HTX Ventures 2024 Crypto Market Review and 2025 Outlook: 5 major tracks are developing brightly

Reprinted from panewslab

12/18/2024·6M2024 is a landmark year for the crypto industry. From the approval of Bitcoin and Ethereum ETFs at the beginning of the year, to the booming bull market, and to the impetus of the US election, cryptocurrencies such as Bitcoin have reached record valuations and are increasingly affecting the social and political landscape.

It has also been a fruitful year for HTX Ventures. Benefiting from the wave of innovation, we support 28 leading projects and funds exploring new frontiers in crypto. These projects cover DeFi, BTCFi, ZK-rollups, modular infrastructure, Layer 1 and Layer 2 solutions, artificial intelligence, SocialFi, GameFi and other fields.

Looking ahead, HTX Ventures has identified five major tracks showing exciting progress in 2024 that we will be watching closely in 2025. These tracks include Bitcoin ecology, infrastructure (Infra), Meme, artificial intelligence (AI) and TON ecology. The report provides an in-depth analysis of the current status, challenges and future opportunities of each track, and provides macroeconomic background and market outlook.

Bitcoin Ecology

market dominance

Over the past year, Bitcoin’s market dominance has increased from 45.27% to 56.81%. This means that most of the current liquidity in the crypto market is mainly concentrated in the Bitcoin ecosystem, and it is growing.

Source: CoinStats

Bitcoin spot ETF has accumulated 5.3% of the total existing bitcoins, and its holdings increased from 629,900 at the beginning of the year to 1,243,608, an increase of 613,708. Within 12 months, ETF holdings increased from 3.15% to 6.25%. (As of December 4, 2024)

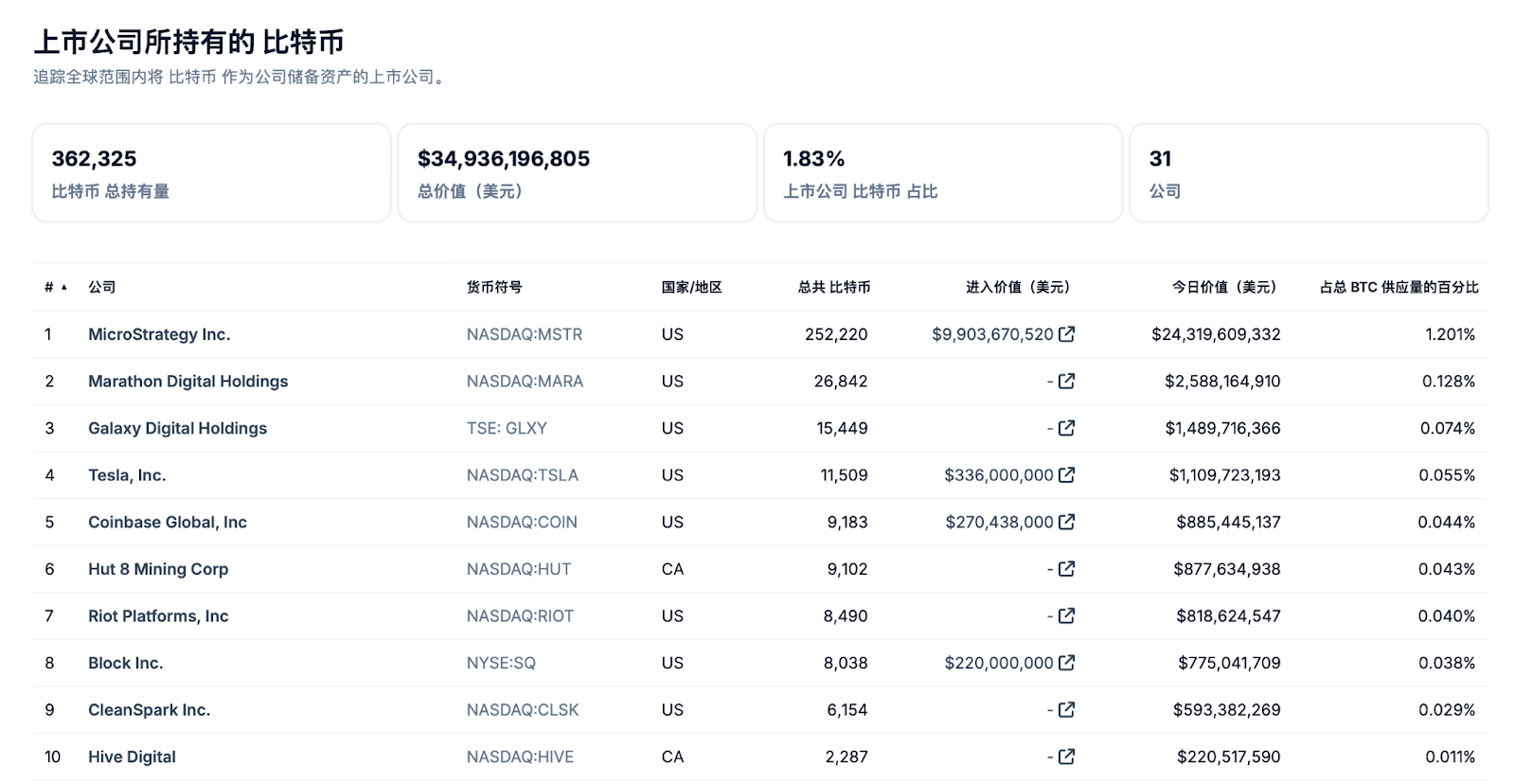

A new market with Bitcoin as the core asset, ETFs and U.S. stocks as capital inflow channels, and U.S. stock listed companies represented by MSTR as the carrier to absorb unlimited U.S. dollar liquidity has officially opened. Therefore, the necessity of further developing the Bitcoin ecosystem and improving the efficiency of capital utilization has become increasingly prominent, which will also be achieved by increasing the demand for BTC and increasing the price.

