How to make money with ETH in the right way, sharing 16 income strategies with more than 20% APR

Reprinted from panewslab

01/07/2025·4MAuthor: Stephen , crypto KOL

Compiled by: Felix, PANews

At present, sustainable and scalable ETH yields >20% are not common. Crypto KOL Stephen reviewed the strategies to keep the annual interest rate (APR) above 20%.

wstETH

wstETH is arguably the most popular, competitive and scalable strategy in history. Even in the most depressed bear markets, APR typically ranges from 8% to 30%.

The working principle of wstETH is to use the pledge yield of ETH (about 3%) to offset the cost of borrowing ETH (about 2%).

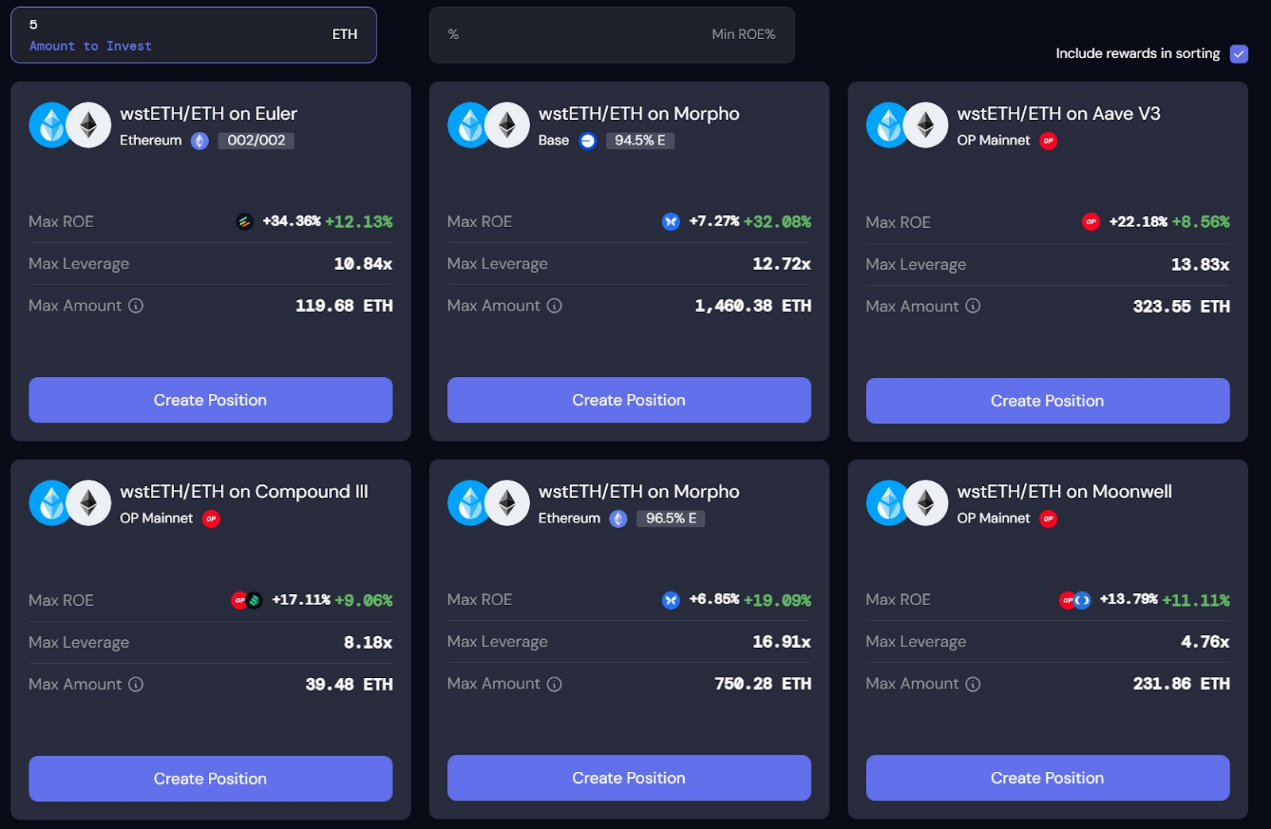

There are four great places to do it:

- Morpho Labs

- Aave

- Compound Growth

- Euler Labs

The current APR for this strategy ranges from approximately 26% to 46%. Of course, you can use Contango to automatically leverage these positions to generate TANGO points, OP emissions, etc.

