From scanning chains, monitoring to trading, how to play BSC chains with no foundation?

Reprinted from panewslab

02/17/2025·2MAuthor: Zibu

cz(@cz_binance) started by shouting $tst with a hesitant shout, and now he is pushing up his pet dog. It seems that he really wants to make the meme on the bsc. So, how to play the meme on BSC? If you want to do a good job, you must first sharpen your tools. This article will introduce the tools you can use from the various processes you participate in.

1. Scan the chain

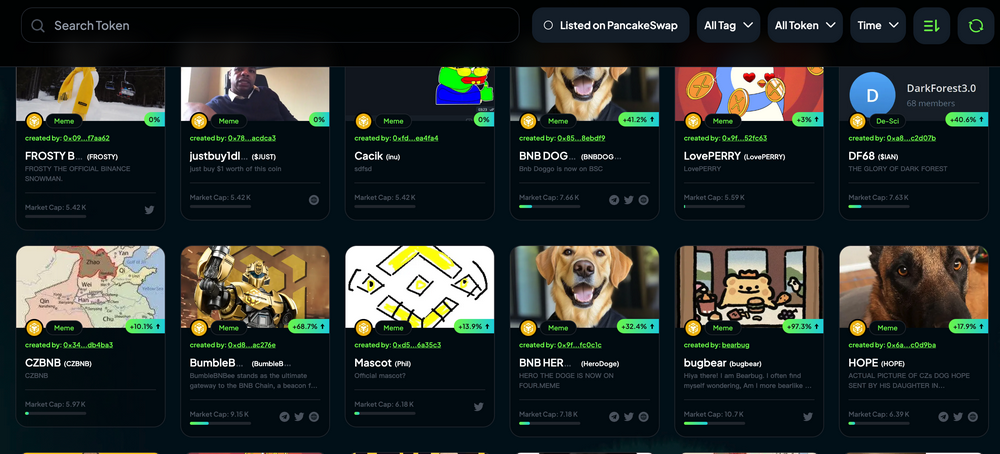

The pump platform on BSC is https://four.meme/. We can view the coins in the inner disk on the [Board] page, and we can perform various filters according to conditions; we can also view the market value list and 24-hour transactions on the [Ranking] page. Ranking.

2. On-chain tools

In addition to scanning the chain, we can use many on-chain tools to help us filter coins, mainly considering indicators such as market value/pool, transaction volume, transaction number, and creation time.

The following are the most commonly used on-chain tools.

URL: https://universalx.app/user/x/0x_zibu?inviteCode=E8LJSP

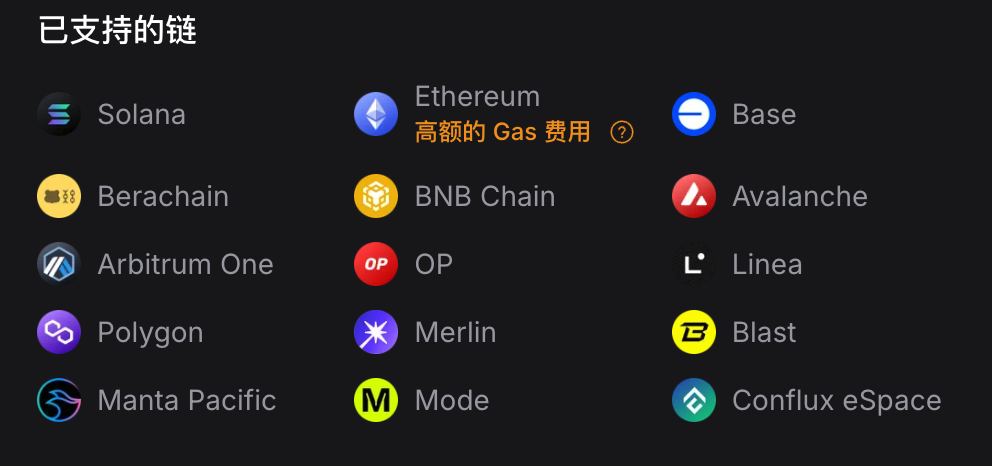

UniversalX (@UseUniversalX) is the first official application of Particle Network (@ParticleNtwrk), which can seamlessly call full-chain assets in unmanaged situations, without manual bridging and gas management. UniversalX currently supports Solana, BSC and 13 other mainstream EVM chains. UniversalX also supports mobile devices, and both App Stroe and Google Play are on the shelves.

