In-depth analysis of the current market: The resonance results of theft of large amounts of funds caused by market concerns and liquidity migration in the game between major powers

Reprinted from panewslab

02/27/2025·2MAuthor : @Web3 _Mario

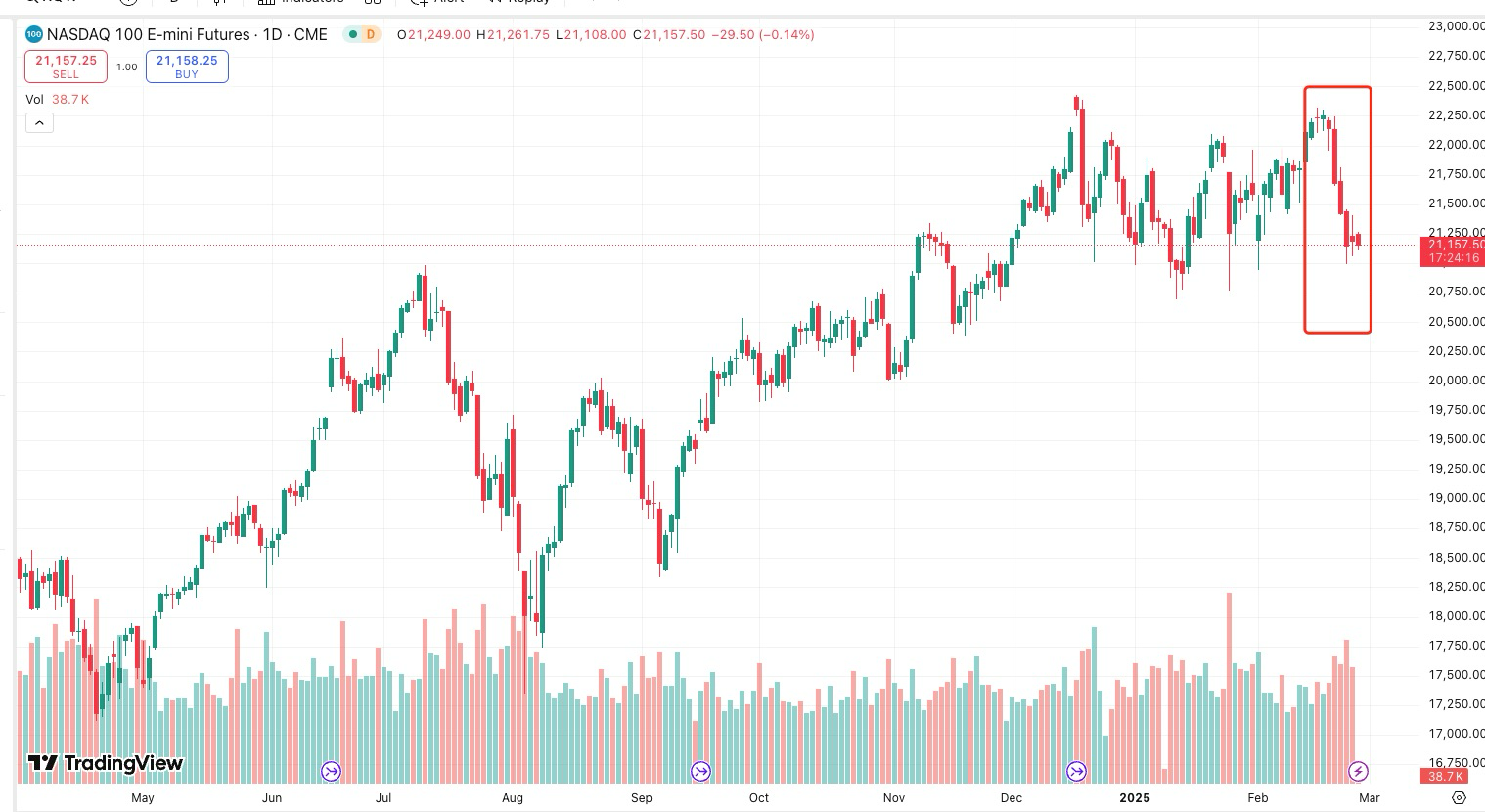

Abstract : The cryptocurrency market has experienced a wave of major corrections in recent days. The consulting in the market is very chaotic. Coupled with the negative news of huge hackers in the currency circle, it has brought difficulties to how to understand the recent market trend in the short term. I hope to share and discuss this with you. I think there are two main reasons for the current cryptocurrency market retracement. First, from a micro perspective, the successive hacking incidents have caused concerns about traditional funds and the risk aversion sentiment has heated up. Secondly, from a macro perspective, DeepSeek's open source week further burst the US AI bubble, and combined with the actual policy direction of the Trump administration, it triggered market concerns about US stagflation, and on the other hand, it started a revaluation of China's risky assets.

