From speculation to practicality: What’s next for the on-chain lending market?

Reprinted from panewslab

03/16/2025·3MAuthor: equilibrium

Translation: Shan Oppa, Golden Finance

The on-chain lending protocol, as the cornerstone of Internet finance, has a vision to provide equitable access to capital for individuals and businesses around the world, no matter where they are. This model helps to build a more equitable and more efficient capital market, thereby driving economic growth.

Despite the huge potential for on-chain lending, the current main user base is still crypto-native users, and most of the uses are limited to speculative trading. This greatly limits the total market it can cover (TAM).

This article explores how to gradually expand the user base and transition to a more productive lending scenario while addressing possible challenges.

Current status of on-chain lending

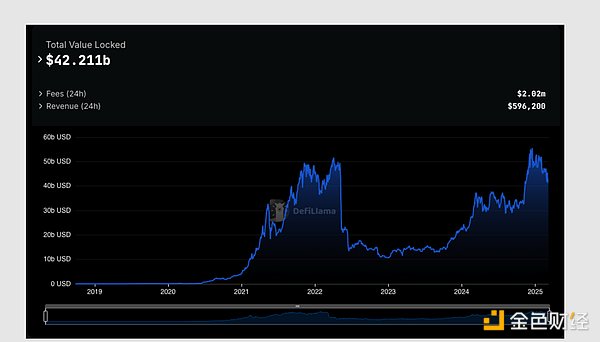

In just a few years, the on-chain lending market has developed from a conceptual stage to multiple market-tested agreements, which have experienced many severe market tests and have not generated bad debts. As of now, these agreements have attracted a total of $43.7 billion in deposits and issued $18.6 billion in outstanding loans.

Source: DefiLlama

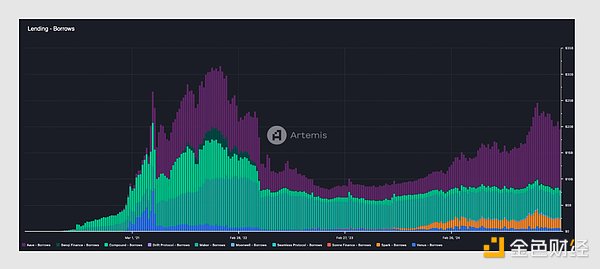

Source: Artemis

Currently, the main sources of demand for on-chain lending agreements include:

- Speculative Trading: Crypto investors use leverage to buy more crypto assets (for example, borrowing USDC with BTC as collateral, then buying more BTC, or even looping multiple times to increase the leverage multiple).

- Liquidity acquisition: Investors acquire liquidity of crypto assets through borrowing and without selling assets, thereby avoiding capital gains taxes (depending on the jurisdiction).

- Arbitrage Lightning Loan: A very short-term loan (borrowed and returned within the same block) used by arbitrage traders to take advantage of the market's short-term price imbalance and make price corrections.

These applications mainly serve encrypted native users and focus on speculation. However, the vision of on-chain lending goes far beyond that.

Compared with the total outstanding debt of $320 trillion worldwide, or the total loans of $120 trillion from households and non-financial enterprises, the current $18.6 billion outstanding loans in the on-chain lending agreement account for only a tiny part of that.

Source: International Finance Association Global Debt Monitoring

As on-chain lending gradually transforms to more productive capital uses (such as small business financing, personal car purchases or home purchase loans), its market size (TAM) is expected to grow by orders of magnitude.

The future of on-chain lending

To improve the practicality of on-chain lending, two key improvements are needed:

1. Expand the scope of mortgaged assets

Currently, only a few crypto assets are available as collateral, which greatly limits the number of potential borrowers. In addition, to compensate for the high volatility of crypto assets, existing on-chain lending usually requires a mortgage rate of up to 2 times or higher, further suppressing lending demand.

Expanding the scope of acceptable collateral assets will not only attract more investors to use their portfolios to borrow, but also improve the lending ability of on-chain lending agreements.

