How will BTC go to $93,000 in the future?

Reprinted from jinse

04/23/2025·25DCompiled by: Deng Tong, Golden Finance

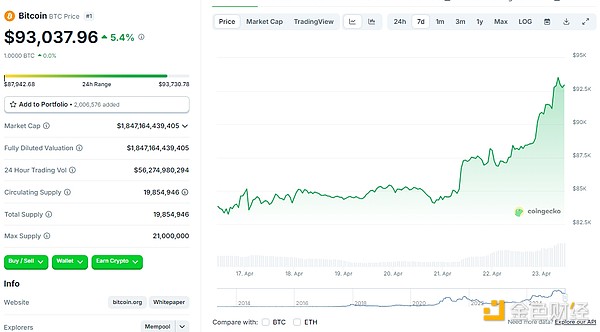

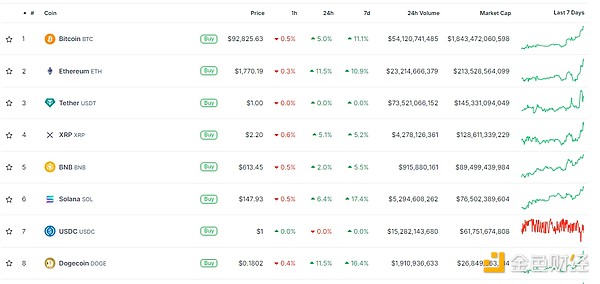

Bitcoin price has been on a continuous downward trend since January, and the overall market of the crypto market continues to be in a downturn. But starting last night, BTC rebounded and rose, with a maximum price of over $93,000, which may be a signal that Bitcoin may open up a new long-term uptrend. As of press time, the BTC price is now at $93,037.96, with a maximum of $93,518.26 during the day. The entire crypto market is also synchronized with the price of Bitcoin, and many cryptocurrencies have recorded double- digit gains. For a moment, the sound of the cow returning quickly was heard.

What caused the crypto market to rebound suddenly and sharply? How will the future market trends go?

1. Is Trump going to put down the tariff stick?

Early this morning, US President Trump said that tariffs on Chinese goods will not be as high as 145%, and tariffs will drop significantly, but will not be zero. When Trump was asked whether he would take a tough stance against China, he said he would not.

In addition, Treasury Secretary Bescent hinted at JPMorgan 's closed-door meeting that tariff policies will be loose. White House Press Secretary Levitt said at a press conference that Trump 's relationship with China is moving in the right direction. For specific content, please click "Trump makes three concessions at 00:00, 01:00, 05:00 in the morning"

Charles Gasparino, a senior reporter of Fox Business Channel, said that today's market ushered in a compromise day: Trump seems to have made concessions on trade policy and Powell's stay or leave, and stock index futures rose accordingly; Musk also claimed that he would gradually withdraw from the government's Ministry of Efficiency and return to Tesla's main business. This is the case with the market, it will always force you to bow your head and admit defeat. Ask me to say: Make Caving Great Again! Maybe this time, neither Trump nor Musk will change his mind and turn accepting compromise into a life creed!

Tesla CEO Musk said on a Tesla (TSLA.O) earnings call that he would continue to advocate lower tariffs, but the tariff decision was entirely decided by US President Trump. Musk said I will provide my advice to the president, and the president will listen to me, but ultimately he will make the decision himself. I have made public several times that I think lowering tariffs is usually beneficial to prosperity, but this decision is ultimately done by the elected president who represents the people. Therefore, I will continue to advocate lowering tariffs rather than raising them, but that's all I can do.

Adam Button, analyst at Forexlive, financial website: The US dollar continues to regain some of the lost land yesterday. At the same time, the stock market strengthened and some small buying positions appeared on bonds. The market is eager to hear good news. I think the good news today is that Trump remains silent on trade issues. This may convince some marketers that he is eager to reach a deal, and anything that could turn the market around. Imagine the president keeping silent on trade issues every day (the market should be happy).