**Micro level: The huge continuous capital losses have caused traditional

funds to worry about the short-term trend of cryptocurrencies, and risk aversion has heated up**

I believe that everyone still remembers the Bybit that happened last week and the recent Infini theft incident. There are already many related discussions, so I will not go into details here. Let’s talk a little about the impact of stolen funds on these two companies and how they affect the industry. First of all, for Bybit, although the amount of US$1.5 billion is roughly equivalent to its net profit of about one year in terms of scale, this is definitely not a small amount for a company in the expansion stage. Generally speaking, it is enough for a company to maintain a cash reserve of 3 months to one year. Considering that the exchange business belongs to a high cash flow industry, its cash reserves are likely to be closer to the left level. So let’s take a look at Coinbase’s 2024 financial report and we can roughly draw some preliminary judgments. Coinbase's full-year revenue in 2024 more than doubled compared with last year to US$6.564 billion, net profit was US$2.6 billion, while in terms of expenditure, the total operating expenses in 2024 were US$4.3 billion.

Then referring to the data disclosed by Coinbase, and combining Bybit's current expansion stage, spending control will be more radical. It is estimated that Bybit's cash flow reserves are basically between 700 million US dollars. Then, the 1.5 billion user capital loss is obviously impossible to advance by relying on their own funds. At this time, capital lending, equity financing or shareholder capital injection are needed to overcome this crisis. However, no matter which model, considering the hidden concerns about the weak growth of the cryptocurrency market in 2025, the resulting capital cost may be quite large, which will obviously bring certain burden to future corporate expansion.

Of course, I saw news today that the core vulnerability of the attack is Safe rather than Bybit itself, so there may be some incentives to recover some losses, but the important factor that plagues the crypto industry is that the legal framework is incomplete, so the relevant litigation process must be lengthy and cost-effective. It may not be easy to recover the losses. As for Infini, it is obvious that the loss of US$50 million is unbearable for start-ups, but it seems that the founder is strong and it is indeed rare to overcome difficulties by investing in funds.

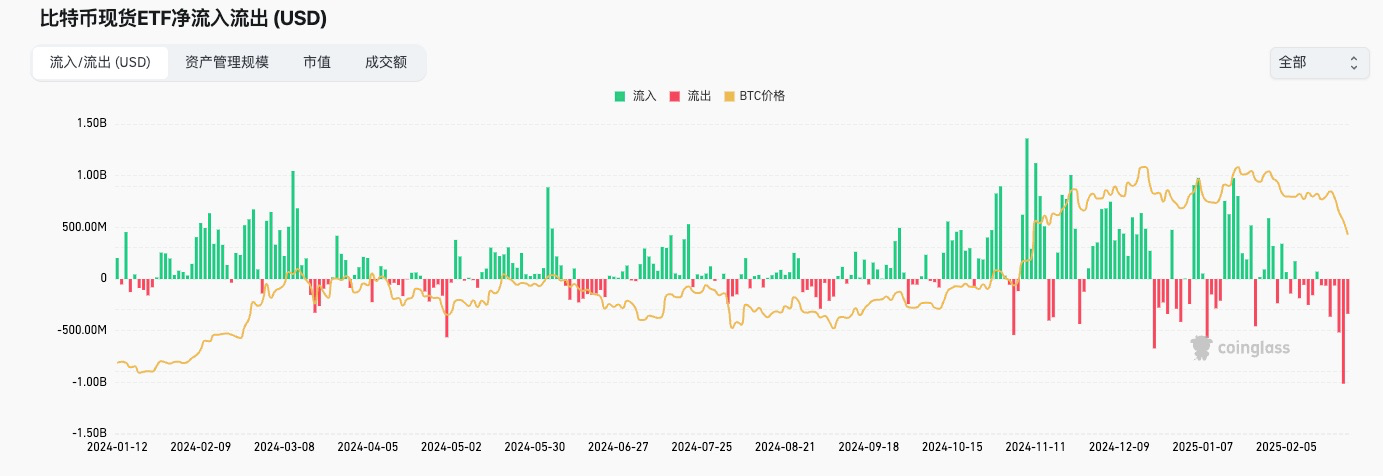

These two consecutive large losses seem to be commonplace for currency traders who are used to high risks, but they have obviously shaken the trust of traditional funds. Specifically, from the fund flow of BTC ETFs, it can be seen that the attack since the 21st has obviously triggered a large outflow of funds, which means that the impact of the incident on traditional investors is probably negative. If the concerns caused are focused on whether it will hinder the formulation of a regulatory-friendly legal framework, then this matter is important. Therefore, it can be said that theft incident is microscopically the fuse that triggers this cycle of reincarnation.