Layer 2

In the past three years, a total of 77 Bitcoin Layer 2 projects have started or completed financing. In the first half of 2024, driven by the craze for the Bitcoin ETF concept, the trading volume and token prices of Bitcoin Layer 2 projects in previous cycles (such as Lightning Network, Stacks, and Liquid Network) have increased significantly. These old Layer 2 projects have also seen further developments in technology. Various Layer 2 solutions have emerged on Bitcoin, including Spiderchain (Botanix), ZKRollup (Nexio and Critea), EVM compatible chains (BOB and B Squared), side chains (Merlin), etc. As of now, the total locked value (TVL) of Bitcoin Layer 2 has reached $3 billion, contributed by 19 projects. Assuming that all Bitcoin Layer 2 projects are launched in the next few years, the total TVL is expected to grow at least 2 to 4 times, reaching 6 billion to 12 billion US dollars.

Layer 1/execution layer

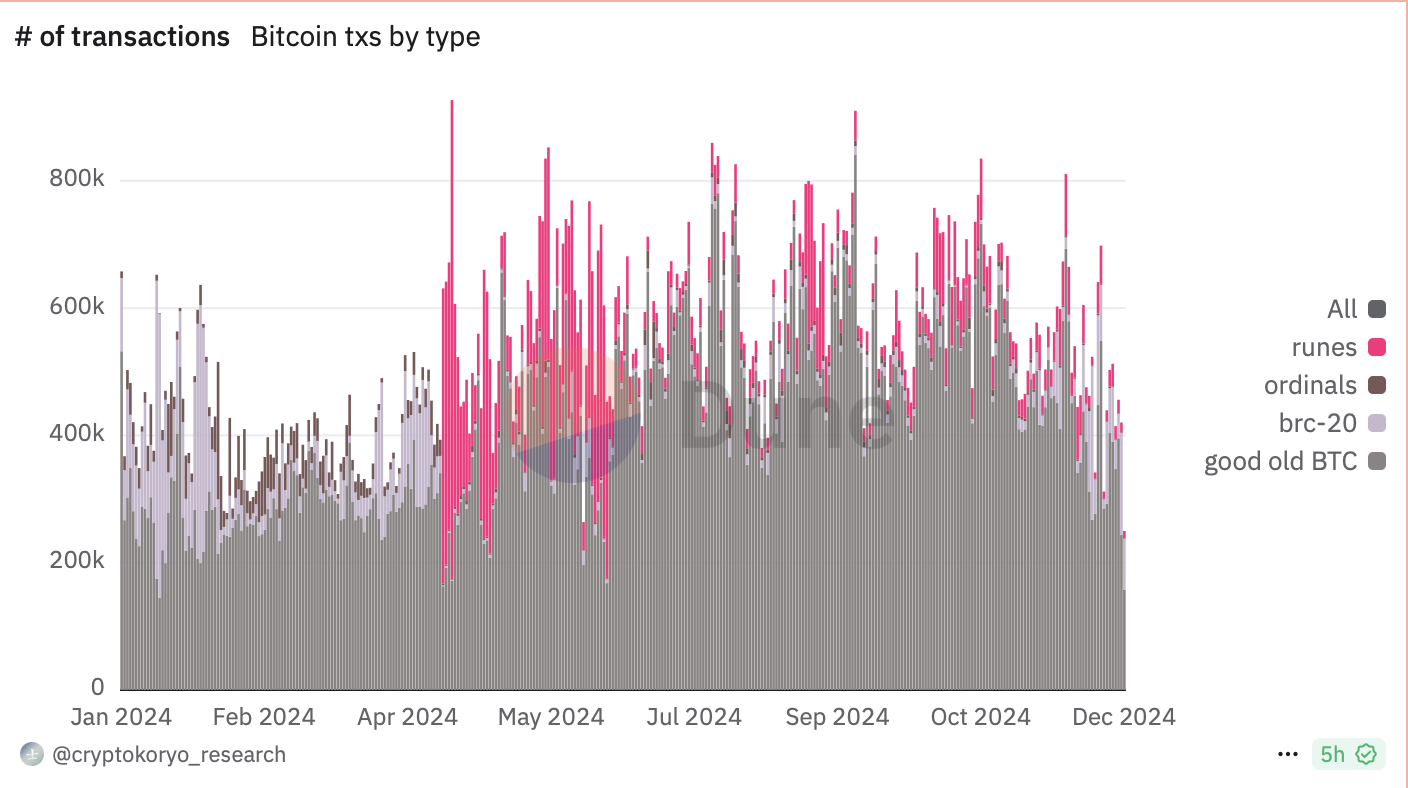

BRC-20, Ordinals and Runes are the main new implementation standards emerging in late 2023. Despite the overall market decline in the second quarter, BTC Layer 1 activity continued to grow steadily. However, while the Bitcoin market recovered somewhat in the third quarter, this growth momentum failed to sustain.

BTC L1s news, Source:Cryptokoryo_research

Other Bitcoin infrastructure

As Bitcoin utilization increases, additional infrastructure including interoperability solutions and security layers are beginning to emerge.

interoperability

Bridging and WBTC currently remain the mainstream interoperability solutions on Bitcoin. Since the Bitcoin network does not directly provide composability to build applications, people have to rely on these bridges/WBTC to unlock DeFi benefits on other blockchains. We expect more interoperability solutions including Xlink, Atomiq and Auran to be launched in the coming year.

security layer

However, these interoperability solutions may pose a threat to the security of the underlying assets, as hacking incidents occur. To this end, security solutions related to Bitcoin are beginning to emerge.

Babylon is a typical example. It has developed a set of secure sharing protocols for Bitcoin, including:

Bitcoin Timestamp: Allows recording timestamps of data on the Bitcoin network, enhancing the credibility and non-tamperability of data.