Not just a trade war with China, the White House is also about to reach a comprehensive agreement with Japan and India to avoid mass tariffs from the United States, but they may leave many tricky details for later discussion. In the absence of a comprehensive trade agreement, government officials are working to sign a so-called “memorandum of understanding” or a broad “structure” for future agreements. "It can take several months to finalize the final agreement, and these are complicated," one of the people familiar with the matter said.

2. Encryption-friendly Paul Atkins officially takes office as SEC

Chairman

Paul Atkins was sworn in as Chairman of the Securities and Exchange Commission (SEC) , and the formal handover of Gary Gensler's leadership has been completed. Atkins, who has worked with digital asset companies, is expected to continue the temporary leadership reversal of the previous cryptocurrency boycott of the U.S. SEC. Atkins said he was honored that Trump and the U.S. Senate had “trust and confidence” in him and was pleased to start working with other commissioners. “We will work together to ensure that the United States is the best and safest place to invest and do business in the world,” he said in a statement.

Previously, he served as a member of the US SEC and runs a Washington consulting firm focusing on compliance and policy matters. In addition to Wall Street connections, Atkins also works as an advisor for cryptocurrency companies.

Michael Saylor said: " SEC Chairman Paul Atkins will be positive about Bitcoin."

Trump said SEC Chairman Paul S. Atkins is the best candidate to ensure certainty in cryptocurrency regulation.

Previously, Trump pointed out that the cryptocurrency industry urgently needs clear regulatory policies. Atkins's appointment is an important factor that benefits the crypto market.

3. Financial markets worry about the independence of the Federal Reserve

Tensions between Trump and Fed Chairman Powell are growing. The two's differences mainly focus on inflationary pressures brought by tariffs and concerns about the Fed's unwillingness to cut interest rates, casting a shadow on the dollar.

The dollar index, which tracks the dollar's exchange rate against a basket of currencies, has fallen since February, falling to its lowest point since 2022. Trump's public pressure on Powell and speculation that he may try to remove Powell or other Fed officials have heightened concerns about the independence of the Federal Reserve, which is the fundamental pillar of the U.S. financial system.

The potential consequences of the depreciation of the dollar on the global economy are unpredictable, but one thing is certain: Bitcoin will be the main beneficiary. It is a decentralized, censorship-resistant currency that is completely managed by code, has a fixed supply plan, and has no central authority to manipulate its issuance. As people 's confidence in the traditional monetary system continues to weaken, Bitcoin's narrative becomes stronger and stronger.

Standard Chartered analyst Jeff Kendrick said that if concerns about Fed independence continue, Bitcoin could rise to an all-time high. He said that cryptocurrencies are a hedge against risks to existing financial systems due to its decentralized ledger. The risks of U.S. Treasury bonds reflect this after Trump hinted that he might remove Fed Chairman Powell because he hoped to cut interest rates. Kendrick said the yield premium of investors' purchase of long-term Treasury bonds has increased significantly compared to short-term Treasury bonds, which has benefited Bitcoin.

Cryptocurrency analyst Rekt Capital noted that Bitcoin has decisively broken through months of downward trend, “The downward trend that lasts for months is over. When the technical downward trend is broken, the technical upward trend will appear.”

BTC/USD 1st day picture. Source: Rekt Capital

4. Countries and institutions increase their holdings in BTC

Bo Hines of the President 's Advisory Board of Digital Assets said in an April 14 interview that the United States is looking for "multiple creative ways" to fund its Bitcoin investment, including getting money from tariff revenues and reevaluating the Treasury's gold certificates, creating a paper surplus to fund BTC reserves without selling gold.

On April 21, Saylor announced that it had acquired 6,556 bitcoins for about $555.8 million, with an average price of about $84,785 each. This brings MicroStrategy 's total holdings to an astonishing 538,200 bitcoins, worth approximately US$48.4 billion at current prices.

