James Wynn Why did Zhao Changpeng support Web3 dark pool trading after the stock price was over $100 million?

Reprinted from chaincatcher

06/03/2025·14DOriginal title:: : [Issue] Darker than Black: Web3 Needs Dark Pools

Original author: c4lvin : : FP, researcher of Four Pillars

Original translation: Tim, PANews

Key points:

- Former Binance CEO Zhao Changpeng proposed that the dark pool perpetual contract DEX needs to be built to solve the MEV attacks and large positions exposed due to DEX transparency, which has triggered a wave of attention in the dark pool track.

- Dark pools are private trading places that have existed for a long time in traditional financial markets. Their advantage is that they can allow institutions to handle large-value positions without causing market fluctuations, but they have been repeatedly abused and controversial due to their centralized operational model.

- The dark pool built in a decentralized Web3 environment can solve the key flaws of Web3 and the existing financial system and is evaluated as an innovative move that will play an important role in the future Web3 privacy market.

Source: "The Black Contractor"

Today (June 1, 2025), the post posted by former Binance CEO Zhao Changpeng on Twitter caused huge uproar in the community. He raised the potential demand for "dark pool perpetual contract DEX", pointing out that the transparency of DEX's real-time public orders will be detrimental to traders. The post sparked debate on the privacy and efficiency of cryptocurrency transactions, which particularly brought the dark pool concept to attention. This article aims to analyze what a dark pool is and what a dark pool in Web3 means.

Source: CZ Twitter

1.What is a dark pool?

1.1 Dark Pool in Traditional Fields

Source: b2broker

Although CZ's remarks may mistakenly believe that dark pool trading is a unique innovation of Web3, in fact, this financial instrument has been around for decades in traditional markets. The history of dark pools can be traced back to the 1979th issue of the Securities and Exchange Commission that year, allowing securities listed on specific exchanges to be traded on other platforms. With the rise of electronic high-frequency trading in the 1980s, the transparency of order book information was far beyond the past, prompting institutional investors who were unwilling to expose large-scale holdings to demand for privatized trading venues.

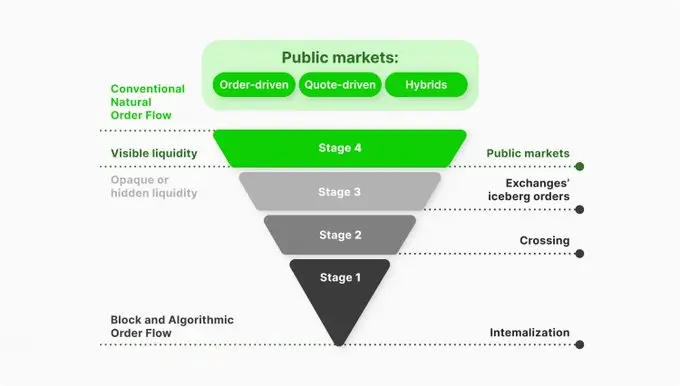

Usually, we will be exposed to public exchanges like the New York Stock Exchange or the Nasdaq, but when opening bulk trading positions on these public exchanges, it may significantly affect the market price and even cause unexpected losses to ordinary traders. Dark pool refers to an independent trading system that allows institutions or large investment banks to perform large-scale transactions privately.

In traditional exchanges, all buying and selling orders are publicly displayed on the order book for market participants to view, while the dark pool trading platform does not disclose the order price or quantity before the transaction is completed. Due to this feature, large institutional investors can hide trading intentions while minimizing market impact. As of 2025, as much as 51.8% of US stock trading have been completed through dark pools, indicating that dark pools have surpassed simple alternative trading methods and become the mainstream trading method.

There is a certain difference between this dark pool trading and cryptocurrency over-the-counter trading. Dark pool operators accumulate chips by shorting stocks, thereby providing buyers with purchases. Since the short trading details must be disclosed to financial regulators such as the US Financial Industry Regulatory Bureau, the transaction data and trading volume of the dark pool are actually open and transparent. But the difference is that the identity of the institution that initiates the transaction directly will not be disclosed. Currently, the trading volume of dark pools is disclosed in the form of DIX index, and traders often speculate on the institutional capital trends based on this.