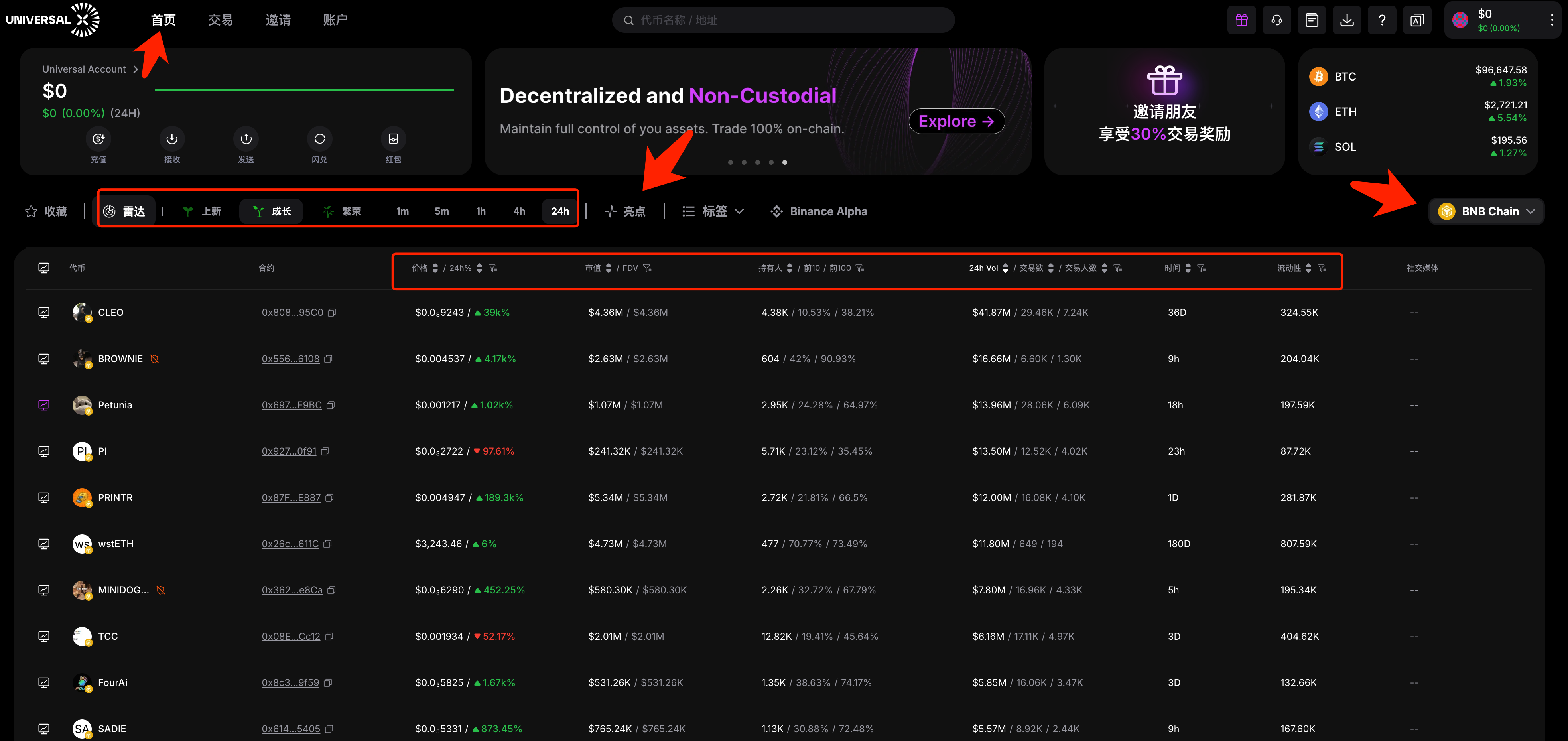

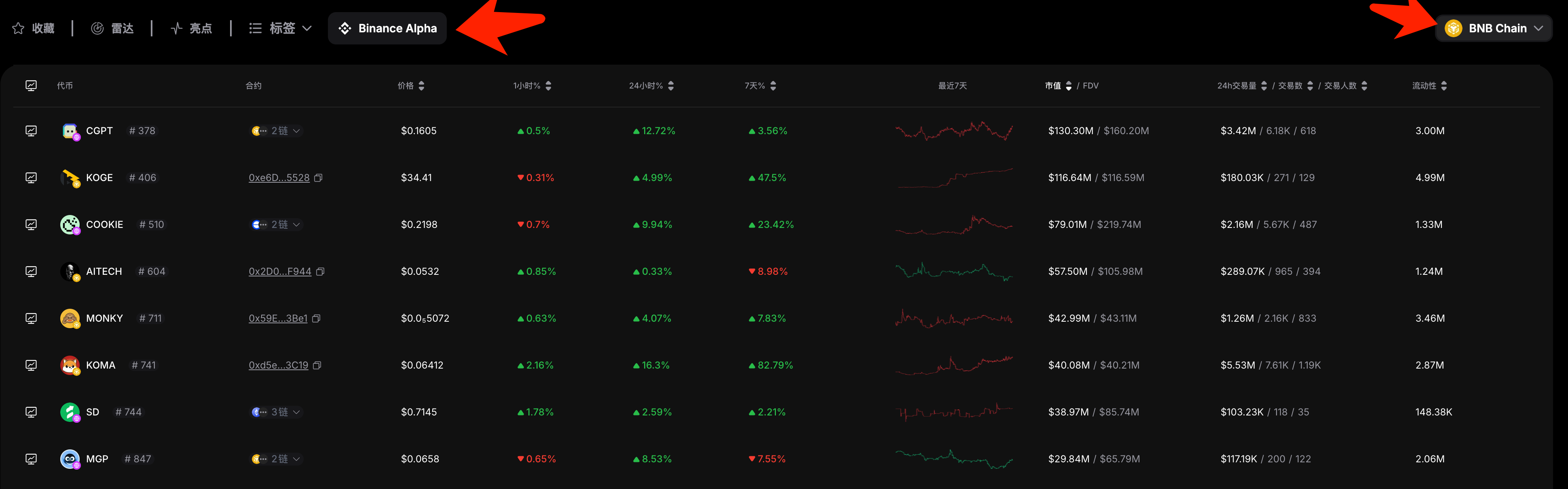

On the homepage of UniversalX , select [BNB Chain] and press "News", "Growth" and "Prosperity" in the [Radar] section to select coins from different periods. The main filtering indicators are market value, holders, transaction volume, and liquidity.

