IOSG: How does PayFi solve the "impossible triangle problem" in traditional finance?

Reprinted from panewslab

12/24/2024·4M

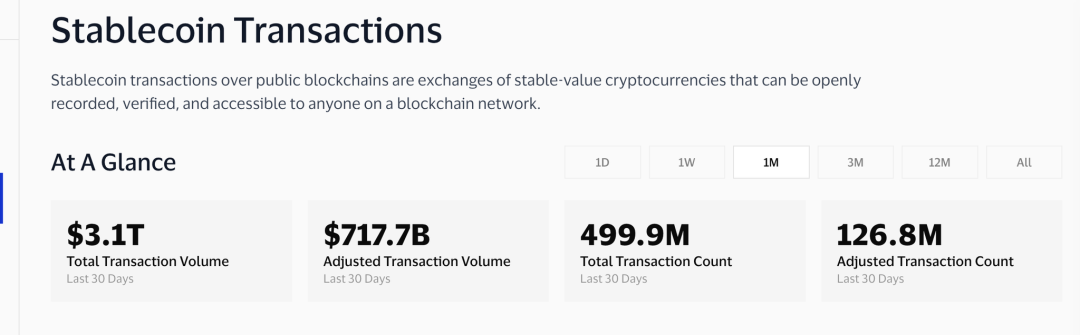

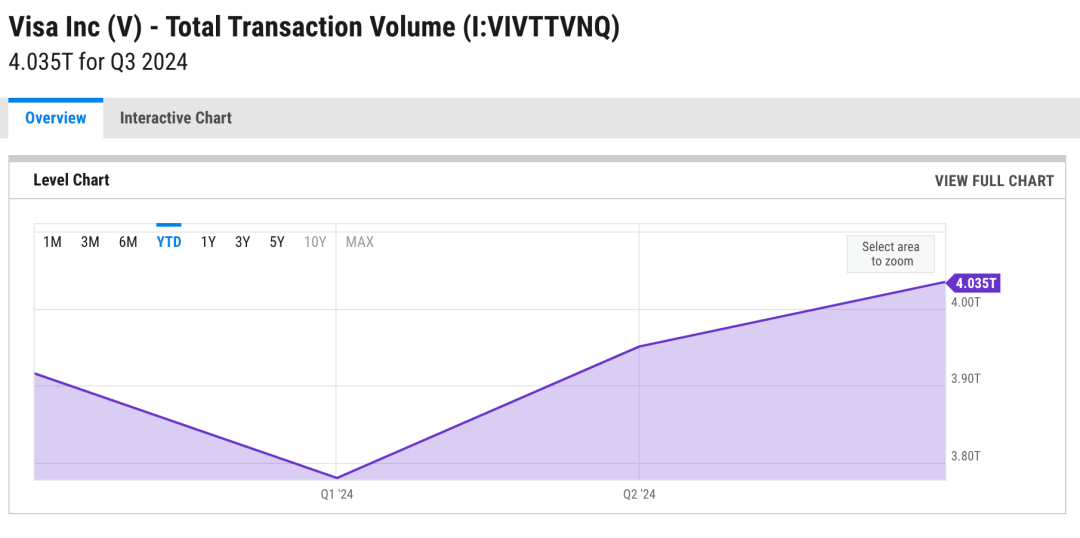

Proof of success for Web3 payments

The rapid growth of stablecoin payments is reshaping global finance, with transaction volumes rivaling those of major payment networks. However, this is just the beginning of a transformative financial era.

source: visaonchainanalytics

source: ycharts

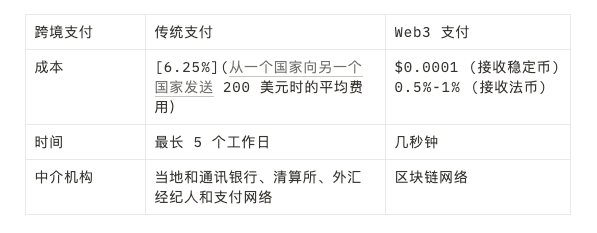

Inefficiencies in traditional systems, such as cross-border payments, create huge opportunities for stablecoins:

“Cross-border payments typically incur high transaction fees, exchange rate marks, and intermediary fees (and take a long time to complete settlement)…The market for B2B cross-border payments is huge…FXC Intelligence estimates that B2B cross-border payments will be The total market size is US$39 trillion and is expected to grow 43% to US$53 trillion by 2030.” - “The Future of Payments” by Andreessen Horowitz.