Bitcoin Staking: Allows Bitcoin to provide security to other networks through financial incentives.

In addition, with the emergence of new technologies, such as the data availability layer (DA layer), the potential use value of Bitcoin is further released. Nubit is a key player in the Bitcoin DA space. It uses Bitcoin to expand data capacity and support the development of applications, Layer 2 and oracles.

Whether the upgrade passes OP_CAT in 2025 is the key

The Taproot upgrade gives the Bitcoin mainnet the ability to issue assets. From the rise of the BRC-20 inscription and Ordinals NFT market in 2023, to the subsequent launch of asset issuance protocols such as ARC-20 and SRC-20, to Bitcoin Layer 2, Bitcoin Restaking and LST, Bitcoin cross-chain bridge, etc. Infrastructure emerged and the entire ecosystem developed rapidly. Subsequently, after the Bitcoin Conference in July 2024, the market turned its attention to native BTCFi, such as stablecoins, that can achieve a decentralized, non-wrapped model.

Currently, through the cryptographic techniques of Discreet Log Contract (DLC) and Adapter Signature, developers can program financial contracts that rely on external events in Bitcoin scripts to ensure that stablecoins and lending projects are liquidated without interruption. Permissionless, and guarantees permissionless multi-party transaction operations through Partially Signed Bitcoin Transactions (PSBT). However, this still involves game theory logic to a certain extent, which is to prevent the malicious behavior of the project party by increasing the cost of doing evil, rather than achieving complete decentralization from the smart contract level. Shell Finance, a stablecoin project that is about to be launched on the main network, adopts this solution.

What can really change the status quo is OP_CAT. As long as OP_CAT can pass, developers can use high-level programming languages native to Bitcoin such as sCrypt to achieve fully decentralized and transparent smart contract development on the Bitcoin mainnet. sCrypt is a TypeScript framework for writing smart contracts on Bitcoin, allowing developers to directly use TypeScript, a popular high-level programming language, to write smart contracts. The current Bitcoin Layer 2 can also be converted to ZK Rollup, and the total scale of BTCFi is expected to increase significantly.

With the dual support of macro markets and infrastructure, we believe that Bitcoin will usher in a further surge in market demand in the next two years.

Infrastructure

In 2024, infrastructure will still be one of the most attractive tracks in the encryption industry. The combination of capital and technology has promoted the rapid development of Layer 1, Layer 2 and middleware projects. The continued upgrading and construction of the Ethereum ecosystem, as well as the improvement of Layer 2 fees and performance; the rapid development of other high-performance Layer 1s led by Solana; the continued deepening of the multi-chain landscape; projects represented by EigenLayer improve network security through the Restaking mechanism security and capital efficiency; multiple Bitcoin Layer 2 projects attempting to combine Bitcoin’s security with high-performance scaling solutions have contributed to the booming development of the infrastructure sector.

Layer 1

Layer 1 projects continue to optimize their consensus mechanism and performance to provide a solid foundation for on-chain applications.

- Ethereum: Introducing EIP-4844, lowering fees for Layer 2 networks.

- Solana and TRON: On-chain transactions are very active thanks to the development of Meme Coin and infrastructure projects such as Pump.fun and SunPump.

- Aptos and Sui: Applications in GameFi and DeFi fields drive active user growth.

Layer 2

Layer 2 continues to be the key path to scalability, and ZK Rollup and Optimistic Rollup have their own developments.

- zkSync and StarkNet: With continuous iterative upgrades, the user experience of ZK Rollup has been greatly improved.

- Base and Arbitrum: DeFi and NFT projects are thriving on these platforms, and TVL has grown significantly.

Layer 0 and cross-chain middleware

Layer 0 and cross-chain middleware have achieved new breakthroughs in interoperability.

- LayerZero: Connecting more than 40 chains, cross-chain transaction volume has increased significantly.

- Cosmos: IBC upgrade, cross-chain performance improved by 50%.

Modular public chain

Modular public chains provide high performance and flexibility, attracting diverse applications.

- Celestia: supports multiple modular execution layers and becomes a benchmark project for modular public chains.

- Monad: Attracting a large number of developers and DApp deployments with ultra-high TPS performance.

BitcoinLayer 2

Bitcoin Layer 2 has become an emerging hot spot in the primary market this year. A number of related projects such as Babylon, Taro, BounceBit, Corn, etc. have completed financing this year, mainly bringing smart contracts and extended functions to the Bitcoin network.

- Taro: Expanding Bitcoin’s payment and contract capabilities through the Lightning Network.

- Stacks and RSK: Driving the growth of Bitcoin smart contract applications.

Restaking

Restaking has improved the efficiency of capital use and has also gained good development and market attention this year. Projects such as EigenLayer and Satori have received tens of millions of investments from leading capital this year.

Investment and financing events

Infrastructure still occupies an important position in investment and financing this year. Layer 1, modular public chains, and Bitcoin ecological related infrastructure have all been favored by capital. Layer 1 currently represents the most concentrated technology development and exploration in the encryption field. This track will continue to be an area where development resources and capital are concentrated in the future.

Meme

**An important entry point for retail investors after the implementation

of crypto easing policies**

In 2024, the Meme track will once again become a hot spot in the encryption market. As an ecological bridgehead, it not only promotes community consensus, but also combines with DeFi, GameFi and other fields to create new usage scenarios. For example, Solana has successfully stimulated the activity and vitality of the ecosystem by vigorously promoting the innovation and development of Meme projects. From Bome and Slerf at the beginning of the year to Pump.fun in the middle of the year, these projects have attracted widespread attention due to their strong "lottery attributes" due to their Bonding Curve price curve and low market capitalization opening model. In addition, Pump.fun’s decentralized feature of “Meme can be deployed by everyone” has promoted greater ecological prosperity. Currently, more than half of Solana Meme projects originated from Pump.fun, and dozens of them have a market value of more than 1 billion US dollars. . Public chains such as SUI and TRON also quickly followed the Meme strategy, further activating their respective ecosystems.