When issuing new products, you can pay more attention to "new products", and when doing the second stage, you can pay more attention to "growth", and "prosperity" is mainly the old currency that has been online for a long time.

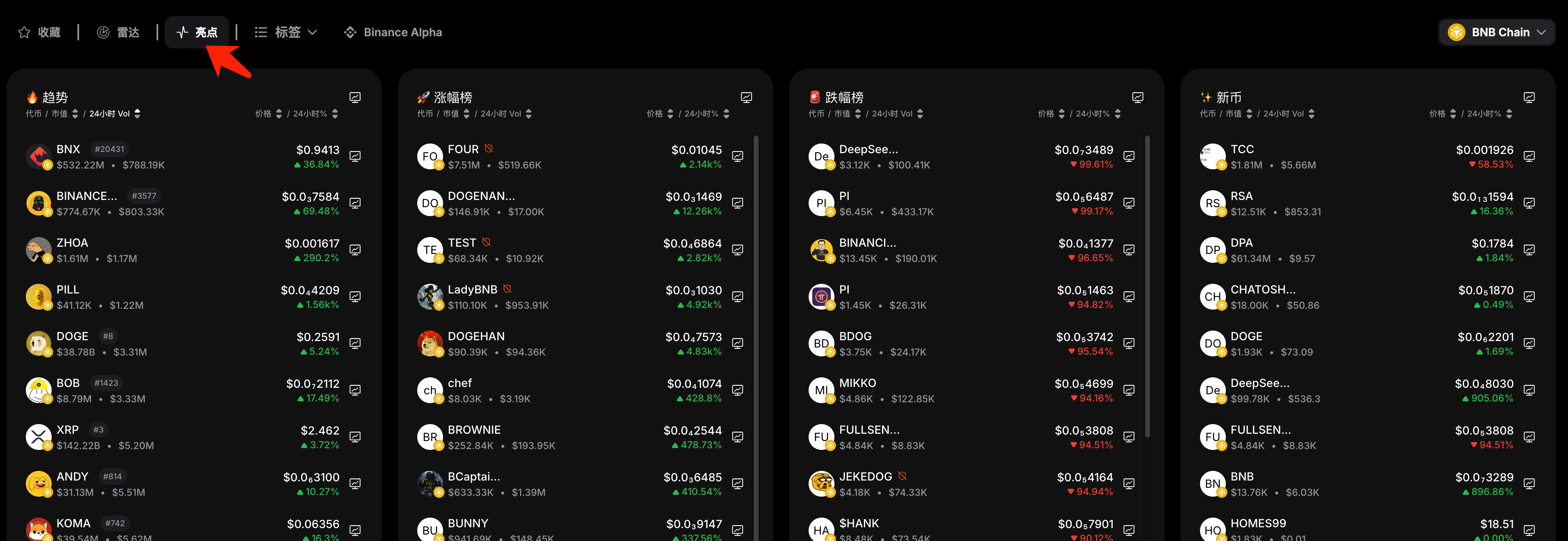

[Highlights] The function has made 4 lists, including "trend", "increase list", "decline list", and "new currency". Among them, "trend", "increase list", and "new currency" can be focused on.

UniversalX also lists coins on Binance Alpha, which can be viewed by the full chain or only a certain chain, such as the coins of the BSC chain. This function is better than what Binance Wallet does, which cannot be filtered by links.

2.debot

Website: https://debot.ai?inviteCode=175623

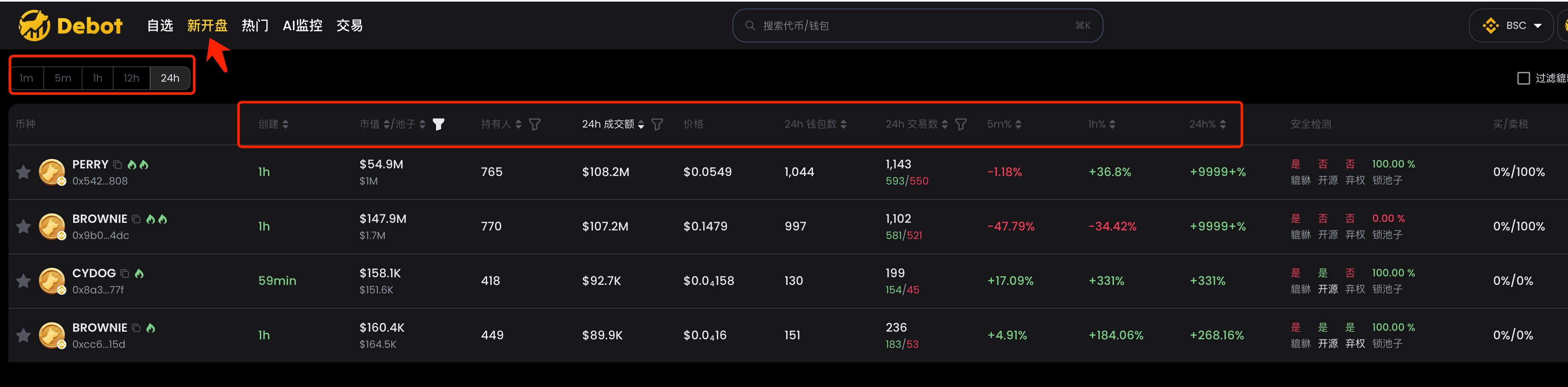

debot mainly consists of two sections: [New Open] and [Popular].