**Macro level: geopolitical game between major powers intensifies,

DeepSeek open source week reconstructs the competitive landscape of the AI track, and the liquidity migration of China 's risky assets entering the revaluation stage**

So let’s take a look at some of the impacts at the macro level, and the conclusion is obviously unfavorable to the crypto market in the short term. In fact, after a period of observation, the Trump administration's policy direction has been clearer, that is, through strategic contraction, exchanging space for time, completing internal integration and industrial reconstruction, the United States can gain the ability to re-industrialize, because technology and production capacity are the most core factors in the game between great powers. The most important factor in achieving this goal is "money", and "money" is mainly reflected in the US fiscal situation, financing capacity and the real purchasing power of the US dollar. The relationship between these three points is complementary, so it is not easy to observe the changes in the relevant process, but we can still figure out some core concerns:

1. The issue of US fiscal deficit;

2. Risk of stagflation in the United States;

3. The strength and weakness of the US dollar;

First of all, let’s look at the first point. The fiscal deficit problem in the United States has been analyzed a lot in previous articles. Simply put, the core reason for this round of fiscal deficit problem in the United States can be traced back to the extraordinary economic stimulus bill of the Biden administration to deal with the new crown epidemic, and the Ministry of Finance represented by Yellen adjusted the structure of US bond issuance and caused interest rate inversion by over-issuance of short-term bonds, thereby harvesting wealth globally. The specific reason is that excessive short-term bond issuance will lower the price of short-term US bonds on the supply side, thereby increasing the yield of short-term US bonds. The increase in short-term US bond yields will naturally attract the US dollar to return to the United States, because you can enjoy excess risk-free profits without losing time costs. This temptation is great. This is also why capital represented by Buffett chose to sell a large number of risk-free assets in the previous cycle and increase cash reserves. This puts great pressure on the exchange rates of other sovereign countries in the short term. In order to avoid excessive exchange rate depreciation, central banks of various countries have to sell short-term bonds in a loss-making state on the basis of discounts, turning floating losses into real losses in exchange for a stable exchange rate of US dollar liquidity. In general, this is a global harvesting strategy, especially for some emerging countries and trade surpluses. However, there is also a problem in doing so, that is, the debt structure of the United States will increase its debt repayment pressure in the short term, because short-term debt needs to be paid with interest when maturity. This is the origin of the debt crisis caused by this round of US fiscal deficit, and it can also be said to be a thunder left by the Democratic Party to Trump.

The biggest impact of the debt crisis lies in affecting the credit of the United States, thereby reducing its financing capabilities. In other words, the US government needs to pay higher interest rates to raise funds through Treasury bonds, which overall raises the neutral interest rate in American society. This interest rate cannot be influenced by the Federal Reserve's monetary policy. The raised neutral interest rate puts huge pressure on corporate operations and will cause stagnation of economic growth. The stagnation of economic growth will be transmitted to ordinary people through the employment market, which in turn triggers a shrinking investment and consumption. This is a negative feedback closed loop that triggers an economic recession.

The focus of observation on this main line is on how the Trump administration reshapes the US government's fiscal discipline and solves the fiscal deficit problem. The specific policies involved are the DOGE Efficiency Department led by Musk, which has reduced U.S. government spending and redundant staff layoffs, as well as the impact on the economy. At present, Trump has a very strong internal integration force in this round, and reform has entered the deep waters. I will not track progress here, but I will only introduce some of my own observation logic.

1. Pay attention to the radical degree of policy advancement of the Ministry of Efficiency, such as the excessively severe layoffs and reductions, which will inevitably cause concerns about the economic outlook in the short term, which is usually unfavorable to risky assets.