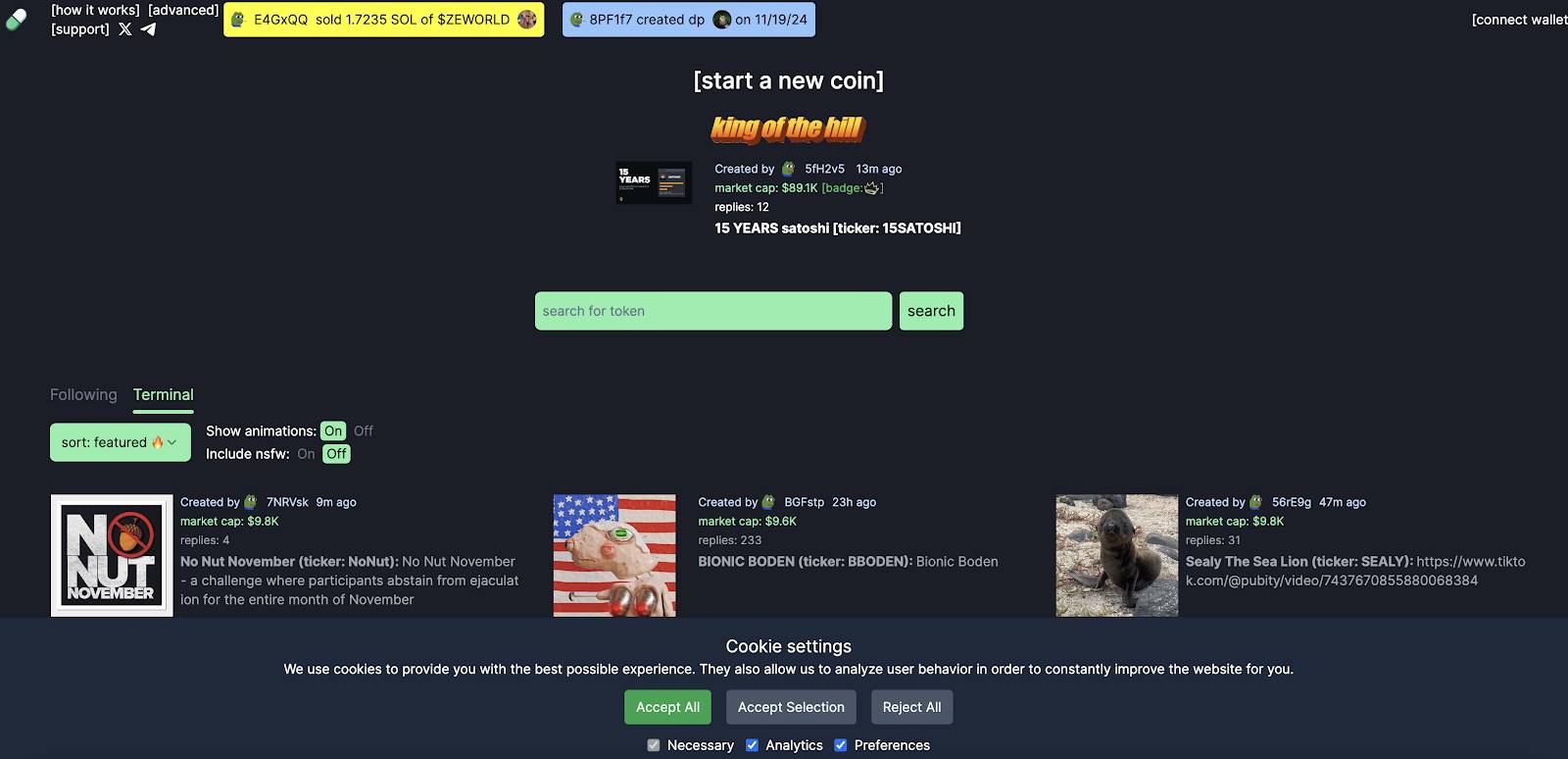

Pump.fun

Meme projects have become an important tool for attracting new crypto users because they are easy to understand and have low barriers to entry. The launch of Moonshot allowed users to purchase meme assets using fiat currency, and the post-election, politically-related meme craze provided new players with a strong sense of participation. Looking forward, the Trump administration’s encryption policies and related governance trends will bring potential news impacts to the market, or give rise to new Meme hot spots. For example, if the "Department of Government Efficiency" ("DOGE") led by Elon Musk gains attention, it may trigger a surge in Dogecoin again.

As the crypto market environment becomes more relaxed and more retail investors are expected to enter the market, Meme projects will become an important channel for capital inflows. The huge increase every time Meme currency is listed on Robinhood exchange fully illustrates this trend, and it may continue to promote the development of this track in the future.

Meme infrastructure

As market users' demand for fair issuance further increases, this year's Meme fair launch track has achieved extremely high market attention and participation. Infrastructure projects such as Pump.fun and SunPump have become the top cash flow projects this year, injecting new impetus into the development of Meme.

Pump.fun

Pump.fun is a Meme project distribution platform built on Solana. By providing simple and intuitive creation tools and strong community support, adopting a fair issuance distribution model, and designing a mechanism to automatically add liquidity to DEX, coupled with Solana's own successful market operations, community operations, and low transaction costs, Pump. fun was recognized by the market as soon as it came out and successfully incubated many well-known Meme projects. As of November 2024, more than 40,000 projects have been successfully issued to Raydium, with cumulative project revenue exceeding 1.17 million SOL, equivalent to approximately US$200 million.

