Koreans are crazy about speculation? Good news is coming? Explore the password for pulling the disk behind AUCTION's 400% increase in a month

Reprinted from panewslab

03/17/2025·3MAuthor: Luke, Mars Finance

Recently, the price of Bounce Finance's native token $AUCTION has ushered in an astonishing wave of rises, rising against the trend from the low point less than a month ago, breaking through the highest level of $35, an increase of more than 400%. This abnormal movement not only broke the market downturn, but also triggered widespread discussion. What exactly drove the surge in AUCTION? Before analyzing the specific reasons, let’s take a systematic look at AUCTION and the projects behind it.

What is AUCTION?

$AUCTION is a native token of the decentralized auction platform Bounce Finance, running on BNB Chain (formerly Binance Smart Chain). Founded in 2020, Bounce Finance initially focuses on providing decentralized auction tools, allowing users to create various auction pools, including token sales, NFT auctions, etc. Its uniqueness is that it breaks the limitations of traditional centralized platforms and provides project parties and investors with flexible and efficient financing and trading methods.

As the core token of the platform, $AUCTION has multiple functions: users need to hold AUCTION to participate in the platform's auction activities, pay fees or receive additional rewards. At the same time, AUCTION is also used for governance, and holders can make suggestions on the development direction of the platform and vote. With the expansion of platform functions, AUCTION's application scenarios have gradually extended from pure auction tools to DeFi, NFT and even physical asset auction fields.

In recent years, Bounce Finance has continuously iterated and launched diversified mechanisms such as fixed-price auctions and Dutch auctions. Through in-depth binding with the BNB Chain ecosystem, it has attracted a large number of project parties and users. Auction Intelligence (AI Agent Launchpad), launched in early 2025, further introduced AI technology into the platform, marking its progress towards intelligence and diversification. AUCTION's total supply is 10 million pieces, and its current circulation is about 7.8 million pieces. Its market value has ranked among the top small and medium-sized DeFi tokens before its surge.

