Golden Web3.0 Daily | EOS announces rename to Vaulta

Reprinted from jinse

03/19/2025·2MDeFi data

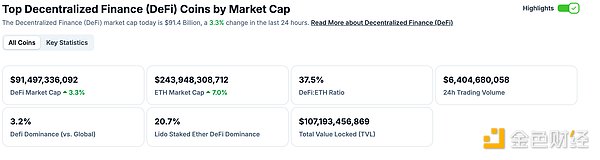

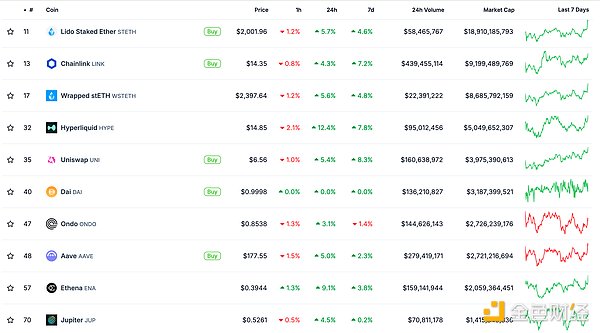

1. Total market value of DeFi tokens: US$91.497 billion

DeFi total market value data source: coingecko

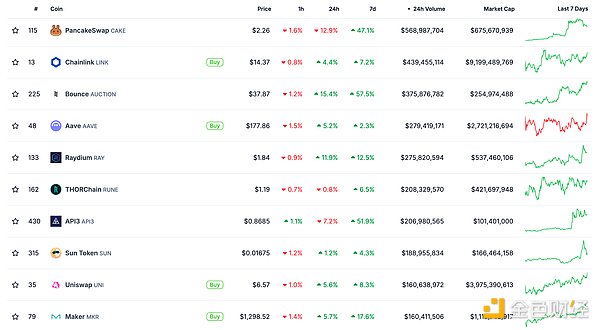

2. The trading volume of decentralized exchanges in the past 24 hours was US$6.404 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

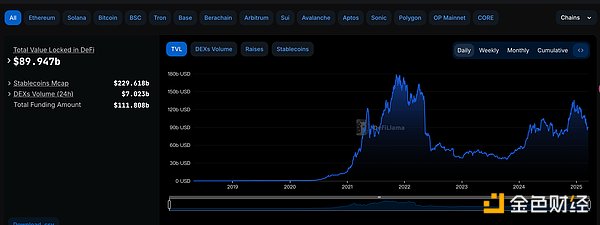

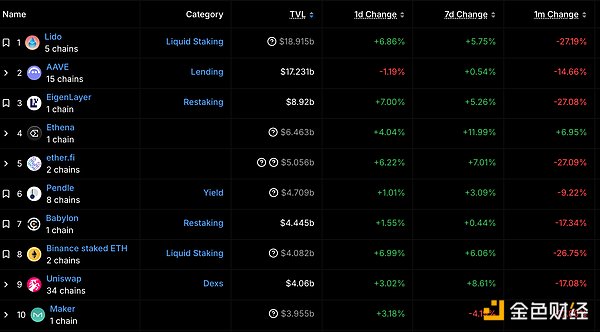

3. Locked assets in DeFi: US$89.947 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

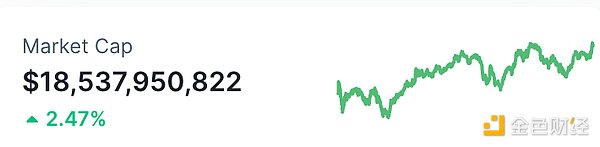

1.NFT total market value: US$18.537 billion

NFT total market value and market value top ten projects data source: Coinmarketcap

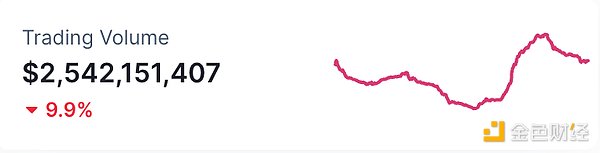

2.24-hour NFT trading volume: US$ 2.542 billion

NFT total market value and market value top ten projects data source: Coinmarketcap

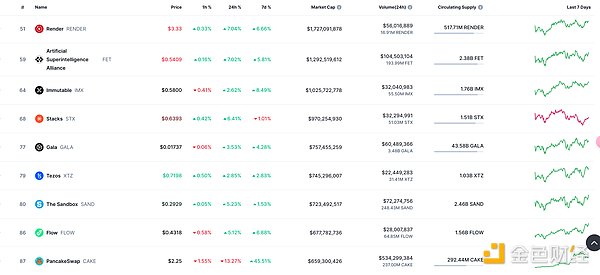

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

EOS announces renamed to Vaulta, turning its focus to Web3 banking

EOS Network announced its transformation to Web3 banking business, and the brand will be renamed Vaulta. On the one hand, it will provide blockchain- based services customized for banks; on the other hand, it will provide a wider financial ecosystem, including exSat's Bitcoin banking solutions, blockchain insurance, tokenized real-world assets, etc. The transformation includes token exchanges, which are tentatively scheduled to take place at the end of May. In addition, Vaulta will also set up a banking advisory committee, which is composed of financial and blockchain industry experts, and is committed to bridging the gap between traditional banking and Web3, with members including executives from Systemic Trust, Tetra and ATB Financial. Vaulta plans to retain the EOS network technology infrastructure, including smart contract architecture, decentralized databases and cross-chain connections, as part of the Web3 banking initiative, the platform will be integrated with exSat, a digital banking solution focused on Bitcoin. In addition, Vaulta plans to reach a partnership with Ceffu, Spirit Blockchain and Blockchain Insurance, and is expected to announce a strategic partnership in the coming months.