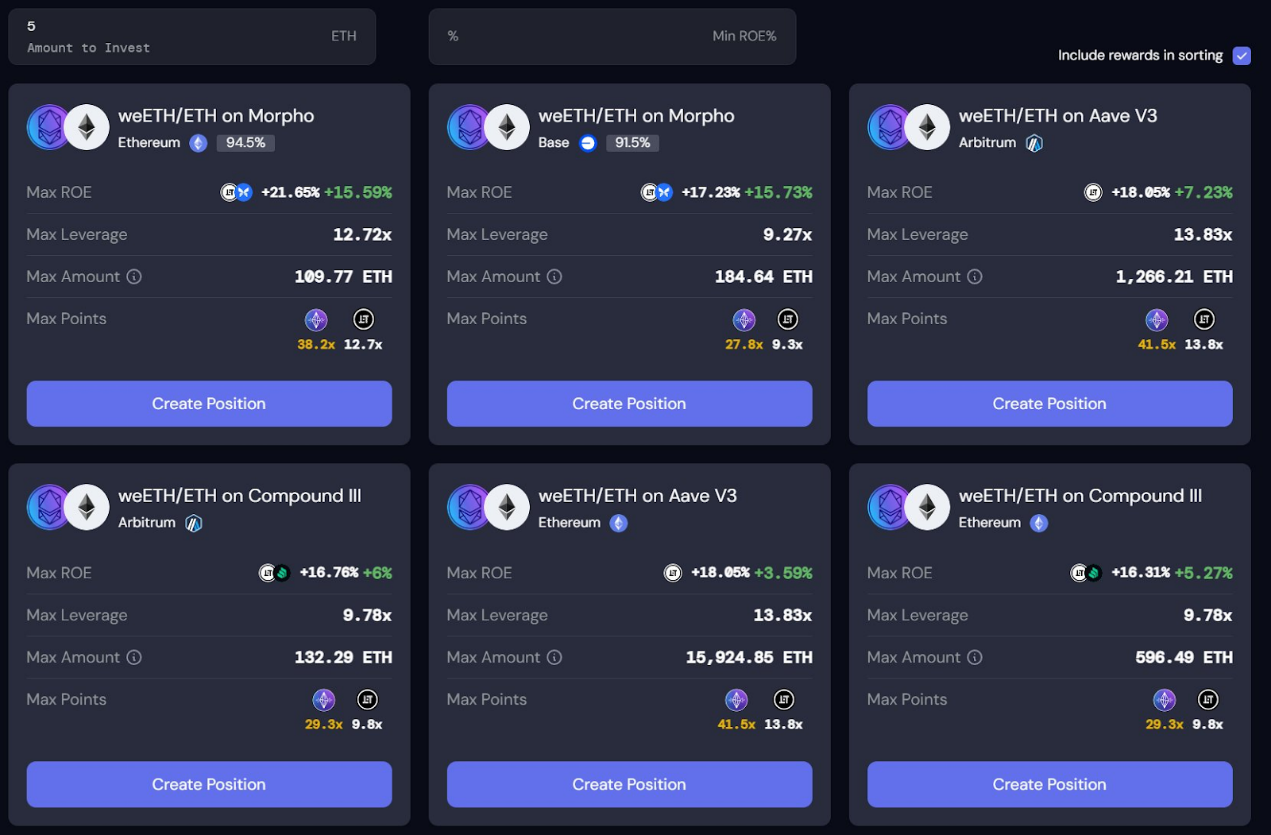

Leverage weETH

This strategy is the same as the previous one, except that this strategy is also eligible for various points and emissions. Therefore, the average return for this strategy is slightly higher:

- ether.fi points

- Veda Points

- LRT2 Points

- EigenLayer programmatic rewards (such as $LRT2)

Three blue-chip money markets are the best places to leverage:

- Compound Growth

- Aave

- Morpho Labs

APR ranges from 22% to 36% before considering LRTsquared, EtherFi S4, and Veda points. The actual rate of return after taking points into account may be above 50%.

Note: Although Morpho currently has the No. 1 APR, the gap between the top three protocols is not that big, so hedging between them can usually get you the most competitive and consistently high APR (which can hedge against unstable borrowing rates ).