US listed company DeFi Development Corporation (formerly Janover Inc.) announced an increase in holdings of 88,164 Solana (SOL), worth approximately US$11.5 million. After this purchase, the company's total Solana holdings increased to 251,842 units, worth approximately US$34.4 million (including pledge rewards). It is reported that Janover is an artificial intelligence platform connecting the commercial real estate industry. It announced today that it has been renamed DeFi Development Corporation.

Metaplanet CEO Simon Gerovich posted on the X platform that some shareholders expressed concerns about the company's share price and would take the matter seriously and express their gratitude. Metaplanet has increased its holdings to 4,855 BTC in the past year, with Bitcoin yields so far this year of 119.3%, becoming Asia's largest Bitcoin listed company and the world's tenth largest shareholder, and still sticking to the goal of 10,000 BTC by the end of this year. Although the stock price fluctuates in the short term, I believe that in the medium and long term, the stock price will tend toward fundamentals.

Tesla has not conducted any cryptocurrency transactions in the past three months and currently holds 11,509 bitcoins on its balance sheet.

Meanwhile, investors who favor traditional financial instruments rather than holding Bitcoin directly have also begun to rekindle interest. According to CoinGlass, on April 21, the BTC ETF recorded $381 million inflows – a much- needed reversal after a long period of large-scale capital outflows. Since February, ETFs have experienced a net outflow of 33 days, while inflows have only 21 days, and outflows have dominated trading volumes. Recent reversals show that investor confidence has rekindled, especially those from the TradFi camp.

Spot Bitcoin ETF capital flow. Source: SoSoValue

5. The Russian-Ukraine war may be quelled

US President Trump said on the 21st local time that he will announce his peace plan on the Russian-Ukrainian conflict in the next three days. According to reports from multiple American media, the project may include territorial issues and the dispatch of European troops into Ukraine. Previously, Trump also posted a message calling on Russia to end the Russian- Ukrainian conflict: Russia must take action. Too many people are dying, thousands every week, in a terrible and meaningless war. If I were the president, this war shouldn't have happened, nor would it have happened!

6. Bitcoin market share rises to a new high in the past four years

According to TradingView data, Bitcoin market share (BTC.D) rose to 64.61% today, a record high since February 2021. The high market share of Bitcoin shows the silence of the counterfeit market, but it also represents a bottoming out rebound. According to previous historical data, when Bitcoin's market share surged to 60% in November last year, altcoins started a bull market. In 2019 and 2021, the Bitcoin market share reached a high of 70%, and then ushered in a magnificent general market.

7. What is the future rise of BTC?

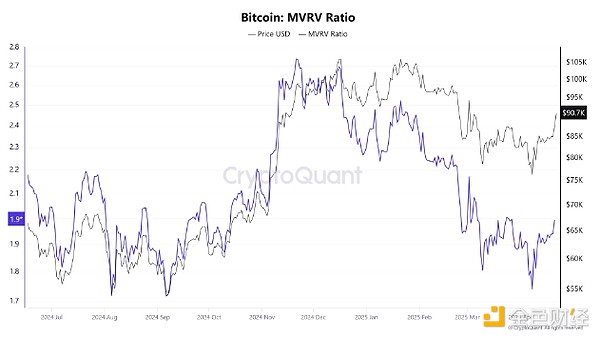

In the long run, DYOR cryptocurrency founder Hitesh Malviya said that if BTC maintains its MVRV ratio of 2 over the next six weeks, its gains could reach 70% to 80%. Market Cap to Real Value (MVRV) ratio is a key on-chain metric that compares Bitcoin’s market cap to its actual value (i.e., the value that Bitcoin calculates at its latest transaction price). Historically, an MVRV above 3.7 usually indicates overvalued valuations and a market peak, while an MVRV close to 2 predicts a strong price increase.

