If the micro strategy is forced to sell BTC, how much selling pressure will it bring to the market in extreme cases?

Reprinted from panewslab

04/09/2025·1MAuthor: Ashley

Strategy (formerly MicroStrategy), led by Michael Saylor, is in trouble as the single company with the largest number of bitcoins in the United States, due to the double pressure of falling Bitcoin prices and huge debts. According to the 8-K filing filed on April 7, Strategy stated that if it cannot cope with current financial difficulties, it may be forced to sell its Bitcoin position.

Strategy in financial trouble

Strategy's current financing and coin buying model relies on the market's expectations of long-term bullish Bitcoin. If the price of Bitcoin falls into long-term fluctuations or declines, the company will face double pressure: it must not only pay interest on existing debts, but also deal with the equity dilution risks caused by additional stock issuance.

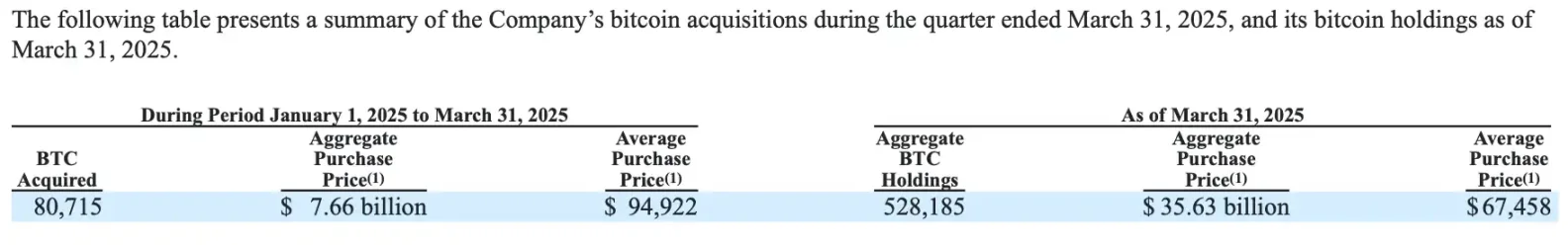

According to the 8-K document, Strategy currently holds 528,185 bitcoins, with a total value of over US$40 billion, and an average purchase cost of US$67,458 per coin. Since its transformation into a "bitcoin enterprise" in 2020, the company has continuously increased its holdings through financing methods, becoming a benchmark for cryptocurrency investment in the US stock market. However, Strategy's financial situation is facing a severe test as Bitcoin price falls back from its $100,000 high at the end of 2024 to around $76,400, coupled with a $8.22 billion debt burden.

Strategy's Bitcoin strategy was once the engine of its stock price soaring, but now it has become the sword of Damocles hanging overhead. The SEC document clearly states that Bitcoin accounts for the "big majority" of a company's balance sheet, and its price fluctuations directly determine the company's financing ability and debt repayment prospects. Once certain key factors get out of control, selling Bitcoin may become a reality that has to be faced.

The biggest risk comes from the continued decline in Bitcoin prices. If the price falls below the cost price of $67,458 and even slides to a recent low of $74,500, the company's asset value will shrink significantly. The document warns that if Bitcoin falls below book value, Strategy may find it difficult to raise funds through issuing stocks or bonds. Since Trump's victory in November 2024, the company has purchased 275,965 bitcoins at an average price of $93,228 each, costing $25.73 billion, and has now lost $4.6 billion. To make matters worse, Bitcoin did not realize a loss of up to $5.91 billion in the first quarter of 2025, which made the risk worse.

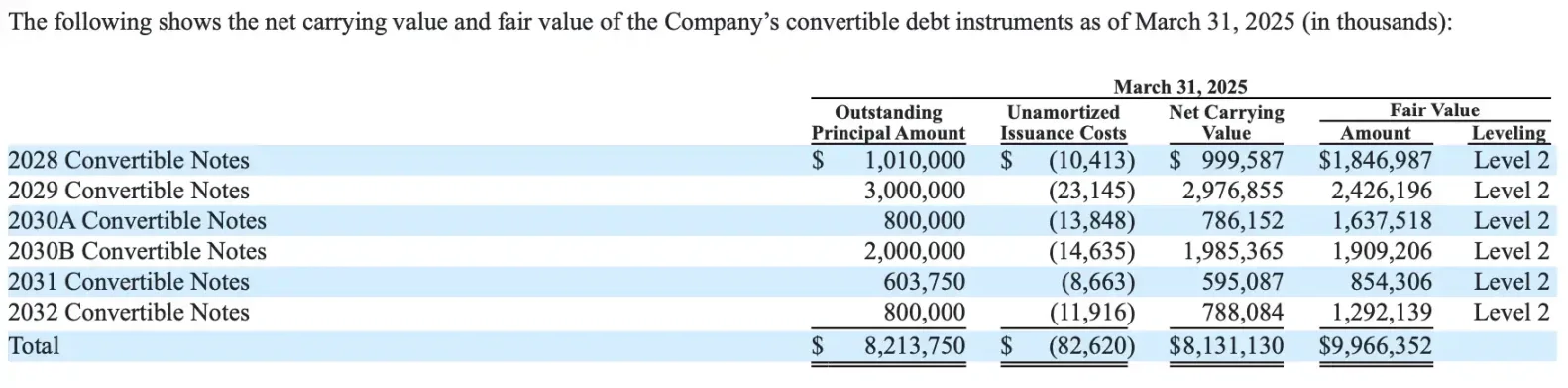

At the same time, the cash flow crisis also made the company walk on thin ice. Strategy's core business, data analysis software, has been unable to bring forward positive cash flow for several consecutive quarters. However, the company also has to pay $35.1 million in debt interest and $146 million in dividends each year, totaling $181.3 million. If external financing cannot keep up, selling Bitcoin is almost the only way out. The document mentioned that the $8.22 billion debt (as of the end of March 2025) puts pressure on repayment, and if the market environment deteriorates, the company may even be forced to sell at a "lose price" below the cost price.