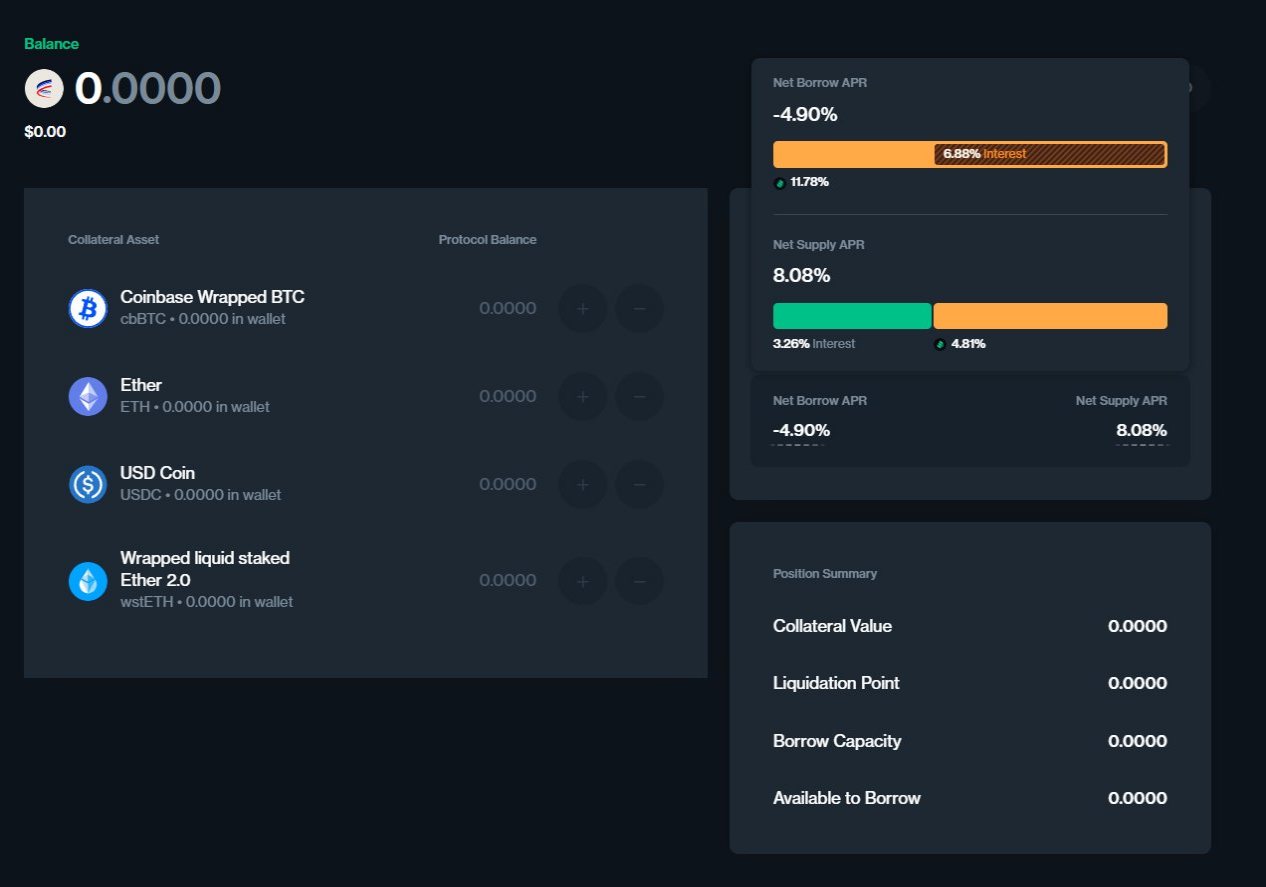

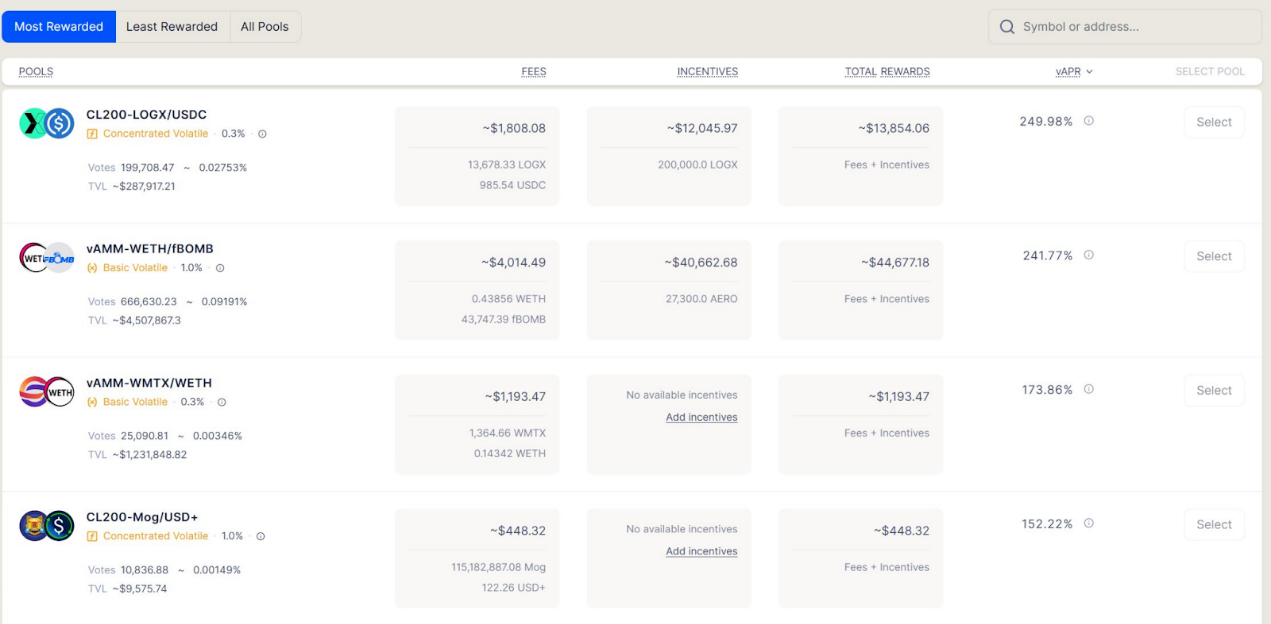

AERO Mining

Compound Growth is currently paying users to borrow AERO against cbETH, ETH, and wstETH.

At the same time, you can get AERO by voting on Aerodrome at about 200% APR.

Of course, the liquidated loan-to-value (LLTV) ratio is 65%, so let’s look at some reasonable positions:

