Golden Web 3.0 Daily | Trump established a cryptocurrency working group

Reprinted from jinse

01/24/2025·5MDeFi data

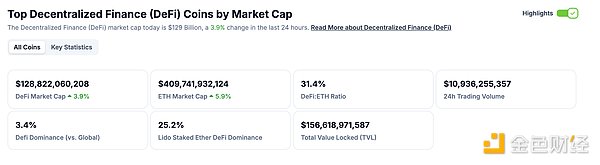

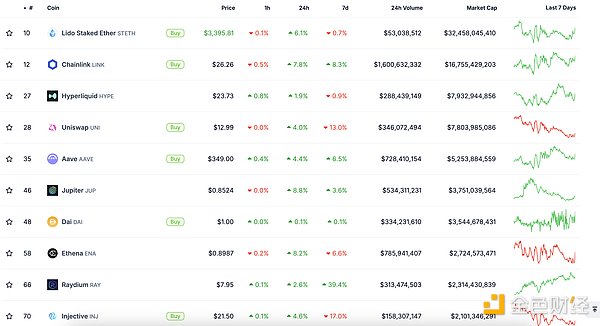

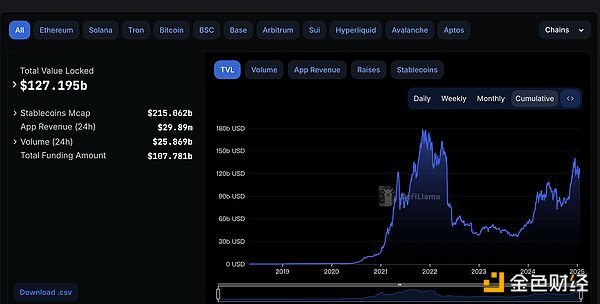

1. Total market value of DeFi tokens: US$128.822 billion

DeFi total market capitalization data source: coincko

2. The trading volume of decentralized exchanges in the past 24 hours was $10.936 billion

Trading volume data of decentralized exchanges in the past 24 hours Source: coingecko

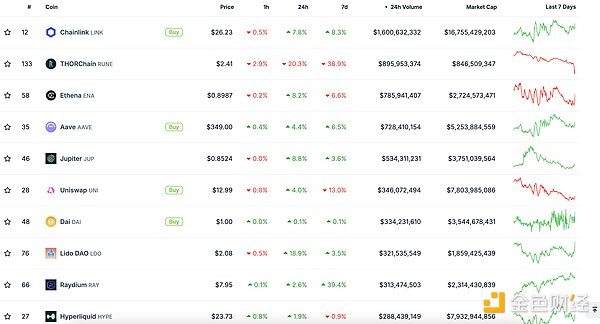

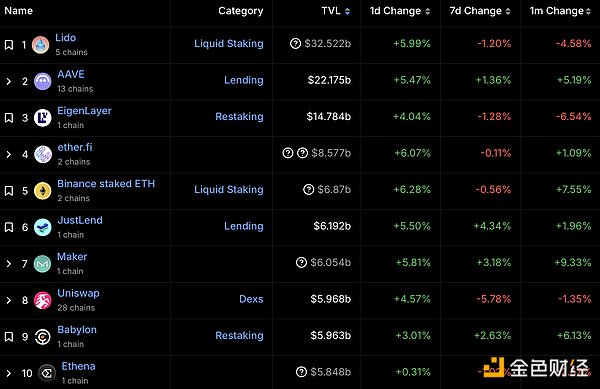

3. Assets locked in DeFi: $127.195 billion

Data source of the top ten locked assets of DeFi projects and locked positions: defillama

NFT data

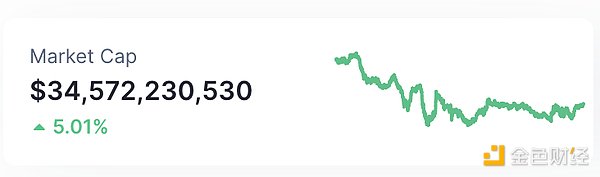

1.NFT total market value: US$34.572 billion

NFT total market value and market capitalization top ten project data source: Coinmarketcap

