Golden Web3.0 Daily | Texas pushes forward Bitcoin Reserves Act

Reprinted from jinse

03/10/2025·2MDeFi data

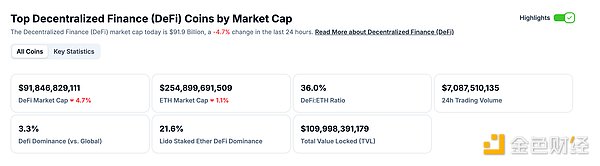

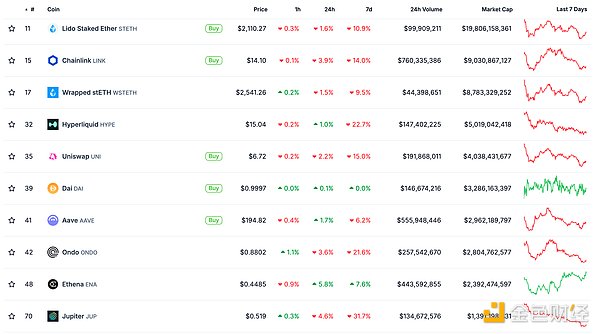

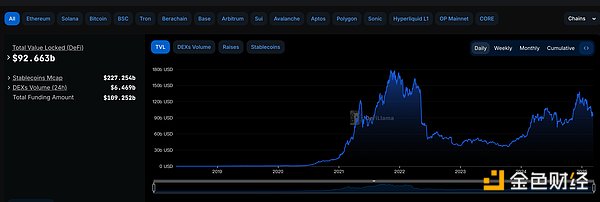

1. Total market value of DeFi tokens: US$91.846 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$7.087 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

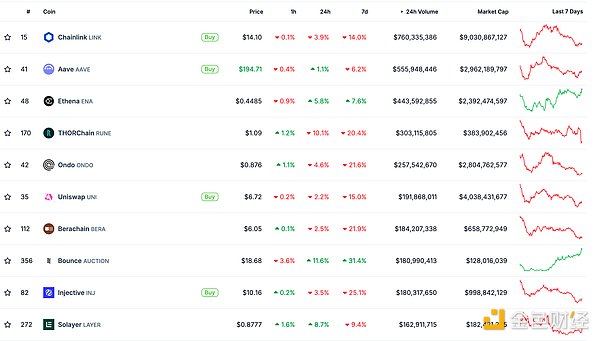

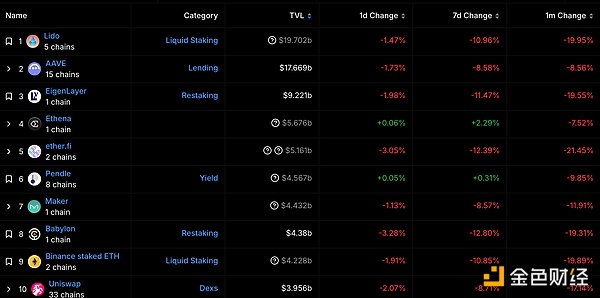

3. Locked assets in DeFi: US$92.663 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

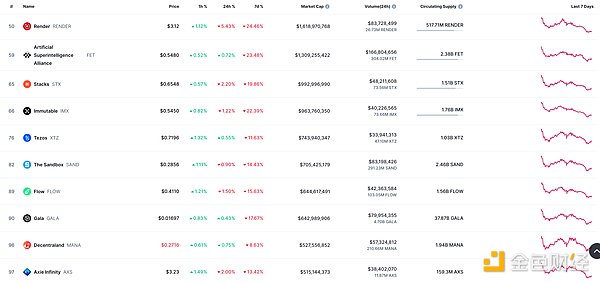

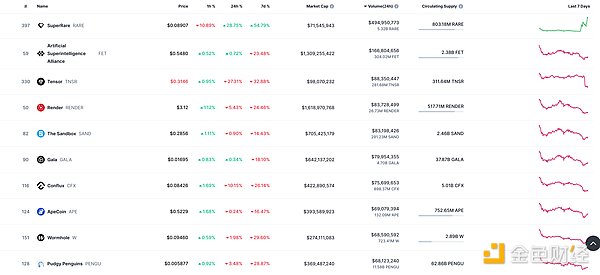

1.NFT total market value: US$17.911 billion

NFT total market value and market value top ten projects data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.759 billion

NFT total market value and market value top ten projects data source: Coinmarketcap