Loan-to-value ratio ( LTV ) 50%

Relative AERO clearing growth: 30%

ETH mortgage total yield: 100% APR

Loan to value ratio 25%

Relative AERO clearing growth: 160%

ETH mortgage total yield: 54% APR

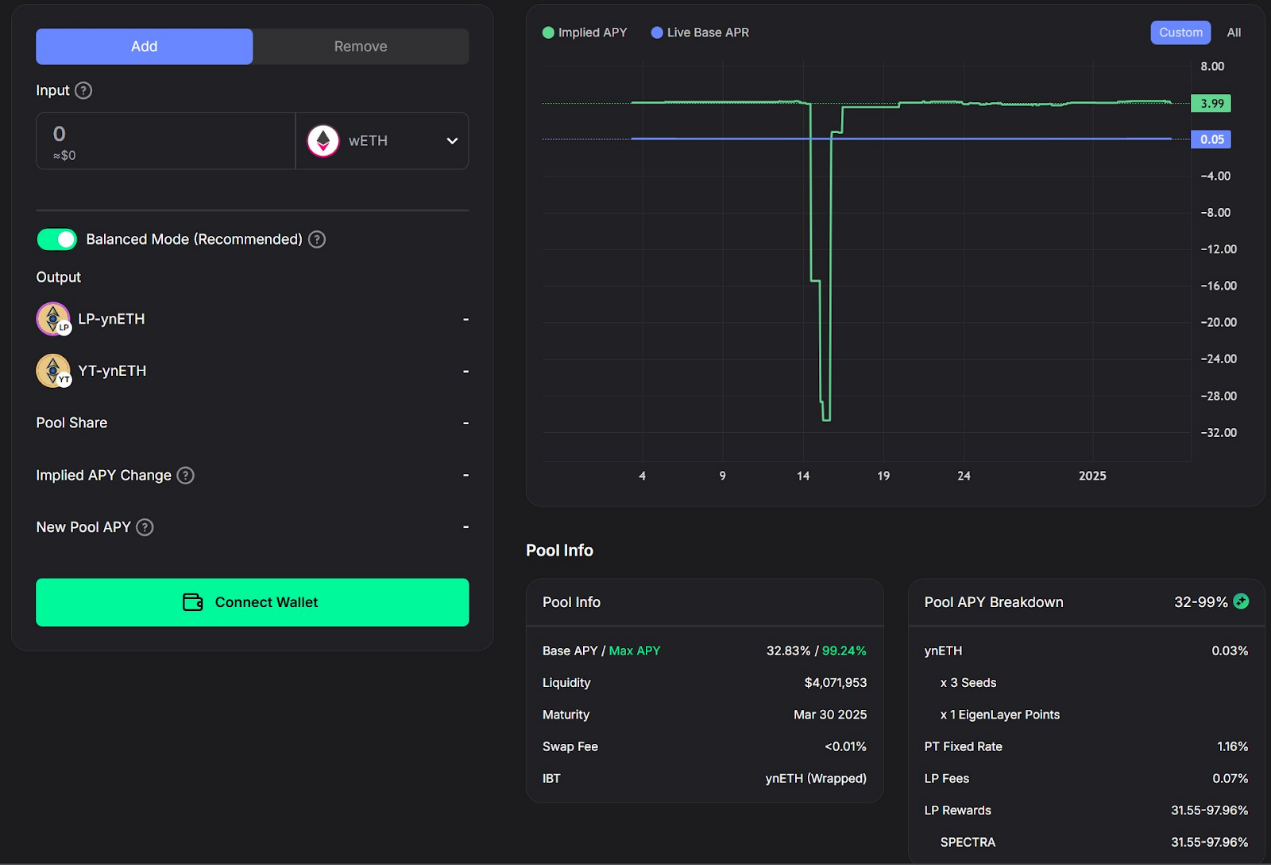

ynETH

Spectra is a competitor of Pendle, and although it has generated some recent buzz with its USR pool, its launch of the ynETH pool also provides certain market opportunities.

At 0 boost, the APR is 33%, and with boost, the APR can reach 100%.

It's worth noting that holding/locking in SPECTRA might work out well if it becomes a true competitor, so adding some yield-enhancing exposure might not be so bad.

