In the long run, Ethereum's price will definitely not be able to catch

Reprinted from jinse

02/15/2025·2MRecently, Binance sold about $8 billion in crypto assets reserves, sparking widespread discussion in the market. The market generally believes that Binance's crypto assets sell-off is just a routine operation, with the purpose of making a profit. However, the facts do not seem so simple.

First of all, the cash out scale this time is as high as US$8 billion, which is as much as 7 times the US$1.1 billion in February 2024. There may be two major reasons for such a large-scale asset sell-off: one is to beautify the financial statements, and the other is to carry out large-scale shareholder equity distribution. The former may prepare for equity financing or equity transfer, while the latter may involve cash out of important shareholders.

Secondly, after the reduction, Binance's BTC holdings decreased from 46,896 to 2,747, a decrease of 94.1%; ETH holdings decreased from 216,313 to 175, a decrease of 99.9%. The clearance reduction of Ballast assets shows that Binance is more pessimistic about the future market.

It is worth noting that Binance's large-scale share reduction mainly occurred in January, which also provides a reasonable explanation for the market's flash crash in early February. However, news always serves the layout of capital. In such a sluggish market environment, the negative news that Binance "runs away" is self-evident. Interestingly, ETH, which was cleared by Binance in January, was bought by US stock ETFs in early February.

Over the past year or so, Bitcoin’s rise has been mainly due to its rise as a new medium of stored value, while Solana’s popularity is continuously driven by the PVP funding market. Although the two have different groups of participation, they all have one thing in common: the rise is mainly driven by capital rather than technological innovation. This has led to poor performance in this bull market by Ethereum and altcoins that rely on fundamentals. However, the speed of technological innovation is difficult to predict, just like before the birth of DeepSeek, almost no one in the market believed that China could develop a big model with close performance but much lower cost than ChatGPT. Therefore, although we cannot predict when a 0-1 breakthrough in blockchain will occur, buying at a relatively low and holding for a long time is still a wise choice.

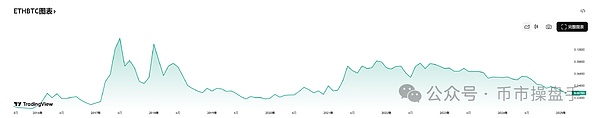

During the plunge on February 3, the ETH exchange rate against BTC once hit 0.0237, a new low in the past five years, and the price almost returned to the level before the start of the 2020 bull market. If calculated from September 1, 2022, ETH against BTC has fallen by 73% so far. This level of decline only occurred in history from 2018 to 2019. But after this decline, the mid-term bottom is coming.

Although there are some minor flaws in the distribution system of L2 and the performance of the Ethereum Foundation is also considered to be not positive enough, these have not shaken Ethereum's core competitiveness. So far, the fundamentals of ETH are still making steady progress.

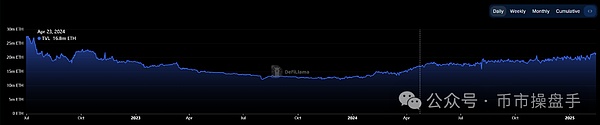

Since November 2023, TVL (total value locked) of the Ethereum network has maintained steady growth regardless of how ETH price fluctuates. Even during the plunge from January 31 to February 3, Ethereum's TVL did not show a significant decline. This shows that the long-term demand growth (without any subsidies) of the Ethereum network remains, and the current downturn is mainly due to insufficient total industry demand.

Although Layer 2's transaction fees dropped by 10 to 100 times after the Cancun upgrade, and the network fees created by Ethereum unit TVL showed a significant decrease from the previous month, the transaction volume created by unit TVL (including L2) was explosive. increase. This instead shows that after the Cancun upgrade, the network value created by unit TVL has been greatly improved. In short, without sacrificing decentralization, reducing costs and increasing efficiency must be the core element of maintaining the competitiveness of public chains. In addition, historically, a large number of innovations have started with cost reduction and efficiency improvement. Therefore, evaluating the strategic significance of Cancun upgrade and L2 expansion should focus on long-term development, rather than just focusing on small short-term fluctuations in network expenses. In other words, Ethereum’s past large-scale infrastructure and cost reduction and efficiency improvement plans are all preparing for the arrival of the industry’s singularity.

Although Ethereum has not performed well in this bull market, it still outperforms 88% of the projects in the top 100 tokens, highlighting the overall poor performance of the altcoin. According to TradingView data, the market value share of altcoins (excluding the top ten market capitalizations) fell from 9.8% on February 1 to 7.8% on February 3, setting a record low in the past three years. At present, the valuation of the vast majority of altcoins is below 80% of the historical quantile, and the price is still below 90% of the historical quantile, which means that the valuation of most altcoins has returned to Bitcoin $15,500. at the same level.

Currently, more and more people believe that only Bitcoin truly represents the ultimate value of blockchain, and most other blockchain projects may end up being the memory of the times. However, according to historical experience, when a sector enters the stage of "killing valuation" from "killing valuation", it usually means that the low point of the sector has already appeared. Of course, the author always emphasizes that only about 5% of the altcoins have long-term value, and they are basically the leading players in various fields.

Historically, it usually takes a long time to rebuild confidence after each crash, and there may be a second or even a third bottoming out in the middle. What we have to do is to build positions in batches at low points and wait for the arrival of a new cycle.

In the operation of altcoins, what type of trading opportunities investors focus on mainly depends on individual risk preferences and profit expectations. For stable investors, I think the platform coins of leading exchanges still have a certain margin of safety, after all, the current valuation and growth potential are still very good. ETH, which is relatively behind in this round of upsurge, can also be considered. After all, the unblocking of ETH staking and the launch of hybrid encryption ETFs can still bring a lot of incremental growth.

panewslab

panewslab