Bitcoin MVRV ratio. Source: CryptoQuant

Bitcoin's MVRV score has remained above 2 from October 2024 to February 2025, consistent with its all-time high. Recently, the indicator has fallen below 2 during the market adjustment period, but is currently trying to regain this key level.

Analysts at Standard Chartered Bank and Intellectia AI said the institutional demand for Bitcoin by exchange-traded funds (ETFs) and traders seeking to hedge macroeconomic risks could cause Bitcoin prices to more than double this year. Intellectia AI also believes that institutional demand drivers, including corporate Bitcoin buyers as well as exchanges, may continue to drive positive price movements.

But analytics firm CryptoQuant also warned that headwinds for Bitcoin’s rise remained, potentially limiting its further gains, driven by new hopes of a resurgence of investor optimism and easing of U.S.-China trade tensions. If market sentiment weakens, the market may experience a pullback.

8. Appendix: Can tariffs really benefit the US economy?

Goldman Sachs economists predict that U.S. GDP will only increase by 0.5% in the fourth quarter compared with the fourth quarter of 2024 due to pressure on the economy due to tariffs and policy uncertainties. Currently, business and consumer surveys show a slowdown in the economy, but official economic data have not shown that sign. They reasoned that economic indicators may show a recession more clearly starting in mid-to-late summer. “The evolution of data in recent weeks is consistent with previous 'event-driven' growth slowdowns. However, it is too early to draw strong conclusions from the current limited data.”

Citigroup chief economist Shitz said Tuesday that the chances of a recession in the U.S. economy is 40% to 45% due to the impact of U.S. President Trump imposed tariffs on other trading partners. Shitz expects U.S. GDP to grow in the second quarter, driven mainly by consumers' rush to buy goods before the tariffs take effect. He said the biggest impact of U.S. economic growth is expected to appear in the second half of this year. “Tariffs are a stagflation shock to the U.S. economy,” Shitz said.

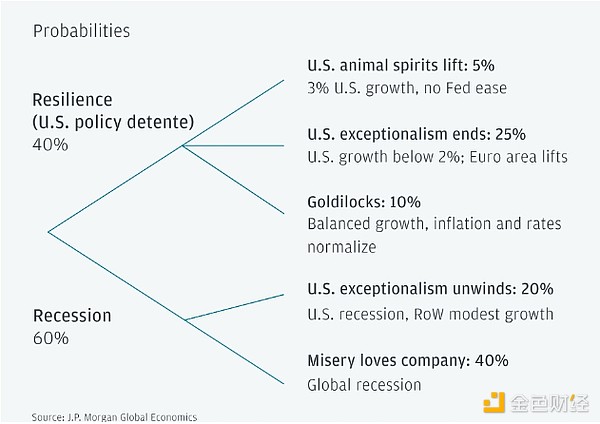

A JPMorgan Chase study on April 15 showed that the likelihood of a U.S. recession in 2025 has risen from 40% to 60%. "The latest elimination of tariffs on Liberation Day reduced the impact on the global trade order, but the remaining 10% of the general tariffs still pose a substantial threat to economic growth, while the 145% tariff imposed on China keeps the possibility of a recession at 60%.

Global recession prospects. Source: JPMorgan Chase

Jeffrey Sachs, a professor of economics at Columbia University in the United States , said in an interview recently that as time goes by, the United States ' share of the world economy is declining, and the US dollar will no longer be the world's major currency, which cannot be stopped. The weaponization of the US dollar forces other countries to abandon the settlement of the US dollar. Saxophone said that the US weaponizes the US dollar and often uses the dominant position of the US dollar to threaten other countries and interfere with trade, which will force other countries to gradually abandon settlement in US dollars in international trade and instead use other currencies. Sax also predicts that in 10 years, the role played by the dollar will be completely incomparable to the present.

panewslab

panewslab

chaincatcher

chaincatcher