2. Pay attention to the feedback from macro indicators on their policies, such as employment data and GDP data.

3. Pay attention to the progress of the tax reduction policy.

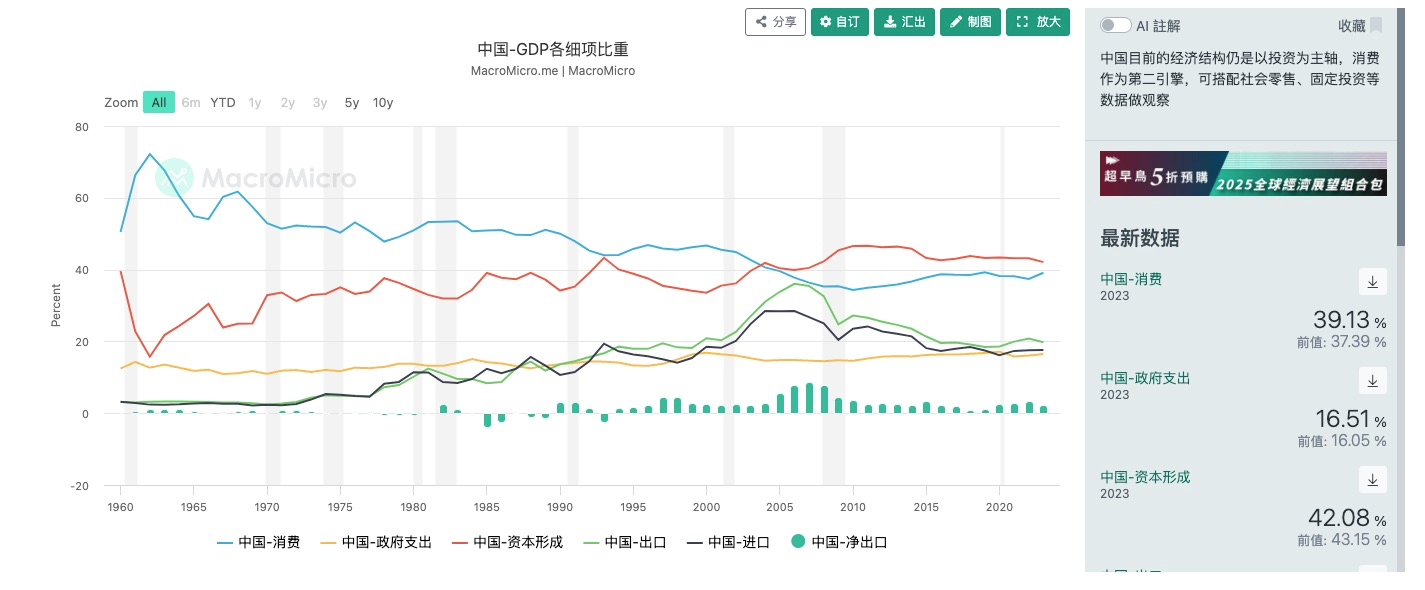

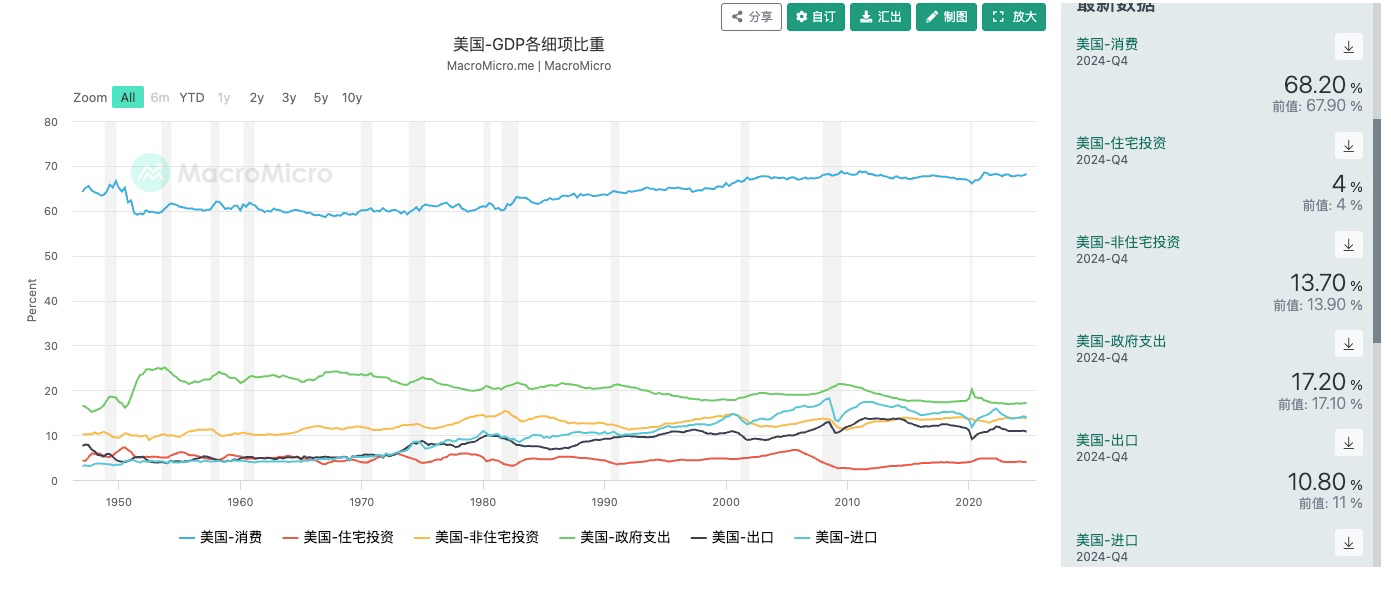

We cannot underestimate the impact of government spending and government employees on the U.S. economy. Usually we think that China's government spending must account for a higher proportion than that of the United States, but in fact this is a wrong impression. The U.S. government spending accounts for 17.2% of GDP, while China is 16.51%. Government spending is usually transmitted to the entire economic system through multiples of the industrial chain. The structural differences between the two sides mainly reflect that the proportion of consumption in the U.S. GPD is very high, while the proportion of imports and exports in China's GDP composition is higher. This represents two different ways of boosting the economy. For the United States, expanding foreign demand and increasing exports is a means to boost the economy, while for China, domestic demand still has great potential to tap.