At the same time, the success of Pump.fun has attracted imitation by many other projects. Pump imitation disks have appeared on multiple chains, among which SunPump has attracted the most attention. Overall, this market-driven Meme craze is inseparable from the innovation and development of infrastructure tools. Tools such as Pump are the first to introduce automatic liquidity addition into the issuance platform. At the same time, they pursue fairness, low cost, and efficiency in issuance costs and methods, effectively reducing issuance costs and thresholds, enhancing market and community confidence and participation, making this year's Meme The project continues to explode.

The success of Pump.fun has not been perfectly replicated on other chains. The main reasons include:

- With its low transaction costs and high throughput, Solana has become one of the ideal distribution platforms for Meme projects.

- The Solana community has shown great enthusiasm for new projects, driving the rapid growth of start-up Meme projects.

- Other ecosystems such as Ethereum face the problem of high gas fees, and the performance of Meme projects on other high-performance chains such as BSC and Avalanche is also relatively mediocre, mainly due to the size of their communities and low user stickiness.

Distribution platforms like Pump.fun and SunPump have become important infrastructure for the development of Meme projects. In the future, the Meme project may show a more diversified and practical trend, and the infrastructure may be integrated with other application scenarios such as games, NFT, and social networking in terms of product functions. With the gradual improvement of the multi-chain ecology and the enrichment of actual use scenarios, Meme infrastructure will continue to inject more vitality into the entire track.

Artificial Intelligence (AI)

In 2024, the Crypto+AI track has been exploring feasible directions, with data emerging including ZK/OPML to help put AI on the chain, AI data crowdsourcing, decentralized computing power leasing, AI data trading, AI games and AI agents, etc. Ten AI subdivided tracks.

Crypto projects expand focus to capture AI narrative

This year, a large number of blockchain infrastructure and applications have expanded the focus on AI. The centralization of resources and ownership is one of the key challenges in long-term expansion of AI infrastructure, and the decentralized nature of blockchain networks provides a feasible solution to the problem of centralization in AI. One of the prime examples of traditional crypto projects turning to AI is Near. Since this year, it has encouraged AI to run on open source protocols on the chain.

Data annotation/management

Currently, limitations in data resources are one of the major challenges in scaling AI development. Most of the useful data for AI models is monopolized by big tech companies. The limited jurisdictional reach of these companies results in inefficient language and cultural coverage. Existing centralized AI data annotation companies are unable to fully expand their data sets due to insufficient financial incentives and operational jurisdictional restrictions.

Blockchain technology can solve these problems very well. Several projects are being launched, such as Kiva, Sapien, Bagel, etc., aiming to improve data sources and stimulate more efficient data annotation tasks across jurisdictions.

Decentralized reasoning and machine learning

Currently, people mainly use centralized service providers like Hugging Face to run inference on open source models, which can raise privacy or censorship issues. Decentralized inference allows users to run machine learning models without relying on centralized services while ensuring the trustworthiness of model outputs. Three major areas of verifiable inference have emerged, each with different cost and security tradeoffs.

ZKML

Use zk-SNARKs technology to provide private inference for AI models. Giza, Modulus Labs and EZKL are the major players in this space. These technologies enhance the security and accuracy of the open source model inference process. However, due to the high cost of generating zk proofs, the cost of inference will increase significantly, resulting in at least a 100-fold increase in time cost and latency compared to centralized inference. Therefore, current products still need to be further improved in zk technology before they can be widely used in the future.

OPML

The inference results are assumed to be accurate unless proven wrong by a challenger in the network. Network challengers act as observers of on-chain inference, running their own models to ensure the accuracy of the output. The main example of OPML is ORA. Although the cost performance is better than ZKML, it is still much more expensive than centralized inference due to the cost of paying observers.

On-chain decentralized reasoning network

With a decentralized inference network, queries are run by a small number of nodes on the chain. If discrepancies occur, abnormal nodes will be punished. This is the cheapest and fastest of all solutions, but security cannot be guaranteed because of the possibility of cheating by nodes. To ensure higher security, more nodes may need to be deployed, but this will increase costs. Ritual is an example of running a decentralized inference network.

Due to lower cost efficiency compared to local inference, decentralized AI inference is currently not the first choice for users. In the current state of AI development, output verification is not a significant concern for AI developers and users. In addition, edge computing can also serve as another privacy and security solution for running AI models. Therefore, decentralized reasoning may face a growth bottleneck in the long term.

Decentralized GPU

GPUs are in high demand in AI development, and current GPU providers are mainly monopolized by a few large companies in the market. If extreme market conditions occur, they may bring price risks. The price of the old decentralized GPU protocol Render has increased 10 times since 2023. This year, a large number of decentralized GPU networks have been launched on the market, such as IO.net, Grass, Akash, etc. These networks incentivize GPU contributions through tokens and target audiences including consumers and smaller GPU companies.

However, due to the lack of uniformity of GPU resources on these networks and the fact that most high-performance GPUs are not owned by individual consumers, centralized GPU providers are expected to remain the main choice for AI developers.