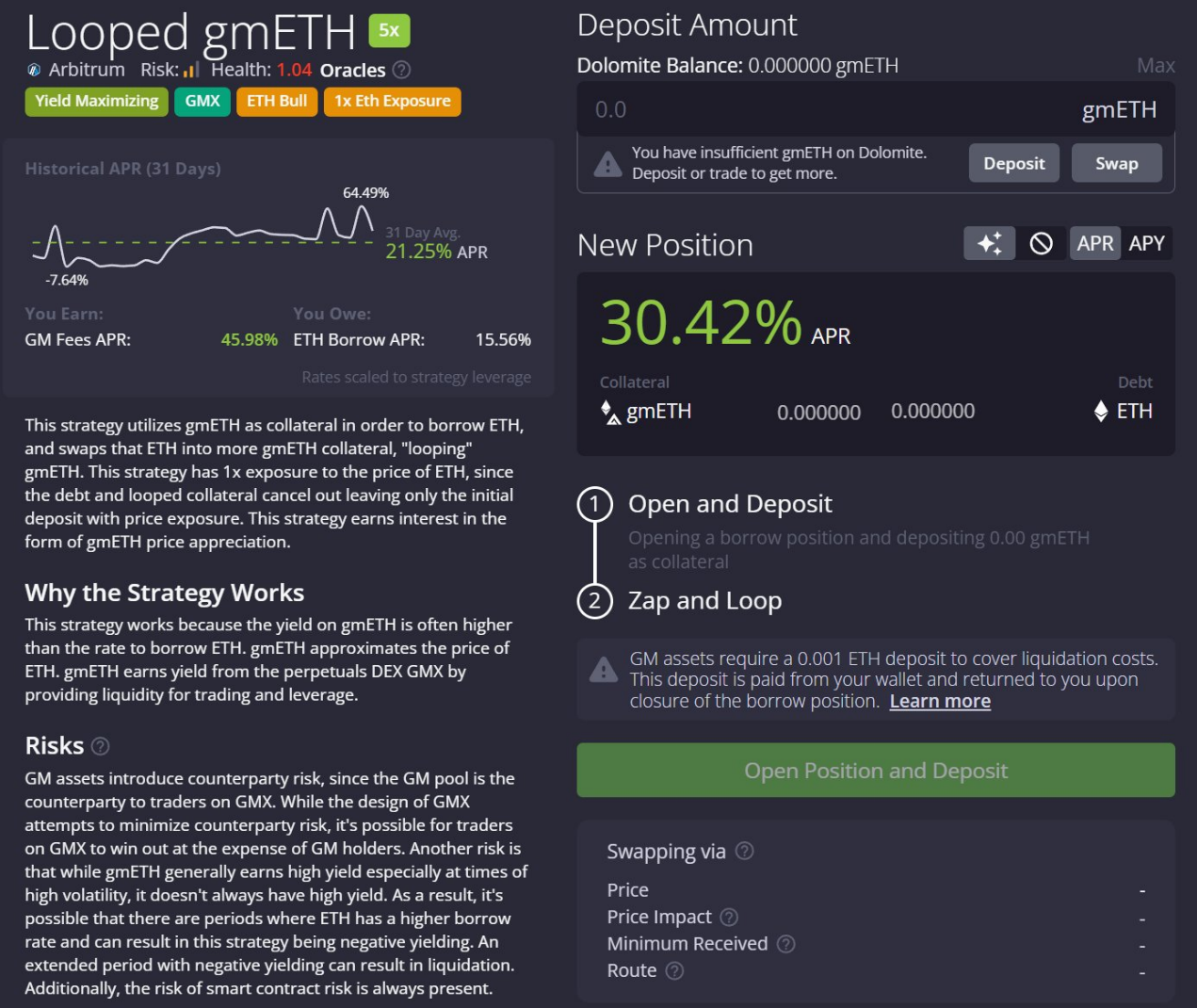

gmETH

This strategy is somewhat controversial, as gmETH has experienced principal losses.

gmETH is the so-called "Counter Party Vault". When traders on GMX receive excess returns, it will fall relative to ETH. Vice versa is also the norm in the past.

You can implement this strategy in Dolomite, where the current annual interest rate is about 30%, and the historical average annual interest rate is about 20%.

