Haedal Protocol analysis: No. 1 seed player of Sui liquid pledge track, TVL crushes competition

Reprinted from panewslab

04/28/2025·16DAuthor: nicoleliu.eth

Compiled: Tim, PANews

PANews Editor's Note: Sui ecological liquidity staking agreement Haedal will be TGE on April 29, and users can receive airdrops. The author of this article is a founding partner of Comma3 Ventures, an institution that has participated in the seed round investment of Haedal Protocol. Haedal Protocol is a hidden gem project in the liquid staking field in Sui ecosystem. As the Sui pledge market is ready to go, Haedal's innovative products and strong data make it one of DeFi's preferred investment targets.

Here are the reasons worth investing and the key points you need to pay attention to 👇 (All data as of April 15)

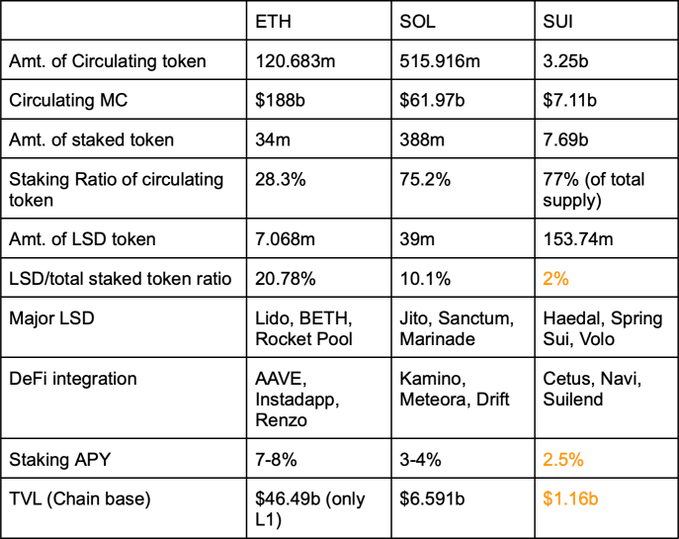

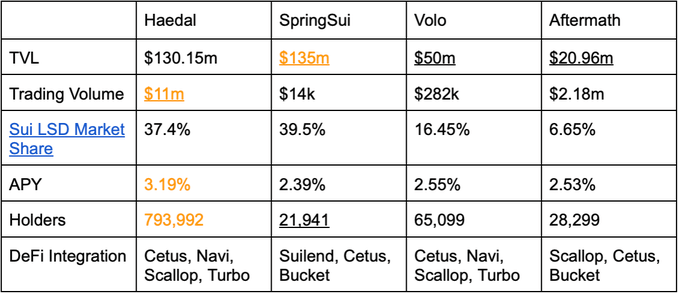

The liquid pledge market of Sui Network is not yet prosperous, with the total value of pledged SUIs being US$307.48 million, of which only 2% are liquid. In contrast: 10.1% of the total value of US$4.29 billion pledged SOL in the Solana network is liquid; 30.5% of the total value of US$10.25 billion pledged ETH in the Ethereum network is liquid. With the development of the Sui ecosystem, the Haedal pledge agreement with TVL currently with a TVL of US$120 million is expected to become the leader in mobile pledges of the ecosystem.

A major problem with Sui's liquid staking derivatives market is that its annualized staking yield is low, about 2.5%, while Solana's APY is 7-8%, and Ethereum's 3-4%.

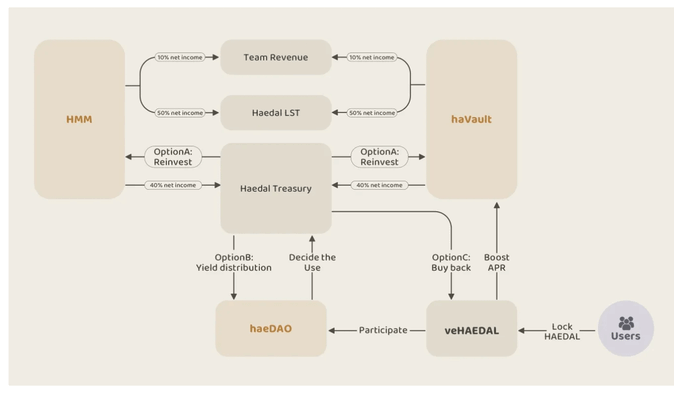

Haedal has significantly improved the staking performance of Sui network by adopting a dynamic validator selection mechanism and an innovative Hae3 framework: including three major components: HMM, HaeVault and HaeDAO, and its performance exceeds other LSD protocols.

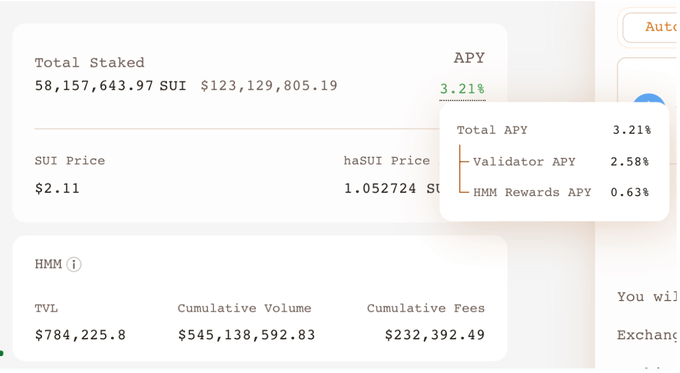

Haedal monitors the status of all network verification nodes and selects the node with the highest APR when staking. When canceling the stake, Haedal will give priority to withdrawing funds from verification nodes with lower APR. This strategy can continuously ensure that liquid staking tokens maintain high annualized yields.