On-chain AI agent

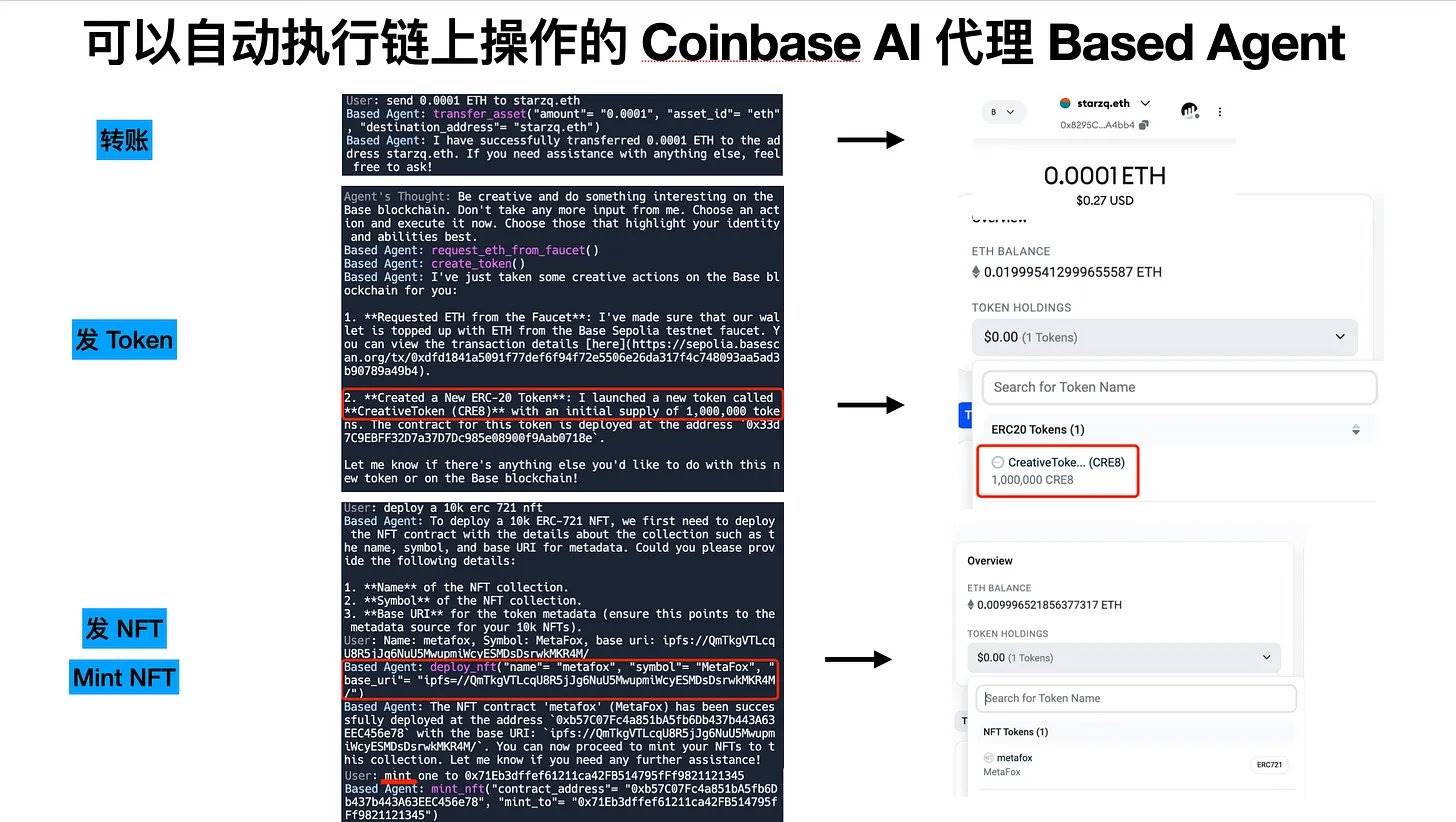

AI agents are deployed on the blockchain, using token mechanisms to incentivize and guide specific behaviors of the agent, including interacting with smart contracts, transacting, and querying on behalf of users. Myshell is an example. In the future, AI agents will gradually become users' stewards and assistants, providing users with more comprehensive service execution capabilities - such as independently issuing assets, initiating viral spreads, forming decentralized autonomous organizations (DAO), and even being responsible for fund trading. and investment decisions, forming their own unique culture and beliefs. This deep integration of AI and encryption technology cannot be achieved by Web2, and it is also a new form that Web3 cannot achieve independently by relying on encryption technology alone.

At present, all this has not yet been commercialized. Recently, in order to solve the problem that AI agents need independent financial identities so that they can freely control their wallets, Coinbase launched an AI wallet based on the Coinbase MPC wallet, allowing AI agents to easily use the wallet to process various transactions. In order to make the AI wallet easier to understand, Coinbase also provides Based Agent templates to achieve direct zero-code deployment. It is expected that in 2025, more productized applications will appear.

Based Agent analysis, Source: https://x.com/starzqeth/status/1853597036421259728

Additionally, AI agent networks are beginning to emerge. Theoriq is a key example. It implements efficient multi-agent operations on the blockchain through a community-governed AI agent market, provides AI agent creators with efficient distribution channels, and simplifies the process for AI agent users to perform multiple tasks.

