Golden Web3.0 Daily | SEC and Ripple reach preliminary settlement agreement

Reprinted from jinse

04/15/2025·29DDeFi data

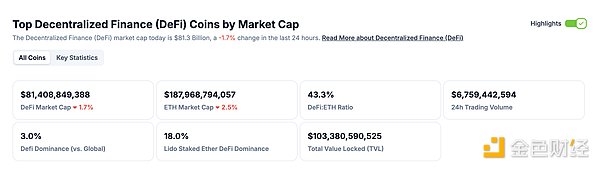

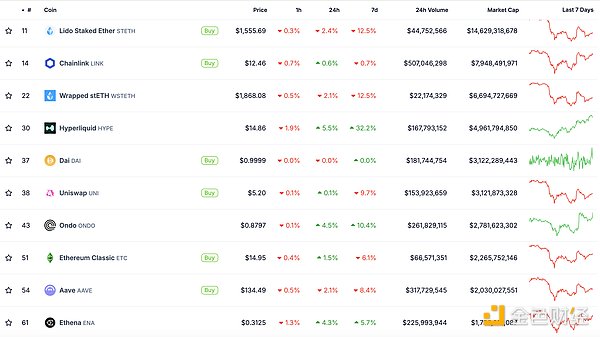

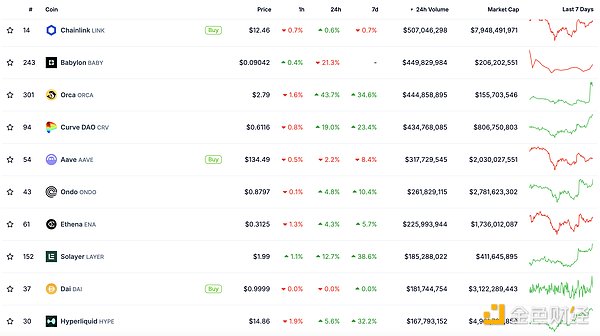

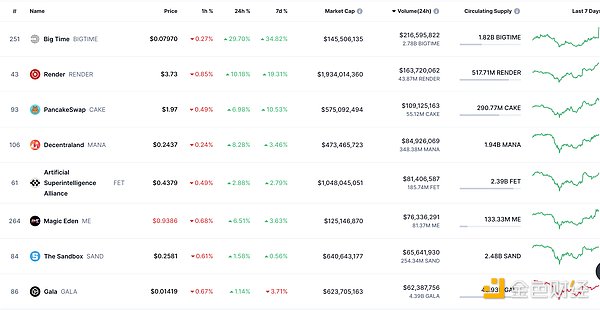

1. Total market value of DeFi tokens: US$81.408 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$6.837 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

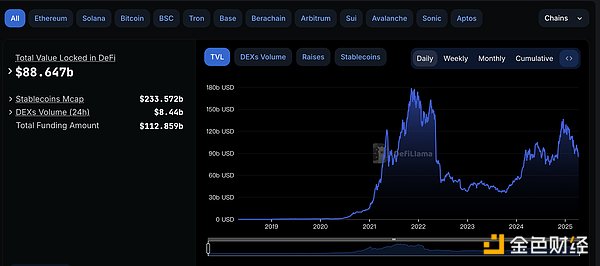

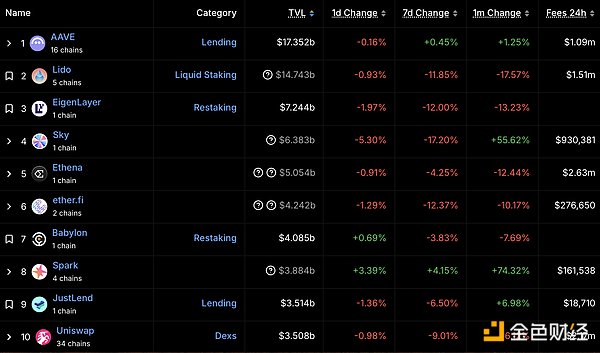

3. Locked assets in DeFi: US$88.647 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

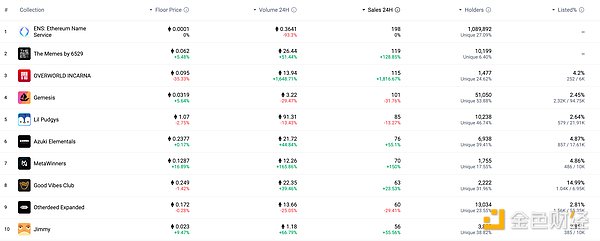

1.NFT total market value: US$15.939 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.142 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

SEC and Ripple reach preliminary settlement agreement, both parties apply to suspend the appeal process

According to former U.S. federal prosecutor James K. Filan, the SEC and Ripple have jointly submitted a motion to the U.S. Court of Appeals for the Second Circuit, applying to "abayance" the appeal and cross-appeal process of both parties, on the grounds that the two parties have reached a "principle settlement agreement" and are currently pending approval by the SEC committee. If approved, a confirmatory ruling will be applied to the District Court. The court has cancelled the original arrangement to submit defense materials on April 16. This motion marks the case may soon usher in a final settlement.

DeFi hotspots

1. The suspected Mantra DAO project party destroyed 18.417 million OMs worth about US$119 million

According to Arkham monitoring, the suspected Mantra DAO project party's address transferred 18.417 million OM to the destroyed address at 18:59 (UTC+8), which is worth approximately US$119 million based on the current price. As of now, the cumulative destruction of OMs has reached 103.6 million, accounting for 11.66% of the total supply, with a cumulative destruction value of approximately US$668 million.

2.Curve founder: once again extends the lock-up period of veCRV held to 4 years

According to Golden Finance, Curve founder Michael Egorov said on X that he has once again extended the lock-up period of his holding veCRV to 4 years and publicly extended the specific trading records of the lock-up.

3. BlackRock spot Ethereum ETF purchased 3,840 ETH on April 10

Golden Finance reported that BlackRock spot Ethereum ETF purchased 3,840 ETHs worth $6.4 million on April 10.

4. The 209th Ethereum ACDE Conference: Pectra client is expected to be released on April 21

According to Tim Beiko, the 209th Ethereum Executive Layer Core Developers Conference (ACDE) focuses on the upcoming Pectra and Fusaka upgrades. The Pectra client is expected to be released on April 21, adding the EIP-7702 delegation status to JSON-RPC. Fusaka, it is clearly stated that EIP-7823 (limiting MODEXP complexity), EIP-7825 (transaction gas limit) and EIP-7907 (contract code size measurement and limit increase); EIP-7762 and EIP-7918 will be adopted in the blob fee mechanism to balance resource utilization and market supply and demand.

5.Loopscale ends closed testing and is online

Golden Finance reported that the modular DeFi loan market Loopscale ended its 6-month closed test and went online. Loopscale is built on Solana and is supported by CoinFund, Solana Ventures and Coinbase Ventures.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.