HMM (Haedal Market Maker) optimizes the liquidity of each DEX on the Sui blockchain by combining oracle pricing and real-time market data, and charges a 0.04% transaction fee.

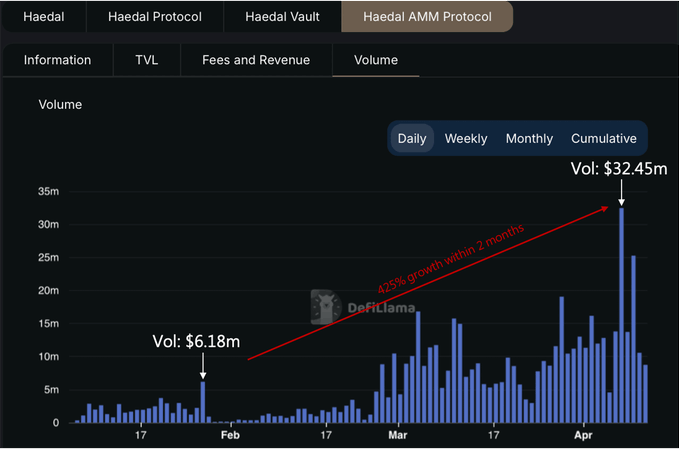

From February to March, transaction volume grew from $59.13 million to $284.15 million, incurring $236,000 in fees, with an average TVL of $800,000 during the period. After using 50% of revenue to incentives, haSUI's annualized rate of return increased by 24.4%, from 2.58% to 3.21%.

Cetus Protocol is the largest DEX in the Sui ecosystem, with daily trading volume of $92 million. Haedal was launched on January 6, 2025, and its current daily trading volume is US$5.69 million, equivalent to 6.12% of Cetus' trading volume. By adopting the oracle pricing mechanism, HMM is ready to achieve rapid revenue growth by capturing arbitrage trading volume.

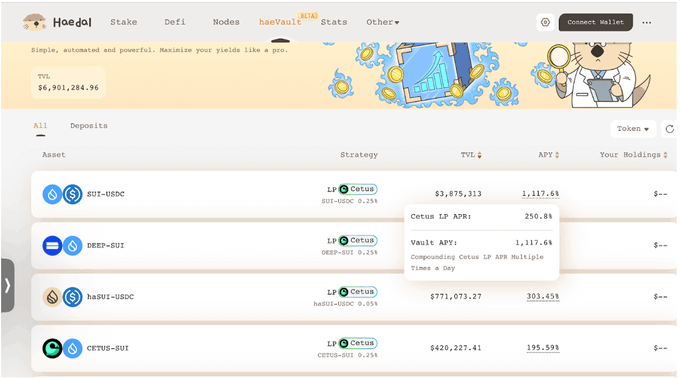

Haedal Vault simplifies the liquidity supply process for users with idle

funds, eliminating the tedious operation of managing LP positions, allowing

users to easily deposit funds and obtain higher returns.

Haedal Vault simplifies the liquidity supply process for users with idle

funds, eliminating the tedious operation of managing LP positions, allowing

users to easily deposit funds and obtain higher returns.

HaeVault improves profits through an ultra-narrow rebalancing strategy. Taking the SUI-USDC trading pair as an example, the annualized yield provided by the Cetus platform is 250.8% (based on Cetus data), while HaeVault achieved an annualized yield of 1117%. After deducting 16% of fees, the net yield is still as high as 938%.

Hae3 is deeply integrated into the Sui DeFi ecosystem (TVL exceeds US$1 billion). Among them, the HMM protocol captures the DEX fee income, the Haedal vault optimizes the liquidity provider income, and HaeDAO grants governance decision-making power.

Volo and Suilend, which focus on basic staking and lending businesses, lack this synergy, which makes Haedal a better return optimizer.

The use cases of HAEDAL tokens further consolidate their application value. Lock it as a veToken, can participate in HaeDAO governance, or be used to increase the annualized rate of return of the vault. In addition, potential airdrop opportunities (which are very common in the Sui ecosystem) also add additional advantages.

Haedal's core indicators performed strongly: TVL reached $117.36 million (compared with Suilend's $117.4 million and Volo's $50 million), with more than 44,000 daily active wallets and 794,000 holders. Currently, Haedal is temporarily leading the way in three key indicators: trading volume, annualized yield and holder size.

The support of VC organizations such as Hashed, Comma3, OKX Ventures, and Animoca Brands further illustrates its potential.

Haedal stands out with its high-growth market (LSD penetration is only 2%, with 10x upward potential), innovative products and solid fundamentals. With the expansion of Sui ecosystem, the agreement is well positioned in the field of liquidity staking and is expected to become an industry leader.

chaincatcher

chaincatcher