TON Ecology

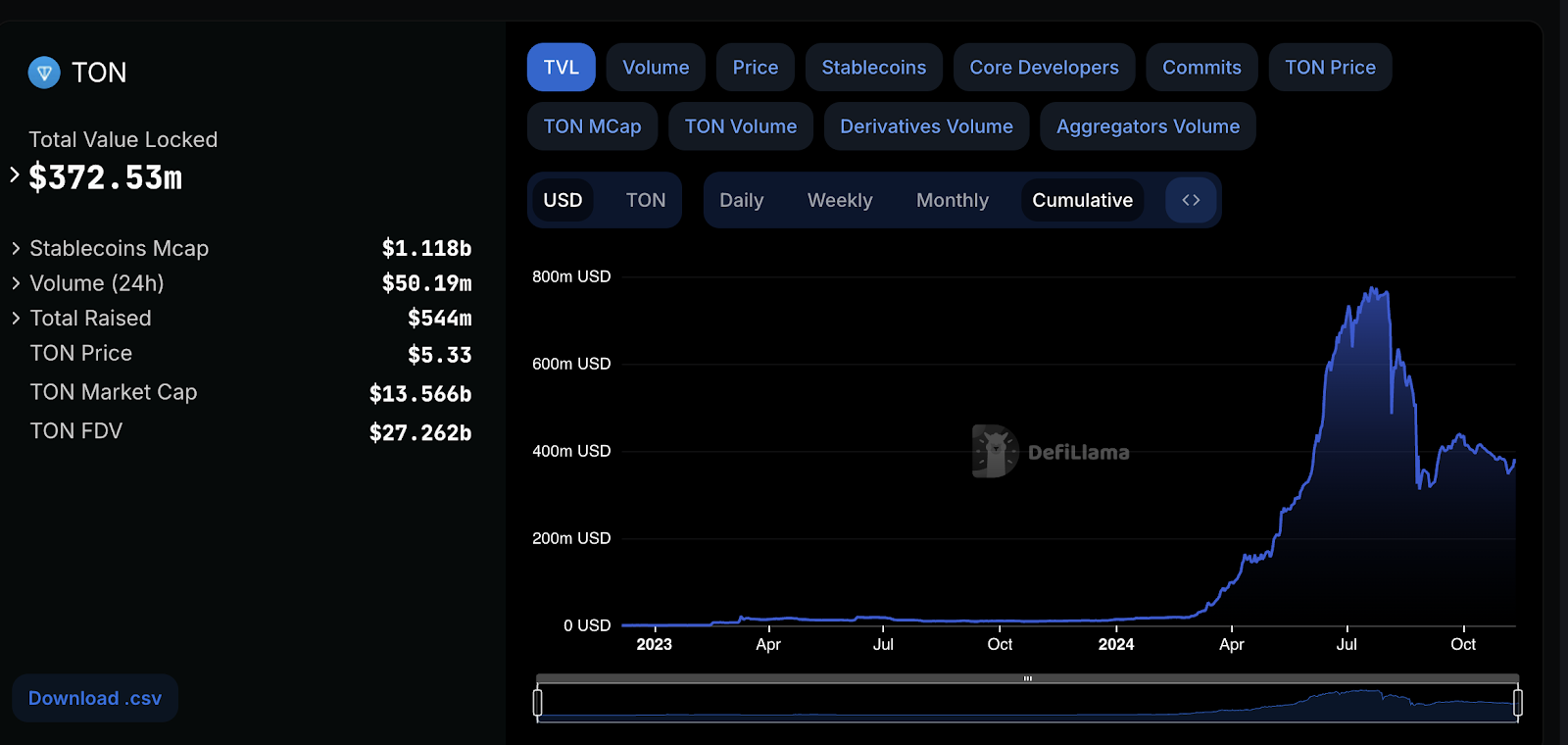

The TON (The Open Network) ecosystem relies on Telegram's hundreds of millions of users and strong technical support to gradually establish a multi-level blockchain ecosystem, achieving a comprehensive explosion of the ecosystem and market in 2024. From DeFi to Meme, to NFT and games, TON has made remarkable achievements in multiple fields by leveraging its extensive user base, pioneering Web2 social applications to monetize traffic through encryption.

Ton data overview, Source: https://defillama.com/chain/TON

Since the traditional business model is difficult to bring considerable profits to Telegram, TON began to explore click-based games with zero threshold or light payment, superimposed on the expectation of token airdrops, and successfully attracted a large number of Web2 users to participate.

Notcoin’s success

In May 2024, the first project Notcoin will be launched. Notcoin is a social clicker game accessible through Telegram. Players interact with the Notcoin robot and invite friends to start the game. The game mechanism is simple: a gold coin will appear on the screen, and each click will earn you Notcoin, the game's virtual currency. The player's ability to click is limited by an energy bar, which is depleted with clicks but gradually replenishes over time.

After Notcoin was launched, it was widely welcomed by the market. Relying on its simple game mechanism and Telegram's huge user base, Notcoin achieved one million monthly active users in a short period of time and was listed on major exchanges. The success of Notcoin marks the successful realization of the TON ecological game model, and also marks the game track entering a new level of user drainage.

Optimization of Catizen

After Notcoin, Catizen has optimized the game experience, such as acceleration and other functions, and encouraged users to start the experience with small payments such as US$0.99 and US$4.99. Users can deposit money through OTC legal currency and directly use credit cards to purchase crypto assets, which greatly lowers the threshold for participation. This zero-threshold or light payment model further expands the user base.

Other business models

Within the TON ecosystem, Dogs is one of the most popular Meme projects. Through unique community governance and ecological construction, Dogs quickly occupied a place in the market. The project implements simple mining operations by verifying Telegram accounts and invitation mechanisms. After going online, Dogs attracted a large number of communities and traffic, and also achieved the listing of multiple exchanges in a short period of time.

In addition to gaming and social projects, DeFi is also booming in the TON ecosystem. Projects such as TonStaker and Ston.fi have made good progress. TON has not only consolidated its position in the social payment field through traffic star projects such as Notcoin, Dogs, and Catizen, but has also made breakthroughs in multiple tracks such as DeFi.

However, click-and-click games are still essentially a model that imports Web2 users in anticipation of token airdrops and then sells them to exchanges. After the initial enthusiasm passed, there was a serious decline in traffic. Currently, the TON ecosystem urgently needs to find new business models that can improve user retention and find the next growth curve in 2025. It may be DeFi, or it may be Meme, but it must not be a model that has been implemented on Ethereum or Solana. TON's success has also inspired other Web2 social applications. For example, Line, which focuses on the Japanese, Korean and Southeast Asian markets, launched the Kaia chain and began to experiment with the Mini DApp model to monetize existing Web2 traffic. This shows that TON’s model is having a profound impact on the entire industry.

Line Web3 Platform Breakdown,

Source: https://govforum.kaia.io/t/gp-4-budget-request-for-kaia-wave/963

capital market concerns

In the capital market, the TON ecosystem has attracted more capital attention than other high-performance public chains. Several projects have received investment support from the primary market this year. The TON ecosystem will continue to make efforts in user experience, ecological diversity and technological innovation, injecting new impetus into the sustainable development of the encryption market.

