HYPE prices hit new highs Hyperliquid ecological panoramic view

Reprinted from jinse

05/27/2025·12DAuthor: David C, Bankless analyst; Translation: Golden Finance xiaozou

Recently, Hyperliquid has become an existence that cannot be ignored.

HYPE rebounded nearly 4 times from its all-time lows, becoming the best performing asset among the top 100 tokens in the past month - an increase of more than 110%. Ecological data is even more eye-catching: Hyperliquid now accounts for 70% of the transaction volume of DeFi perpetual contracts, with a total transaction volume of US$1.5 trillion, and Ecological TVL soared to US$1.4 billion - an increase of more than 100% this month alone.

In this explosive growth, Hyperliquid seems to be conducting a global tour—twitter flooding, national television promotions, and Bloomberg special reports have become the core of policy discussions. In other words, Hyperliquid's momentum has accelerated significantly since our January report this year (weeks before HyperEVM went live).

To understand the motivation for success, you must first understand the architectural design of Hyperliquid:

HyperCore is the exchange layer, which serves as the native perpetual contract DEX that laid the reputation of Hyperliquid, and is responsible for handling all transactions, liquidity and order book functions.

HyperEVM is a universal EVM smart contract layer launched in February this year, allowing developers to build DeFi applications that can interact with HyperCore in depth liquidity.

HyperCore can be regarded as an engine, and HyperEVM is an application that calls the engine's power - the two together form the Hyperliquid blockchain.

After clarifying the architecture, let's dive into Hyperliquid's growth narrative.

1. HyperEVM explosive growth

There is no doubt that HyperEVM has changed the most since January.

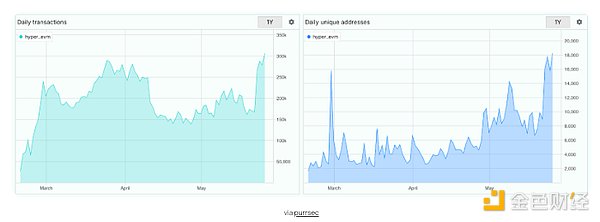

Although the initial development is slow, HyperEVM growth has been explosive in recent weeks - the daily trading volume on-chain has continued to hit a new high (it has recently exceeded 300,000 transactions), and more than US$250 million of HYPE has crossed the chain to the EVM layer, and more than 50 DeFi projects are being actively built here. All this is achieved without ecological subsidies or incentive plans, which makes people ask: Why can another universal EVM chain gain such great appeal?

2. Application ecology explodes

The answer seems to lie in its support for the exchange level. HyperEVM provides developers with two unique application deployment methods:

Standard deployment: Fully compatible with other EVM chains. Existing DeFi applications can be copied, pasted and run directly.

Native deployment: Smart contracts can read (that will support writing) exchange-level data in real time - including user balances, position status and real-time price. Imagine DeFi applications can directly access the order book of mainstream exchanges, which is exactly what this model implements.

In the development of the ecosystem, I have paid special attention to a protocol that takes advantage of this connection - Felix. This DeFi lending agreement contains two main markets:

CDP market: Users can mint decentralized stablecoin feUSD by depositing mortgage assets such as HYPE. Recently, the Vanilla market was launched - a peer-to-peer lending pool built on Morpho. Unlike minting feUSD, users can directly lend or borrow tokens (including the upcoming HUSD, a stablecoin launched by Felix in partnership with the m0 Foundation).

CDP and Vanilla markets provide users with flexible lending options—whether it is anchoring the stability of assets through fiat currency or the leverage effect of decentralized assets—and feeding back value to Hyperliquid’s EVM layer and exchange layer.

Although HyperEVM's DeFi ecosystem is much more than Felix, there are also protocols such as Hyperlend, HypurrFi and Morpho running through Morphobeat, I would like to emphasize three other projects:

HyperUnit (Unit for short): Unit provides an unmanaged tokenization protocol to realize cross-chain access of assets on Hyperliquid L1. Assets packaged through this protocol can be circulated on both the HyperCore exchange (for spot trading) and on HyperEVM (for DeFi applications), where uBTC is active in multiple markets such as Felix as an important collateral asset.

PvP.Trade: PvP.Trade designed in Runescape style is a Telegram trading robot that turns trading into multiplayer games. The product was launched in early 2024. Users can join the team and conduct spot or contract transactions through simple instructions such as "/long" or "/short". They can not only show off against each other, but also operate with teammates, and compete for rankings. Its underlying layer connects to Hyperliquid's deep liquidity through Builder Codes, allowing developers to connect to HyperCore without building from scratch.

