Liquidity War 3.0: Bribery Becomes the Market

Reprinted from panewslab

05/11/2025·29DAuthor: arndxt , Encryption KOL

Compiled by: Felix, PANews

The profit war may be staged again. If you stay in the DeFi field for long enough, you will understand that total locked positions (TVL) is just a vanity indicator. Because in the highly competitive modular world of AMMs, perpetual contracts and lending agreements, what really matters is who can control the flow of liquidity, not who owns the agreement, nor who even gives the most rewards. It’s who can convince liquidity providers (LPs) to deposit funds and ensure TVL is stable. This is exactly the origin of the bribery economy.

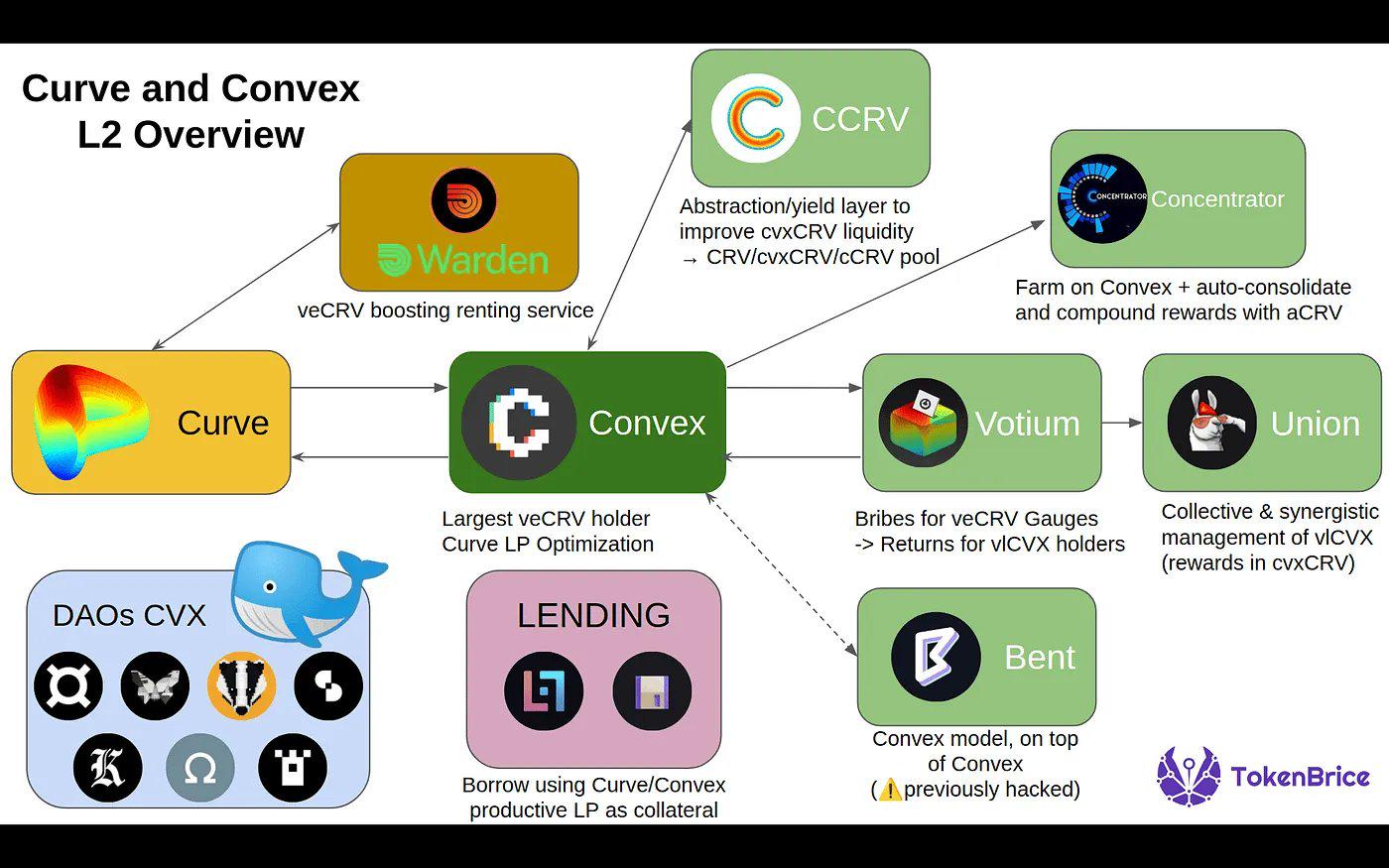

Once informal ticket buying behaviors (Curve War, Convex, etc.) have now become a mature liquidity coordination market, equipped with order books, dashboards, incentive routing layers, and in some cases, gamified participation mechanisms.