[New Opening] The section is a new currency released within 24 hours. It can be filtered by indicators such as time period, market value, transaction volume, and transaction number. Its advantage is that it has the additional indicator of "wallet number".

The [Popular] section is to filter all coins online according to their popularity. The filtering indicators are similar to the [New Open] section.

3.gmgn

Website: https://gmgn.ai/?ref=sxsy7oyJ

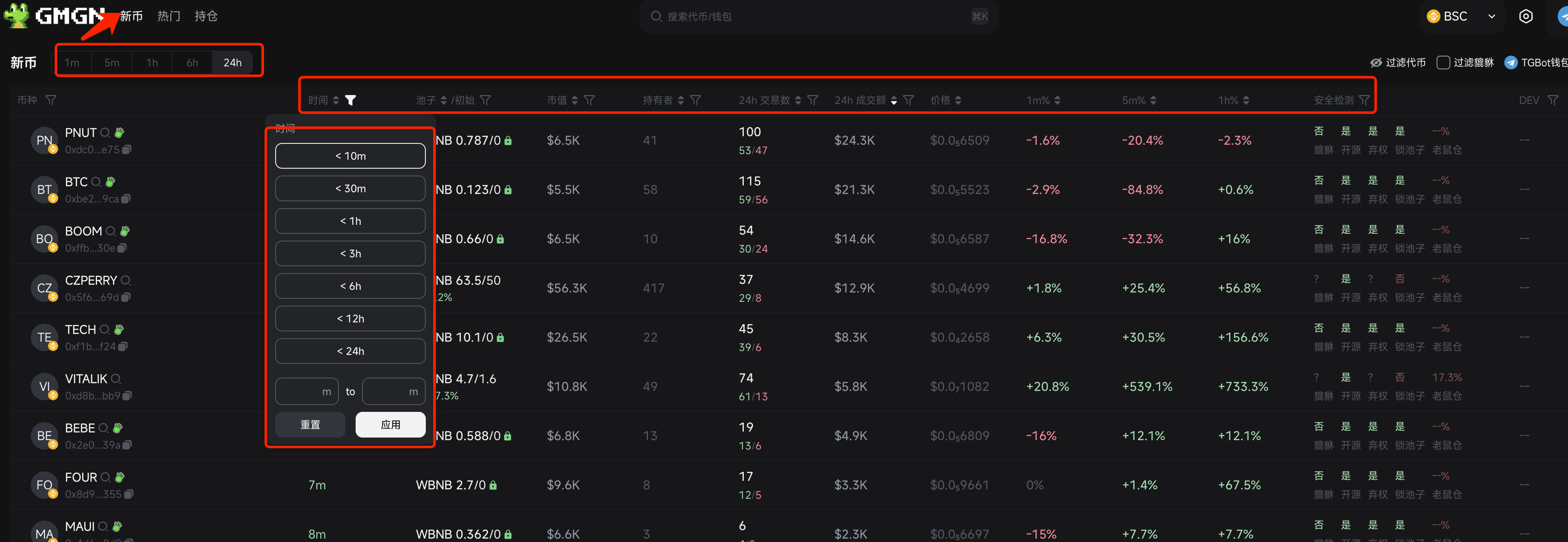

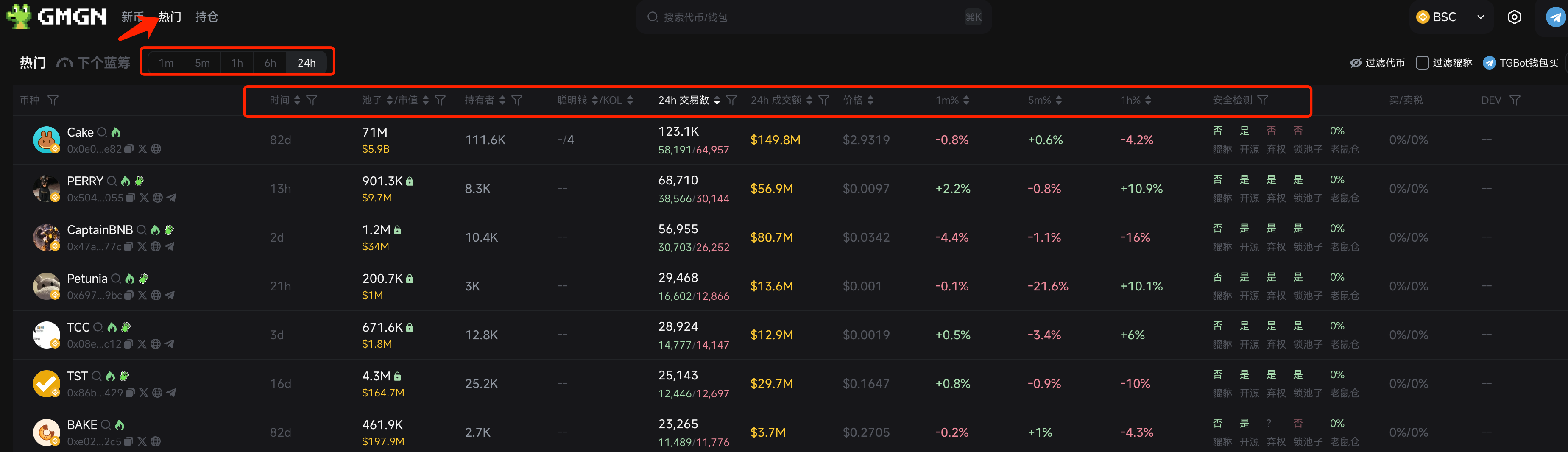

gmgn just supported BSC chain some time ago, and was forwarded and referenced by cz. gmgn 's BSC chain is mainly composed of two sections: [Singcoin] and [Popular], which are similar to debot .

