Golden Web3.0 Daily | US SEC ends investigation of Yuga Labs

Reprinted from jinse

03/05/2025·3MDeFi data

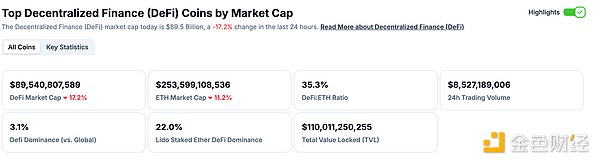

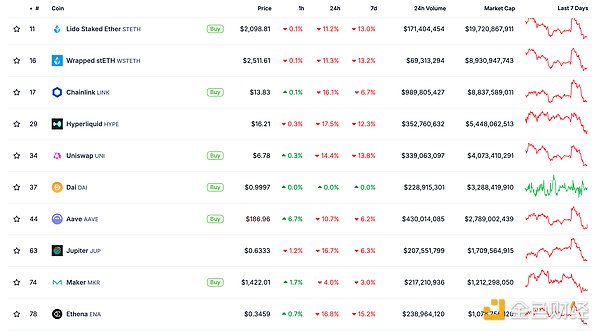

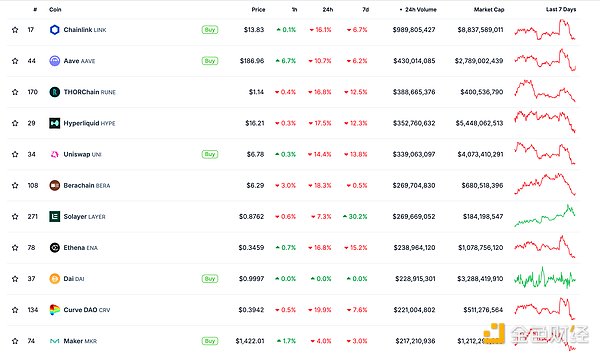

1. Total market value of DeFi tokens: US$89.54 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$8.527 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

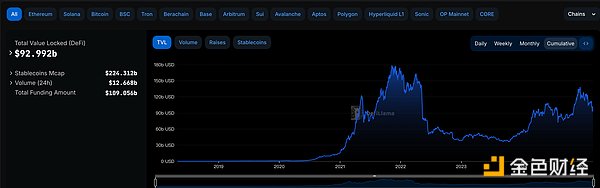

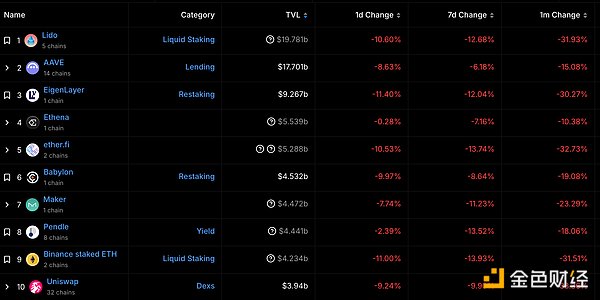

3. Locked assets in DeFi: US$92.992 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

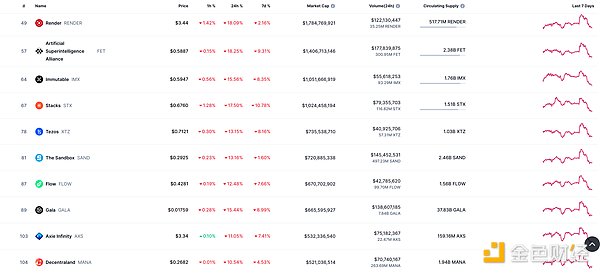

1.NFT total market value: US$18.906 billion

NFT total market value and market value top ten projects data source: Coinmarketcap

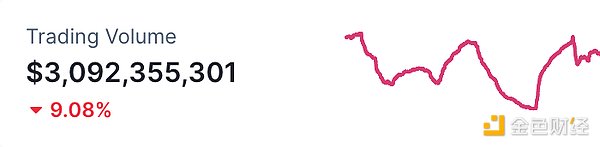

2.24-hour NFT trading volume: US$ 3.092 billion

NFT total market value and market value top ten projects data source: Coinmarketcap

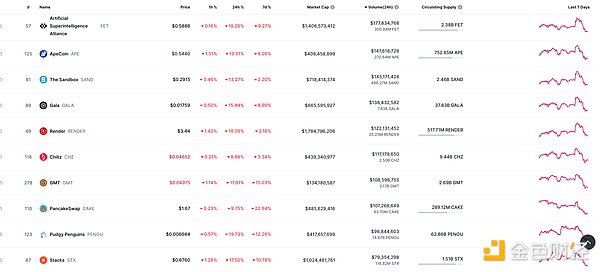

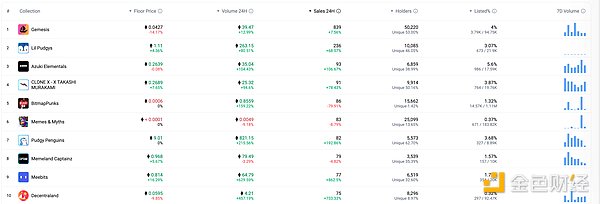

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

US SEC ends investigation into Yuga Labs

Yuga Labs' X account posted, "The SEC has officially concluded its more than three-year investigation into Yuga Labs. This is a major victory for the NFT industry and all creators who are driving ecological development, further confirming that NFT is not a securities."

