Golden Web3.0 Daily | Walmart and Amazon are planning to issue stablecoins

Reprinted from jinse

06/13/2025·1DDeFi data

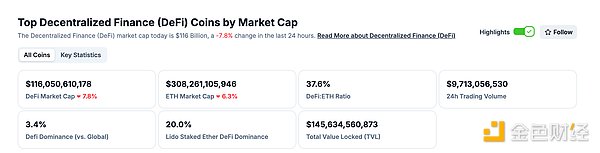

1. Total market value of DeFi tokens: US$116.05 billion

DeFi total market value data source: coingecko

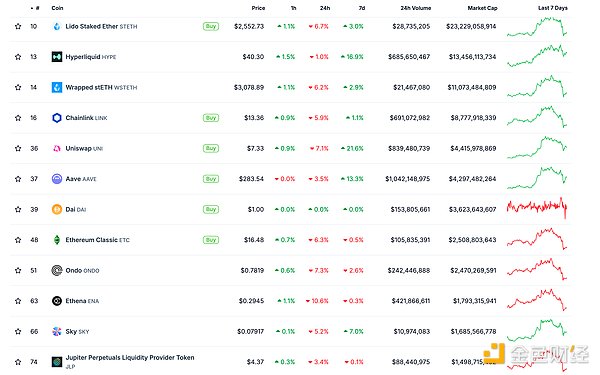

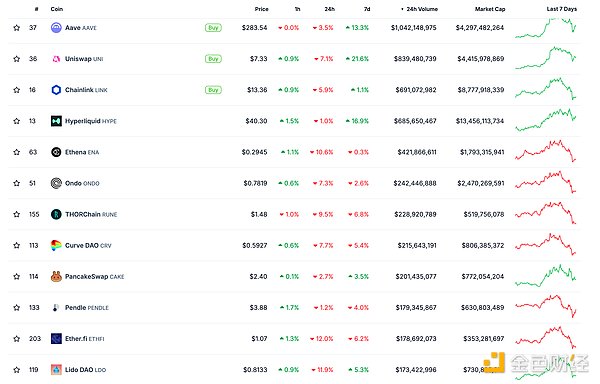

2. The trading volume of decentralized exchanges in the past 24 hours was US$9.713 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

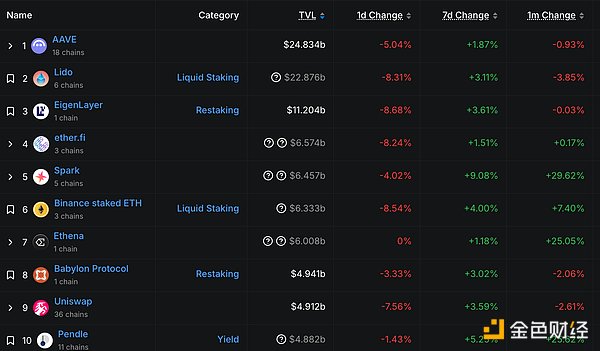

3. Locked assets in DeFi: US$111.203 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

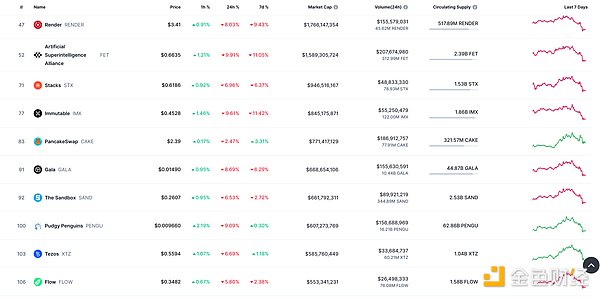

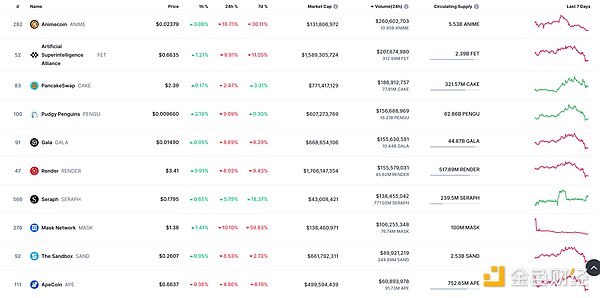

1.NFT total market value: US$18.072 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.947 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

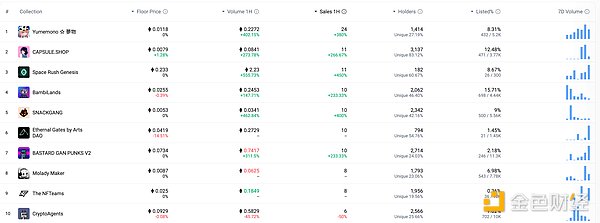

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Walmart and Amazon are planning to issue their own stablecoins

According to the Wall Street Journal, Walmart and Amazon are exploring the issuance of their own stablecoins in the US market, or for payment and settlement in their own merchant ecosystem. The move could transfer large amounts of cash and card swipe transactions out of the traditional financial system, reduce billions of dollars in handling fees and speed up payments, according to sources.