Real-world adoption is already underway:

“With traditional payment channels too difficult, slow, and expensive, there are now approximately 30 million active users moving $3.2 trillion worth of stablecoins every month.” - Sequoia Capital, “Partnering with Bridge: A Better Money” Transfer method》

The advantages of blockchain-based payment systems are obvious:

“Unlike most traditional financial payment methods, which take days to settle, blockchain rail can settle transactions almost instantaneously across the globe…Due to the elimination of various intermediaries and superior technological infrastructure, crypto Enabled payments can offer significantly lower costs than existing products” - The Future of Payments by Andreessen Horowitz.

Traditional financial giants are taking notice:

“Industry giants including Stripe are launching new payment options for these assets, and the numbers are growing rapidly…Bridge is built on blockchain, and it runs 24 hours a day, in almost every country – at a cost that is only that of traditional FX rail ” - Sequoia Capital, “Partnering with Bridge: A Better Way to Move Money.”

PayFi: Smart Dollar

Not every dollar is created equal. Some are able to move into prime opportunities, while others wait to depreciate.

PayFi integrates DeFi into payments, turning every dollar into smart, autonomous money. It converts idle funds into productive assets that generate income while maintaining liquidity.

Historically, only large capital holders have had access to high-quality financial opportunities.

Historically, access to high-quality financial opportunities has often been limited to large capital holders due to high minimum investment requirements, exclusive access to private markets and barriers to specialized financial vehicles like hedge funds or private equity. PayFi democratizes this advantage, making it possible to earn competitive returns on even small sums without sacrificing accessibility. Smart stablecoins can solve the triple dilemma of time, risk and liquidity, such as allowing users to receive discounts by paying bills early.

Advantages of Web3 Payments

Web3 payments are like high-speed trains: moving value around the world efficiently, quickly, and reliably. PayFi goes a step further and adds an intelligence layer similar to an automated logistics network. Not only does it move value quickly, it also provides some key features:

- Smart Routing: Automatically direct assets based on user-defined logic (smart contracts).

- Aggregation Efficiency: Combine multiple trades for better liquidity.

- Dynamic Optimization: Redirect in times of congestion or high network charges.

- Programmable Finance: Automate payments based on complex conditions.

- Asset swapping: Swap assets as needed during your journey.

PayFi doesn't just move money - it makes money smarter and more efficient. Almost all products use one or more of these features.

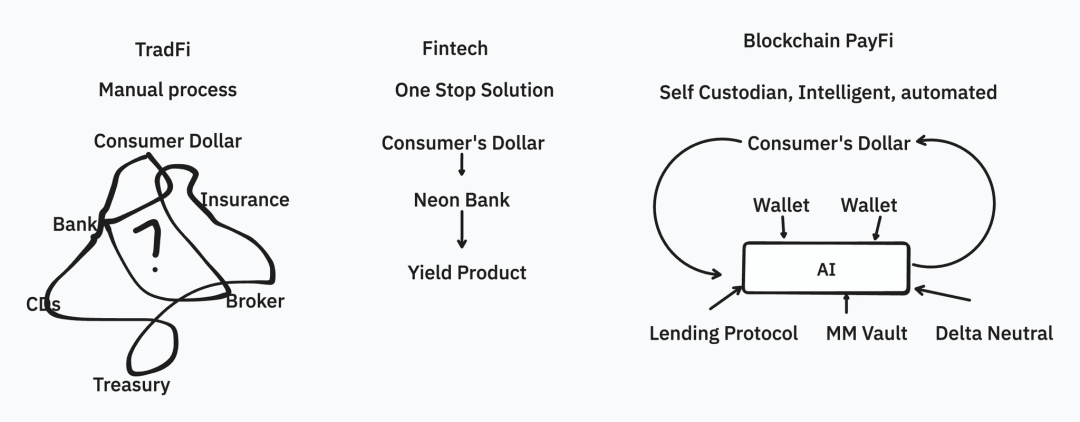

Solve the "cash problem"

While cash remains king due to its liquidity, autonomy, global offline acceptance, and privacy, it has one key flaw: devaluation. Inflation continues to erode its value, leaving users to choose between liquidity and yield.

Traditional fintech applications like PayPal and Venmo offer yield products, but these solutions are fragmented, offer limited returns, and require users to actively transfer funds to specific accounts.