2. Promote ultra-low mortgage loans

Currently, most on-chain lending agreements adopt an over-collateralized model (i.e., the mortgaged assets that the borrower must provide are valued higher than the amount of the borrowed). This model leads to inefficient capital utilization, making it difficult to achieve many practical application scenarios (such as small business financing).

By adopting ultra-low mortgage loans, on-chain loans can cover a wider group of borrowers and further enhance their usefulness.

The above improvement measures are difficult to implement, some of which are relatively easy to implement, while others bring new challenges. However, the optimization process can be gradually advanced from easy to difficult.

In addition, fixed-rate lending is also an important feature in the development of on-chain lending, but this issue can be solved by a third party bearing the borrower's interest rate risks (such as through interest rate swaps or customized agreements between the borrowers). Therefore, this article will not discuss in detail (there are currently agreements, such as Notional, which provide fixed-rate lending services).

1. Expand the scope of mortgaged assets

Compared with other asset classes around the world, such as the public equity market ($124 trillion), the fixed income market ($140 trillion) and the real estate market ($380 trillion), the total market capitalization of the cryptocurrency market is only $3 trillion, accounting for only a small part of global financial assets. Therefore, limiting the collateral scope to some crypto assets greatly limits the growth of on-chain lending, especially when the collateral requirement is as high as 2 times or even higher to compensate for the high volatility of crypto assets.

Combining asset tokenization with on-chain lending allows investors to more effectively use their entire portfolio to borrow, rather than being limited to a small portion of crypto assets, thereby broadening the scope of potential borrowers.

The first step to expanding the scope of mortgaged assets may start with assets with high liquidity and frequent transactions (such as stocks, money market funds, bonds, etc.), which have less impact on existing lending agreements and have lower cost of modification. However, the speed of regulatory approval will be the main limiting factor in growth in the field.

In the long run, expanding to less liquid physical assets (such as tokenized real estate ownership) will provide huge growth potential, but will also bring new challenges such as how to effectively manage the debt positions of these assets.

Ultimately, on-chain lending may develop to the extent that mortgage loans are made by mortgages, that is, loan issuance, real estate purchase, and property deposit loan agreements as collateral can be completed atomically in one block. Similarly, businesses can also finance through lending agreements, such as purchasing factory equipment and depositing it as collateral in the agreement.

2. Promote low-collected loans

Currently, most on-chain lending agreements adopt an over-collateralized model, where the mortgaged assets that the borrower must provide are valued higher than the amount of the borrowing. Although this model ensures the security of the lender, it also leads to inefficient capital utilization, making it difficult to achieve many practical application scenarios (such as small business working capital loans).

In the crypto industry, the initial demand for low-collected lending may come from market makers and other crypto-native institutions that still require financing channels after centralized lending platforms (such as BlockFi, Genesis, Celsius) go bankrupt. However, early attempts to decentralized low-collateral lending (such as Goldfinch and Maple) mostly put lending logic off-chain processing, or eventually turned to the over-collateralized model.

A new project worth noting is Wildcat Finance, which attempts to reintroduce low-collateralized lending while retaining more on-chain components. Wildcat is only used as a matching engine between the borrower and the lender, and the lender evaluates the borrower's credit risk by itself, rather than relying on the off-chain credit review process.

Outside the crypto industry, low mortgage lending has been widely used in personal loans (such as credit card debt, BNPL buy first and pay later) and commercial loans (such as working capital loans, microcredit, trade financing and corporate credit lines).

The biggest growth opportunity for on-chain lending products lies in markets that traditional banks cannot effectively cover, such as:

1. Personal lending market: In recent years, non-traditional lending institutions have continued to increase their share in the individual low-cost mortgage market, especially among low-income and middle-income groups. On-chain lending can serve as a natural extension of this trend, providing consumers with more competitive lending rates.

2. Small Business Financing: Due to the small amount of loans, large banks are often reluctant to provide loans to small businesses, whether for business expansion or working capital. On-chain lending can fill this gap and provide more convenient and efficient financing channels.

