Global companies are buying Bitcoin, but Asian companies account for less than 1% of their currency holdings

Reprinted from panewslab

04/29/2025·12DSummary of key points

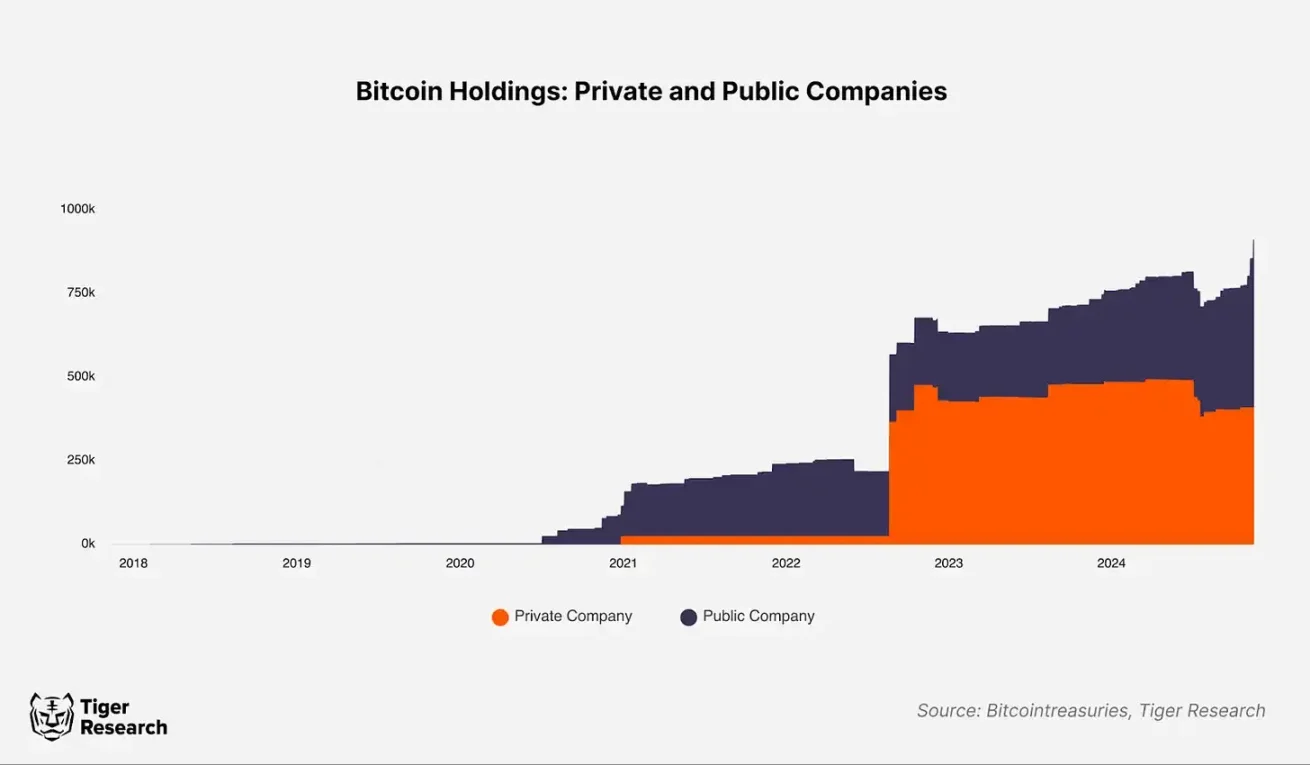

· The trend of corporate investment in Bitcoin is expanding: corporate investment strategies have gradually heated up since the Securities and Exchange Commission approved the Bitcoin spot ETF. This trend is not limited to Western markets, but is extending to Asia.

· Why companies choose Bitcoin: Bitcoin has shown great appeal in diversifying asset allocation, improving fund management efficiency, and enhancing corporate value.

· Participation and development prospects in the Asian market: Asian companies' investment in Bitcoin is still in its infancy, but successful cases such as Metaplanet show that the market's expansion potential is huge. However, regulatory uncertainty and lack of institutional support remain major obstacles.

1. Introduction

This year, the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin spot ETF. This move has become a milestone for crypto assets to move towards institutionalization. Since then, more and more companies have begun to incorporate Bitcoin into their investment strategies. For example, MicroStrategy has made Bitcoin one of its important financial assets. This trend is rapidly expanding from the Western market to the Asian market and gradually becoming a global phenomenon. This article will analyze the main strategies and the influencing factors behind the promotion of Bitcoin adoption.

