Golden Web3.0 Daily | ai16z is considering adjusting its token economic model

Reprinted from jinse

12/30/2024·4MDeFi data

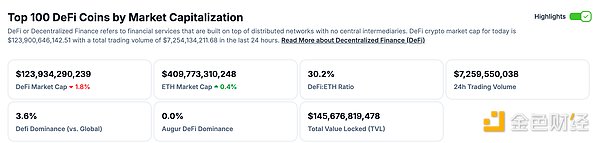

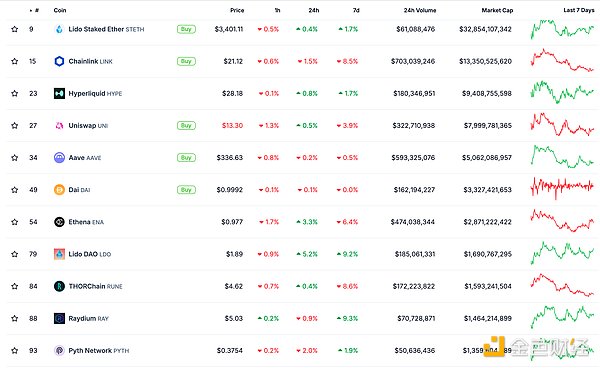

1. Total market value of DeFi tokens: US$123.934 billion

DeFi total market capitalization data source: coincko

2. The trading volume of decentralized exchanges in the past 24 hours was $7.259 billion

Trading volume data of decentralized exchanges in the past 24 hours Source: coingecko

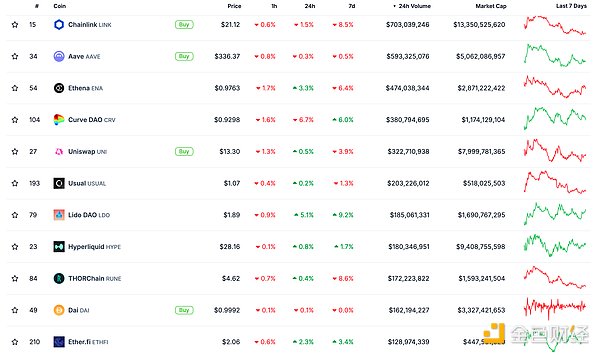

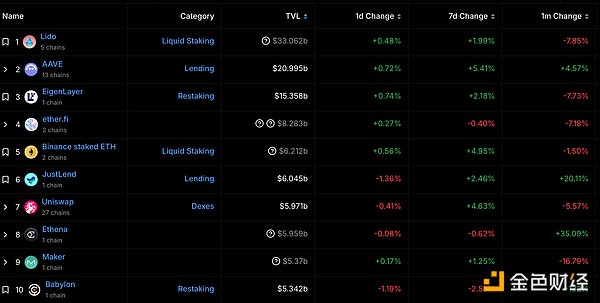

3. Assets locked in DeFi: $121.828 billion

Data source of the top ten locked assets of DeFi projects and locked positions: defillama

NFT data

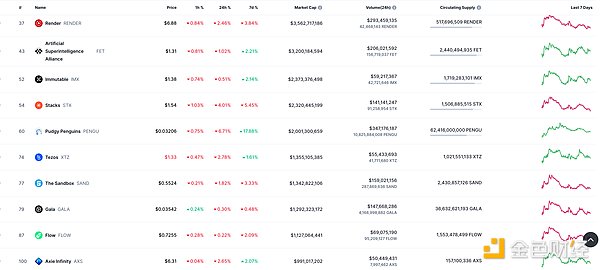

1.NFT total market value: US$37.862 billion

NFT total market value and market capitalization top ten project data source: Coinmarketcap

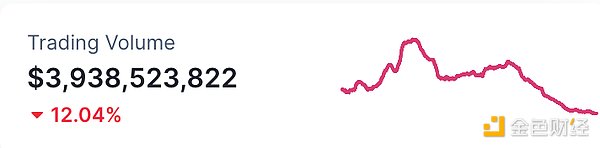

2.24-hour NFT trading volume: US$ 3.938 billion

NFT total market value and market capitalization top ten project data source: Coinmarketcap