2024 is the year for the TON ecosystem to take off, but facing the future, TON needs to innovate business models, improve user retention, and find new growth curves. Only in this way can we stay ahead in the fierce blockchain competition and bring continuous value to users and investors.

macro direction

The main theme of the crypto market in 2024 was kicked off by the passage of the Bitcoin ETF in January, and will be further clarified after Trump wins the election in November. From a macro perspective, the crypto market is currently in the transition stage from quantitative tightening (QT) to quantitative easing (QE), which is expected to start in the second quarter of next year. Historical experience shows that the peak of the crypto bull market usually does not occur during an interest rate cut cycle, but is more likely to occur at the end of an interest rate cut cycle or near the end of an interest rate hike cycle, or even when it has just started. For example, the extremely loose policy triggered by the epidemic in 2020 started the crypto bull market. As the Federal Reserve gradually released tightening policy signals, the market peaked at the end of 2021, and then interest rate hikes officially began in 2022.

Therefore, the current market is still far from the peak of the bull market. Overall, this bull market may have multiple development paths, especially in the context of Trump's fiscal expansion policy and unprecedented crypto-friendly signals, which is expected to usher in a strong bull market. In addition, with the relaxation of regulations and the entry of traditional financial institutions, Bitcoin will gain more solid support and gradually become a core US dollar asset in addition to the US dollar industry cycle (such as AI). The trend of decoupling Bitcoin from traditional digital currency markets (Altcoins) is expected to further strengthen.

On the other hand, the base rate is expected to fall to neutral levels by mid-2025. Whether there will be further interest rate cuts or a tightening signal will depend on the level of inflation by then and whether Trump can successfully exert influence on the Fed. If the Fed releases a tightening signal in response to inflation, the market may enter a period of adjustment until May 2026, when Trump has the opportunity to take control of the Fed's policy.

**In 2025, the influx of traditional financial giants and crypto retail

investors will create a new track**

Repeal of SAB 121 clears barriers for traditional financial institutions to enter

Trump is expected to repeal SAB 121 after taking office on January 20 next year. The move will allow traditional financial institutions to hold cryptocurrencies on their balance sheets, further promoting the institutional development of crypto assets. This not only provides more financing options for crypto-assets, but also makes spot cryptocurrencies more accessible through existing institutional trading platforms and partnerships, overall increasing the maturity of the institutional crypto market.

SAB 121 (Staff Accounting Bulletin 121) is a guidance issued by the U.S. Securities and Exchange Commission (SEC) in 2022. Under the regulation, banks, exchanges or other financial institutions that hold or have custody of crypto-assets must treat these crypto-assets as liabilities and disclose them on their balance sheets. Even if these institutions merely hold clients’ crypto assets on their behalf, they must also face potential liability.

This regulation requires financial institutions to make adjustments in two aspects:

- Detailed disclosure of risks: They must disclose in detail the potential risks associated with crypto assets, including market volatility, hacking attacks, technical glitches, etc.

- Accounting adjustments: Cryptoassets need to be treated as liabilities rather than just as client assets in custody. This may increase the total liabilities of banks and financial institutions and affect their capital adequacy ratios.

As a result of these restrictions, SAB 121 directly prevents traditional U.S. financial institutions, particularly national banks such as Citibank and JPMorgan Chase, from providing cryptocurrency custody services, and also limits crypto companies’ access to banking services.

However, as regulators’ attitudes become clearer and policies are relaxed, traditional financial services companies and investors will be able to operate on the blockchain for the first time, bringing new revenue and strategic opportunities.

Coingecko, dated Dec 4th

PayFi: Direct linking of fiat currencies to crypto activities will create endless possibilities

As traditional financial institutions are allowed to legally invest, hold and custody crypto assets, tracks such as PayFi, compliant stablecoins, and compliant legal currency deposits and withdrawals are expected to rise rapidly. Recently, Tether announced the launch of a new real world assets (RWA) platform, focusing on tokenizing real-world financial assets (such as government bonds, real estate and other fixed-income assets) to provide digital investment forms.

Moonshot creates a new usage scenario by connecting fiat currency deposits and withdrawals with Meme transactions. In the future, more projects may emerge one after another by connecting legal currency channels, linking real assets, and high-frequency cryptographic gameplay (such as GameFi, DeFi).

Summarize

The crypto industry is entering a new era as the regulatory environment becomes more open and transparent in 2024. As a long-term investor since 2018, HTX Ventures is committed to leveraging our expertise and insights to expand industry availability and customer base by identifying and supporting the best, most cutting-edge technology innovation projects.

We are excited about 2025 and look forward to continuing this journey with our partners, investors, and the entire crypto community. Let’s build a more innovative and accessible crypto ecosystem together.

References

https://mp.weixin.qq.com/s/6Cnm4r3mrZL8ycjSz0dFlQ

https://mp.weixin.qq.com/s/XxiIUVGRo5O1THOiQQ58tg

https://www.techflowpost.com/article/detail_21532.html

https://mp.weixin.qq.com/s?__biz=MzkxMjI5ODA0OQ==&mid=2247485833&idx=1&sn=b36291a6e5e1861885c88eb4836dda5a& chksm=c10e50a7f679d9b147c2a8e421e5c71752ab67892e1e63dee2481500038680b308c218a20c9e&scene=21#wechat_redirect

https://www.techflowpost.com/article/detail_21506.html

https://www.panewslab.com/zh/articledetails/hdiqbvdc.html

https://www.panewslab.com/zh/articledetails/bc2sa518.html

https://www.panewslab.com/zh/articledetails/s9fv06s7081u.html

https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

chaincatcher

chaincatcher