Golden Web3.0 Daily | Musk appears on the cover of Time magazine

Reprinted from jinse

02/08/2025·3MDeFi data

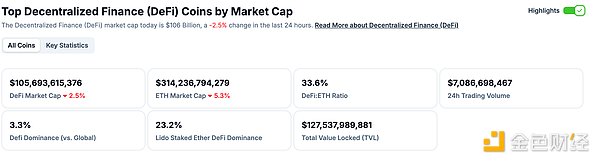

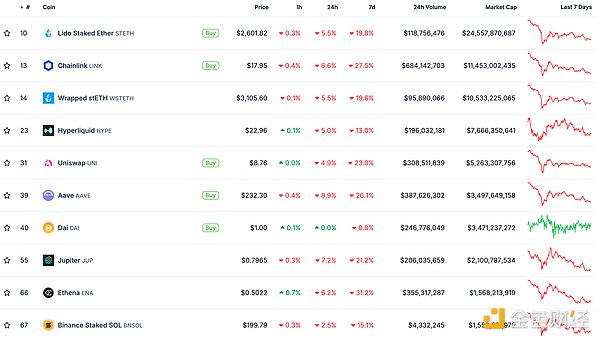

1. Total market value of DeFi tokens: US$105.693 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$7.086 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

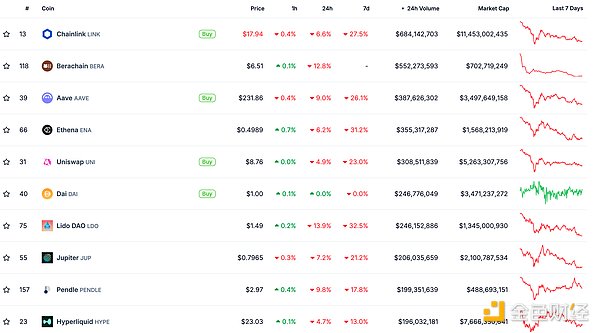

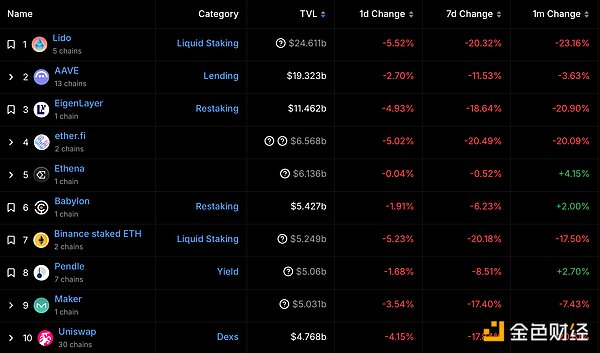

3. Locked assets in DeFi: US$104.619 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

1.NFT total market value: US$22.031 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.555 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

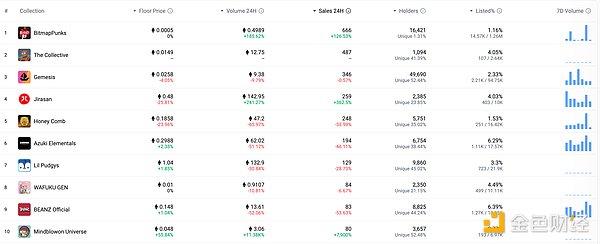

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Musk appears on the cover of Time magazine

According to February 8, Time magazine has included Elon Musk as the cover character in this issue and published an article "Elon Musk's War against Washington". Musk is in the cover, wearing a suit and sitting behind a luxurious wood-carved desk that symbolizes power (or imitate the firm table in the office of the US president). On the left side behind is the American flag and on the right side is the presidential flag, suggesting that Musk has been deeply bound to presidential power and American politics. According to the article: On one side, it is an institution with a 64-year history, a budget of $35 billion, and its mission is clearly stipulated by federal law; on the other side, it is a politically sabotaged team used by Musk to dismantle the federal bureaucracy. They call themselves members of the Ministry of Government Efficiency (DOGE), a group of temporary staff members without a charter, without a website, and without explicit legal authorization. Its power comes from Musk, the wealthiest man on the planet, who was given the task of dismantling most of the federal bureaucracy—cutting budgets, undermining civil service, and depriving independent institutions of the ability to hinder the president’s goals.

Game hot spots

1.Layer3 gaming network B3 will launch B3 tokens and perform airdrops on February 10

February 8 news, the Layer3 gaming network B3, built on Base, announced on Friday that it will launch its recently announced B3 token on February 10, accompanied by airdrop activity. Snapshots of network activities will be taken before the planned "S1 Airdrop", and there will be more airdrops, tournaments and gamifications to earn B3 in the future. According to posts on X platform, stakeholders of B3 will receive certain benefits, including tokens for a dedicated game chain, experience new games on the network ahead of time, and other potential rewards. The post also briefly introduces token economics: 34.2% of the token supply will be allocated to communities and ecosystems, 23.3% will be allocated to teams and consultants, 22.5% will be used to support the Player1 Foundation for the B3 ecosystem, and 20% will be reserved To investors. Tokens for investors, team members and consultants will have a lock-in period for one year before unlocking monthly for the next three years. The total supply of B3 has not been announced yet.