MEME hot spots

1. WIF breaks below $0.6

According to Golden Finance, the market shows that WIF has fallen below $0.6 and is now at $0.59, with a 24-hour decline of 23.38%. The market fluctuates greatly, please do a good job in risk control.

2. Data: Giant whale, which lost tens of millions of dollars on tokens such as PEPE and BEAM, turned to buying BTC and MKR

According to OnchainLens monitoring, a whale lost $853,000 again on ONDO after losing $14.14 million in PEPE and BEAM. It has since spent 5.33 million DAIs to buy 63.42 WBTC for $84,150 and 1,087.32 MKR for $1,416 using wstETH worth $1.53 million.

DeFi hotspots

1.Tether 's asset tokenization platform Hadron now supports Bitcoin L2 network Liquid

According to Golden Finance, according to Tether CEO Paolo Ardoino, Tether's digital asset tokenization platform Hadron, now supports asset tokenization on the Liquid Bitcoin Layer 2 network.

2. Hyperliquid mainnet validator set will be fully delicensed, set N to 20 and gradually increase

According to Golden Finance, Hyper Foundation announced on X that the Hyperliquid main network's validator set will be fully delicensed after the next network upgrade. Similar to the test network, the top N validators ranked by stake will form an active set. The initial N is set to 20 and will gradually increase over time. In addition, Hyperliquid has now launched the Delegation Program, which aims to enhance network security and decentralization and supports validators committed to ecological development. The official suggests that verifiers should be familiar with the test network and understand the relevant technical details before running the main network node. It is worth noting that the 10,000 HYPE self-delegated stake will be locked by the agreement for one year, and this lock will still apply even if the validator fails to enter the active set. Hyper Foundation strongly recommends that validators apply to participate in the commissioned program before running the mainnet node.

3. Trust Wallet officially integrates Sonic public chain to expand the DeFi ecosystem

On March 4, Trust Wallet fully integrates the Sonic (S) public chain, and users can now conveniently manage assets on the Sonic chain in their wallets, including sending, receiving and storing native S tokens and tokens issued based on Sonic. This integration not only optimizes the user experience of Trust Wallet, but also enhances the interoperability of the Sonic ecosystem and expands its application scenarios in the DeFi field. Sonic is the new generation of Layer-1 blockchain, created by DeFi godfather Andre Cronje and his team. It inherits the technical advantages of the Fantom ecosystem, has high throughput, low transaction costs, is compatible with EVM, and supports final confirmation in less than a second. It has a TPS of up to 10,000 and is designed for DeFi, chain games and innovative financial applications. Trust Wallet, as the world's leading non-custodial wallet, supports 140 public chains and has 200 million downloads. This integration not only accelerates the expansion of the Sonic ecosystem, but also consolidates Trust Wallet's leading position in the crypto market. Through this cooperation, Trust Wallet users will be able to seamlessly experience the DeFi protocol and new digital assets in the Sonic ecosystem, further broadening the application boundaries of decentralized finance.

4. Argo Blockchain signs a $40 million financing agreement to support it in M &A transactions

According to Golden Finance, Argo Blockchain, a Nasdaq-listed Bitcoin mining company, announced that it has signed a priority guaranteed convertible loan agreement with a financing scale of US$40 million. The initial financing amount is US$15 million, and the remaining US$25 million will be completed in the next 18 months. Three multinational institutions will participate in the investment (the specific organization name information has not been disclosed at present) and will join the Argo board of directors. The new funds will be used to expand its Baie Comeau mining facilities, enhance its balance sheet and conduct a series of potential mergers and acquisitions.

5.Onyx announces the launch of Layer1 blockchain Goliath

According to Golden Finance, Onyx announced the launch of the Layer1 blockchain Goliath, designed specifically for financial institutions, which will provide "comparable transaction speeds to networks such as Visa." It is reported that Visa can process 24,000 transactions per second. Goliath will use the Proof of Stake (PoS) consensus mechanism to support high-speed transactions. According to the announcement, the project is built on XCN Ledger. Onyxcoin has used it as a Layer-3 rollup solution in the Onyx ecosystem. Goliath will operate as a standalone Layer-1 blockchain, but will remain interoperable with existing financial networks. Additionally, Onyx has set key milestones for the project. The test network will be deployed in the third quarter of 2025, while the main network will be released in early 2026.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

panewslab

panewslab