Huge whales on the chain stock up on a large scale, increasing chip

concentration

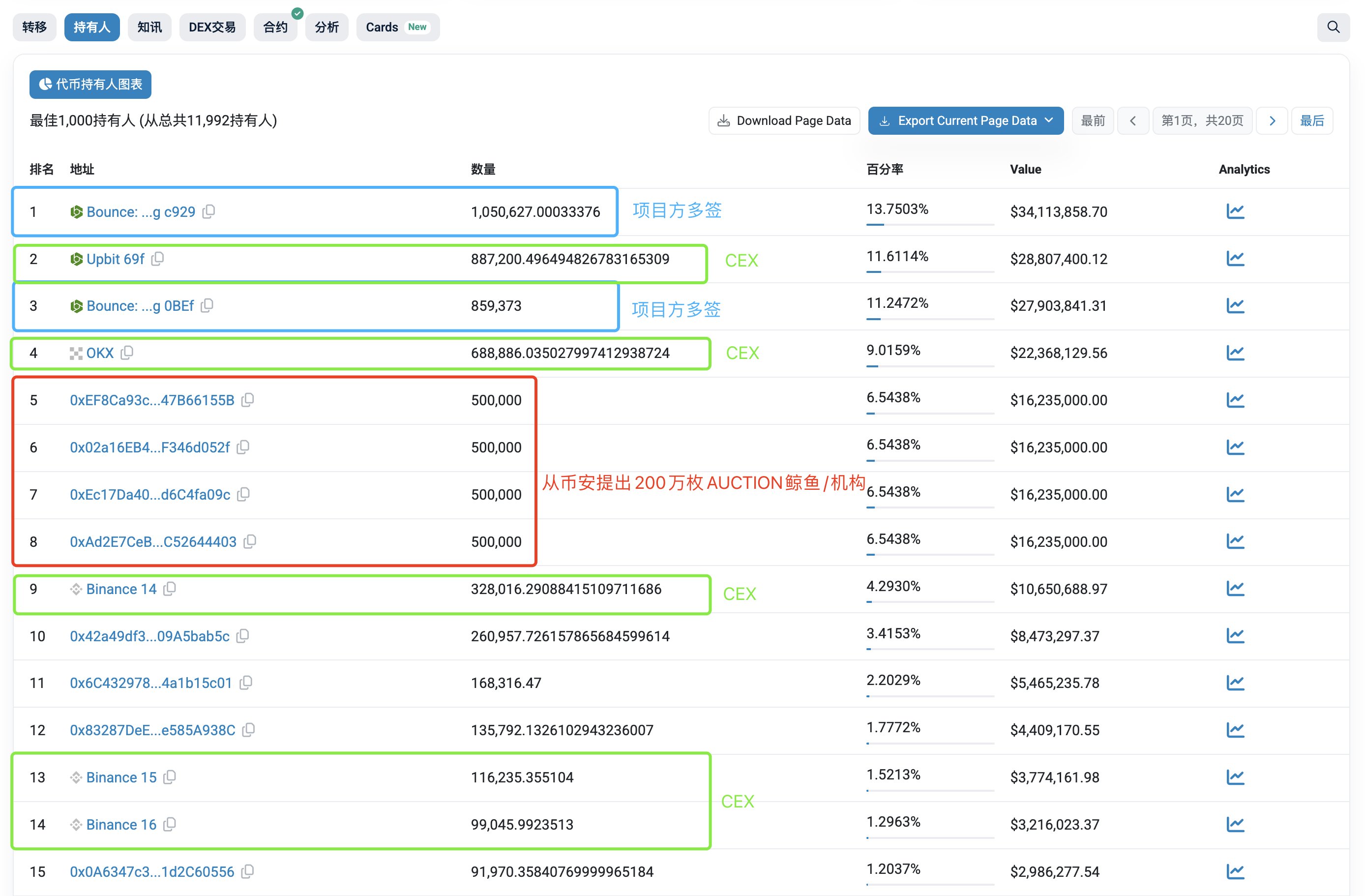

On-chain data shows that AUCTION's circulation chips are rapidly concentrating in the hands of a few large investors. According to monitoring, one or a group of giant whales/organizations have withdrawn a total of 2 million AUCTIONs from Binance through multiple addresses over the past three weeks, accounting for 26% of the total supply, with a total value of approximately US$62.44 million. As of March 16, Binance's AUCTION balance was only 706,000 (about 9%), and the potential selling pressure on the exchange's spot pallet was significantly reduced.

The specific timeline is as follows:

- On March 8, a newly built wallet extracted 160,700 AUCTION (approximately US$2.45 million) from Binance.

- On March 10, the giant whale bought a total of 386,300 (about 6.31 million US dollars), and its floating profit reached 465,000 US dollars.

- From March 14 to 16, the same agency withdraws another 365,000 (about $9.62 million) and 134,000 (about $4.15 million) through the new address.

The current chip distribution on the chain is displayed:

- Exchange wallet (Upbit/Binance/OKX): 2.11 million (27%);

- Giant whales/Institution hold: 2 million (26%);

- The project party’s multiple signing address: 1.91 million (25%).

This highly concentrated chip structure shows that the giant whale/institution has achieved a certain degree of "control". The tightening of liquidity in the spot market has laid a solid foundation for price increases.

Contract trading volume surges, leveraged fuel boosts pull-up

The surge in AUCTION is closely related to the popularity of the contract market. Data shows that the recent AUCTION contract trading volume is as high as 10 times the spot trading volume, and the price has completely broken through the bottom chip-intensive area. This high proportion of contract holdings has brought significant effects and also explains why some investors prefer this type of currency.

The logic can be summarized into the following points:

First of all, high contract positions mean that the long-short game is fierce, and the market opponents are sufficient, providing impetus for price fluctuations. AUCTION's contract holdings even exceed the market value, implying that the dealer behind it has strong strength, sufficient chips and a strong desire to pull the market. Secondly, the panic operations of highly leveraged players become the "fuel" for pulling the plate. Once the price starts, the chain reaction of liquidation or reverse buying will quickly amplify the increase.

For example, if an investor opens short AUCTION at $25 and the price rises to $28, facing the pressure of loss, he may choose to cut his losses and close his position or even go long with the backhand. This psychological game is infinitely amplified in an environment of high contract holdings, and the panic operations of a large number of retail investors further push up prices. Currently, AUCTION has hit a 300-day high, but capital inflows have slowed down, indicating that pulling momentum may be close to the stage top. This also confirms the characteristics of the currency with high contract holdings: the dealer has strong control ability, significant leverage effect, and full of short-term explosive power.

New project expectations and the catalysis of BNB's ecological popularity

AUCTION's price fluctuations have always been closely related to the popularity of the IEO (Initial Exchange Offering) project on the Bounce Finance platform. This surge coincides with the platform launching a new AI Agent Launchpad - Auction Intelligence. This project was launched on BNB Chain on March 3. Users can participate in the creation and issuance of AI proxy tokens by holding $AUCTION or $Broccoli tokens. The platform also issues 1,000 AUCTION airdrops every day for 10 days. This mechanism directly stimulates token demand and ignites the market's expectations for new IEO projects.

At the same time, the BNB ecosystem has been performing very well recently. As an important DeFi project on BNB Chain, Bounce Finance and its token AUCTION naturally benefited from this craze. Auction Intelligence's innovative concept of AI+DeFi further enhances the attractiveness of the project and may become an important signal for giant whales to make an advance layout.

In addition, Bounce Finance announced the upcoming physical auction, involving Yayoi Kusama's artwork "Pumpkin" (1998), to be exhibited in Seoul, South Korea in mid-April, with $AUCTION's status as a core practical token strengthening. This series of good news has injected more room for imagination into the market.

summary

The surge in AUCTION is due to the superposition effect of multiple factors: the giant whales on the chain build a bargaining foundation, the leverage effect of the contract market boosts the price soaring, the craze between Auction Intelligence and the BNB ecosystem has stimulated market enthusiasm, and speculative sentiment adds fuel to the rise. For investors, on-chain capital trends and contract positions should be closely tracked in the short term, while staying alert for high-level pullbacks. Whether the new IEO will become the trigger point for the next wave of market trends still needs to wait for subsequent updates from Bounce Finance to confirm.

At the same time, the market is weaving a series of straightforward and attractive narratives for investors: BTC's "insider market smash and liquidation war", BNB's "ecological hot favor", AUCTION's "whale strong control", and BNX's "contract delivery game". Behind these stories is a similar logic - the market dominated by the dealer, and as long as you follow up boldly, you will have a chance to get a share of the pie. However, although this "dealer leads the way" model is simple and crude, it has hidden secrets: AUCTION's 26% chip concentration may be a signal of short-term profit, but the potential shipment risks of the dealer are also chilling. In this craze, the contest between reason and impulse has just begun.

chaincatcher

chaincatcher