2. Telegram game TapSwap will launch token TAPS on BNB Chain

On February 8, TapSwap, a Telegram-based click-to-money game, announced that its upcoming TAPS token will be released on BNB Chain instead of the original TON network. The game was originally scheduled to complete token airdrops in late January, but recently said it had postponed the token release based on the recommendations of an unnamed "level one" decentralized exchange in a bid to find better market conditions. However, after completing the first season of the game on February 6, the project decided to advance the token release on BNB Chain, which is expected to take place on February 14, according to X posts earlier this week.

3. Report: Telegram game user retention rate hovers at 5-20%, far lower than the traditional game benchmark

According to Golden Finance, data analysis company Helika released a report saying that Telegram game user retention rate "hovered between 5-20%, far below the traditional gaming benchmark (20% to 30%)." The analytics also said the disappointing airdrop, especially the “Hamster Kombat” airdrop, caused the “excitement” of Telegram click-to-earning game to dissipate, and Hamster Kombat’s user base plummeted to 11 from 300 million in August after the airdrop 41 million in the month. "As the attractiveness of Easy Sky Investment Fund gradually fades, the number of DAU/MAUs in similar applications has declined, and the activity of the entire ecosystem has also declined," the company added.

DeFi hotspots

1. ArweaveOasis, a blockchain built on Arweave, will be launched on the main network tomorrow

According to the news released by ArweaveOasis, its main network will be officially launched at 7:20AM Beijing time on February 9. It is reported that AO is a scalable blockchain network built on Arweave, which supports unlimited parallel computing operations while maintaining network verifiability. Its distributed architecture allows for easy access to existing smart contract platforms.

2. The net inflow/outflow of funds in the US Ethereum spot ETF yesterday was 0

According to the news on February 8, according to SoSoValue data, yesterday (February 7 Eastern Time), the total net outflow of Ethereum spot ETFs was $0.00. Yesterday, Grayscale Ethereum Trust ETFETHE net outflow was US$0.00 per day, and currently ETHE's historical net outflow was US$3.926 billion. Grayscale Ethereum Mini Trust ETFETH net outflow per day is $0.00, and currently the total historical net inflow of Grayscale Ethereum Mini Trust ETH is $612 million. As of press time, the total net asset value of Ethereum spot ETF was US$9.88 billion, the ETF net asset ratio (market value compared to Ethereum's total market value) reached 3.17%, and the historical cumulative net inflow has reached US$3.179 billion.

3.StarkWare Lianchuang: STARK prover Stwo is scheduled to be deployed on the main network of Starknet and StarkEx system in the second quarter

Golden Finance reported that StarkWare co-founder and CEO Eli Ben-Sasson posted a post on X platform to explain the next chapter of Starknet. He said that the new STARK prover Stwo will be available on the Starknet and StarkEx system main network in the second quarter of 2025. It is expected to provide faster client proof for gaming, DeFi, etc., with the lowest average cost of user operation in all Rollups. Eli Ben-Sasson also said that the current STRK stake in the first phase has exceeded 160 million, with more than 60,000 pledge users; Starknet is about to become the first network to settle on Bitcoin and Ethereum at the same time, if OP_CAT is delayed or Sidechain that will take alternative paths, including BitVM, ColliderScript, operations simulated by Taproot, and trust minimized sidechains are not adopted.

4. Solana re-pled agreement Fragmetric completes a $7 million seed round

Golden Finance reported that Solana's re-staking agreement Fragmetric completed a $7 million seed round of financing, led by Finality Capital Partners and Hashed, with Hypersphere, Presto Labs, Bitscale Capital, Halo Capital and Flowde SK participates in investment, and new funds plan to enhance the security of Solana ecosystem and economic growth, establish a re- pled ecosystem through standardized LRT and community contribution.

5.DeFi investment platform Prodigy.Fi completed a seed round of $5 million, led by Quantstamp and Republic

Golden Finance reported that DeFi investment platform Prodigy.Fi announced a $5 million seed round of financing, led by Quantstamp and Republic, with Arbelos Markets, RSK Capital and Samara Alpha Management participating. The new funds are intended to support its platform based on Beracha. In to buy or Sell cryptocurrencies such as encapsulated Ethereum (WETH).

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

panewslab

panewslab

chaincatcher

chaincatcher