Now this is becoming the most strategic layer in the entire DeFi stack.

Change: From issuance to meta-incentive

During the period 2021-2022, the agreement guides liquidity in a traditional way:

- Deploy a fund pool

- Issuing tokens

- LP, which is based on profit-oriented, can still stay after the yield drops

But this model has a fundamental drawback: it is passive. Each new agreement is competing with an intangible cost: the opportunity cost of existing capital flows.

1. The origin of the profit war: Curve and the rise of the voting market

The concept of the income war began with the Battle of Curve in 2021 and gradually became concrete.

Curve Finance's unique design

Curve introduced the economics of voting custodial (ve) tokens, where users can lock CRV (Curve's native token) for up to 4 years in exchange for veCRV, which gives users the following advantages:

-

Rewards for improving Curve Pools

-

Governance rights with voting weight (which pools earn benefits)

This creates a metagame around returns:

-

The agreement wants to gain liquidity on Curve

-

And the only way to get liquidity is to attract votes to their pool

-

So they started bribing veCRV holders and asked them to vote for it

So Convex Finance came into being (a platform that focuses on improving the Curve protocol income):

-

Convex abstracts veCRV locking (simplifies Curve usage process) and aggregates users' voting rights.

-

It became the "Curve's king" and had a huge influence on the whereabouts of CRV revenue.

-

Each project began bribing Convex/veCRV holders through platforms such as Votium.

Experience 1: Whoever controls the voting weight will control liquidity.

2. Meta-incentive and bribery market

The first bribery economy

Initially, it only operated manually to affect issuance, but later gradually evolved into a mature market in which:

- Votium became the off-market bribery platform for CRV releases.

- The emergence of Redacted Cartel, Warden and Hidden Hand extends this model to other protocols such as Balancer and Frax.

- The agreement no longer only pays issuance fees, but strategically allocates incentives to optimize capital efficiency.

Extensions beyond Curve

- Balancer adopts voting hosting mechanism through veBAL

- Frax, Tokemak and other protocols integrate similar systems

- Incentive routing platforms like Aura Finance and Llama Airforce further add complexity, turning issuance into a capital coordination game

Experience 2: Returns are no longer related to annualized rate of return (APY), but to programmable meta-incentives.

3. How to launch a profit war

Here is how the agreement competes in this game:

- Liquidity Aggregation: Aggregate influence through Convex-like encapsulators (such as Aura Finance for Balancer)

- Bribery activities: Budget reserved for ongoing election bribery to attract issuance when needed

- Game Theory and Token Economics: Locking Tokens to Build Long-term Consistency (e.g., Ve Model)

- Community Incentives: Gamify voting through NFT, lottery or reward airdrop

Today, protocols like Turtle Club and Royco are driving this liquidity: no longer blindly issuance, but auction incentives to LPs based on demand signals.

Essentially: “You bring liquidity, and we direct the incentives to where we need them most.”

This releases a second-order effect: protocols no longer need to force acquisition of liquidity, but coordinate it.