2. The craze for companies to invest in Bitcoin

As Bitcoin’s value is gradually recognized, its appeal continues to increase. At the national level, some governments have also begun to discuss investing in Bitcoin. For example, El Salvador has taken active action to continue to purchase Bitcoin. And in the United States, discussions about President-elect Trump's plan to reserve Bitcoin have become the focus. In addition, Poland and Suriname are also exploring the possibility of using Bitcoin as a strategic asset.

However, except for El Salvador, most countries' investment in Bitcoin remains in the stage of policy discussion or campaign commitment, and there is still some time before actual implementation. The United States has not invested directly in Bitcoin yet, but it holds some of the Bitcoins to recover criminal proceeds. In addition, due to the high fluctuation of Bitcoin prices, central banks in many countries still tend to choose gold as a more stable reserve asset.

Government actions on Bitcoin are slow and limited, but corporate participation is showing an accelerated trend. Companies like MicroStrategy, Semler Scientific and Tesla have made bold investments in the Bitcoin space. This is in stark contrast to the cautious attitude adopted by most governments.

3. Three reasons why companies pay attention to Bitcoin

Investing in Bitcoin is no longer just a trend, it is gradually becoming the core financial strategy of a company. Bitcoin has attracted the attention of enterprises for its unique characteristics, and its value is mainly reflected in the following three aspects:

3.1. Achieve asset diversification

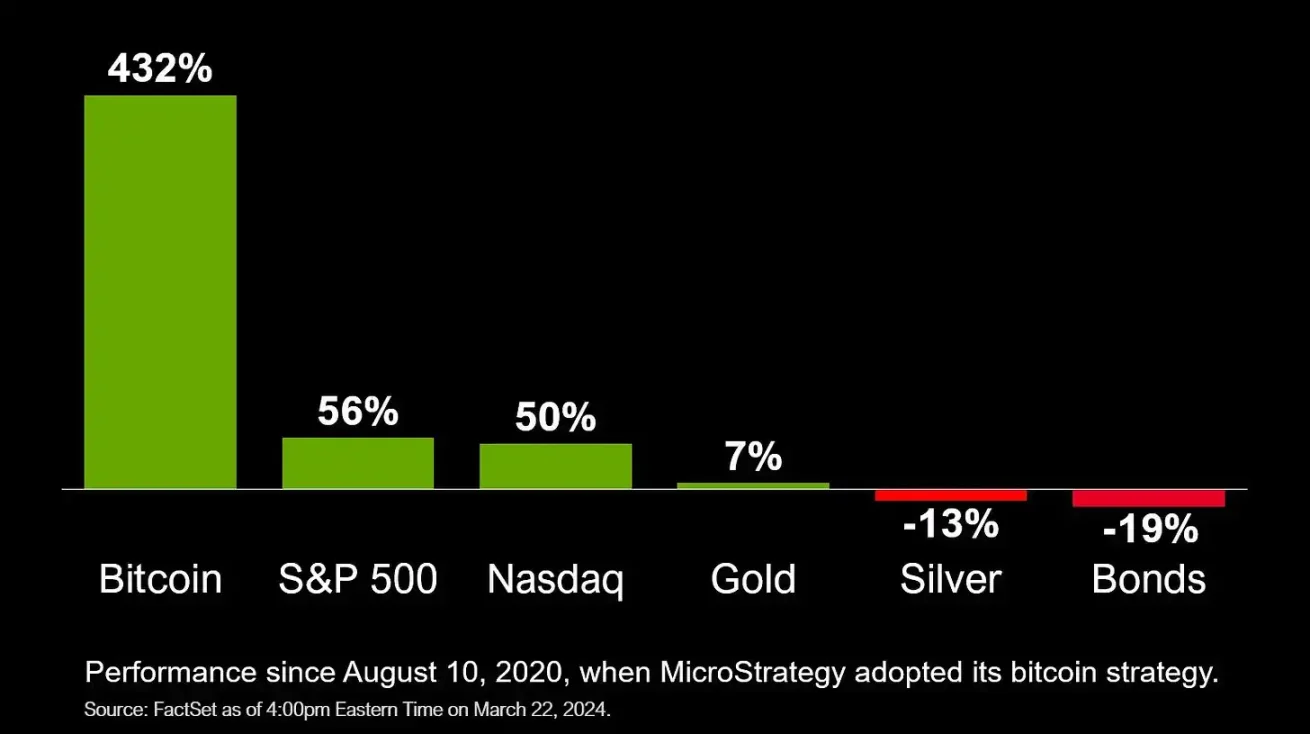

Traditionally, corporate financial assets are often allocated around stable options such as cash and government bonds. These assets can ensure liquidity and help avoid risk, but their yields are low and often difficult to outperform inflation, which may lead to a shrinking value of real assets.