[Sing Coins] The section is also a new currency released within 24 hours. It can be filtered by time and has a finer granularity. Security detection also supports filtering. It is common for some coins on EVM to not open source, not abandon, or lock pools when they first opened. Therefore, it is indeed very practical to support filtering; other indicators are common, as shown in the figure

The [Popular] section is to filter all coins online according to their popularity, and the filtering indicators are similar to the [Sing Coin] section.

gmgn also designed the [Next Blue Chip] function on the BSC chain, and there is no data at the moment. Compared with this function on the SOLANA chain, it is roughly a selection of potential coins. You can also pay attention to it after it is launched later.

When looking at the line, gmgn 's [Holder] section has added new functions, which can intuitively see the changes in the holder, the average amount of coins per capita, and the average buying price of the Top 100, which is used to quickly measure the holder's The basic situation is very convenient. There will be a progress bar below the address of each holder, which is used to display the remaining positions of the current address. It is a very intuitive and practical function.

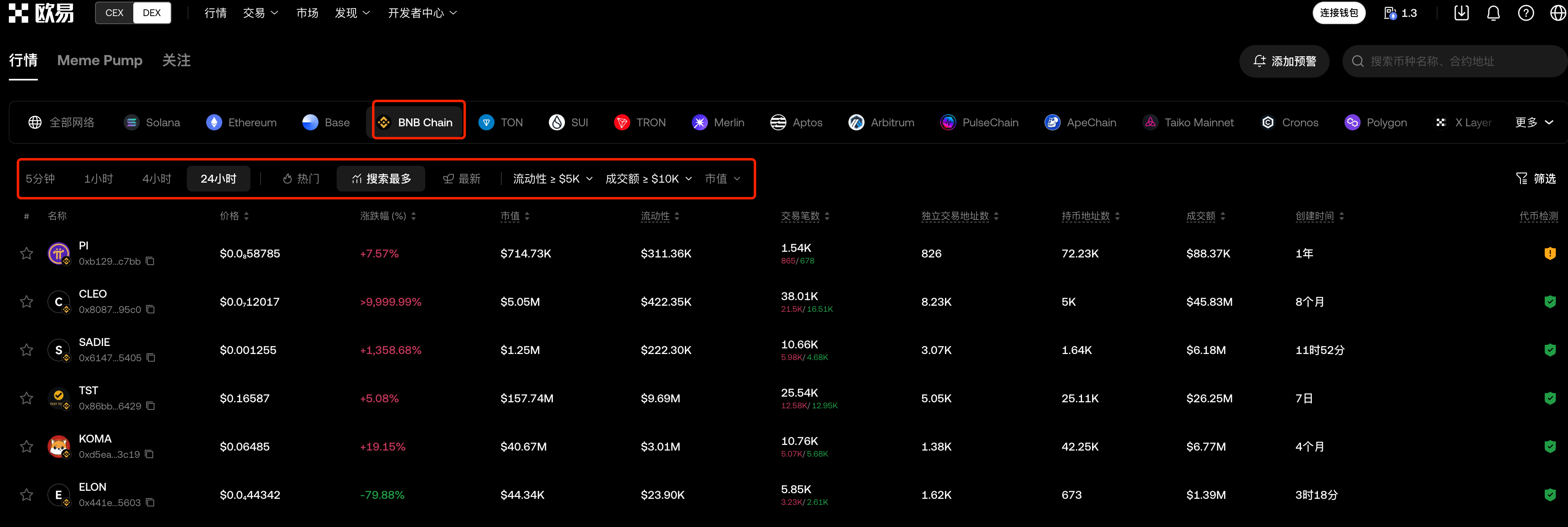

4.OKX

Website: https://www.okx.com/zh-hans/web3

OKX is made in a relatively complete way, and it supports all kinds of chains, and there are also BSC chains. Compared with Web3 wallets, the web page has richer features and can be filtered based on time, popularity, the most searched, and the latest indicators.