PayFi revolutionizes this space with seamless solutions. Whether in the form of stablecoins, loyalty points or pending refunds, funds within the PayFi system generate earnings seamlessly, whether they are stored in wallets, payment channels or shopping platforms. Users enjoy returns commensurate with their investment while keeping their funds immediately available.

This means:

- There is no idle capital: every dollar is continuously working.

- Global returns: Even non-cash assets can generate returns.

Interest-bearing stablecoins, for example, demonstrate how PayFi integrates money-making opportunities into everyday financial systems.

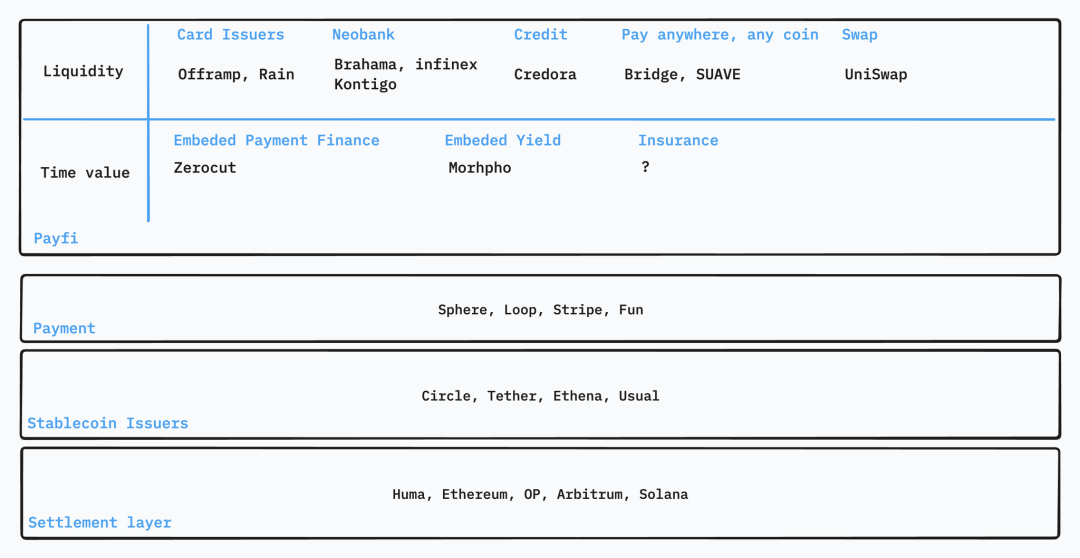

Chance

By leveraging the composability of blockchain, PayFi unlocks top financial opportunities for everyone, every asset, everywhere. Developers can build on existing protocols without starting from scratch and provide a seamless user experience.

Payment time financial products

User profile/needs: Targeted at individuals or small and medium-sized enterprises with stable sources of income but tight cash flow. The goal is to provide flexible payment options, ease cash flow pressure, and reduce the risk of late payments.

Users benefit through tailored financial planning, reduced costs through exclusive discounts and uninterrupted access to essentials and services even when cash flow is tight.

The benefits for merchants include reduced payment delays, faster reinvestment of funds into operations, and enhanced customer loyalty through flexible supply.

These products provide users and merchants with greater flexibility and fairness in financial transactions. For example:

- Early payment discount: Users who pay their bills immediately after receiving funds can enjoy a small discount, incentivizing prompt payment.

- Installment payments and “buy now, pay later”: These options give consumers the ability to manage their cash flow, making large purchases more affordable without having to pay the full amount at once.

- Merchant Accelerated Payments: Merchants can get payments faster, which incurs a small fee but improves liquidity and smoothes cash flow.

Some Web2 projects, such as Affirm, Afterpay, Klarna and PayPal, offer installment payment solutions.

Embedded Revenue Solutions

User profile/needs: Targeted at individuals who hold mainstream currencies and have some idle funds, focusing on small-scale fund management. This product provides a U.S. dollar yield solution with low risk, high liquidity, convenience and flexibility. Users want to easily grow small amounts of capital while maintaining strong liquidity for financial needs. Some users have preferences for specific assets, such as U.S. Treasuries or DeFi lending yields.

PayFi turns idle assets into income-generating capital. Compared to traditional "earnings" products, PayFi's embedded earning solutions work seamlessly across a variety of asset types and products, such as points from an online store, pending refunds, or gift cards.