Challenges to be solved

While the above two improvements will significantly expand the potential user base of on-chain lending and support more efficient financial applications, they also introduce a range of new challenges, including:

1. Dealing with debt positions backed by illicit assets

Crypto assets are traded 24/7 all-weekly, while other assets with higher liquidity (such as stocks, bonds) are usually traded from Monday to Friday, but the price update frequency of illiquid assets (such as real estate, artworks) is much lower than this. The irregularity of price updates can make the management of debt positions more complicated, especially during periods of severe market fluctuations.

2. Liquidation issues of physical mortgage assets

Although the ownership of physical assets can be mapped to the chain through tokenization, its liquidation process is far more complicated than that of on-chain assets. For example, in the scenario of tokenized real estate, asset owners may refuse to void property and even need legal procedures to perform liquidation.

Given that on-chain lending agreements (and individual lenders) cannot handle the liquidation process directly, one solution is to sell the liquidation rights at a discount to a local debt collection agency, who is responsible for handling the liquidation matters. Such mechanisms need to be deeply integrated with the real-world legal system to ensure the feasibility of asset monetization.

3. Determination of risk premium

The risk of default is part of the lending business, but this risk should be reflected in the risk premium (i.e., the additional interest rate added on a risk-free rate basis). Especially in the field of low mortgages, it is crucial to accurately assess the borrower’s default risk.

There are currently a variety of tools that can be used to estimate default risk, depending on the borrowing category:

• Individual Borrower: Web Proof, Zero Knowledge Proof (ZKP) and Decentralized Identity Agreement (DID) can help individuals prove their credit scores, income status, employment status, etc. while protecting their privacy.

• Corporate Borrower: By integrating mainstream accounting software and audited financial reports, companies can prove their financial status such as cash flow, balance sheet, etc. on the chain. In the future, if financial data is fully uplinked, the company's financial information can be seamlessly integrated with lending agreements or third-party credit rating services to assess credit risks in a more trustworthy way.

4. Decentralized credit risk model

Traditional banks rely on internal user data and external public data to train credit risk models to assess borrowers’ default probability. However, this data silo effect brings two major problems: new entrants have difficulty competing because they cannot access data sets of the same size. Decentralized processing of data is difficult because the credit evaluation model cannot be controlled by a single entity, and user data must remain private.

Fortunately, the fields of decentralized training and privacy computing are developing rapidly. Future decentralized protocols are expected to use these technologies to train credit risk models and perform inference computing in a privacy-protected manner, thereby achieving a more fair and efficient credit assessment system on the chain.

Other challenges include on-chain privacy, adjusting risk parameters as collateral pools expand, regulatory compliance and easier use of borrowed benefits for real-world utility.

in conclusion

On-chain lending protocols have laid a solid foundation in the past few years, but they have not really reached their full potential yet.

The next stage of on-chain lending will be even more exciting: the protocol will gradually transition from a scenario that focuses on crypto-native and speculative to more efficient and real-world-related financial applications.

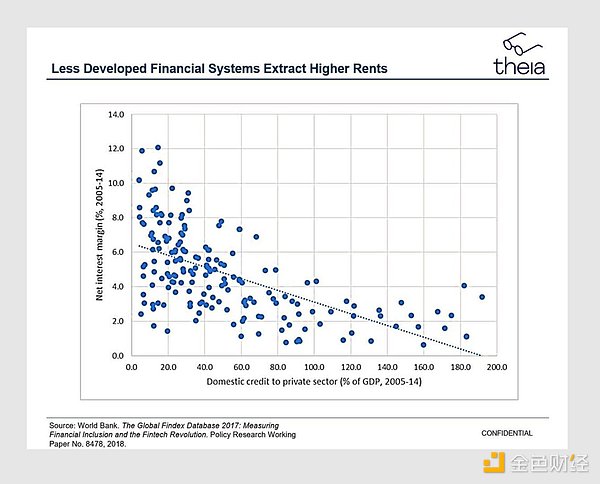

Ultimately, on-chain lending will help eliminate financial inequality so that all businesses and individuals, no matter where they are, can get equal access to capital. As Theia Research summarizes: “Our goal is to create a financial system where net interest spreads are compressed to the cost of capital”.

This will be a goal worth striving for!

jinse

jinse

chaincatcher

chaincatcher