MEME hot spots

1. A PEPE giant whale is suspected to sell 609 billion PEPEs that it built a position a month ago, worth US$6.43 million

According to the monitoring of the on-link analyst @ai_9684xtpa, PEPE giant whale 0x6ea...41FE0 is suspected to sell 609 billion PEPEs that were built a month ago, worth US$6.43 million. If sold, it will lose US$1.185 million. The giant whale proposed 2.2 trillion PEPE (US$27.63 million) from the exchange at an average price of US$0.0000125 during the period from 05.17 to 05.18. It is currently suspected to have cut 160 million of losses and lost US$2.042 million.

2. A whale deposited $6.55 million worth of PEPE into Binance again, and its overall position loss was $3.26 million.

According to OnchainLens monitoring, a giant whale deposited 609 billion PEPEs into Binance, worth about 6.55 million US dollars. The giant whale deposited a total of 1.6 trillion PEPEs into Binance, worth about $18.1 million, and faced a loss of about $3.26 million. The wallet still holds 600 billion PEPE pieces, worth about $6.39 million.

DeFi hotspots

1. The Ethereum Foundation transfers 1,000 ETH to the relevant address

According to Golden Finance, according to PeckShield monitoring, the Ethereum Foundation has transferred 1,000 ETHs (worth about US$2.5 million) to the relevant address 0xc061...0B6d.

2. The ETF Store President: I firmly believe that BlackRock will eventually apply for spot XRP ETF

Golden Finance reported that Nate Geraci, president of The ETF Store, said he firmly believes that BlackRock will eventually apply for spot XRP ETFs, and Geraci pointed out in his recent comments that BlackRock has always been leading the way in terms of Bitcoin and Ethereum ETFs, so it has no reason to let other companies take the lead in terms of XRP or Solana. He also expects BlackRock to launch an exponentially encrypted ETF. It is worth noting that the industry commentator has also recently stated that the Grayscale Digital Large Cap Fund, which includes XRP, could become the next approved ETF. Geraci's recent comments came after a series of early predictions. As early as March 2025, he said that BlackRock may submit an application immediately once the legal war between Ripple and the SEC is over. At the time, he believed that major institutions like BlackRock and Fidelity would not want other companies to dominate the growing altcoin ETF space. Meanwhile, last month, he also highlighted a milestone that could support spot XRP ETFs: the launch of regulated XRP futures on the Chicago Mercantile Exchange. Geraci believes this is an important step to make XRP ETFs more likely to achieve, as futures contracts often pave the way for spot ETF applications.

3. Encryption Intent Engine Protocol Enso Token Sales have been launched on CoinList

On June 13, according to official news, Enso token sales of Enso protocols have been launched on CoinList. Users can log in to the sales page to purchase tokens. According to the official website, Enso is an encrypted connection layer and intent engine that connects all ecosystems to a network, allowing application developers and users to express their desired results as intent, so that they can build truly composable applications without building manual integration.

4.Spark announces that the first phase of the Ignition airdrop program qualification inspection tool has been launched

According to Golden Finance, according to Spark's official social media disclosure, DeFi project Spark announced that the first phase of the Ignition airdrop plan qualification inspection tool has been launched.

5. The US SEC formally abolished the severe proposals for DeFi and hosting proposed by the Gary Gensler era

According to crypto journalist Eleanor Terrett, the U.S. Securities and Exchange Commission (SEC) has just officially abolished the extended custody rules proposal and rules 3b-16, as well as other rules from the Gensler era. The Custody Rules aim to cover all client assets, including cryptocurrencies, expand the definition of “custody” and raise concerns about whether certain state charter entities should be identified as qualified custodians. Rule 3b-16 proposes to treat decentralized finance (DeFi) exchanges/platforms as national stock exchanges for supervision. The SEC also abandoned its proposal to require listed companies to comply with enhanced environmental, social and governance (ESG) reporting requirements.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

chaincatcher

chaincatcher