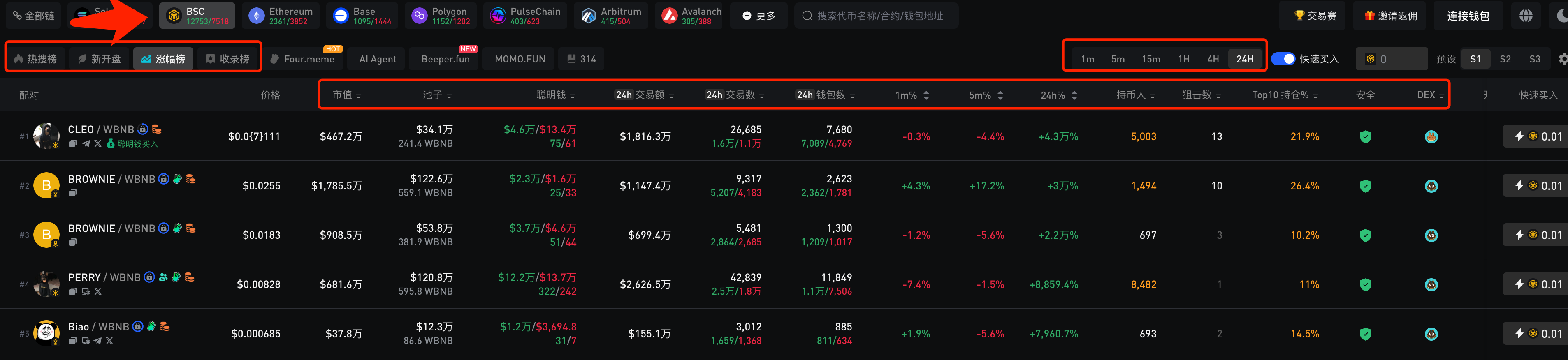

5.ave

Website: https://ave.ai/

ave is an old tool. It has been widely used since the last bull market, supports multiple chains, and also has apps to facilitate viewing of the line. The functions of the BSC chain support four sections: [Hot Search List], [New Open], [Growth List], and [Included List]. Each section can be filtered by different indicators. Some indicators can only be filtered and cannot be sorted. It depends on which type of personal habits like.

Ave has made a separate section of Four.meme's coins, supporting five sections: [Rechargeable internal disk], [New internal disk], [Absent full], [New external disk], and [Hot external disk]. It is good to use it for scanning the chain, and it feels much more comfortable than the official website’s scanning chain. I hope other tools will follow up earlier.

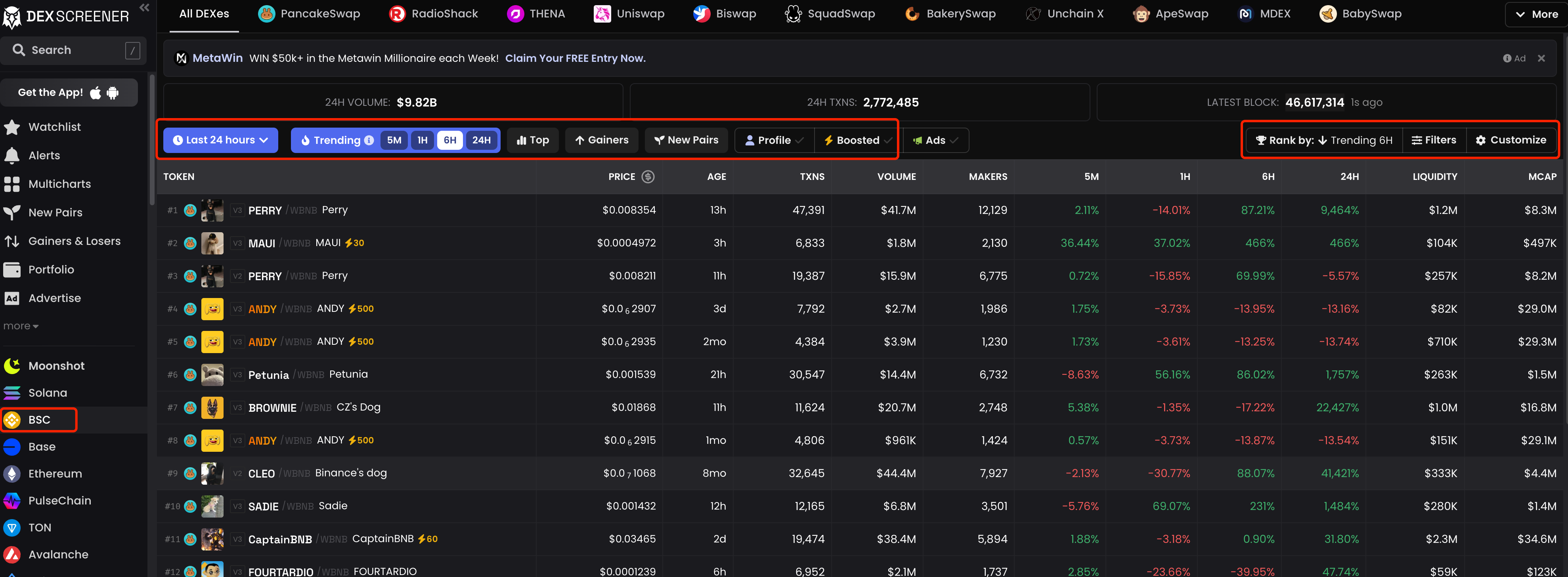

6.Eagle

Website: https://dexscreener.com/

Like Ave, Eagle is both old tools and supports many chains. Eagle supports filtering by time period, trend, TOP transaction volume/transaction number, income, new pool and other indicators, and can also customize various filter conditions. Overall, the indicators are very rich. I have used the Eagle's filter indicators to run data for several years and have made many strategies.

The advantage of the Eagle is that it is large and comprehensive, but the disadvantage is that the K-line is not that fast, and it will be several seconds later than other tools. His multicharts function is particularly useful, especially suitable for watching multiple coins on the disk. Some tools also have this function, but none of them are as useful as Eagle, although Eagle has some improvements.

3. How to find smart money

Monitoring smart money is an effective way to obtain early golden dogs and popular coins on the current chain. Everyone uses more on sols. The bull market of BSC chain has been silent for too long, and many people around them have not accumulated smart money from BSC chains. , so how should we find smart money?