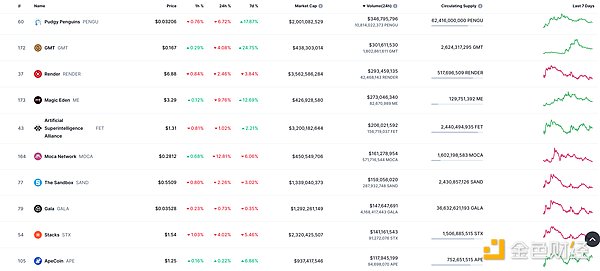

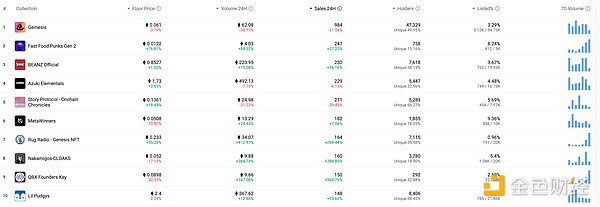

3. Top NFTs in 24 hours

Top 10 NFT sales within 24 hours Data source: NFTGO

headlines

ai16z is considering adjusting its token economic model and may launch L1 blockchain

Golden Finance reported that according to The Block, AI agent platform ai16z is exploring adjustments to its token economic model and may launch an L1 blockchain. The team has held preliminary discussions with contributors aimed at improving the value accumulation of their tokens. These discussions include a staking mechanism offered to token holders, bringing benefits such as early access to new features and a share of platform fees. Additionally, according to a document shared by a contributor, ai16z may consider launching a Layer 1 blockchain specifically for AI applications.

DeFi Hotspot

1.Usual: Currently has the largest Curve liquidity pool

Golden Finance reported that Usual posted on the X platform that its protocol currently has the largest Curve liquidity pool, and its transaction volume has always been among the top three.

2. Data: The total pledged amount of HYPE on the Hyperliquid main network has exceeded 320 million, approximately US$9.07 billion.

Golden Finance reported that according to official website data, the total pledged amount of HYPE on the Hyperliquid mainnet has exceeded 320 million, with a value of approximately US$9.07 billion.

3. Binance will list Solv Protocol (SOLV)

Golden Finance reported that according to an official announcement, Binance announced that it will launch SolvProtocol (SOLV) on the Megadrop platform, a financial ecosystem focused on Bitcoin. The total supply of SOLV is 9,660,000,000 pieces, and the Megadrop reward is 588,000,000 pieces. The specific trading time will be announced separately.

4.Hyper Foundation: HYPE staking is now online on the mainnet, and the delegation plan will be released soon

According to Golden Finance, the Hyper Foundation stated on the New blocks on Hyperliquid are proposed by validators in proportion to the amount of HYPE staked to them. Staking is an important responsibility of the Hyperliquid community. Users can stake HYPE to trustworthy validators and receive HYP staking rewards. Users may consider different metrics when choosing which validator to stake, such as uptime, commission, reputation, and community contribution. There is a delegation program to support high-performance validators and further decentralize the network. More information about this program will be announced separately. Please note that locked tokens can be staked, but their rewards are locked.”

5. The NEAR Infrastructure Committee releases the 2025 plan, which will carry out wallet improvements and other activities

Golden Finance reports that the NEAR Infrastructure Committee released the 2025 plan. It will continue to support the infrastructure and ongoing commitments from the previous year, including but not limited to the above- mentioned wallets, Fast NEAR and NEARBlocks; establishing a working group to manage accounts, actively respond to proposals, look for innovations and draft RFPs; from NEAR wallet to Solana application Programmed NEAR single sign-on, on-ramps and off-ramps; supports the development of tools and services that enable NEAR to integrate with other blockchain ecosystems (Multichain Explorer, Oracles, Omnitoken, Omnibalance Support) easier access and interoperability; invest in underlying infrastructure.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

chaincatcher

chaincatcher

panewslab

panewslab