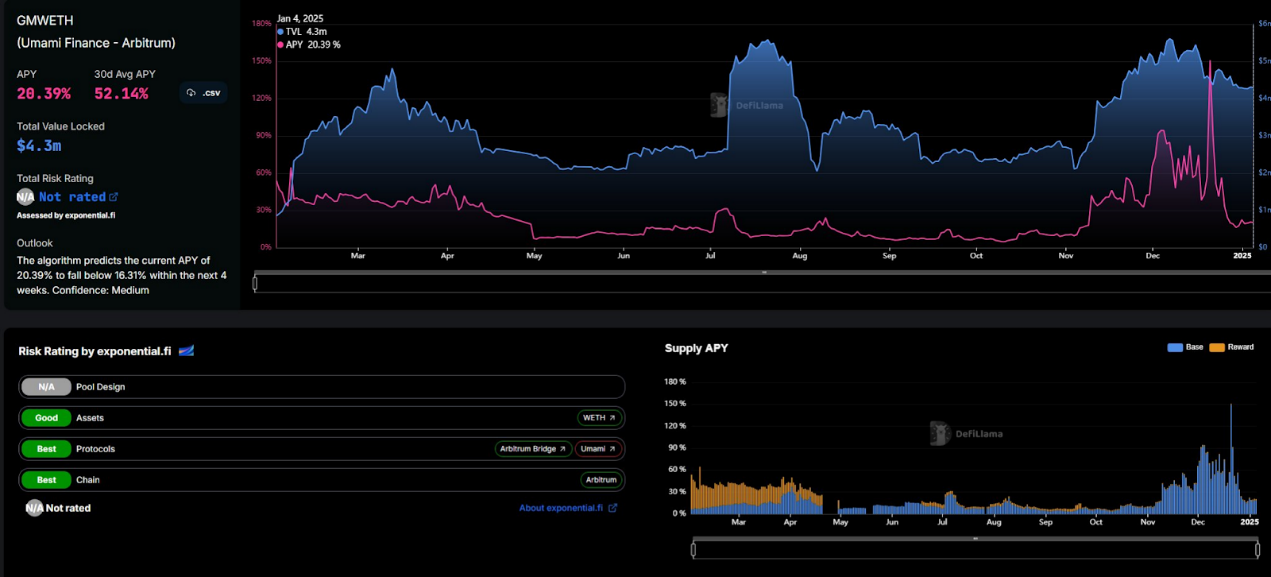

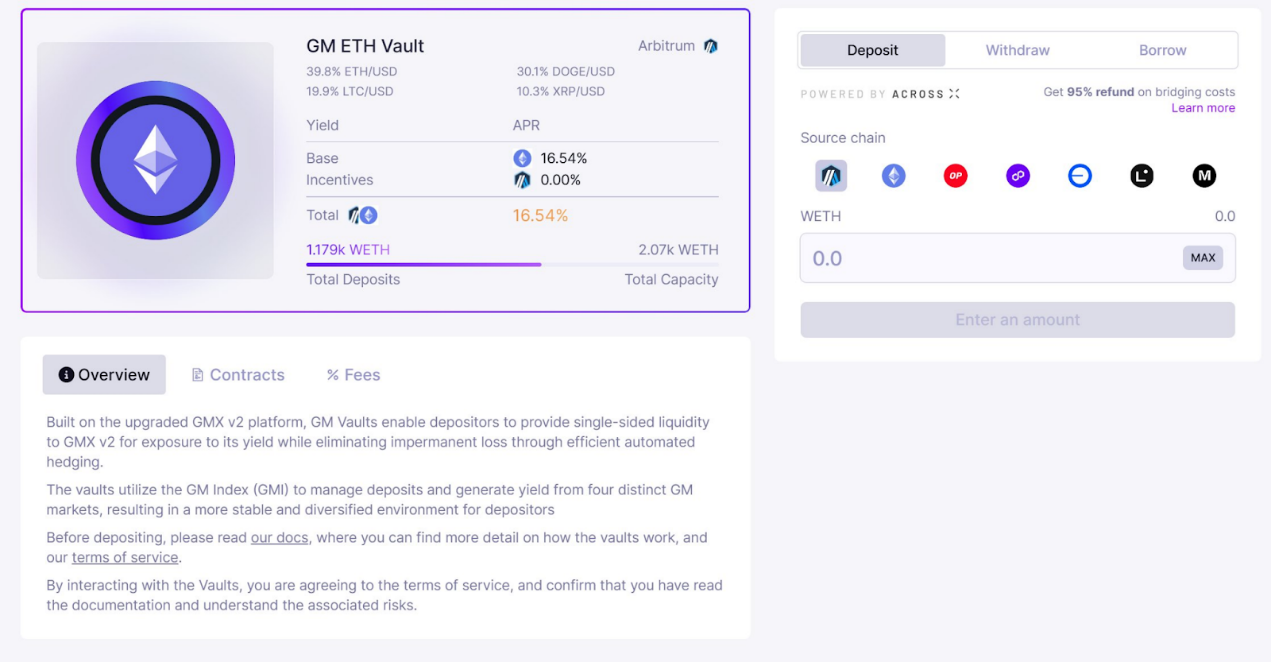

GMWETH ( Umami )

This strategy is very similar to the previous position, but it hedges most of the delta and risk.

While the current APR is around 16.5%, it has historically been quite high (around 50%), and in the mid-term future, the average APR will be over 20%.