1.2 Criticism of traditional dark pool transactions

However, dark pool transactions in traditional finance have been criticized. Since dark pool transactions are manipulated by centralized operators, when the profits available for corruption far exceed the fines required to be paid, it is very easy to be abused, and the criminal cases caused by this are emerging in reality.

Source: SEC

In 2016, several major financial institutions were fined more than $150 million for violating federal laws in dark pool operations, including Barclays and Credit Suisse who were sued by the U.S. Securities Regulatory Commission for violating dark pool regulatory regulations. These institutions are accused of providing customers with false information about the composition of dark pool participants and not transparently disclose the fact that they provide preferential treatment to high-frequency trading companies.

In 2018, the Securities and Exchange Commission fined Citigroup $12 million for misleading investors in its dark pool trading business. Citi leaked confidential customer order information to high-frequency trading companies, allowing these companies to execute more than $9 billion in reverse transactions with Citi customers and make easy profits.

These problems stem from trust dependence and conflict of interest on centralized operators, and the decentralized dark pool solution in Web3 is just able to resolve these pain points.

1.3 Dark Pool in Web3

The concept of dark pool in Web3 is also attracting attention, and its implementation form is more complex and transparent than that of dark pool in traditional financial markets. Although all transactions on the blockchain will be recorded publicly, which seems to be contradictory, the Web3 dark pool effectively guarantees transaction privacy by using advanced cryptography technologies such as zero-knowledge proof and multi-party computing. The inherent transparency of blockchain has become its technological advantage in achieving higher privacy protection.

The core advantage of Web3 dark pools is that unlike traditional Web2 mode dark pools, they can avoid operational risks. Since transactions are automatically executed through smart contracts, no intermediary involvement is required, traders can always maintain full control of their assets. At the same time, unlike traditional dark pools, there is no risk of operators abuse customer information under this model, and all transaction processes can be verified through cryptography technology.

Web3 dark pool also introduces a new concept called "Programmable Privacy". This feature allows developers to flexibly set which parts of the application should remain private and which parts need to be public. For example: On the premise of meeting regulatory compliance requirements, transaction instructions can be kept confidential throughout the process, and the final transaction results are only disclosed to specific parties. Although traditional software technology is not impossible to implement similar functions, Web3 technology has significant advantages in terms of flexibility advantages and protocol verifiability in implementation of programmable privacy protocols.

2. Requirements for dark pool perpetual contract DEX

CZ proposed a perpetual contract DEX that requires dark pool mode, and pointed out that the transparency of current DEX has caused many problems. The core arguments and basis he elaborated are as follows:

2.1 Avoid MEV Attacks

The transparency of DEX is one of the main causes of MEV attacks. As mentioned above, when the DEX order is exposed in the blockchain memory pool, the MEV robot will detect these transaction information and implement pre-transaction, post-transaction or sandwich attacks. This leads to traders' final transaction prices far below expectations, especially the slippage of large orders will increase significantly. CZ once said: "If you want to complete a $1 billion order, you must hope to complete the transaction before others notice it." He advocated that the dark pool mechanism is needed to solve this kind of problem.

2.2 Potential huge demand

CZ mentioned that dark pools have been widely used in traditional financial markets, and pointed out that the liquidity that dark pools can provide may be as high as ten times that of public exchanges. He believes that the crypto market also needs such solutions, emphasizing that traders' privacy protection is particularly important in high-risk products such as perpetual contracts.

Beyond CZ's view, the demand for dark pools has been considered to be growing recently not only in the Web2 market, but also in the Web3 market. According to Blocknative research, Ethereum's private memory pool transactions account for only 4.5% of the total in 2022, but have recently accounted for more than 50% of the total gas fees. Although there is no memory pool environment in the Solana network, various transaction robots and wallet solutions have used MEV prevention functions as standard, which shows that users' awareness of MEV has been significantly improved. This clearly proves that the Web3 community is now fully aware of the operational behavior that affects transaction results, and there is a strong need to actively avoid these effects.