Common yield solutions on the market include farming modules embedded in wallets, yield-bearing stablecoins, and flexible yield products on centralized exchanges (CEX). Revenues mainly come from DeFi lending, protocol airdrops, delta neutral strategies and US bonds.

On-chain embedded yield solutions are somewhat superior to fintech and traditional banking solutions, primarily due to liquidity management limitations caused by the custody nature of funds in traditional systems.

Embedded yield solutions increase transparency and capital efficiency by enabling user self-custody and autonomous liquidity management. Revolut, for example, held $13 billion in deposits last year but could only offer 3% interest due to liquidity constraints. Moving such systems on-chain would enable users to directly control their funds, allocate funds into liquidity pools or other revenue opportunities, and maximize returns without the constraints of centralized management.

For users and institutions, this improves access to loans and credit products that differ from traditional finance.

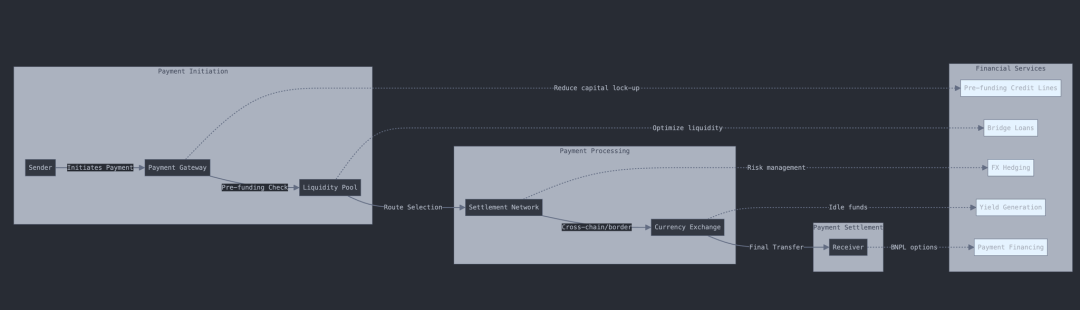

Payment is a complex process, and we can do a lot to improve capital efficiency at each step of the financing process.

PayFi apps often rely on third-party integrations, making the space competitive. However, PayFi can differentiate itself by focusing on three core strengths:

- User appeal: Build a moat through high transaction volume and frequency.

- Orchestrate Complexity: Simplify fragmented payment processes for users.

- Functional richness: Provides functions lacking in traditional Web2 systems.

Also to consider are:

- The efficiency gains they bring

- Their role in the payments process and potential market size

- Regulatory and risk management aspects

PayFi Pillars

Infrastructure: Huma

Huma builds everything from scratch, introducing the PayFi stack.

- Transaction layer: handles payment processing and settlement

- Currency layer: managing stablecoins and digital assets

- Custody layer: ensure safe storage of assets

- Financing layer: providing loans and credit services

- Compliance layer: maintaining regulatory compliance

- Application layer: Provide user-oriented services

What sets Huma apart is its focus on short-term financing within the payments and supply chain space. The platform enables real-time credit assessment and automated underwriting through smart contracts, making it possible to provide instant financing decisions for payment transactions.

Some other Web3 RWA funding platforms include Centrifuge (the first RWA project) and Ondo.