Source: Michael Saylor X

Bitcoin, as an emerging alternative asset, can effectively make up for these shortcomings. It not only has high return potential, but also diversify investment risks, providing enterprises with a brand new asset allocation option. Over the past five years, Bitcoin has performed significantly better than traditional assets such as the S&P 500, gold and bonds, and even surpassed junk bonds that are considered high-risk and high-return. This shows that Bitcoin is not only an alternative, but also an important tool for corporate financial strategy.

3.2. Improve asset management efficiency

Another important reason why Bitcoin attracts businesses is its efficient asset management features. Bitcoin supports 24/7 trading, which provides businesses with great flexibility to adjust their asset allocation at any time. In addition, compared with traditional financial institutions, the monetization process of Bitcoin is more convenient and does not need to be limited by bank business hours or cumbersome operating procedures.

Source: Kaiko

Although companies are still worried about the possible impact on prices when cashing in Bitcoin, this problem is gradually easing as the market depth increases. According to Kaiko data, Bitcoin's "2% market depth" (i.e. the total amount of buying and selling orders within the current market price range of 2%) has grown steadily over the past year, with an average daily market depth of about $4 million. This shows that the liquidity and stability of the Bitcoin market are continuing to improve, creating a more favorable environment for enterprises to use Bitcoin.

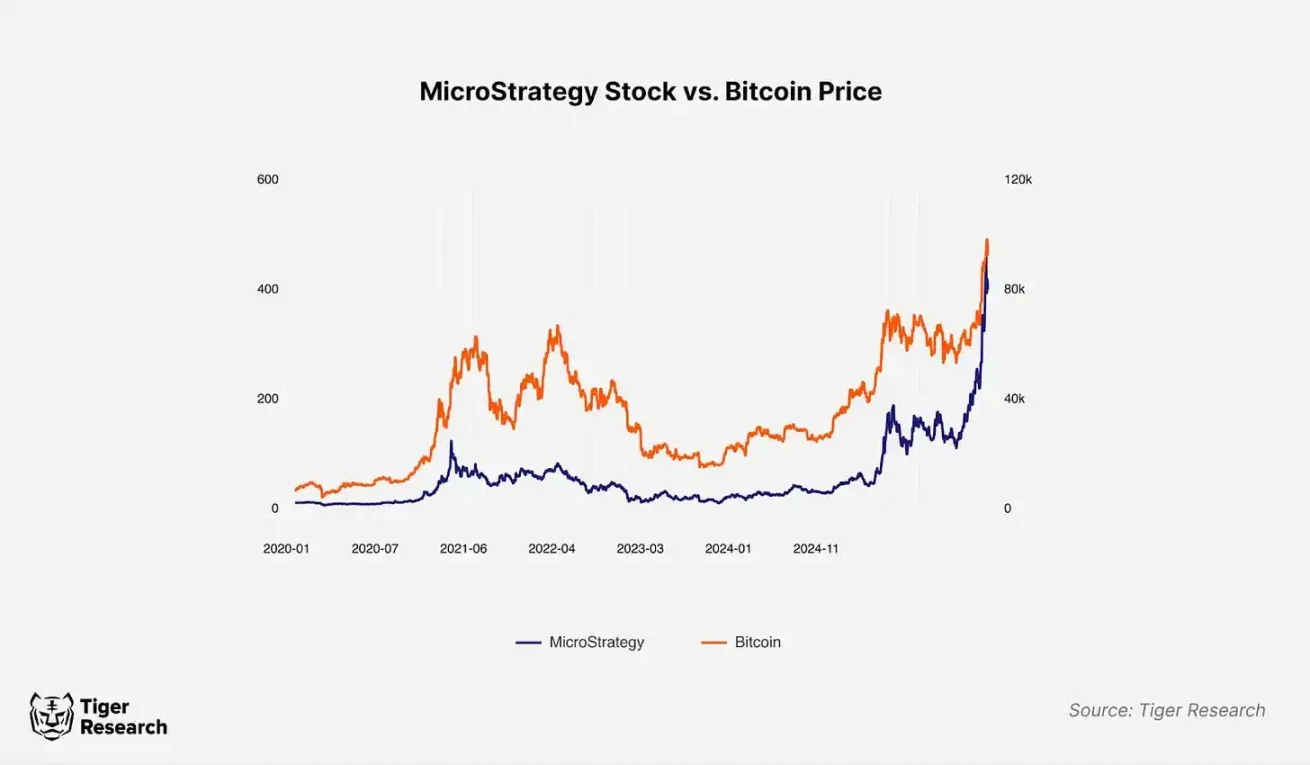

3.3. Enhance corporate value

Holding Bitcoin is not only a financial choice, it can also significantly increase corporate value and share price. For example, MicroStrategy and Metaplanet both saw a sharp rise in their share prices after announcing their acquisition of Bitcoin. This strategy is not only an effective marketing tool in the digital asset industry, but also provides a way for companies to seize growth opportunities in this area.