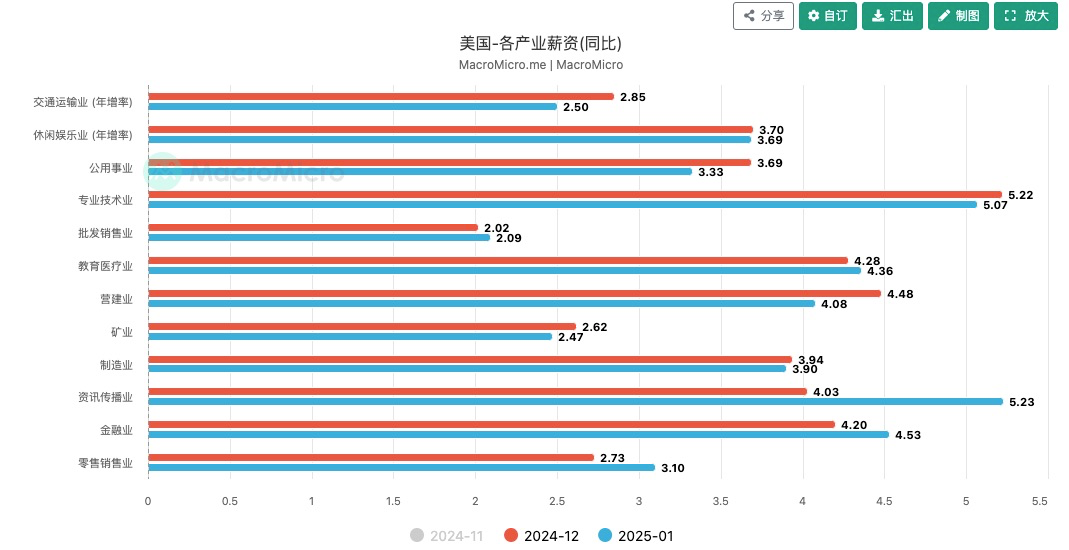

The same is true for consumption. In this picture, we can see that the salary level of government departments is not low in the entire industrial chain, and reducing government redundant staff has also hit the economic growth of the United States on the consumption side. Therefore, overly radical policy advancement will definitely trigger panic in the economic recession. Some things will be slower and smoother, but they must also cooperate with the pace of the Trump administration's overall policy advancement. As for the advancement of tax cut policies, it seems that Trump's focus is not yet here, so the hidden concerns about the reduction in income brought about in the short term do not seem to be obvious, but we must also be vigilant.

The second is the concerns about the stagflation issue in the United States. The so-called stagflation refers to the intensification of inflation while economic growth is stagnant, which is unacceptable to society in terms of pain index. In addition to the impact of government spending reductions on economic growth just mentioned, there are some important concerns:

1. How will DeepSeek further impact the AI track.

2. Promotion of the US sovereign fund.

3. The impact of tariff policies and geopolitical conflicts on inflation.

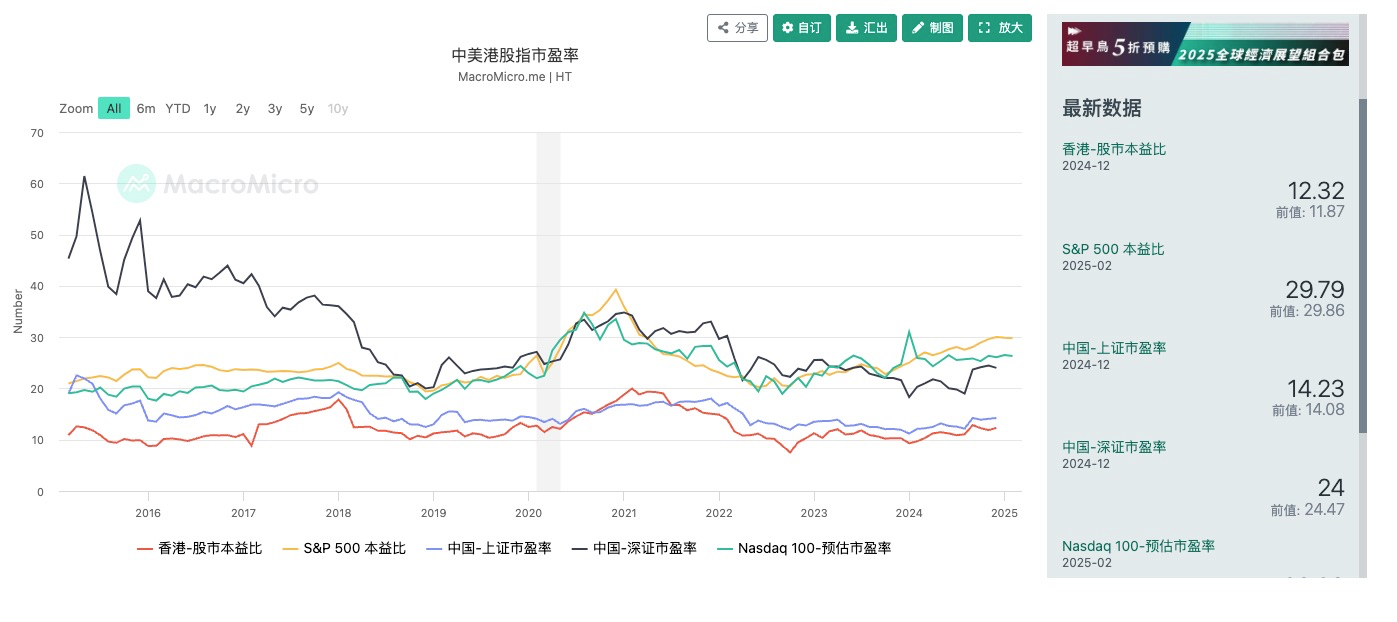

Among them, the author believes that the first point is the most significant impact in the short term. Friends who are interested in technology may know that DeepSeek's open source week has many achievements that are extremely shocking, but they all point to one point that AI's demand for computing power has been greatly reduced. This has allowed the stock market to remain stable during the past interest rate hike cycle in the United States lies in the huge narrative of the AI track and the United States' monopoly on the upstream and downstream of the AI track. The market has given extremely high valuations to the US AI-related stocks, which naturally has an optimistic attitude towards the new round of US economic growth driven by AI. However, all this will be reversed by DeepSeek. The biggest impact of DeepSeek lies in two aspects, one is on the cost side, that is, it greatly reduces the requirements for computing power, which has led to a significant pullback of the performance growth potential of upstream computing power providers represented by Nvidia. On the second side, it broke the US monopoly on downstream AI algorithms through open source, and then suppressed the valuation of algorithm providers represented by OpenAI. Moreover, this impact has just begun, and it depends on how the US AI will respond at that time, but in the short term, it has shown that the valuation of US AI stocks will be pulled back and the valuation of Chinese technology stocks will be returned.