Similar Web2 players: SWIFT, Visa, Mastercard

Pay: Fun

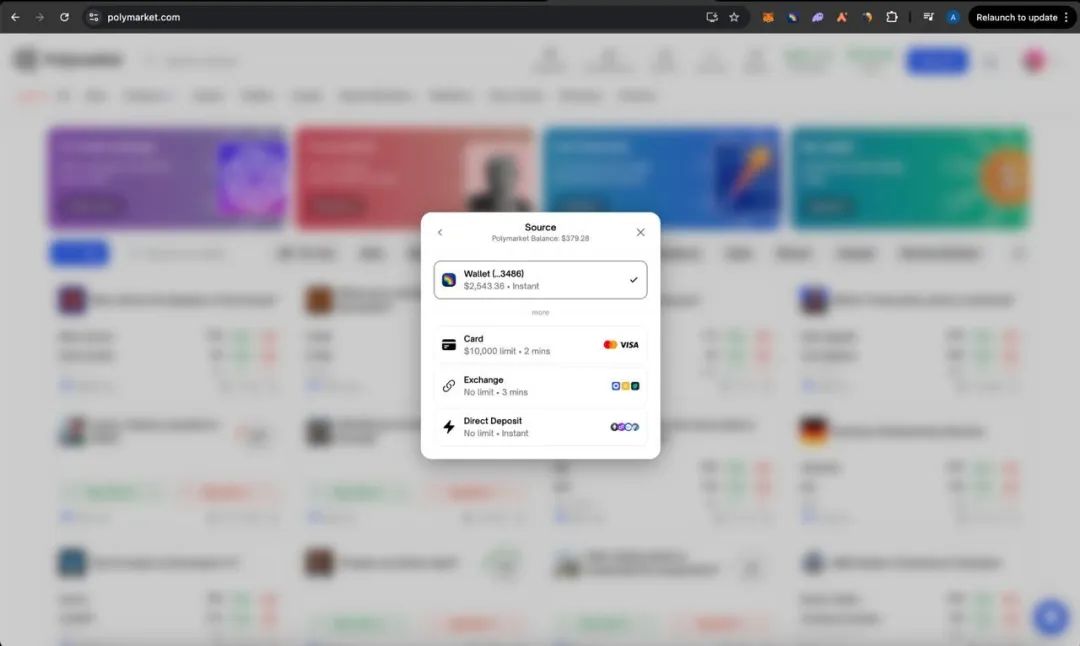

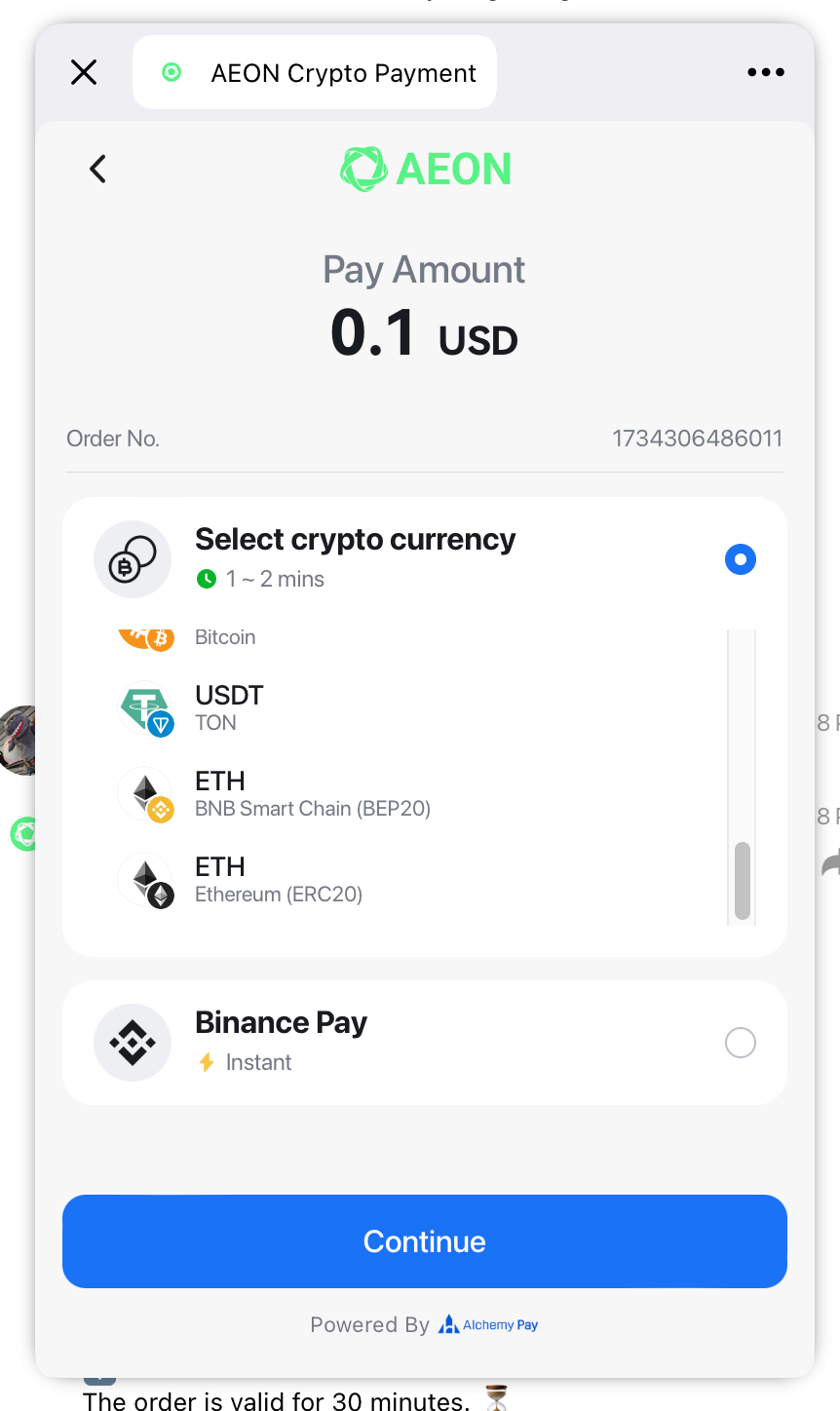

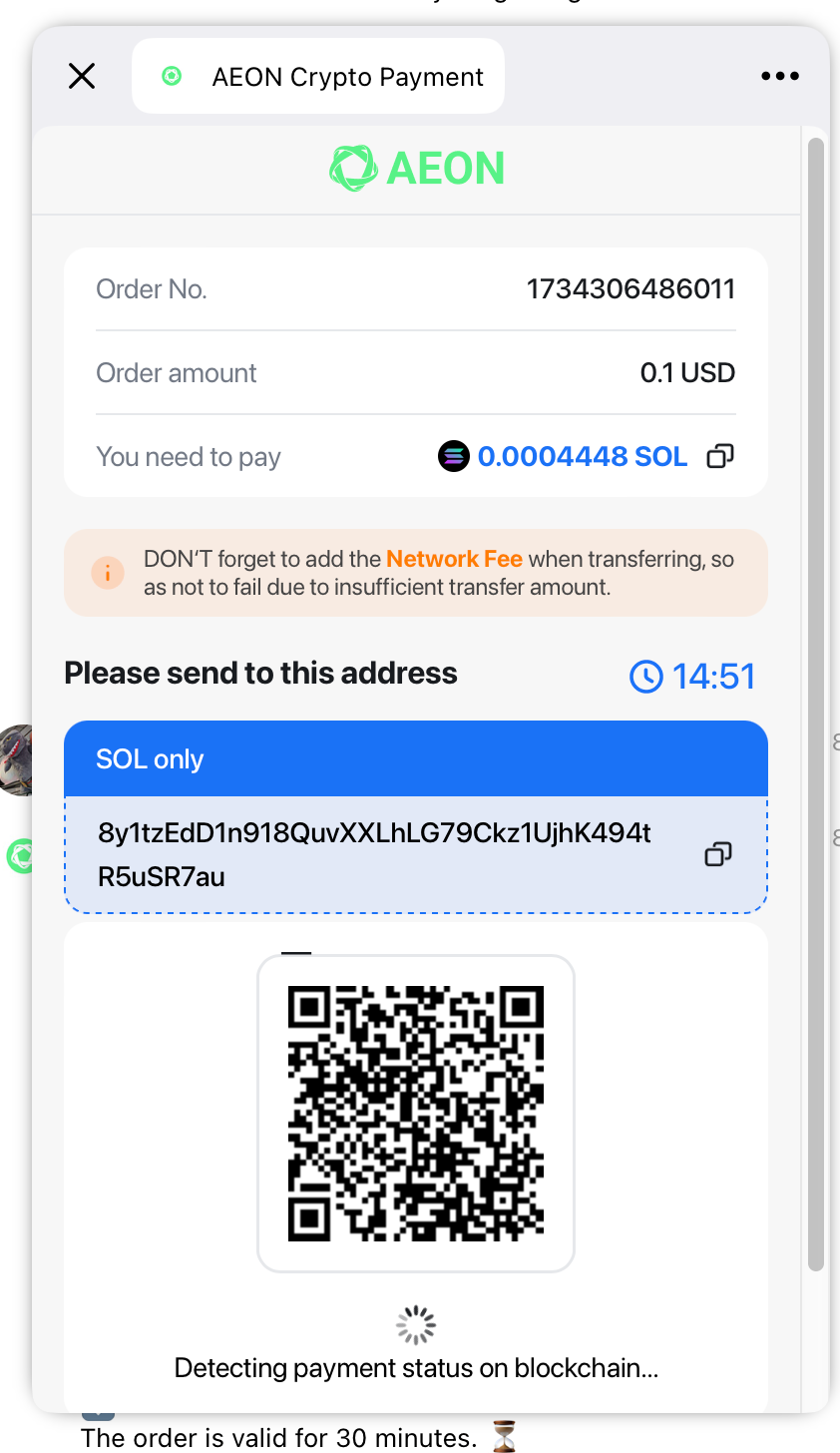

Fun.xyz launches Checkout, a multifunctional tool designed to simplify any on-chain action by allowing users to complete transactions with any asset at the point of purchase. Checkout aggregates diverse payment options, improves user experience and maximizes dApp conversion rates.