2.3 Potential damage from DEX transparency

CZ said "all orders are public in real time on DEX", and emphasized that this will pose a major hidden danger in perpetual contract trading. In perpetual contract DEX, traders' positions and closing points are directly exposed on the blockchain, which makes it possible for malicious participants to use this information to manipulate the market. For example, when other traders find the price of large-scale positions, they can deliberately push the market price to trigger forced closing. CZ also mentioned that this is related to "recent events", which seems to imply the HLP liquidation incident of the Hyperliquid platform or the large-scale liquidation incident of James Wynn.

Source:@simonkim_nft

A more detailed explanation of CZ's tweet can be found in a recent article written by Hashed founder Simon Kim. The article points out that although Web3 can achieve decentralization and privacy protection, it actually creates the most transparent monitoring system in history, emphasizing the reality that all transactions are permanently recorded, visible to anyone, and analyzed by AI.

This article focuses on analyzing the case of MicroStrategy, proving that even businesses cannot escape tracking. Despite Micheal Saylor's repeated strong warnings on the risk of public wallet addresses, blockchain analytics platform Arkham Intelligence has gradually successfully tracked the company's holdings of Bitcoin, locking in 87.5% of its total holdings.

The article also focuses on the $100 million liquidation incident experienced by James Wynn on the Hyperliquid exchange, which highlights the necessity of dark pool trading. Wynn once established a 40-fold leveraged long position in Bitcoin worth $1.25 billion, but because its liquidation price is publicly verifiable, market participants were able to use this loophole to snipe. Some traders continued to reverse their positions during the same period, making a profit of $17 million in a week. This incident reveals the disadvantages of transparent position information in perpetual contract DEX, and also confirms that there is a practical need for a trading environment with opaque position information.

3. Different ways to implement dark pools on the chain

Although many people may have first come into contact with the concept of dark pool trading due to CZ's tweet, in fact, many projects are continuing to advance dark pool development. In order to achieve the core goal of "trader privacy" as a dark pool, and there are multiple technical paths, different projects have adopted different encryption solutions. The following are mainstream implementation methods and their representative projects:

3.1 Renegade

Source: Renegrade

Renegade is one of the most representative on-chain dark pool projects on the current Ethereum layer 2 network Arbitrum main network. The project has built its privacy protection solution by combining multi-party computing with zero-knowledge proof technology.

In the Renegade protocol, all status data (balance, order book, etc.) are managed locally by the trader without relying on centralized or distributed servers. When a trader executes a transaction, he must be aware of the old and new wallet status at the same time and submit three key information to the smart contract: commitment, nullifier and validity proof. This structural design is also common in projects such as Zcash based on zero-knowledge proofs.

The core feature of Renegade is to ensure the privacy of the entire process before and after the transaction. Before the transaction, the order details (price, quantity, direction, etc.) are completely hidden; after the transaction is completed, only the opponent can know the type of assets exchanged. All transactions are anchored to Binance's real-time mid-price execution, with no slippage or price impact, making it an attractive Web2-style project.

Renegade's architecture is characterized by the fact that whenever a new order enters the system, many independent relayers will continue to perform multi-party computing with each other through point-to-point communication. In the process of performing multi-party computing, Renegade proves a special NP proposition called "VALID MATCH MPC". The above proof shows that after a public order information commitment and a public matching tuple commitment, both parties are actually aware of the valid input order. Through this collaborative zero-knowledge proof structure, Renegade provides users with complete anonymity, privacy and security.

3.2 Arcium

Arcium is a privacy project built on the Solana ecosystem. Its core technology is to use the MPC that adds secret sharing to achieve encrypted shared state. This solution allows developers to store encryption status on the chain and perform data calculations, while ensuring that the underlying original data is kept confidential throughout. It is particularly worth mentioning that Arcium's innovative architecture can realize local non-interactive addition operations and complete multiplication operations through single-wheel communication, which greatly improves computing efficiency while providing strong security guarantees.

