Is 2025 the time to determine the fate of cryptocurrencies?

Reprinted from panewslab

03/11/2025·2MAuthor: Stephen McBride

Compilation: Vernacular Blockchain

Source: TradingView

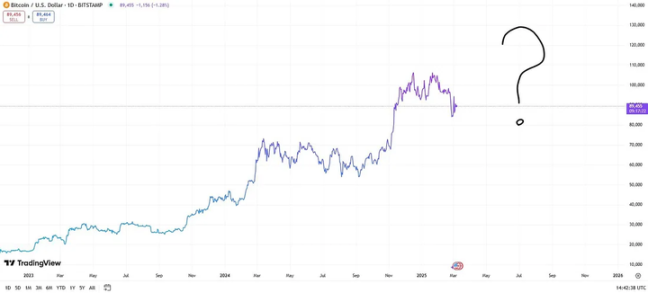

1. The crypto market is at a critical turning point

Bitcoin (BTC) has stalled after breaking $100,000, while many small cryptocurrencies have given up their post-election gains.

However, in the history of cryptocurrency, we are about to usher in an unprecedented change - government support, which is what the market has long longed for.

Relevant research shows that this will be a strong boost to drive a new round of cryptocurrency prices, and may even break the long-standing four-year cycle.

Washington's attitude has turned the cryptocurrency from "in fact illegal" to "national priority development projects." Over the past month, we have witnessed a series of nearly countless positive regulatory changes:

- Trump signed an executive order to lay the foundation for supporting the regulatory environment of cryptocurrencies, end the Operation Choke Point 2.0, and ensure that cryptocurrency companies have access to banking services.

- The Securities and Exchange Commission (SEC) announced the establishment of a special working group to formulate new regulatory rules to clarify which tokens belong to securities and which belong to commodities.

- The SEC repealed SAB 121 regulations, a vague rule that made banks almost unable to host cryptocurrencies for their clients was removed.

- The Commodity Futures Trading Commission (CFTC) will be led by cryptocurrency backer Brian Quintenz, which will further promote a regulatory environment conducive to the development of the industry.

- Congress is expected to pass the stablecoin bill this year to provide a legal framework for the stablecoin market.

- David Sacks, head of Trump's crypto policy, said the government hopes to build the United States into a "global cryptocurrency capital."

- A Texas judge overturned sanctions on privacy agreement Tornado Cash, marking a major shift in regulators' more innovative-friendly.

These positive changes in regulation are countless, and the policy shift in the past month alone is enough to fill a few pages!

2. Clear regulation is the green light signal of Wall Street

The world's largest capital pool can finally make a big move into the crypto market.

For example: Last month, when asked whether Bank of America would enter the crypto business, CEO Brian Moynihan responded: "If the regulatory framework is well-developed to make it a real area where business can be done legally, you will see the entire banking system going all out."

Now, Wall Street can finally invest with confidence, entrepreneurs can finally let go of construction, and as investors, we will seize opportunities in this major change and continue to hold the best crypto assets.

Most investors don’t realize how severe the regulatory storm has hit the crypto market in the past few years. And now, they are underestimating the far-reaching impact of this round of policy turn on the future of the crypto market.

The U.S. government is shifting from an anti-crypto stance to supporting encryption. Every time I talk about crypto regulation in the past four years has been bad news - "Oh, so good, another three-letter agency sued a certain agreement." Now, the situation has completely reversed.

The most important catalyst in crypto history is about to arrive when market sentiment falls to multi-year lows. The Memecoin craze is about to exit, and next, crypto innovation in the United States will usher in real prosperity. The regulatory gate has been opened, and Wall Street's giants will soon enter this new world.

3. Capital flow is the key reason why Bitcoin still leads this bull

market

Since BlackRock launched the iShares Bitcoin Trust ETF (IBIT), the ETF has absorbed $40 billion in just one year.

In contrast, small cryptocurrencies lack such capital flow support, and their market conditions are almost maintained by sporadic retail buys, and most investors only buy a few hundred dollars in chips in small quantities.

In the past few years, crypto funds that once dominated the market have struggled to raise new funds due to regulatory resistance, resulting in few people willing to buy even small cryptocurrencies with strong fundamentals. But as the regulatory environment gradually becomes clear, this situation is changing.

As far as I understand, dozens of crypto funds are actively raising funds, and their goal is to complete the fundraising this quarter. This means that by early summer this year, the market may usher in a new wave of capital.

I also believe that regulatory clarity has the potential to break the traditional four-year cycle—and to move in a positive direction.

Since the crypto market bottomed out at the end of 2022, Bitcoin has been the leader in the market.

Judging from the past four-year cycle, the flow of funds should have begun to enter small tokens at this stage, but this time, they are still waiting for opportunities.

Generally speaking, the market will usher in a deep pullback in 2026, but Washington's major policy shift towards cryptocurrencies may allow this cycle to last longer.

ETFs have brought tens of billions of dollars in new funds to the crypto market, and Washington's policy shift has the potential to introduce "trillion-level" inflows.

Our research shows that the actual process of the current market cycle is earlier than the time point displayed by the calendar.

In 2025, the price of Bitcoin may soar to $250,000.

However, most investors are still looking back, plagued by the shadow of years of regulatory storms, and have not realized that the United States is about to become the center of global cryptocurrency innovation!

4. With the change of regulatory environment, truly valuable crypto

projects are about to grow explosively

In the past few years, due to poor regulation, a large amount of funds have been blocked from the crypto market, resulting in the lack of real development opportunities for most projects. Now, things are changing.

While 99% of cryptocurrencies still lack long-term value…the 1% of quality projects are solving real-world problems in innovative ways and are already profitable.

I just delved into it and found three innovative crypto projects with potential:

- One of them is challenging Google's industry dominance.

- Another one has created the "AI chip version of Airbnb".

- The third has established cooperation with well-known brands such as Disney, Netflix, HBO, Apple, and Nike.

The gates for supervision have been opened, and real value investment opportunities have come!

jinse

jinse