Interview with BitMart Global CEO Nenter Chow: Exploring the integration path of compliance and innovation, and building a secure digital asset ecosystem

Reprinted from chaincatcher

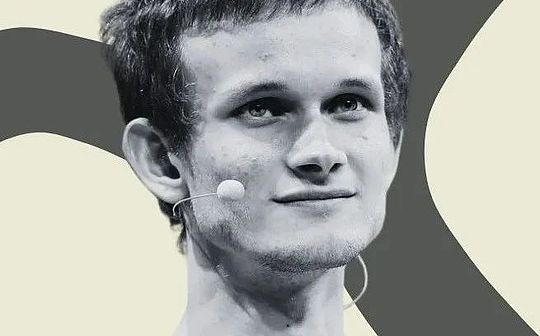

05/19/2025·19DNenter Chow is an experienced finance and blockchain executive, currently serving as global CEO of BitMart, the world's leading digital asset trading platform. Nenter has a career in investment banking for over 17 years and has worked in large institutions such as JPMorgan Chase, Mitsubishi UF Financial Group and Industrial and Commercial Bank of China. He has extensive experience in cross-border mergers and acquisitions and credit transactions, with operations in New York and Shanghai. His deep understanding of traditional finance and emerging technologies has enabled him to connect the East and West markets well.

Market competition

Coinbase just acquired Deribit for $2.9 billion, the largest acquisition in cryptocurrency history. As CEO of BitMart Exchange, how do you interpret such a massive acquisition by one of your biggest competitors?

I think Coinbase’s acquisition of Deribit for $2.9 billion is a transformative milestone in the cryptocurrency industry, especially in derivatives trading. The record-breaking deal is the largest in cryptocurrency history, highlighting the growing market demand for complex trading instruments and marking the market's maturity and ready to be adopted by institutional investors. By integrating Deribit's options platform with Coinbase's infrastructure, this move will provide a streamlined and efficient trading ecosystem that benefits users around the world.

This acquisition marks our transformation to a comprehensive platform, which integrates spot, futures, perpetual contracts and options trading, allowing traders to operate more flexibly and efficiently. In addition, combining Deribit’s massive options market with Coinbase’s regulatory framework is seen as a stable force that helps reduce risks and strengthen market confidence.

At BitMart, we welcome this development and see it as a driving force for innovation across the industry. It strengthens our determination to provide secure, diverse and user-centric transaction solutions while advancing the development of the global digital asset ecosystem. The acquisition emphasizes the value of transparency and regulatory coordination, inspiring us to innovate and collaborate to create a more resilient financial future. We will continue to work to empower users and build an inclusive cryptocurrency environment.

Stable Coin

Over the past 10 days, we have seen a number of important announcements about stablecoins issued by companies from Meta to Stripe. Stablecoins are clearly becoming a strategic business move. What do you think are the biggest benefits for the industry?

Recent stablecoin announcements from companies such as Meta and Stripe mark a decisive moment in the cryptocurrency industry. These advances highlight the key role of stablecoins in achieving fast, cost-effective and convenient global transactions. The main advantage is that they can connect traditional finance and blockchain, enhance financial inclusion and simplify cross-border payments.

By allowing businesses and developers to easily hold, send and use stablecoins, these initiatives provide U.S. dollar-based accounts in more than 100 countries, especially support areas with currency instability or banking services, driving economic empowerment and global trade.

BitMart is actively advancing this vision and announced a strategic partnership with Paxos and the Global Dollar Network (GDN) on May 12, 2025 to integrate the USD-backed stablecoin USDG into our platform. The partnership expands USDG coverage to 10 million users, providing direct purchases and transaction pairs, while strengthening our commitment to trustworthy enterprise-level digital assets. This collaboration is in line with our mission of building trust, compliance and innovation.

We are committed to providing secure, user-centric stablecoin solutions, building a transparent and inclusive digital asset ecosystem, positioning stablecoin as the cornerstone of modern finance, and benefiting global users and enterprises.

game

According to reports, the cost of "GTA 6" has exceeded US$2 billion, even surpassing the world's tallest building, Burj Khalifa. What do you think about the gaming industry at the moment? What is your favorite game type at the moment?

The gaming industry is booming, and GTA 6 reportedly has a $2 billion budget that exceeds $1.5 billion in large real estate projects, highlighting its ambition to redefine entertainment. This investment drives the development of an immersive open-world experience, making it comparable to film and architecture, and sets new industry benchmarks. Web3 gaming is a vibrant force that leverages blockchain to attract billions of players to the decentralized ecosystem through engaging gameplay and economic rewards.

The Play-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work-Work- Mobile platforms are changing the game landscape, and Web3 games have attracted a large number of players with their ease of use, especially in emerging markets. Despite market turmoil and reduced venture capital, Web3 games have attracted a lot of investment driven by innovations such as artificial intelligence and cross-game asset sharing. To be honest, I don't have a favorite P2E game at the moment, but my favorite video game is still Mario Kart, and I've always loved it because of its enduring fun.