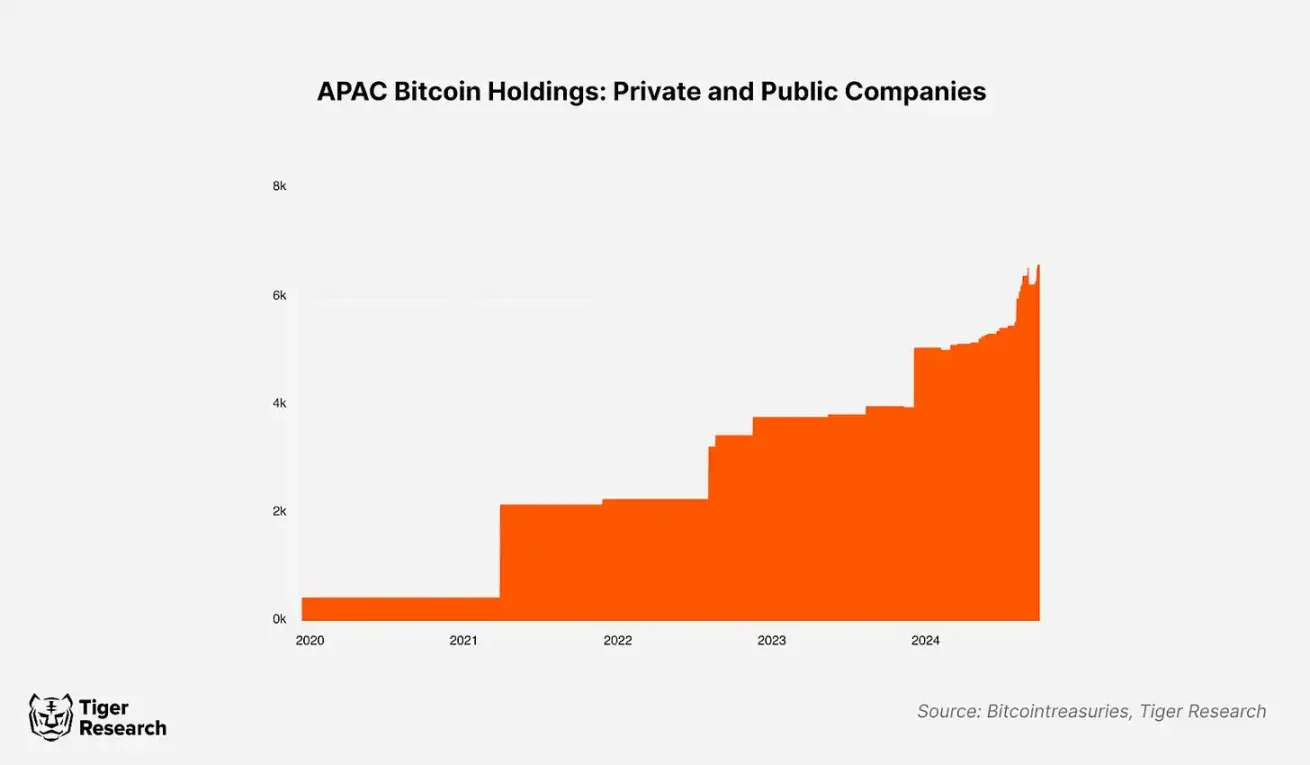

4. Asian companies are increasing their investment in Bitcoin

Although Asian companies are still in their infancy in Bitcoin investment, they are gradually increasing their holdings. For example, China’s Meitu, Japan’s Metaplanet and Thailand’s Brooker Group have regarded Bitcoin as strategic financial assets. Nexon also made large-scale Bitcoin purchases. Metaplanet in particular has performed particularly well, acquiring 1,142 bitcoins in the past six months.