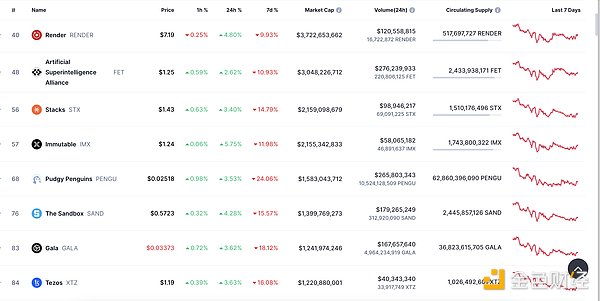

2.24-hour NFT trading volume: $ 4.932 billion

NFT total market value and market capitalization top ten project data source: Coinmarketcap

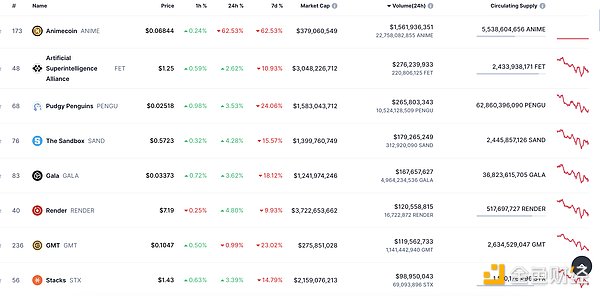

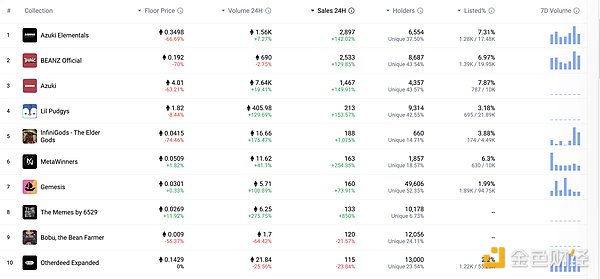

3. Top NFTs in 24 hours

Top 10 NFT sales within 24 hours Data source: NFTGO

headlines

Trump establishes cryptocurrency working group to explore creation of national digital asset reserve

On January 23, 2025, US President Trump issued the first encryption executive order. It calls for the establishment of a cryptocurrency working group to propose new digital asset regulations and explore the possibility of establishing a national cryptocurrency reserve, fulfilling his promise to quickly reform U.S. encryption policy. Meanwhile, the task force will be led by Trump-appointed artificial intelligence (AI) and cryptocurrency commissioner David Sacks. Members of the working group also include heads of government departments and regulators or their designees, including the U.S. Secretary of the Treasury, the Attorney General, the Secretary of Commerce, the Chairman of the U.S. Securities and Exchange Commission (SEC), the Chairman of the Commodity Futures Trading Commission (CFTC) and other government departments and regulators.

MEME Hotspot

1. Changpeng Zhao: I have never purchased Meme tokens or NFTs, but that doesn’t mean I am against them.

Golden Finance reported that Changpeng Zhao tweeted, “I can see the arguments on both sides. But I can’t say I know which side is right and which side is wrong. I think the bottom line is that in a decentralized world, No one is forcing anyone to buy (or not buy) Meme tokens (or any cryptocurrency). You don't have to participate if you don't want to, but others should have their own choice. I'm not buying. Meme Coins (or NFTs) but just because I don’t understand how to appreciate something, doesn’t mean I’m against them.”

2. Trump family encryption project WLFI increased its holdings of 10.61 million TRX and 3,079 ETH

Golden Finance reported that according to Onchain Lens monitoring, in the past 4 hours, the Trump family encryption project World Liberty Financial (WLFI) spent 2.65 million USDT to purchase 10.61 million TRX, and spent 10 million USDC to purchase 3,079 TRX. ETH. They also exchanged 4,700 ETH (worth $15.68 million) for 4,700 stETH and staked them on Lido. They staked a total of 14,701.58 ETH, worth $49 million.

3. Pump.fun founder: ALON tokens were not created and do not recommend anyone to buy them

According to the news on January 24, in response to the community's question "Why give your personal token of the same name alon as CTO", pump.fun founder Alon posted on the X platform: "In a world of permissionless asset creation, most of the Most people will have their own tokens, it's best to agree on one relatively early so people don't farm on other games. Or participate in PVP.” Later, he clarified: “For clarity, I did not create it and do not recommend anyone to buy the token. I took ownership of the TG group created for the coin half a year ago and paid Dexscreener. The cost. It’s kind of crazy and no one’s really paying attention these past few months.”