- Liquidity aggregator: Integrate funds from EVM wallets, Solana wallets, centralized exchanges, and credit cards to enable cross-chain payments.

- Routing Engine: Execute complex, batched on-chain actions while ensuring transaction certainty and price optimization.

- Checkout SDK: A lightweight integration that improves app conversion rates by adapting to users’ preferred payment methods.

The advantage of Fun.xyz is that it removes common obstacles in Web3 transactions, allowing users to more easily perform on-chain actions without the hassle of asset conversion or deposits and withdrawals.

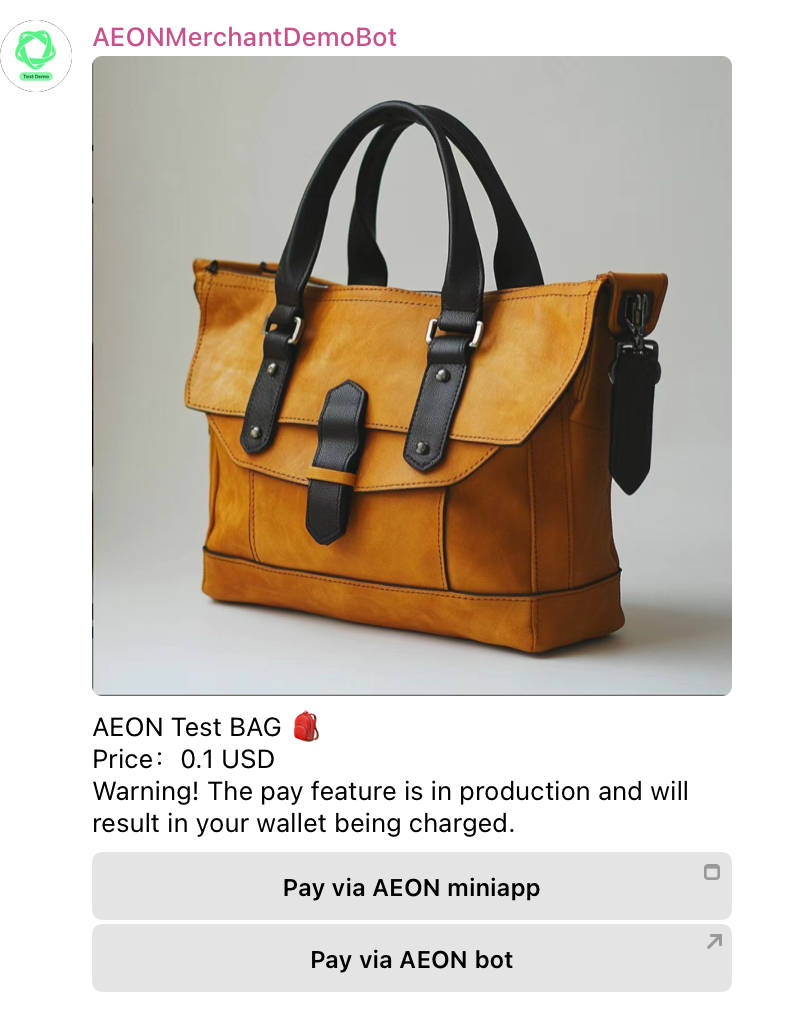

Other players include Aeon, which offers a one-stop checkout experience in the Telegram Mini App.

Embedded Revenue: Morpho

Morpho is a modular lending protocol. It offers potential investors different segregated high-yield pools. Its magic lies in its modular approach. It is embedded into many asset management protocols such as Brahama and Infinex to provide savings benefits.

We are looking for more embedded revenue products. Wallets or any product involving capital custody can be integrated with a few lines of code. This way, you can earn interest no matter where your funds are.