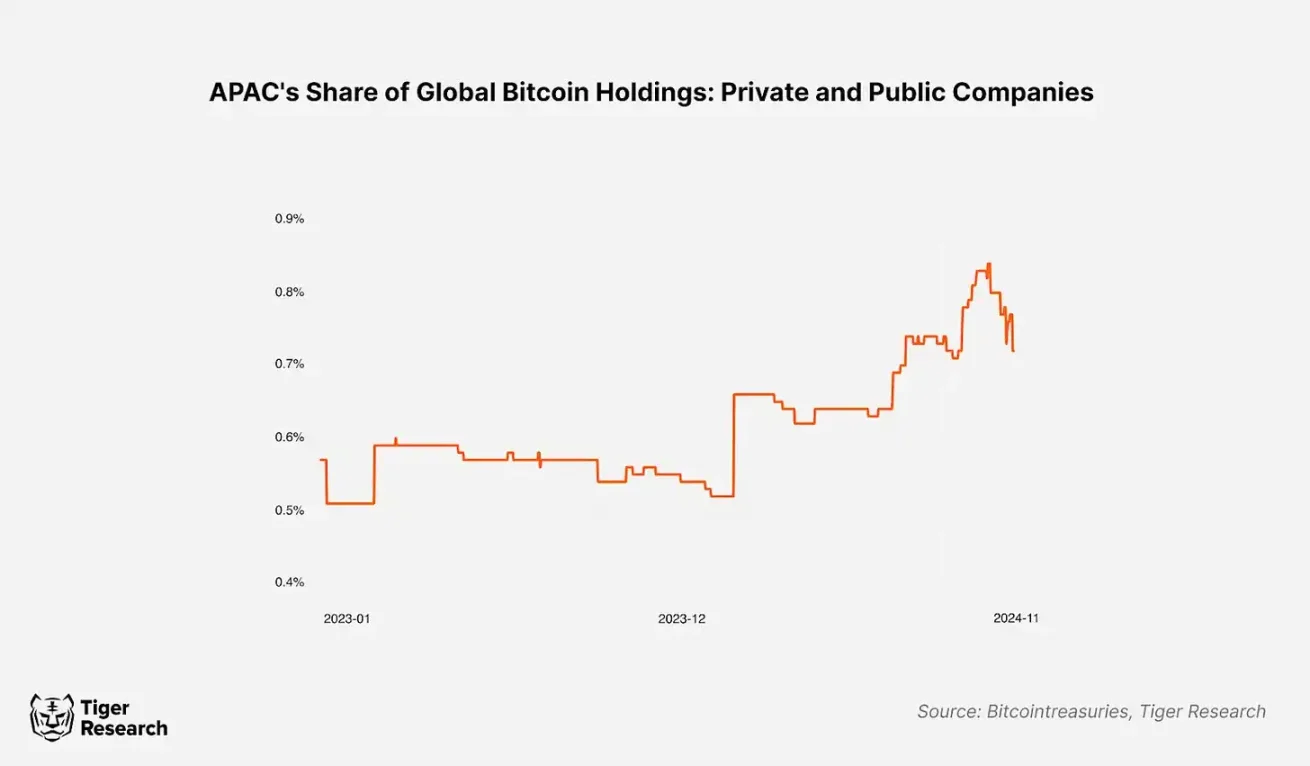

However, Asian companies are still relatively low in participation in the Bitcoin market. According to statistics, the total amount of Bitcoin held by Asian companies accounts for less than 1% of the world, mainly due to regulatory restrictions in many countries. For example, in South Korea, companies are unable to open accounts on cryptocurrency exchanges and face many obstacles to investing in overseas Bitcoin ETFs or launching funds related to cryptocurrency trading. As a result, these businesses are almost unable to invest in Bitcoin through formal channels.

Despite the many challenges in the regulatory environment, the potential for Asian companies to participate in the Bitcoin market is still worth looking forward to. Some companies invest by setting up overseas subsidiaries to bypass regulatory restrictions. At the same time, Japan and other countries have also made certain progress in relaxing relevant policies. Leading corporate investment cases like Metaplanet are attracting more market attention. These positive changes may pave the way for Asian companies to participate more widely in the Bitcoin market in the future.

5. Conclusion

Bitcoin investment is gradually becoming a popular financial strategy adopted by businesses. However, its price volatility remains an important challenge for enterprises, especially under the influence of external factors such as international politics. The 2022 market crash event clearly exposed the potential risks of businesses holding Bitcoin. Therefore, companies should be cautious when investing in Bitcoin and properly match it with safer assets to reduce overall risks.

In addition, for Bitcoin to further develop in its corporate portfolio, it also needs to establish a clear institutional framework. At present, there is a lack of clear guidance on holding and accounting of crypto assets, which often confuses companies in actual operations. Once these uncertainties are eliminated, Bitcoin may play a more important role in diversifying corporate assets.

jinse

jinse

chaincatcher

chaincatcher