryption, institutions with strong capital are also eager to try it. So far, more than 15 institutions have released market forecasts for next year.

In terms of price prediction, all institutions are optimistic about the value of Bitcoin, and 150,000-200,000 is the peak price range of Bitcoin considered by 6 of them. Among them, VanEck and Dragonfly believe that the price will reach US$150,000 next year, while Presto Research, Bitwise, and Bitcoin Suisse believe that it will reach US$200,000. On the basis of strategic reserves, Unstoppable Domains and Bitwise have proposed US$500,000 or more. High judgment. As for other currencies, VanEck, Bitwise and Presto Research have given predictions, believing that ETH will be around US$6,000-7,000, while Solana will be between US$500-750, and SUI may also rise to US$10. Presto and Forbes believe that the total market value of crypto It will reach 7.5-8 trillion, and Bitcoin Suisse said that the total market value of altcoins will increase five times.

Price forecasts are naturally supported. Almost all institutions believe that the U.S. economy will usher in a soft landing next year, the macro environment will improve, and encryption regulations will be relaxed accordingly. More than 5 institutions have a positive view on the Bitcoin strategic reserve, believing that At least one sovereign country and many listed companies will include Bitcoin in their reserves, and all institutions believe that the increase in ETF inflows will become an objective fact.

From a specific track perspective, stablecoins, tokenized assets and AI are the areas that institutions are most concerned about. From the perspective of stablecoins, VanEck believes that stablecoin settlement volume will reach 300 billion U.S. dollars next year, while Bitwise said that driven by accelerated legislation, accelerated financial technology applications, and global settlement, the scale of stablecoins will reach 400 billion U.S. dollars, Blockworks Mippo was more optimistic, giving an estimate of $45 million. A16z also believes that businesses will increasingly accept stablecoins as a payment method, and Coinbase also noted in the report that the next real wave of cryptocurrency adoption (the killer app) may come from stablecoins and payments.

In terms of tokenized assets, A16z, VanEck, Coinbase, Bitwise, Bitcoin Suisse and Framework are all optimistic about the track. A16z’s prediction mentioned that as the cost of blockchain infrastructure decreases, the tokenization of non-traditional assets will become a new source of revenue, further promoting the decentralized economy. VanEck gave a specific value, believing that tokenized securities are worth more than $50 billion, which coincides with Bitwise's forecast data. Messari gave a differentiated conclusion based on reality. He believes that as interest rates drop, tokenized government bonds are expected to face resistance, but idle on-chain funds may gain more favor, and the focus may shift from traditional financial assets to on-chain Chance.

In the direction of AI, A16z, which has already made heavy bets in the field of AI, is highly optimistic about the combination of AI and encryption. It believes that AI’s autonomous agency capabilities will be greatly enhanced. Artificial intelligence can have exclusive wallets to achieve subjective behavior, and decentralization Autonomous chatbots will become the first truly autonomous high-value network entities. Coinbase also acknowledged this, pointing out that artificial intelligence (AI) agents equipped with crypto wallets will be at the forefront of disruption. VanEck stated that there are more than 1 million on-chain activities of AI agents, and Robot Ventures also believes that the total market value of AI agent-related tokens will increase by at least 5 times. Although Dragonfly agrees that the token will see significant gains, it still takes a relatively conservative view on practical applications, believing that the application of the underlying protocol may be relatively limited.

Bitwise and Defiprime pointed out the core usage scenarios. The former believes that AI Agent will lead the explosion of Meme, while the latter says that DeFi is the deep integration scenario. Messari gave a more specific path, believing that the combination of AI and encryption has three major directions. One is new AI casinos, such as Bittensor and Dynamic TAO, and the other is the field where blockchain technology will be used for small and professional model fine-tuning. The third is the combination of AI Agent and MEME.

In other aspects, institutional forecasts have different focuses. For example, YBB believes that the DeFi renaissance will be the main theme in 2025, Robot Ventures believes that there will be a wave of integration in the application chain and L2 track, and Messari predicts that almost all infrastructure protocols will be adopted in 2025. ZK Technology, DEPIN industry will achieve 8-digit to sub-9-digit revenue by 2025, VanEck and Bitcoin Suisse believe NFT Will return again, etc. Since there are too many words, I will not go into details here.

03 Conclusion: Where do investors go?

Although the arguments are slightly different and there are differences in the subdivisions, it is not difficult to see that all institutions have optimistic and positive expectations for next year. Whether it is price increase, ecological expansion or mainstream adoption, they are all expected to Continue to reach new heights in 2025.

It can be foreseen that from the perspective of price alone, it is inevitable that the price of mainstream currencies will rise, especially Q1 next year, which will be a period of intensive policy benefits. The altcoin market will continue to be differentiated. Affected by ETFs, altcoins that meet regulatory compliance are more likely to receive capital inflows and narrative continuation, while other currencies will slowly shrink. If macro liquidity becomes tight, the risks of altcoins will become increasingly prominent. .

From an industry point of view, although the strong old public chains still occupy the leading ecological advantage, the impact from new public chains is also inevitable. Ethereum’s value capture and narrative methods will continue to ferment, but optimistically, the inflow of external funds may alleviate this, and the expansion of technology and the popularization of account abstraction will also become important breakthroughs for Ethereum in 25 years. Solana's growth momentum is still there due to capital's voice, but there are hidden dangers in its high reliance on MEME, and Base's competition with it will become increasingly fierce. In addition, it is expected that a number of new public chains will join the market competition, such as Monad and Berachain.

From infrastructure construction to application development is the general direction of future industrial development. Consumer-level applications will be the focus of applications in the following years. Application chains and chain abstraction may become the main way to build DAPPs. From a track perspective, DeFi renaissance has become a consensus, but at this stage it is still projected on AAVE. As for centralization, the focus is on the payment track. Hyperliquid and Ethena are still worthy of focus.

The speculation wave in MEME will most likely continue in the short term, but the pace will slow down significantly, especially under the influence of the copycat season. However, key directions such as Politifi still have a relatively long narrative to follow. Despite this, the infrastructure surrounding MEME is still expected to be improved, the user experience can be optimized, and the lowering of usage thresholds and the institutionalization of MEME are inevitable trends. It is worth noting that new ways of launching tokens will cause a new wave of excitement at any time.

Since the incremental market comes from institutions, the tracks that institutions are optimistic about are expected to accelerate development, and stablecoins, AI, RWA, and DePin will still become the focus of the next round of narratives. In addition, in the context of tight liquidity, any on-chain liquidity tools and protocols that can increase leverage will most likely be favored.

A new cycle is coming, and as an investor, the only choice is to get rid of the old and welcome the new, discover the cycle, adapt to the cycle, and conduct in-depth research and participation.