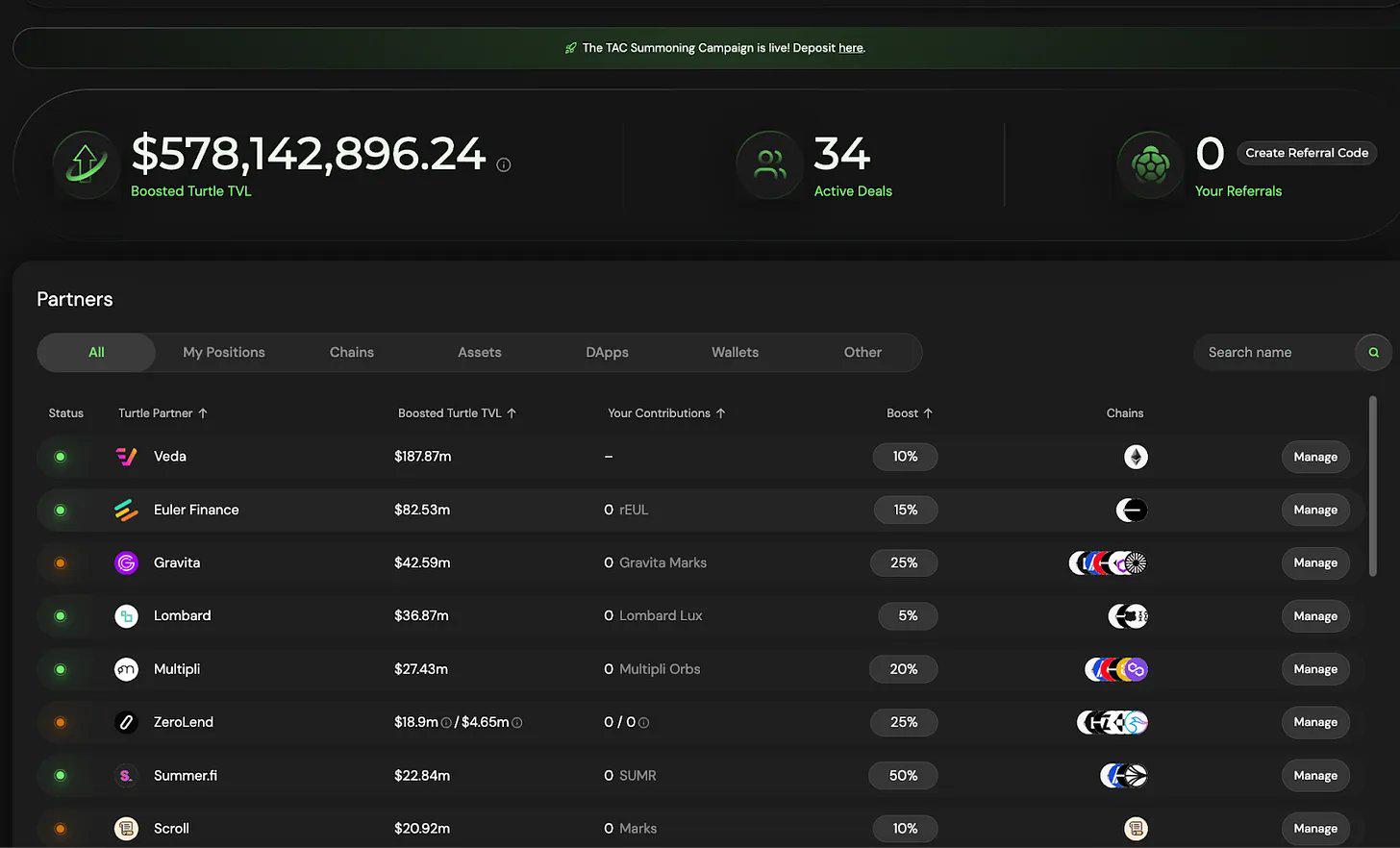

Turtle Club

Turtle Club has quietly become one of the most effective bribery markets, but few people have mentioned it. Their fund pools are usually embedded in partnerships with a total locked value (TVL) of over $580 million, using dual token issuance, weighted bribery, and an unexpectedly highly sticky LP basis.

Their model emphasizes fair value redistribution, which means that the distribution of benefits is determined by voting and real-time capital turnover.

Here is a smarter flywheel: The rewards that LPs receive are related to the efficiency of their capital, not just the size of their capital. This time, efficiency was motivated.

