Golden Web3.0 Daily | Circle Apply for Listing on the New York Stock Exchange

Reprinted from jinse

05/27/2025·11DDeFi data

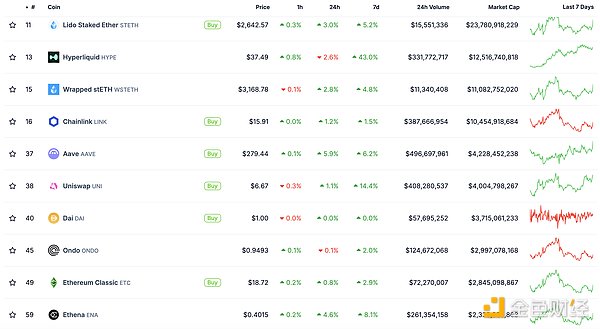

1. Total market value of DeFi tokens: US$122.702 billion

DeFi total market value data source: coingecko

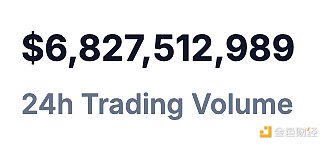

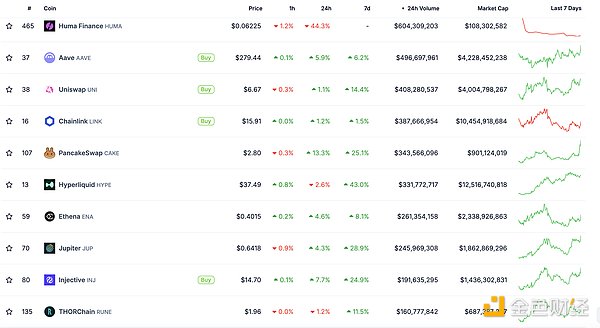

2. The trading volume of decentralized exchanges in the past 24 hours was US$6.827 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

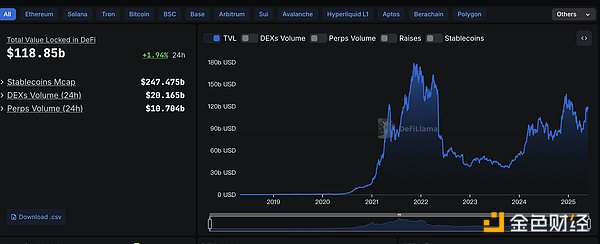

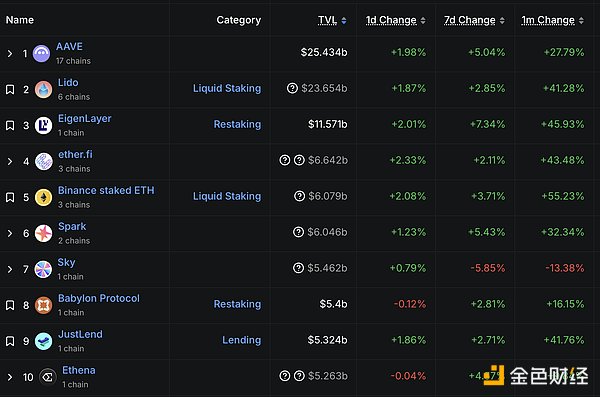

3. Locked assets in DeFi: US$118.85 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

1.NFT total market value: US$22.297 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.204 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

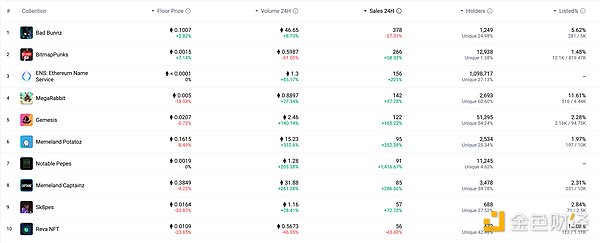

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Circle Apply for Listing on the New York Stock Exchange

Golden Finance reported that Circle Internet Group has applied for an initial public offering (IPO) on the New York Stock Exchange. The company will issue 24 million Class A shares, of which 9.6 million are from the company and 14.4 million are from shareholders. The stock price is expected to be between $24 and $26, with the trading code "CRCL".