Ultimately, I want to see mainstream blockbusters like GTA 6 and Web3 games blend over time, and I believe the industry will innovate by combining high-budget blockbusters with decentralized platforms to attract global audiences.

Community Trust and Supervision

The recent black swan event involving Mantra Network has caused significant losses to the community, once again putting the cryptocurrency sector in the negative spotlight. What do you think we need to do at the industry level to completely prevent similar events from happening again in the future?

I think to prevent future black swan events and rebuild people’s trust in cryptocurrencies, a balanced, resilient ecosystem that includes both decentralized and centralized platforms. By adopting audited open source smart contracts, we can minimize single point of failure, while autonomous hosting solutions like unmanaged wallets can reduce user risk.

Centralized exchanges remain secure and critical, provided they implement strict standards such as mandatory proof of reserves, enhanced cybersecurity, and regular audits to ensure transparency and security. Cultivating industry-wide best practices such as these audits, strong consumer education, and stress-tested protocols can empower users and restore confidence. A collaborative regulatory framework developed with stakeholders can protect innovation while preventing destructive blows.

Reducing leverage and spreading risks can build anti-fragile systems that can withstand market pressure. Community-driven governance and DAO-led insurance funds can further protect users and mitigate losses from hackers or system crashes. By aligning with stakeholders and prioritizing user protection, the crypto industry can cover secure centralized exchanges and decentralized infrastructure and build a resilient ecosystem that thrives in challenges, reduces systemic risks and maintains lasting public trust.

Bitcoin

Since the approval of the Bitcoin ETF and Trump 's re-election, Bitcoin prices have soared and have now become a hot topic in financial planning at the sovereign level. Ten years ago, it sounded like science fiction. How do you view the development of Bitcoin in the next decade?

Bitcoin’s soaring has transformed it from a fringe concept to a global asset driven by ETF approval and discussions at the sovereign level. I agree with Ray Dalio that Bitcoin acts as a “hard currency” like gold, with its fixed issuance of 21 million coins, it can hedge against potential debt crises and fiat currency depreciation. I believe that in the next decade, Bitcoin will continue to consolidate its position as a means of storage of value, rather than becoming a cross-border payment tool like a stablecoin.

Institutional adoption through ETFs will enhance liquidity and stability and attract diversified investors. If there is clear regulatory support, sovereign interests can establish Bitcoin as a strategic reserve, although geopolitical coordination remains key.

DeFi innovations may also enhance Bitcoin’s status, enabling it to become an interest-generating productive asset through lending protocols and earning platforms.

Market volatility and regulatory challenges may persist and require strong risk management and global cooperation. Advances in Web3 can integrate Bitcoin into a decentralized ecosystem and promote financial inclusion in emerging markets. Bitcoin’s resilience and growing legitimacy indicate that it will complement traditional assets in the future, reshaping finance in a responsible way. As long as stakeholders prioritize stability and accessibility, I believe Bitcoin has the potential to diversify its portfolio and create returns.

Open microphone: What you think of the market

We are happy to provide you with an open speaking opportunity. What are your personal opinions on the current market situation? Do you have any insights on the future of the industry and want to share?

The cryptocurrency market is at a vibrant node. While I foresee macro liquidity will drive the next bull market for cryptocurrencies and be bullish in the medium and long term, I do see venture-backed altcoin markets facing challenges in the near term. The oversupply of tokens, massive unlocking, and venture capital pursuit of decentralized prices (DPIs) have brought resistance, and many investors are currently flocking to private equity investments (PIPEs), similar to MicroStrategy's Bitcoin strategy for various altcoins such as $TON, $SUI and $ENA, which suggests limited liquidity for cryptocurrency native projects.

However, as the industry shifts to fundamentals, some highlights are gradually emerging. Income-generating projects are gaining attention, consistent with the growing market’s emphasis on sustainable value. I am particularly optimistic about the tokenization of risk assets (RWA), which will make on-chain access to assets such as real estate and commodities more democratic. Scarce assets such as uranium that are not yet open to exchanges will be traded through the first 24/7 institutional spot uranium trading platform powered by Solana, which represents an innovative opportunity to extend the utility of cryptocurrencies beyond traditional finance.

Focus on fundamentals and new assets will drive long-term growth. BitMart is committed to supporting revenue-driven projects and is committed to providing tokenized assets that promote accessibility and compliance. While short-term excitement will exacerbate market volatility, the industry’s shift to tangible value and on-chain innovation enables it to continue to succeed. I believe that as liquidity improves and regulation becomes clearer, cryptocurrencies will redefine global markets, and risk-weighted assets (RWA) and unique on-chain assets will lead the trend.

jinse

jinse