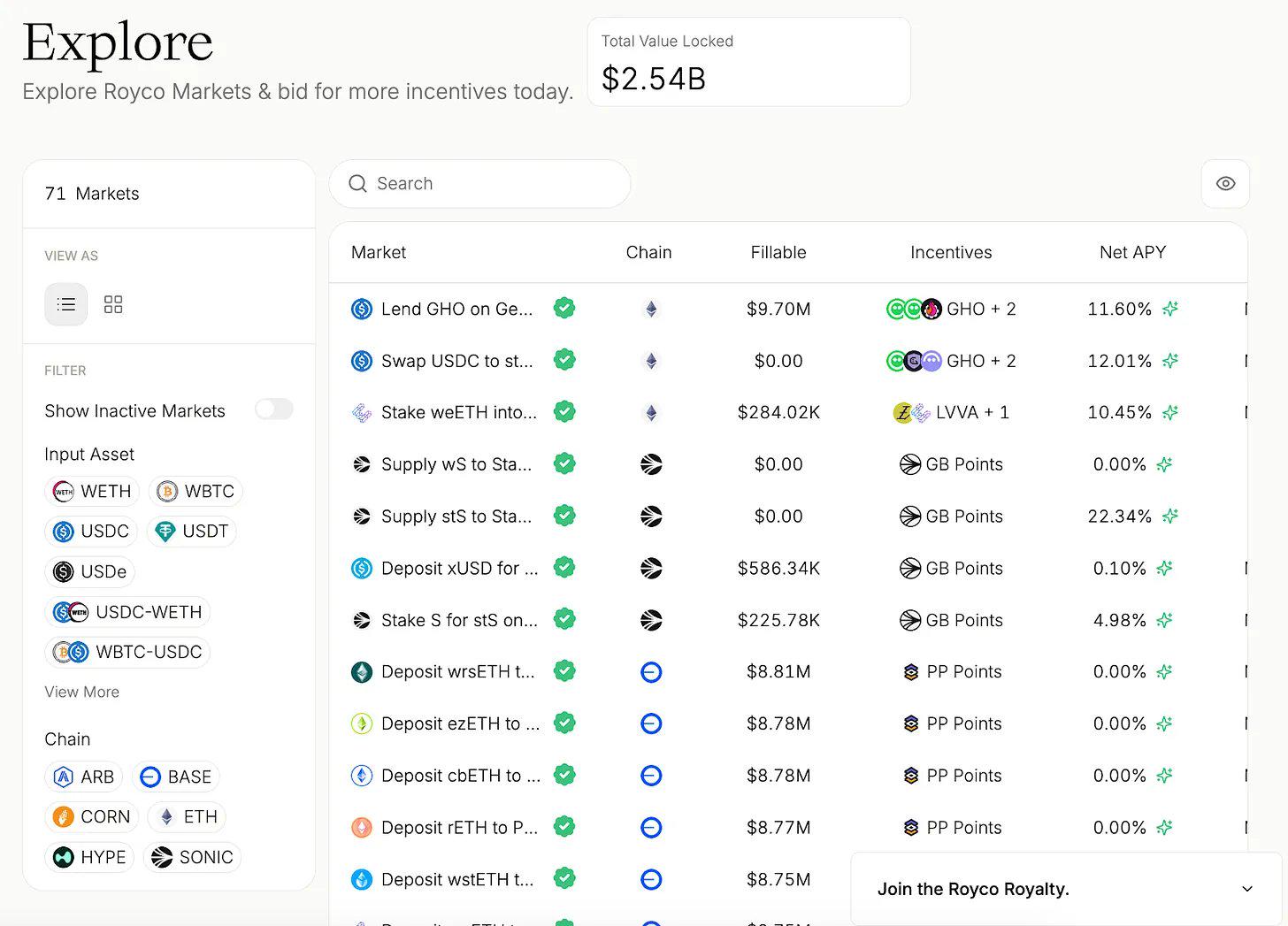

Royco

Royco's total locked position value (TVL) soared by more than US$2.6 billion, a month-on-month increase of 267,000%.

While some of this funding is “powered by points,” it is important to have the infrastructure behind it:

- Royco is the order book for liquidity preference.

- An agreement cannot simply issue rewards and then rely on capital inflows. They issue requests and then the LP decides to invest money, and this coordination creates a market.

Here are the reasons why this narrative is more than just a revenue game:

- These markets are becoming the meta-government layer of DeFi.

- Hidden Hand has sent over $35 million in bribes between major agreements such as Velodrome and Balancer.

- Royco and Turtle Club are shaping effective issuance options.

Mechanism for liquidity to coordinate markets

1. Bribery as a market signal

Projects like Turtle Club allow LPs to understand where incentives flow, make decisions based on real-time metrics, and receive rewards based on capital efficiency rather than just the size of capital.

2. Liquidity Request (RfL) as Order Book

Projects like Royco allow agreements to list liquidity requirements, just like posting orders in the market, where LP executes these orders based on expected earnings.

This becomes a two-way coordinated game rather than a unilateral bribery.

If you can decide the direction of liquidity, it can affect who can survive the next market cycle.

Related Readings: The migration of on-chain liquidity: 15 months of ups and downs, who has stood firm after the hype faded?