How much has MicroStrategy spent on BTC in the past two months?

Reprinted from jinse

12/19/2024·6MAuthor: David Canellis, Blockworks; Compiler: Tao Zhu, Golden Finance

Stablecoins are bringing more liquidity to cryptocurrencies as debate rages over whether Saylor is a once-in-a-lifetime financial genius or just another overleveraged trader.

At least, that's in terms of the raw dollar value currently pumped into the space.

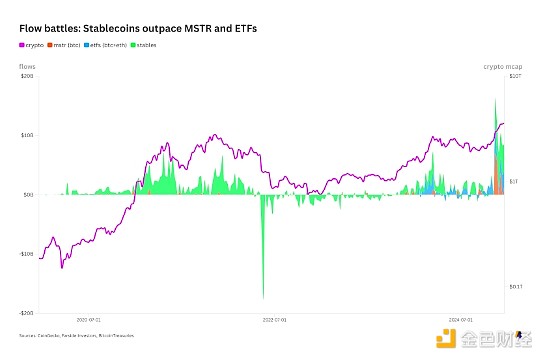

In the past two months alone, MSTR has spent $17.5 billion on Bitcoin , as shown in the orange area below. Most of the cash came from buyers of zero- interest convertible bonds.

A MicroStrategy purchase can simply be viewed as accepting dollars with one hand and exchanging them for Bitcoin with the other. Fast and cheap liquidity in exchange for risk exposure.

During the same period, net inflows into U.S. Bitcoin ETFs increased by $16.5 billion. The ETH ETF saw a net increase of $3 billion, and these flows are shown in blue on the chart.

ETFs follow much the same process as MicroStrategy, but without the bonds. They use investors ' cash to buy equal amounts of Bitcoin or Ethereum, passing the exposure onto shareholders, minus fees.

Stablecoins, MicroStrategy’s Bitcoin purchases and ETF inflows converge in November

Then there are stablecoins. Since mid-October, stablecoin issuers have minted a total of $30.8 billion in tokens. More than 92% of the funds flowed to USDT and USDC.

In addition to Sky's USDS and the more exotic alternatives that have emerged (such as Ethena's USDe and Usual's USD0), stablecoin managers typically take U.S. dollars, buy short-term Treasury bills and other cash equivalents, and then issue them to anyone who wires them, etc. amount of new tokens to supply them with cash.

Clearly, stablecoin flows are not actually the same as ETF inflows or the cash pipeline of MSTR.

But they do represent something similar: a common impulse to enter the cryptocurrency market through multiple routes.

Liquidity over the past nine weeks has reached nearly $68 billion—certainly the largest liquidity wave on record.

chaincatcher

chaincatcher

panewslab

panewslab