MEME hot spots

1. USV partner Fred Wilson was stolen from Twitter, and hackers once posted false MEME coin contracts

On May 27, Fred Wilson, a partner of USV (United Square Venture Capital), the official X account of Fred Wilson, a partner of USV (United Square Venture Capital), was stolen. The hacker once released a false MEME coin contract, which has now been deleted. BlockBeats reminds users not to interact with this account to protect the security of assets.

2. Cryptocurrency profit-taking continues, Dogecoin and Ripple plummeted, and the market is paying attention to Friday 's inflation data

Golden Finance reported that, according to CoinDesk, profit-taking in cryptocurrency market continued to rise before the release of inflation data on Friday, Dogecoin and Ripple plummeted. Traders are closely watching for the upcoming core personal consumption expenditure (PCE) data, a key indicator for the Fed to measure inflation. Despite uncertainty, spot ETF inflows remained stable, with BlackRock's IBIT achieving net inflows for 30 consecutive days. QCP notes that there is a disagreement between digital assets and traditional tech stocks, and while cryptocurrencies have maintained a solid momentum, the flow of funds on products such as the TQQQ Nasdaq ETF has become cautious.

DeFi hotspots

1. More than 150,000 Ethereum validators say support to increase the block Gas cap

According to Golden Finance, according to The Block, gaslimit.pics data shows that more than 150,000 Ethereum validators (about 15% of the network) have expressed support for increasing the block Gas cap. The newly proposed limit increase is intended to push Ethereum’s Gas limit to 60 million units, almost double the current 36 million cap.

2. The Bank of Korea plans to issue deposit-type tokens on public blockchain networks

According to News1, the Bank of Korea (BOK) is exploring the integration of central bank deposit-type tokens with public blockchain networks. South Korea's Deputy Governor Lee Jong-ryeol elaborated on the bank's vision at the "Blockchain Leaders Club" event on Tuesday. Lee said that such state-backed deposit-type tokens are a "stable currency" that will be issued within the central bank's digital currency framework. Data shows that in the first quarter of 2025, stablecoins accounted for 47% of South Korea's cryptocurrency outflows, of which USDT and USDC anchored by the US dollar accounted for 26.87 trillion won (about US$19.1 billion). It is worth noting that South Korean opposition leader Lee Jae-myung previously proposed to issue stablecoins supported by South Korea won to reduce dependence on foreign private stablecoins and curb the outflow of cryptocurrency funds of 56.8 trillion won.

3. The former Coinbase CTO released commemorative tokens for its new book on Zora Network this morning, which may be the reason for the rise of Zora

According to Golden Finance, former Coinbase Chief Technology Officer Balaji Srinivasan released the commemorative token of the same name on Zora Network this morning for his new book "The Network State". The token's market value exceeded US$7 million and fell back, and is now at US$4.5 million, with a turnover since its launch. Previous news, ZORA rose by more than 30% in the past 24 hours.

4. Acurast completes $5.4 million in financing for decentralized computing network

Golden Finance reported that the decentralized computing network Acurast was successfully funded by a community-led financing of cryptocurrency startup platform CoinList, with a valuation of $90 million. The new fund is intended to strengthen the protocol, leveraging a Trusted Execution Environment (TEE) and Hardware Security Module (HSM) to ensure secure and scalable computing while maintaining confidentiality without trusting device owners to meet the next generation of decentralized confidential computing needs in Web3, AI and other fields.

5. Michael Saylor says that institutions release on-chain reserve proofs is a "bad idea" and poses security risks

According to CoinTelegraph, Michael Saylor, executive chairman of Bitcoin investment company Strategy (former MicroStrategy), said at an event during the 2025 conference in Las Vegas on May 26 that the release of on-chain reserve proof is a "bad idea" that will increase security risks and weaken the security of issuers, custodians, exchanges and investors. He suggested using artificial intelligence to deeply analyze the security problems that may be caused by publishing wallet addresses, believing that this will lead to many security risks.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

chaincatcher

chaincatcher