MEME hot spots

1.MUBARAK breaks through $0.18 in a short time

According to Golden Finance, the market shows that due to the influence of CZ's replacement of its X account avatar, MUBARAK broke through $0.18 in a short period of time and is now quoted at $0.17,168, with an increase of 23.54% in 15 minutes. The market fluctuates greatly, please do a good job of risk control.

2. Whale, which once made a profit of $13.56 million from TRUMP, bought 1.136 million BMT in the past 15 hours

According to the monitoring of the on-link analyst Aunt Ai (@ai_9684xtpa), he bought a total of 1.136 million BMT tokens in the past 15 hours at the address where TRUMP single coin profited 13.56 million US dollars. This address has become the fourth largest position address on the BMT chain. Data shows that the address invested a total of US$334,000 to build a position, with an average cost of US$0.2715, and currently has a floating loss of approximately US$32,000.

DeFi hotspots

1.Bitlayer BTC Yield 's first product is available for 47 hours

On March 19, the first BTC Yield product launched by Bitlayer, a project based on the implementation of BitVM technology in Bitcoin, will be fully charged after 47 hours of launch. It is understood that the first product integrated in this sector of Bitlayer is the CeDeFi product BLBTC created by DeSyn. Users can obtain BTC quantitative income, BTR and DSN in three parts. The comprehensive APR can reach up to 20%. The total amount of this product is 600 BTC, and the full amount has been completed. According to the official announcement, in addition to obtaining the corresponding APY benefits provided by the product, new users who participate in Bitlayer BTC Yield for the first time will also have the opportunity to receive an additional 10 BTR novices rewards, with a limited first come first served. On the basis of ensuring security and transparency, Bitlayer will integrate and support more revenue strategy products in the future, provide more gain opportunities for ecological users, and empower BTCFi.

2.Jupiter 's revenue reached US$31.7 million in February, a record high

According to Defilama data, Jupiter's revenue in February reached US$31.7 million, a record high.

3.Cosmos obtains native EVM framework through open source Evmos

Golden Finance reported that Cosmos' Cross-chain Foundation (ICF) has funded the open source of Evmos (EVMOS -32.90%), which is its native EVM framework for a multi-chain ecosystem with more than 200 application chains. The foundation said that the framework was previously developed under the Evmos project and will now be maintained as a "Cosmos EVM" in the official cross- chain software stack, including the Cosmos SDK, which means that the Cosmos ecosystem now has a standardized version of the Ethereum Virtual Machine (EVM). This development enables the Cosmos blockchain to integrate Cosmos EVM for full EVM compatibility, including support for JSON-RPC and Ethereum wallet compatibility via lightweight EVM configurations for native ERC-20 tokens. This integration enhances cross-chain interoperability between the broader EVM ecosystem and Cosmos through the Cross-chain Communication (IBC) protocol. As part of this shift, Evmos co-founder Federico Kunze Küllmer will no longer serve as a core contributor to Evmos while continuing to advise the ICF on the interoperability and modular architecture of Cosmos EVM, Evmos noted. Kunze Küllmer's company Altiplanic is a core contributor to the Evmos code base and will no longer be involved in the project.

4.Enso has now officially launched Sonic Network

According to Golden Finance, EVM trading aggregator Enso has issued a statement announcing that it has officially launched Sonic Network. Enso Shortcuts is supporting the Royco market to earn rewards from Sonic. Sonic has launched Sonic Points Season 1, allocating a portion of its approximately 200 million S airdrops to its ecosystem.

5. Ethereum Foundation: New Test Network Hoodi will activate Pectra network upgrade on March 26

According to Golden Finance, the Ethereum Foundation stated in its official blog that during the activation of the Pectra test network, problems existing in the client's configuration changes in the Ethereum test online deposit contract configuration were exposed. Although the recovery process of the Sepolia network is relatively direct and has been fully restored, the Holesky network has experienced a large number of inactive leaks in the recovery mechanism. The Holesky network has since completed its final confirmation, but it will take about a year for the exiting validator to be completely removed from the validator cluster. While stakers can test deposits, merges, and all other Pectra features, the scale of the exit queue makes it impossible for Holesky to use to test the full validator lifecycle within a reasonable time frame. To solve this problem, a new testnet has been launched: Hoodi. It will activate the Pectra network upgrade on epoch 2048 (Wednesday, March 26, 2025 15:37:12 Beijing time). In the future, staking operators and infrastructure providers should use Hoodi for validator testing. To allow time for migration, Holesky testnet will support it until September 2025. All other Pectra features can be tested on Holesky except for the validator exit. Testnet and its uses summary: Holesky: Verifier and staking provider (expected termination date is September 30, 2025). Client developers will also use Holesky to test Gas limit increase and other protocol stress tests. Sepolia: Application and Tools Developer (expected termination date is September 30, 2026). Hoodi: Verifier and staking provider (expected termination date is September 30, 2028). Planned Sepolia alternative: expected to be launched in March 2026.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

chaincatcher

chaincatcher

panewslab

panewslab