Finally, market and safety factors can be unexpected triggers. If a Bitcoin custodian (such as a bank or a third-party custodian) goes bankrupt or suffers a cyber attack that causes loss of assets, Strategy may be forced to sell its remaining positions to compensate for the losses. The document specifically mentioned that its insurance covers only a small amount of Bitcoin, highlighting the reality of this risk.

Of course, Strategy is not waiting to die. The company plans to alleviate the pressure by issuing additional shares or issuing new bonds. In the first quarter of 2025, it spent $7.7 billion to increase its holdings of Bitcoin at an average price of $95,000 per coin. However, after April, this radical buying and buying strategy slowed down significantly as the market fell. If financing channels are blocked, selling coins will become the last life-saving straw.

What is the impact of potential selling pressure on the market?

Strategy's Bitcoin holdings account for about 2.5% of the total Bitcoin supply, and once sold, the market may be difficult to calm down. The scale of the sell-off depends on the company's specific needs, and the impact will also progress layer by layer.

If it is just to cope with short-term expenses, such as paying annual interest and dividends totaling $181.3 million, it will take approximately 2,318 bitcoins to be sold. This accounts for less than 0.5% of its total holdings of 528,185, and its impact on the market is relatively limited and may only cause small fluctuations. Investors may not be too panicked. However, if Strategy needs to repay some of its debt, such as $1 billion, the sell-off will expand to about 12,800 bitcoins, accounting for 2.4% of its holdings. In an environment where the average daily trading volume of the Bitcoin market is only US$10-30 billion and the liquidity is low, such a sell-off may drive the price to fall by 5% to 10%, which is enough to make the market feel obvious pressure.

More serious is that if Strategy had to repay all $8.22 billion in debt in one go, the scale of the sell-off would surge to about 105,000 bitcoins, equivalent to 20% of its holdings. Such a large-scale sell-off is almost indivisible in the current market and is likely to trigger a price crash, especially given the sensitivity of the Bitcoin market to large transactions -a flash crash that has recently fallen from $83,000 to $74,500 has been fully demonstrated.

The most extreme case is that the company goes bankrupt or is forced to liquidate, which may mean the sale of all 528,185 bitcoins, with a total value of more than $40 billion. This would be a devastating blow to the market, potentially causing Bitcoin prices to halve or worse. However, the possibility of such a comprehensive sell-off is low unless the company encounters a systemic crisis, such as debt defaults and forced regulatory liquidation. In either scenario, Strategy's move could be an important turning point in the Bitcoin market and deserves close attention.

The other side of the market impact is the chain reaction. If Strategy sells, other institutions or retail investors may follow suit, causing Bitcoin price to enter a vicious cycle. Tariff policies after Trump took office have exacerbated risky asset sell-off sentiment, and Strategy's move could be the "last straw" that broke the market.

What makes people even more talked about is that this matter also involves Michael Saylor's own credibility. As a staunch supporter of Bitcoin, Michael Saylor has repeatedly declared "never sell coins" in media such as CNBC, and even said that he would be bequeathing Bitcoin to organizations supporting the asset after his death. However, the wording of the SEC document, “Maybe selling Bitcoin at a lower cost”, seems to break that promise.

Will Bitcoin really be sold?

Strategy's Bitcoin strategy began in 2020, when Saylor positioned it as "digital gold" against inflation. Through the issuance of convertible bonds, preferred shares and ATM additional issuances, the company invested a total of US$35.6 billion to purchase Bitcoin, and its floating profits once reached billions of US dollars. However, the recent decline in Bitcoin price combined with debt pressure has caused the company to fail to make profits for three consecutive quarters.

In fact, the risk of selling in this SEC document is not the first time. Strategy has submitted a total of 25 8-K documents this year, and 8-K documents marked "Operational Results and Financial Status" are generally submitted at the beginning of each month. The "Operational Results and Financial Status" report at the beginning of each month is a routine operation. As early as the 8-K document on January 6, the risk warning of "possible selling of Bitcoin" was mentioned; however, neither the February and March documents mentioned it, and this time it was quoted again in the 8-K form after three months. But the blunt wording of the 8-K document "may sell at an unfavorable price" reflects to a certain extent the increasing pressure at present and may be directly related to the recent large decline in Bitcoin and the unrealized losses of $5.91 billion.

Looking back on the last bear market, Strategy also faced severe tests, with negative net assets, but was not forced to sell Bitcoin. This is mainly due to two key factors: one is that the debt maturity date is far away (as early as 2028), and the other is that founder Michael Saylor has 48% of the voting rights, making it difficult to pass the liquidation proposal. Therefore, even if Bitcoin falls below its cost price, the possibility of triggering a "death spiral" selling is relatively low. Compared with the previous bear market, Strategy now has a variety of countermeasures: issuing bonds, issuing additional stocks, or using $40 billion in Bitcoin holdings as collateral financing.

In addition, from the perspective of macro trends, Bitcoin is gaining recognition from more and more sovereign funds and institutions, and its long-term prospects are improving. Although short-term price fluctuations may bring financial pressure, Strategy has a long debt maturity and improved market environment, and the actual risk of selling is limited.

Related reading: "Michael J. Saylor's Strategic Bet: Bitcoin's Premium Issuance and Capital Manipulation"

In the short term, the market will closely monitor its first quarter report and subsequent financing plans. As for whether it will sell, the market will hold its breath. The next step for this company is not only about its own survival, but may also affect the future landscape of Bitcoin.

chaincatcher

chaincatcher