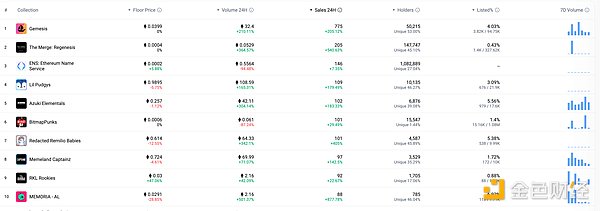

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Texas Senate advances Bitcoin Reserves Act with bipartisan support

The Texas Senate just passed Senate Bill 21 (SB-21) to win by a huge advantage, a big step in bringing digital assets into the national financial system. The Texas Senate voted 25-5 to pass the Texas Bitcoin Reserves Act, which allows the state to invest public funds in bitcoin and other digital assets. According to SB-21, the Texas Comptroller will manage Bitcoin reserves. The bill allows the state to hold digital assets with a total market capitalization of at least $500 billion. Currently, Bitcoin is the only asset that meets this requirement. Funding will come from legislative appropriations as well as private and corporate contributions. The bill also sets up the Strategic Bitcoin Reserve Advisory Committee, which will oversee investments and publish reports every two years to ensure transparency and accountability.

MEME hot spots

1. Industry insiders: The threshold for issuance of "meme coins" is extremely low, and most of them lack technical support.

According to Golden Finance, recently, Manus, known as the "world's first universal intelligent product", was quickly "out of the circle", and its popularity spread rapidly, and the invitation code was once speculated to tens of thousands of yuan. With the popularity of Manus, a number of tokens of the same name in the cryptocurrency market have also appeared in the cryptocurrency market. The price has risen sharply in a short period of time. Some have risen by more than 900%, while others have fallen by 95% in just 3 hours and prices have almost returned to zero. Ji Yichao, co-founder and chief scientist of Manus, immediately clarified that Manus has never participated in cryptocurrency projects, token issuance or blockchain initiatives. An industry insider told reporters that the issuance threshold of "meme coins" is also extremely low. "Now there are many platforms for issuing coins with one click." Zhao Wei, a senior researcher at OKX Research Institute, told reporters that most meme coins lack technical support and community foundation, and eventually lose liquidity due to insufficient market recognition. This type of meme coins that rely on short-term speculation have extremely low survival rates and extremely high investment risks.

2. The WLFI portfolio has currently lost US$110 million, with ETH accounting for 65% of the entire portfolio

According to Golden Finance, according to on-chain analyst Ember Monitor, WLFI's portfolio has currently lost $110 million, and the nine tokens purchased for $336 million are now worth only $226 million. Because ETH accounts for 65% of the entire portfolio, it loses the most: ETH average cost is $3,240, and now it costs $2,000. The loss was as high as US$80.85 million (-37%). The least fall was TRX: it only fell 5% after buying from WLFI.

DeFi hotspots

1. Sony L2 Network Soneium launches Web3 entertainment robot NFT aibo

According to Golden Finance, Soneium, a subsidiary of Sony, launched the Web3 entertainment robot NFT aibo on Opensea, which has now opened Mint, and aibo is an exclusive official authorized SBT collection series.

2.CertiK: A random call vulnerability was detected on Arbitrum, and the hacker has stolen about $140,000

Golden Finance reported that blockchain security company CertiK issued an early warning that its security team detected multiple suspicious transactions on the Arbitrum network. An attacker with the address 0x97d8170e04771826a31c4c9b81e9f9191a1c8613 may have used any call vulnerability to bypass signature verification and stole about $140,000 from multiple unverified exchange adapter contracts.

3.Solana Prediction Market Takes.fun Test Network Ended

Golden Finance reported that Solana forecast market takes.fun tweeted that it has ended the test network test. The team has adopted all feedback and will be launched on Solana soon. Previous news, takes.fun has been launched on the test network. Users can create opinions and transaction opinions and turn on “Agree” or “Disagree” voting. When the user selects it, 20% of the investment amount will be deducted from the liquidity on the other side.

4. Ethereum has potential on-chain clearing at $128 million at $1919

According to DefiLlama data, Ethereum has a potential on-chain liquidation of US$128 million at US$1919.266. Among them, the main one is the liquidation of the MakerDAO agreement, with a scale of US$127.8 million.

5. The Ethereum Foundation Board of Directors updates personnel appointments and removals, Hsiao-Wei Wang joins the board of directors

On March 10, the Ethereum Foundation issued a statement to announce new personnel appointments and removals, and Hsiao-WeiWang will join the board of directors of the Ethereum Foundation. Current board members include AyaMiyaguchi (Chairman), Vitalik Buterin (Founder), Patrick Storchenegger (Swiss Legal Counsel), and Hsiao-WeiWang (Co-executive Director). During this adjustment, the board will share more latest updates on its role and functions in the Ethereum Foundation.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

panewslab

panewslab