Additionally, Arcium adopts programmable privacy capabilities, allowing developers to specify in Solana programs which states should be stored in encrypted form and which functions should perform calculations for specific encrypted states. In Arcium, multi-party computing tasks are managed by a virtual execution environment called Multi-Party eXecution Environment (MXE). MXE is responsible for setting the parameters of the task, such as the data used, the programs executed, and the nodes responsible for the calculation. With this framework, Arcium can support large-scale, parallelized transaction execution similar to Solana.

Source: Arcium

Recently, Arcium successfully launched a dark pool demonstration version on Solana Public Test Network, realizing the first on-chain confidential trading venue on the Solana blockchain. Any existing Solana DeFi project can cooperate with Arcium to deploy dark pool mechanisms on Solana to provide users with confidential transaction services.

3.3 Aztec

Aztec is a zero-knowledge rollup solution focusing on privacy protection. It completed a US$100 million Series B financing led by a16z crypto in 2022, becoming one of the largest investment cases in the privacy technology field.

Similar to the Arcium solution, Aztec allows developers to tag private functions. Functions marked as private are executed and validated on the user device, while only publicly tagged functions will run on the Aztec network. The state value of a private function is stored in a UTXO that is decryptable only by the user and cannot be read by anyone except the user.

Source: Aztec

Aztec has reached a cooperation with Ren Protocol to jointly develop a privacy-protected transaction agreement based on dark pool technology. The trading system built by Aztec allows users to trade through the zero-knowledge proof token "Aztec Notes", and neither transaction information nor amount will be disclosed in the order book. When a user deposits funds into Aztec, the system generates cash-like encrypted credentials through the off-chain UTXO status mechanism. As transactions are submitted and executed, the status tree will continue to update encrypted information, and only the certificate holder can view the content, fully protecting the confidentiality of user identity and account balance.

4. If the technology is successful, the dark pool will flourish

The biggest technical challenge facing Web3 dark pools are scalability and performance issues. Current security multi-party computing and zero-knowledge proof technology have extremely high requirements for computing power, and there are still limitations when dealing with large-scale transaction volumes. Taking the Renegade project as an example, the point-to-point network structure will lead to an exponential increase in system complexity when the number of network participants increases.

There is some trade-off between the privacy and scalability of dark pools. Aztec co-founder Zac Williamson once pointed out: "A completely private transaction will require the transmission of more data due to the complete encryption of information, which will occupy more resources and lead to reduced scalability." To break through these fundamental constraints, a more efficient cryptography library is needed.

Source: Arcium

Network stability is also an important challenge. Recently, Arcium tested a dark pool demonstration application based on the Arcium testnet on Solana's Devnet. During the test, some nodes crashed due to high traffic, resulting in a backlog of order queues. Arcium's test aims to verify infrastructure stability and address such potential issues before the mainnet goes online, and the problem has indeed been quickly resolved. This proves that the implementation of dark pools requires cutting-edge technology and adequate testing to cope with high demanding loads.

In the long run, dark pools are expected to become an important part of the cryptocurrency trading ecosystem. As Binance founder CZ pointed out, dark pools account for more than 50% of the transaction volume in the traditional financial field, and this trading model is likely to occupy an equal proportion in the crypto market. This trend will accelerate further as institutional investors increase their participation in the crypto market.

But this does not mean that the existing DEX will be completely replaced, and the two are more likely to form a complementary relationship to meet different needs. It is expected that the market will show a differentiation trend in the future: small-scale transactions that value price discovery will still be conducted on existing DEXs; while large-scale transactions that focus on privacy will be conducted in the dark pool.

The development of dark pools will expand from the privacy field to a broader application scenario. As Arcium continues to advance, demand for privacy protection technologies in various fields such as AI, DePIN and supply chain management is increasing day by day. As the starting point of the privacy technology layout, dark pools are expected to develop into an important part of the privacy ecosystem.

jinse

jinse