DeFi Hotspot

1.THORChain network is currently running normally, only the savings and loan functions are suspended

Golden Finance reported that X user TCB issued a document clarifying that the THORChain network is currently operating normally and its performance is in line with expectations. Only the Savers and Loans functions have been suspended.

2. Vitalik published an article discussing Ethereum L1 and L2 expansion strategies

Golden Finance reported that Ethereum co-founder Vitalik Buterin published a blog post stating that Ethereum’s goal is the same as the goal on day one: to build a global, censorship-resistant permissionless blockchain. After ten years of hard work, combining technical and social attributes, Ethereum has demonstrated another important quality: Ethereum provides useful services to people and can achieve this on a large scale. We need to continue to build on Ethereum’s technical and social properties, as well as its practical utility. I want to focus on one specific impact that will be very important for users of Ethereum in the short and medium term: Ethereum’s scaling strategy. Today, L2 faces two main challenges: scale and heterogeneity challenges. One possible scaling shortcut is to abandon L2, do everything through L1, and significantly increase the gas limit (either across multiple shards, or on a single shard). However, this approach would unduly compromise many of the advantages of Ethereum’s current social structure, which is very effective at simultaneously enabling different forms of research, development, and ecosystem building cultures. Therefore, we should stick to the original route and continue to scale mainly through L2, but make sure that L2 truly lives up to its promise. Native Rollups are still an early stage idea. A lot of active thinking still needs to be done, especially on how to maximize the flexibility of native Rollup precompilation. Now is the time to redouble your efforts. There are still many areas that require active thinking and brainstorming. The future of Ethereum relies on the active participation of each of us.

3.Newton DAO announced the launch of Newton Finance side chain (NewFi)

According to news on January 24, Newton DAO announced the launch of a new side chain - Newton Finance Blockchain (NewFi) to promote the development and development of innovative technologies such as global payments, decentralized finance (DeFi) and real world assets (RWA). application. This marks an important milestone in the development of the Newton ecosystem, providing developers and users with more powerful blockchain capabilities. As part of this plan, the existing blockchain will be renamed Newton Core. The overall economic model of the project remains unchanged, and the total amount of the platform's native token NEW will not increase and will remain a fixed supply to ensure the sustainability and stability of the ecosystem. At the same time, in order to achieve seamless interoperability, NewFi and Newton Core will achieve cross-chain connection through NewBridge. Users can freely transfer NEW tokens between the two blockchains through NewBridge. This interconnection will create a unified ecosystem, allowing users to fully utilize the advantages of both chains to meet the needs of multiple application scenarios.

4.Farcaster will launch Farcaster tag function

According to news on January 24, Varun Srinivasan, co-founder of Farcaster, a decentralized social protocol, tweeted that Farcaster will launch Farcaster Labels. Tags are an open standard for adding context to accounts and casts, and any developer can provide tag services to other Farcaster or Ethereum applications. The team is releasing Warpcast's spam label, which will prompt users whether an email from an account is spam.

5. DAO governance platform Agora will acquire Boardroom

Golden Finance reports that blockchain governance startup Agora is about to acquire its competitor Boardroom. The company sees the acquisition as a strategic move to strengthen governance within the broader Ethereum ecosystem, citing expectations for renewed growth in decentralized governance amid U.S. President Trump’s pledge to provide regulatory clarity for the blockchain industry. Boardroom was established earlier than Agora and has similar goals to Agora, but adopts a more horizontal blockchain governance approach. Boardroom has gradually transformed from an Agora-style DAO tool into a data feed – a sort of “Bloomberg” for crypto-governed data. Agora declined to disclose the price of the acquisition of Boardroom. Boardroom employees have been hired to Agora, and Boardroom founder Kevin Nielsen will continue to serve as an advisor. Agora co-founder Yitong Zhang said that there are "no plans to deprecate" Boardroom, and the Agora team will keep both platforms running and work with users to determine how to gradually integrate these tools.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and not as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

chaincatcher

chaincatcher

panewslab

panewslab