Liminal: Liminal is a DeFi income protocol that runs automated delta neutral strategies, while operating the spot and perpetual contract markets. After the user deposits into USDC, the system automatically handles policy configuration, position management and rebalancing. The current 16% annualized returns come from charging leveraged traders with funding rates—not token incentives or inflation mechanisms. At present, invitation code is required to participate.

3. HyperCore's continued dominance

Although HyperEVM has seized the headlines, HyperCore's development momentum has not diminished at all.

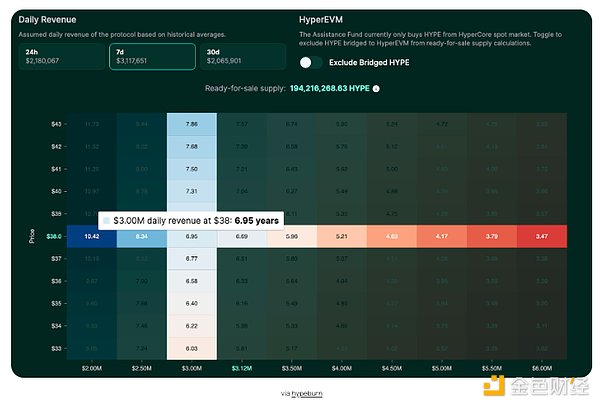

As mentioned above, various indicators at this exchange level continue to refresh their historical peaks. The latest data shows that open contracts reached US$10 million, 24-hour handling fee income is US$5.6 million, and cross-chain deposits US$3.5 billion USD.

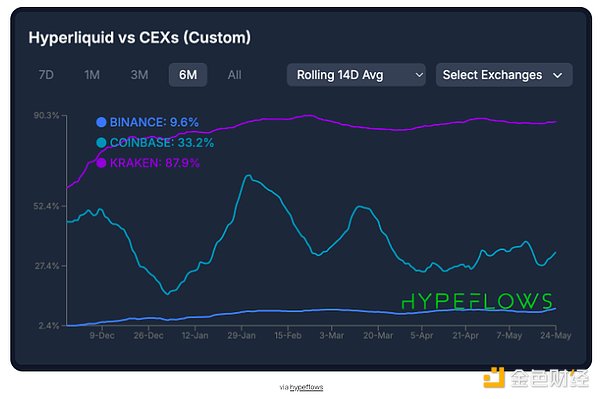

Hyperliquid has been fiercely competing with leading centralized exchanges on perpetual contract trading volumes over the past six months – a miracle for a crypto-native platform without external financing. The new speed often crushes competitors, and the leveraged market of popular tokens is always online for a long time than mainstream exchanges.

All of these activities drive the price increase of HYPE through daily fee repurchases. Since December last year, HyperCore has generated a total of US$240 million in handling fees, with an average monthly average of US$40 million. More than 23 million HYPEs have been destroyed through daily repurchase, of which about 250,000 are directly from the burning of transaction fees. Calculated based on the average handling fee in the past seven days, auxiliary funds can theoretically buy out all circulating supplies within 7 years.

4. The popularity continues to rise

As the ecology continues to advance, the cohesion of the Hyperliquid community continues to increase.

X platform users have signed "Hyperliquid" in tweets and displayed Hypio NFT avatars. In order to replace traditional subsidy incentives, grassroots organizations such as HypurrCollective and HyperActive Capital have emerged, becoming a friendly entrance for new users to enter the ecosystem.

These preludes create conditions for the upcoming HIP-3 upgrade, which will allow anyone to pledge HYPE and create a license-free perpetual market (i.e. tokenized stocks), significantly expand platform capabilities, drive a fully decentralized process, bringing Hyperliquid closer to the vision of "accommodating all financial activities."

Overall, Hyperliquid's success should warm the hearts of those supporters who are tired of endless token incentives and bubbles. Although many people did come to mining for HYPE in the early stages, the continuous use after airdrop and the continuous refreshing historical highs proved that what wins in the end is always the outstanding attractiveness of the product itself.

This growth model driven by real utility (rather than subsidies)—high frequency use, real income creation (current data is extremely impressive), real community cohesion—is showing results. As the HIP-3 upgrade approaches, the highly cohesive community is actively writing a new chapter, and various data indicate that this is just the beginning.

chaincatcher

chaincatcher