Global central banks' "gold rush" may trigger Bitcoin price to hit record highs

Reprinted from jinse

04/29/2025·15DAuthor: Biraajmaan Tamuly, CoinTelegraph; Translated by: Deng Tong, Golden Finance

-

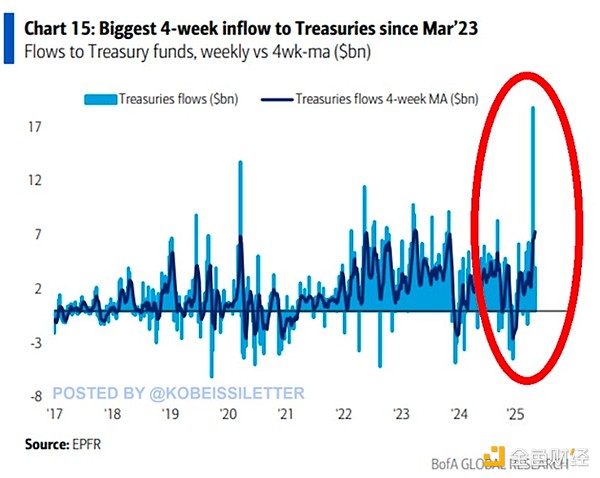

US Treasury funds inflowed $19 billion, the highest level since March 2023, with the 30-year Treasury yield falling by 30 basis points.

-

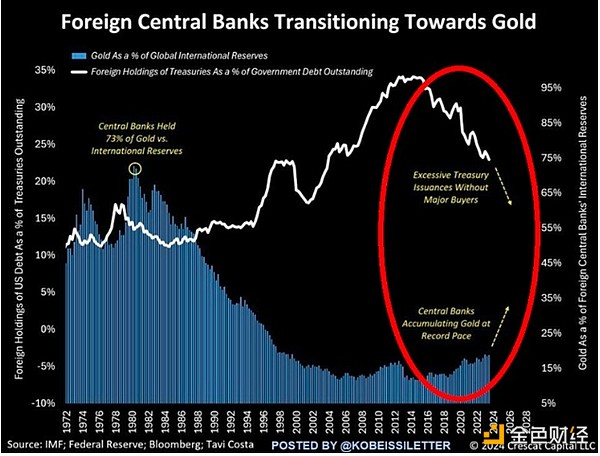

Foreign central banks have lowered U.S. Treasury holdings to 23%, the lowest level in 22 years, while gold reserves have reached 18%.

-

Under a similar trend, Bitcoin soared from $9,000 to $60,000 in 2020, suggesting similar results will occur in 2025.

The global financial trend is undergoing a major shift, and the price of Bitcoin (BTC) may benefit greatly. The latest data shows that US Treasury funds had net inflows of $19 billion last week, surpassing the peak of $14 billion during the 2020 epidemic, and the four-week moving average rose to $7 billion, the highest level since March 2023.

U.S. Treasury Inflow Chart. Source: X.com

The 30-year Treasury yield fell 30 basis points from its peak in April, indicating that bond prices have risen as investors are willing to accept lower returns in exchange for the security of these bonds. As a safe-haven asset, demand for U.S. Treasury bonds has surged, improving market liquidity and stability while reducing U.S. borrowing costs.

However, foreign central banks have adjusted their strategies to cut U.S. Treasury holdings to 23% of U.S. government debt, the lowest level in 22 years. This suggests that while private investors may have driven inflows, foreign central banks are exiting, possibly due to ongoing tariff disputes with the United States.

Foreign central banks hold gold and treasury bonds. Source: X.com

Meanwhile, gold's share of global reserves soared to 18%, a 26-year high and an increase of 8% since 2015. Among them, since 2023, China's gold reserves have doubled to 7.1%.

The global trend of de-dollarization is exactly the same as the positive model of Bitcoin. During the 2020 epidemic, due to the uncertainty of the new crown epidemic, U.S. Treasury bond inflows surged, and the price of Bitcoin soared from $9,000 to nearly $60,000 at the beginning of 2021. Gold 's share of global reserves increased by 14.5% in 18 months.

The current bond market is stabilizing and the central bank has set off a gold craze, which means that Bitcoin 's next bull market will face similar triggers. In 2023, Bitcoin rose 47% in a month, while the Nasdaq fell 8.7% after rising U.S. Treasury yields rose due to recession concerns. Bitcoin’s attractiveness as a global store of value has increased as yields fall and central banks suggest losing confidence in the US dollar.

However, if global markets fall into recession in 2025, Bitcoin’s bullish argument may shake. That's because, as noted last week, during a downturn, investors decided to prioritize liquidity and traditional safe-haven assets such as cash or U.S. Treasury bonds over speculative assets like Bitcoin.

Bitwise CEO says Google searches for "bitcoin" has been at a low level for

a long time

Anonymous global market researcher Capital Flows pointed out that macroeconomic liquidity and market positioning factors have driven the bullish price trend of Bitcoin. The analyst highlighted the impact intensity of BTC in the direction probability tilt chart, indicating that it is ready to rise.

The overall macroeconomic positioning of Bitcoin. Source: X.com

This is consistent with the observations of Bitwise CEO Hunter Horsley: Google’s search volume is close to long-term lows, indicating that the driving force behind Bitcoin’s rise comes from institutions, consultants, businesses and countries, rather than retail investors.

The lack of retail-driven search interest is in sharp contrast with historical trends. In historical trends, Bitcoin’s search volume is highly correlated with its price in the previous cycle (r=91%, according to SEMrush data), indicating a shift in market dynamics and institutional adoption is driving demand.

panewslab

panewslab