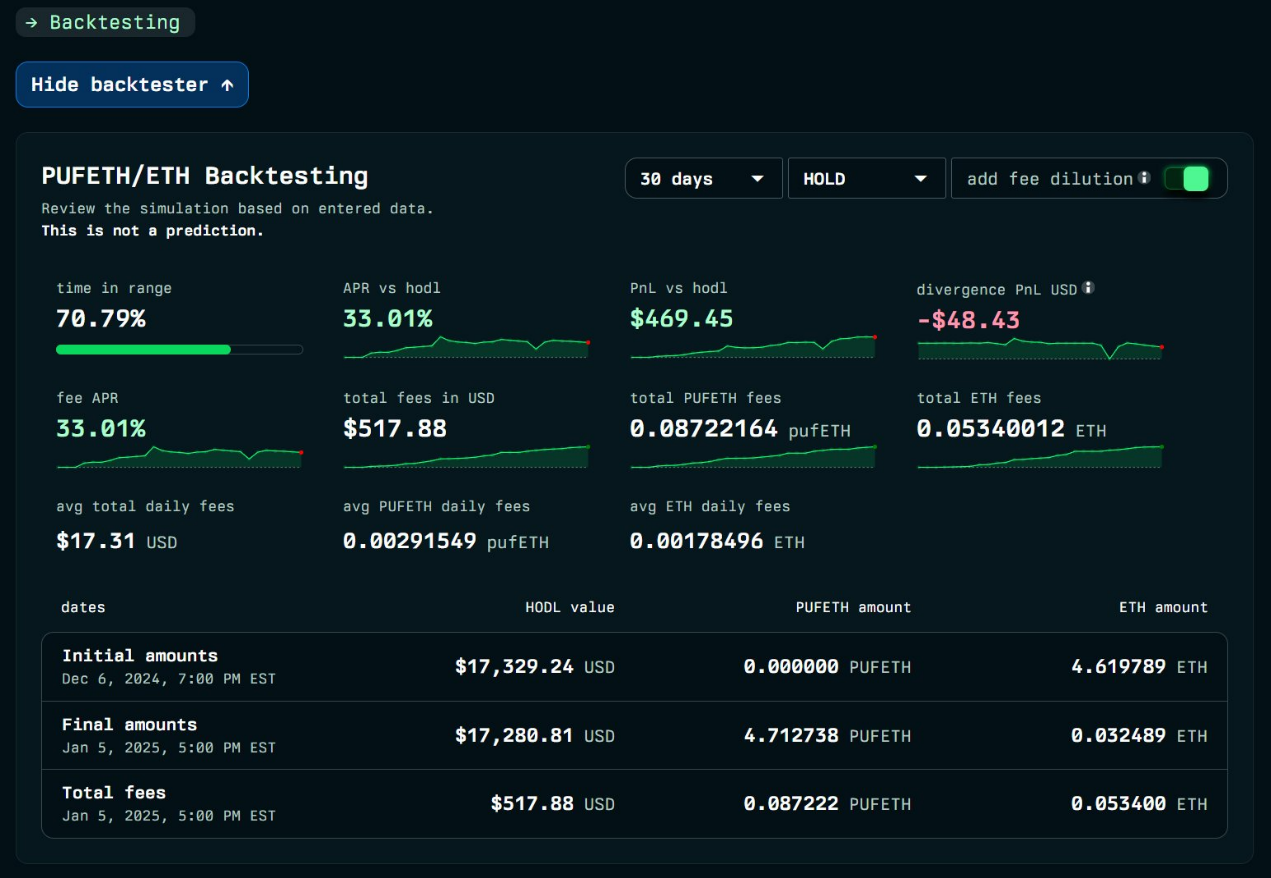

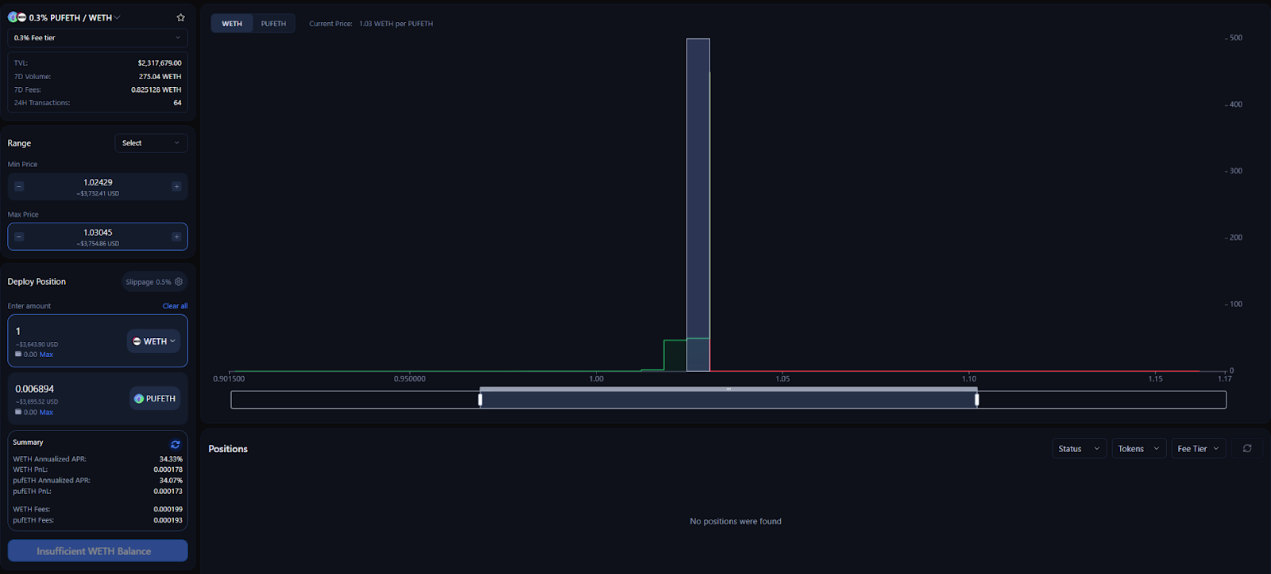

pufETH

Despite more competition of late, pufETH has long been a gold mine. This LP (30bps fee tier) has historically had an APR between 15-50%, with minimal rebalancing.

It's like a hidden gem, although it won't be there forever.

Sustainable and scalable ETH yields >20% are uncommon.

You can find some smaller but still incredible opportunities in places like D2LFinance, but when it comes to smaller positions for smaller gains, it's self-defeating to make them too public.

Related reading: An article taking stock of the seven major DeFi staking platforms in 2025: How to maximize returns?