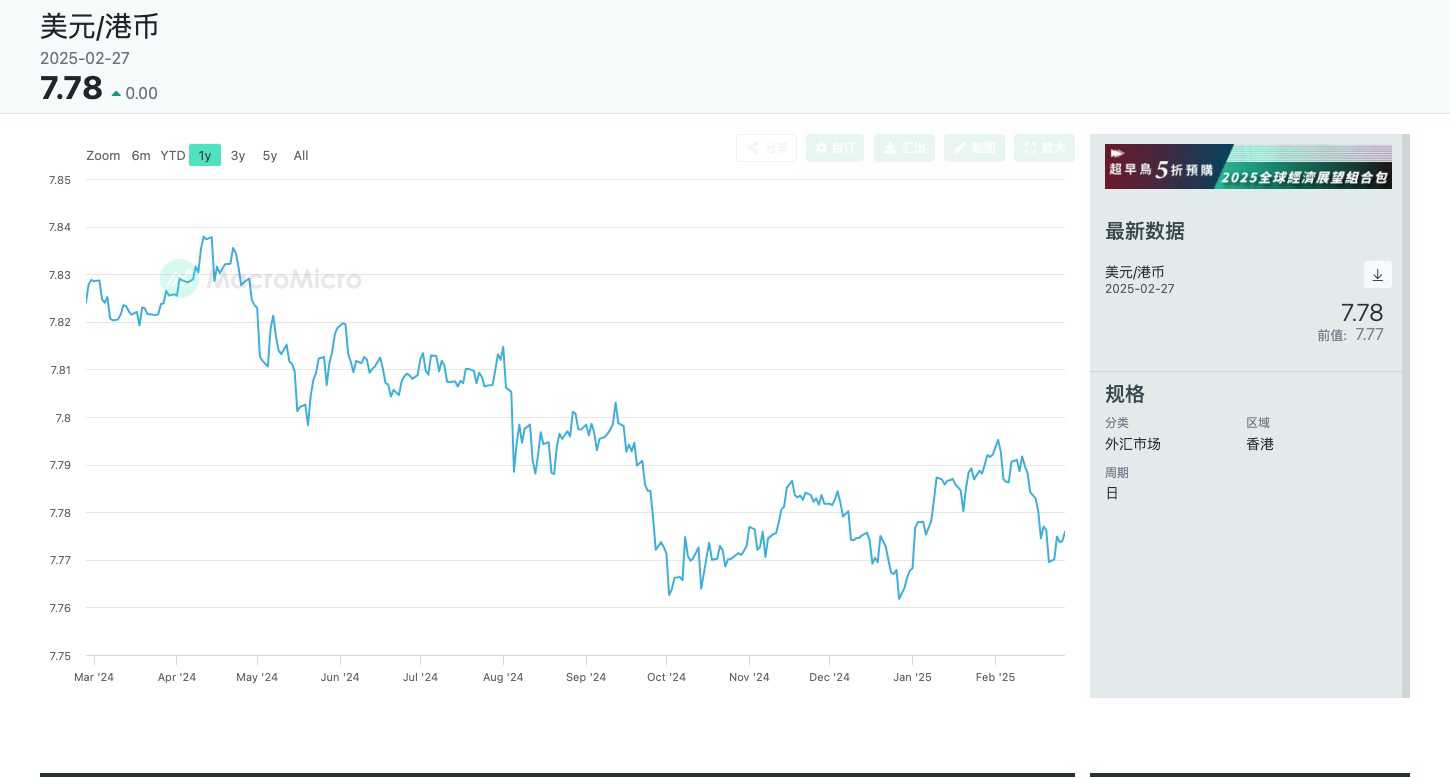

In fact, for a long time, the United States suppressed the valuation of Chinese companies through public opinion suppression, which actually put them in an undervaluation state. Benefiting from the grand narrative brought by DeepSeek to the upgrading of China's manufacturing industry and the relatively gentle attitude of Trump's policy on China's issue, the valuation of Chinese and American companies has returned. According to CICC's report, the rise in this round of Hong Kong stocks is mainly due to the influx of southbound funds, that is, the influx of capital from the mainland side and the influx of overseas passive capital. Overseas active funds, subject to Trump's investment restrictions on Chinese companies, have not seen any obvious changes, but liquidity observation is also very important. After all, there are many means to bypass direct investment and enjoy the dividends of this wave of return to Chinese companies, such as investing in Singapore and other stock markets with high correlation. The changes in capital flow are relatively easy to identify from the Hong Kong dollar exchange rate. We know that the Hong Kong dollar and the US dollar are a joint exchange rate system, that is, the exchange rate of the Hong Kong dollar against the US dollar will stabilize before 7.75 to 7.85. Therefore, when the Hong Kong dollar approaches 7.75, it means that foreign capital's willingness to invest in Hong Kong stocks has strengthened.

The second point worth paying attention to is the construction of the United States sovereign wealth fund. We know that sovereign wealth fund is a good supplement to the government's financial resources in any sovereign country, especially a trade surplus with a large US dollar. Among the top ten sovereign wealth funds in the world, there are 3 in China, 4 in the Middle East and 2 in Singapore, and the number one is the Norwegian government global pension fund, with a total asset size of about US$1.55 trillion. Influenced by the constitutional framework of the US federal government, it is actually difficult for the United States to establish sovereign wealth funds, because the federal government can only receive direct taxes and its financial resources are relatively limited. The United States is currently experiencing the dilemma of fiscal deficits. However, Trump seems to instruct the Treasury Department to establish a trillion-dollar sovereign wealth fund, which is naturally a means to alleviate the fiscal deficit. However, the question here is where the money comes from and what to invest in?

According to the new US Treasury Secretary Bescent, it seems that he hopes to reprice the US gold reserves to provide $750 billion in liquidity for sovereign funds. The reason behind this is that according to Vol. 31, Article 5117 of the US Code, the current legal value of 8,133 metric tons of gold is still US$42.22 per ounce. If calculated based on the current market price of US$2,920 per ounce, the US government will have an unrealized return of US$750 billion. Therefore, additional liquidity can be obtained by amending the law, which has to be said to be a clever approach. However, if it is passed, the US dollar used for investment or alleviating debt pressure will inevitably be exchanged for selling gold, which will inevitably have an impact on the trend of gold.