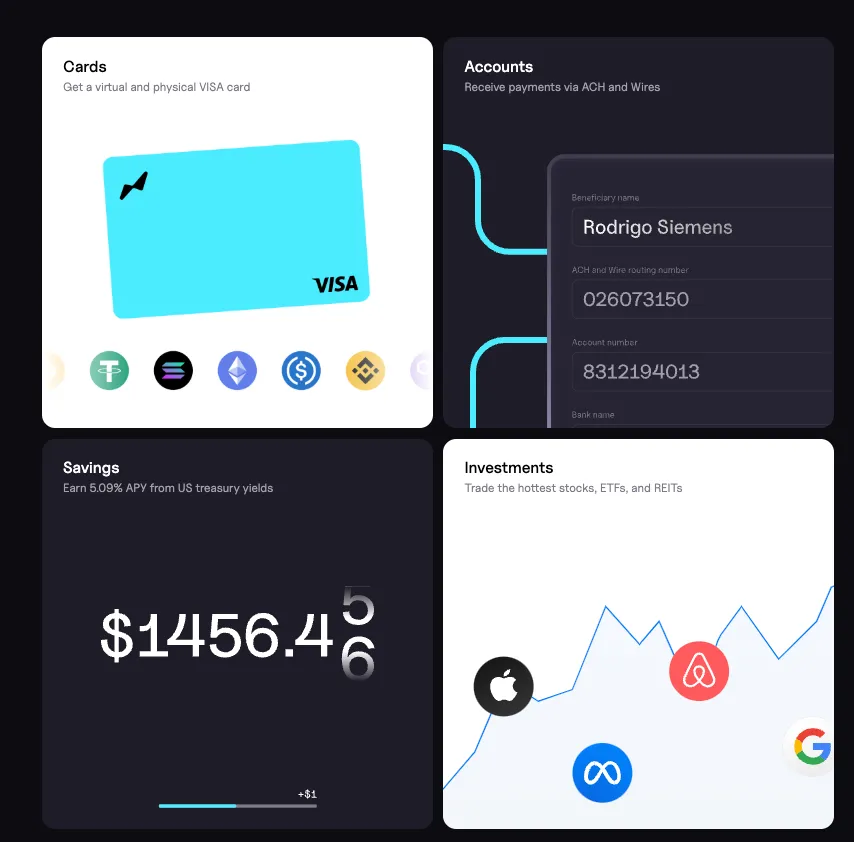

Web3 Card: Offramp

Offramp offers USD-based products for stablecoin holders, offering up to 5% USD yields, a stablecoin-backed crypto card, and ACH and wire transfer payment acceptance. It functions like a new kind of bank, offering bank accounts, payments and savings.

This is a mature space with numerous card issuers, KYC providers and upstream/downstream products. Different card issuers vary in terms of regulations, fees, payment support (e.g. physical cards, Apple Pay). Some of the players include Rain and Immersive, the latter of which is also a major member of the Mastercard network.

However, these are typically prepaid debit cards that require users to deposit funds before use, unlike traditional credit cards. With a credit card, users can repay credit debt using the interest generated by DeFi protocols, although credit also incurs costs due to interest payments over time.

Crypto credit cards are a valuable asset for DeFi protocols as they enable users to seamlessly access their funds for daily spending without having to withdraw funds from the protocol.

Deposits and withdrawals: Bridge

Bridge simplifies global payments with stablecoin-based solutions that enable businesses to move, store and manage money at internet speeds. Through its Orchestration APIs, Bridge removes the complexity of compliance and regulation, seamlessly integrating stablecoin payments with just a few lines of code. Bridge directly supports the U.S. dollar, euro and major stablecoins such as USDC and USDT, and its reserves are invested in U.S. Treasury bonds, providing an opportunity for returns of more than 5%.

Through the bridging issuance APIs, companies can issue their own stablecoins and expand into global markets by offering USD and EUR accounts as well as international currency transfer options.

Vision

As a transformative solution, PayFi effectively solves the “impossible triangle” in traditional finance: returns, liquidity, and risk. In traditional finance, investors often face a trade-off: Achieving high returns often requires sacrificing liquidity or accepting higher risk, while maintaining liquidity and safety often means having to accept lower returns. This triangle has long limited financial opportunities, especially for small-capital investors.

PayFi uses blockchain and DeFi to break this mold. By integrating payment infrastructure with DeFi capabilities, PayFi transforms every dollar into intelligent, autonomous capital that can automatically find opportunities to generate revenue. With the fast settlement of blockchain, the U.S. dollar can maintain liquidity while providing good returns.

chaincatcher

chaincatcher