As for what to invest, the author believes that it is likely to be based on the return of production capacity to the United States. Therefore, the impact on Bitcoin is probably limited. In previous articles, the author has analyzed that the value of Bitcoin relative to the United States in the short and medium term is a target for economic bottoming. This is based on the fact that the United States has sufficient pricing power on this asset. But in the short term, the economy has not experienced a significant recession, so this is not the main axis of Trump's policies, but an important tool to survive the pain of reform.

Finally, in terms of tariffs, the hidden concerns of tariffs have actually been well replaced. At present, the tariff policy is more a bargaining chip for Trump's negotiations than a necessary choice. This can be seen from the proportion of tariffs imposed on China that Trump is still relatively restrained, which naturally considers the impact of high tariffs on internal inflation. The next step I am more interested in is the tariffs on Europe and what rewards the United States can exchange for. Of course, I am concerned about the process of rebuilding independence of the EU. Harvest Europe to restore its own strength is the first step for the United States to participate in this game between great powers. As for inflation risks, although CPI has grown for several consecutive months, considering that the overall situation is still at a controllable level, coupled with the easing of Trump's tariff policy, the current risk does not seem to be great.

Finally, let’s talk about the trend of the dollar. This is a very critical issue and needs to be observed continuously. In fact, the debate over the strength of the dollar under Trump’s new term is continuing. The speeches of some key figures here have significantly affected the market. For example, Stephen Milan, the latest economic adviser appointed by Trump and the current chief of the White House economic think tank, said that the United States needs a weak dollar to boost exports and promote internal reindustrialization. After causing panic to the market, US Treasury Secretary Bescent came forward to appease the market in an interview on February 7, saying that the United States will continue to have a "strong dollar" policy at present, but the RMB is a bit too undervalued.

In fact, this is a very interesting thing. Let’s take a look at what the impact of the strong and weak dollar on the United States? First of all, a strong US dollar will have two main effects, first of all, on asset prices. As the US dollar appreciates, US dollar-denominated assets will perform better, which will mainly benefit US bonds, US stocks of global companies, etc., that is, it will increase the market's enthusiasm for purchasing US bonds. Secondly, in terms of industries, the stronger purchasing power of the US dollar is beneficial to the cost reduction of US global enterprises, but it suppresses the competitiveness of domestic industrial products in the international market and is not conducive to internal industrialization. The impact of a weak dollar is the opposite. Considering Trump's overall policy concept is based on improving production capacity through industrial return, and thus enhancing the competitiveness of the game between major powers. Then it seems that the weak dollar policy is the right solution. But there is a problem here. A weak dollar will lead to a depreciation of US dollar-denominated assets. Considering the current fragility of the US economy and financing pressure, the too fast weak dollar policy will lead to the United States being unable to survive the pain period brought by reform.

Here is a representative event to illustrate this pressure. In Buffett's annual shareholder letter on February 25, he did not point out his dissatisfaction with the US fiscal deficit issue, which obviously exacerbated market concerns. We know that Buffett's capital allocation strategy for a long time in recent times is to choose to clear out the risky assets that are overvalued in the United States in exchange for more cash reserves to allocate US short-term Treasury bonds, and at the same time, it is also a means of interest rate spread arbitrage. It does not need to be discussed here. What I want to say is that Buffett's view has a strong influence in the market, and there will naturally be a unified concern about the capital of the US dollar over-allocated capital, which is the real purchasing power of the US dollar, that is, the concern about the depreciation of the US dollar. Therefore, the pressure to enter the depreciation channel too quickly is very great.

But no matter how you trade space for time and slowly replacing debt, it will become the choice between China and the United States, and the US dollar trend is likely to move out of the pattern of strong first and weak later. Explain that changes in dollar-denominated assets will also move with this cycle. Cryptocurrencies are also one of the assets affected by this wave.

Finally, I would like to talk about my views on the cryptocurrency market. I think there are too many uncertainties in the current market, so individual investors can choose the dumbbell strategy to enhance the anti-fragility of their portfolios. On the one hand, blue-chip cryptocurrencies may participate in some low-risk DeFi returns, and on the other hand, some high-volatility targets are allocated at low prices. As for the short-term trend of the market, the combination of many unfavorable factors has indeed led to certain price pressure, but there seems to be no clear structural risks. Therefore, if the market draws excessively due to panic, appropriate position building is also an option.

chaincatcher

chaincatcher

jinse

jinse