First, use smart money from other chains in EVM, such as ETH chain and BASE chain, to see if the smart money on these chains is active on the BSC chain. If it remains active, it can be used directly.

The second is to use existing tools to analyze the emergence of golden dogs and find out the smart money.

1.debot

Website: https://debot.ai?inviteCode=175623

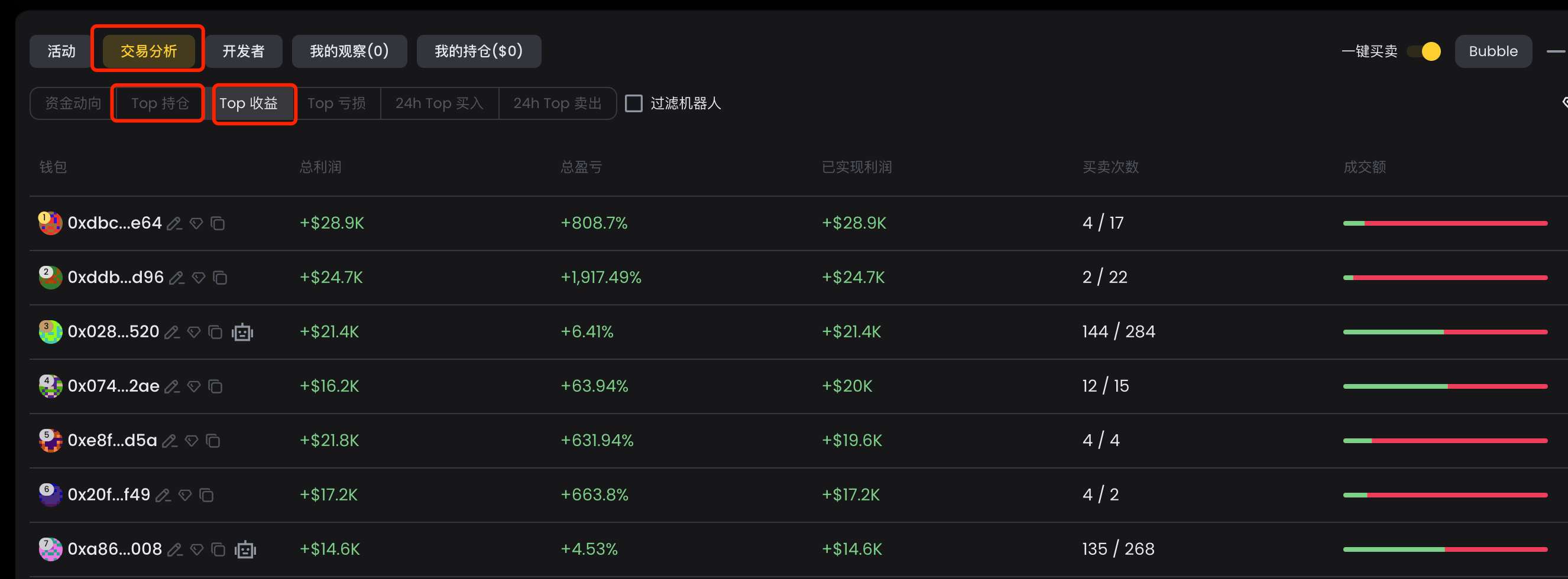

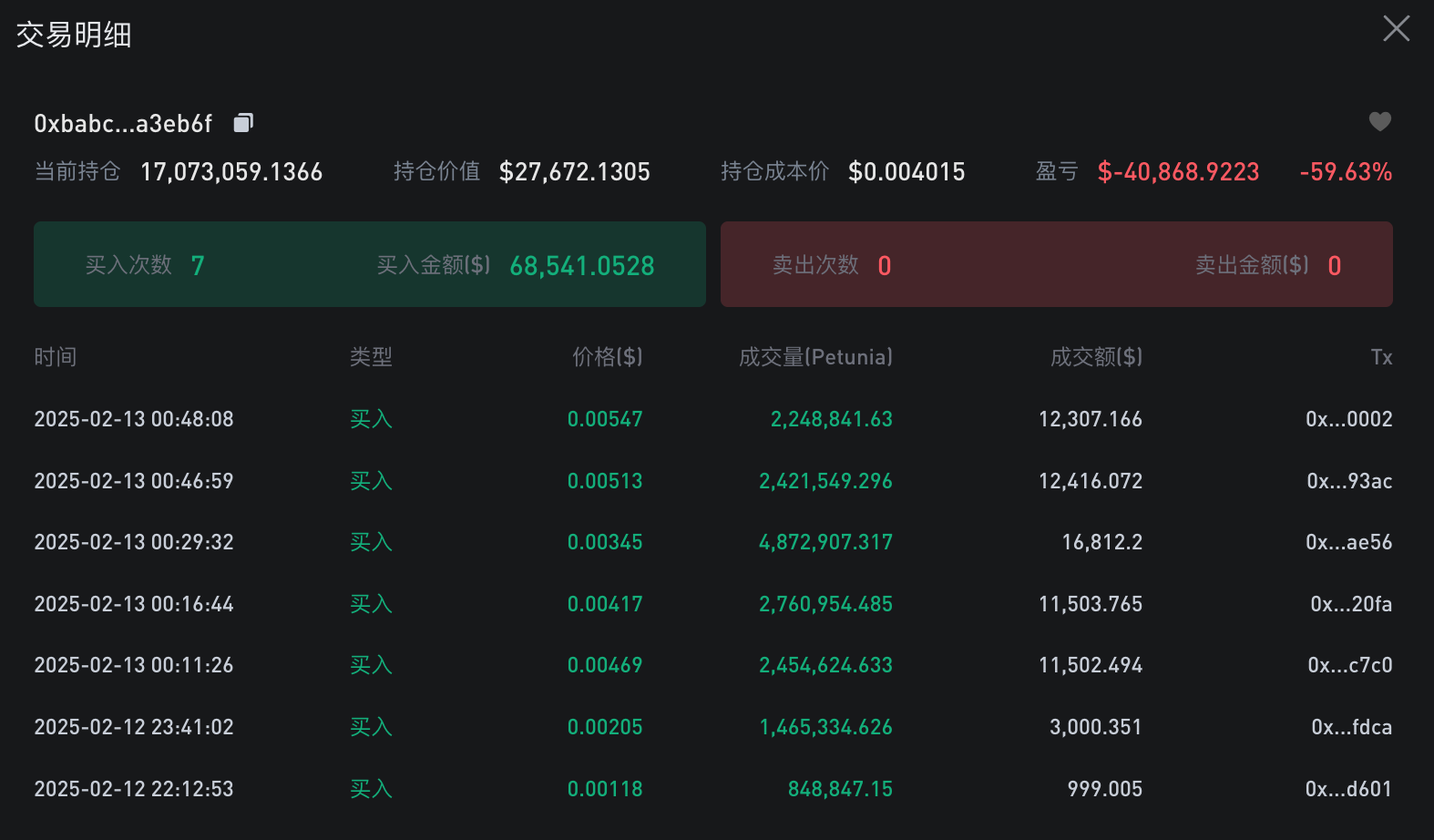

Enter the CA of the coin you want to analyze in the debot and open the [Trading Analysis] at the bottom. We focus on the two parts of [Top Position] and [Top Return]. Among them, [Top Position] is the address list of the Top 100 positions, and [Top Revenue] is the list of the most profitable addresses of the Top 100.

Click any address, and the detailed profit data and transaction records of this address will appear on the right side of the interface.

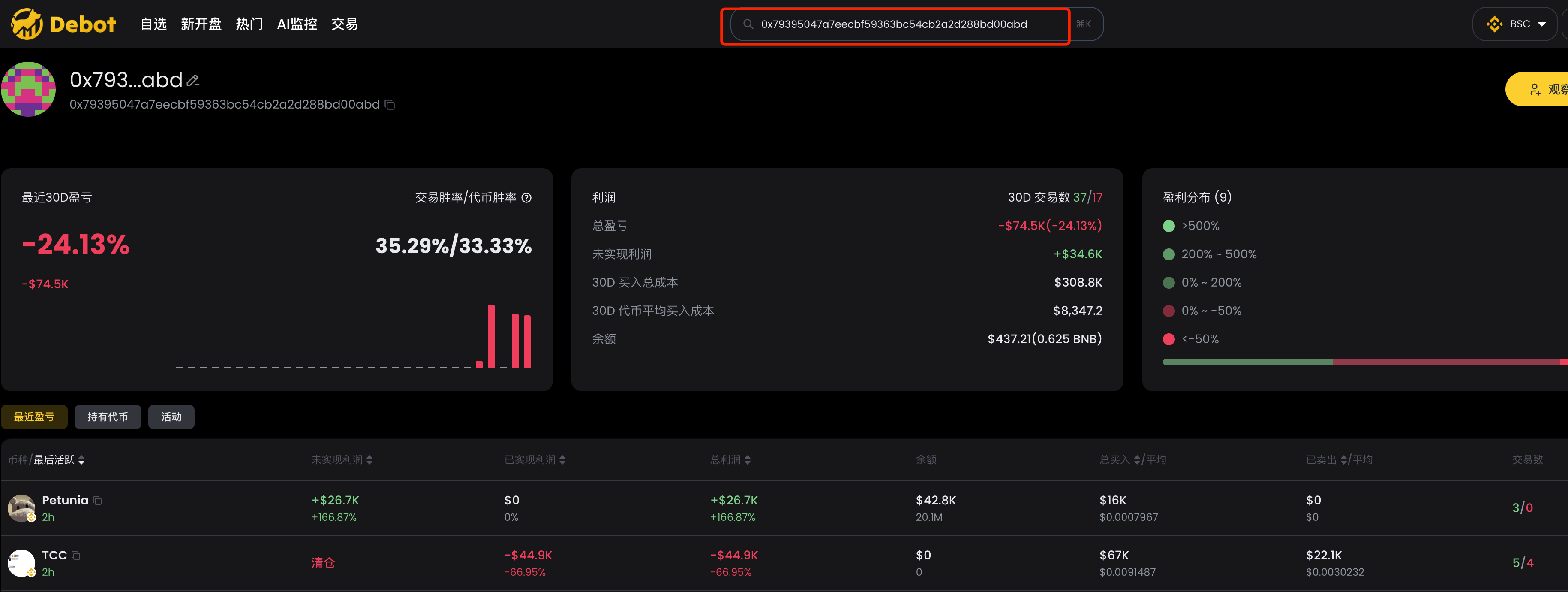

If we want to see the overall profit data, recent profit and loss, token holding, and recent transaction records of an address, we can also enter this address into the search box to see the detailed data.

2.gmgn

Website: https://gmgn.ai/?ref=sxsy7oyJ

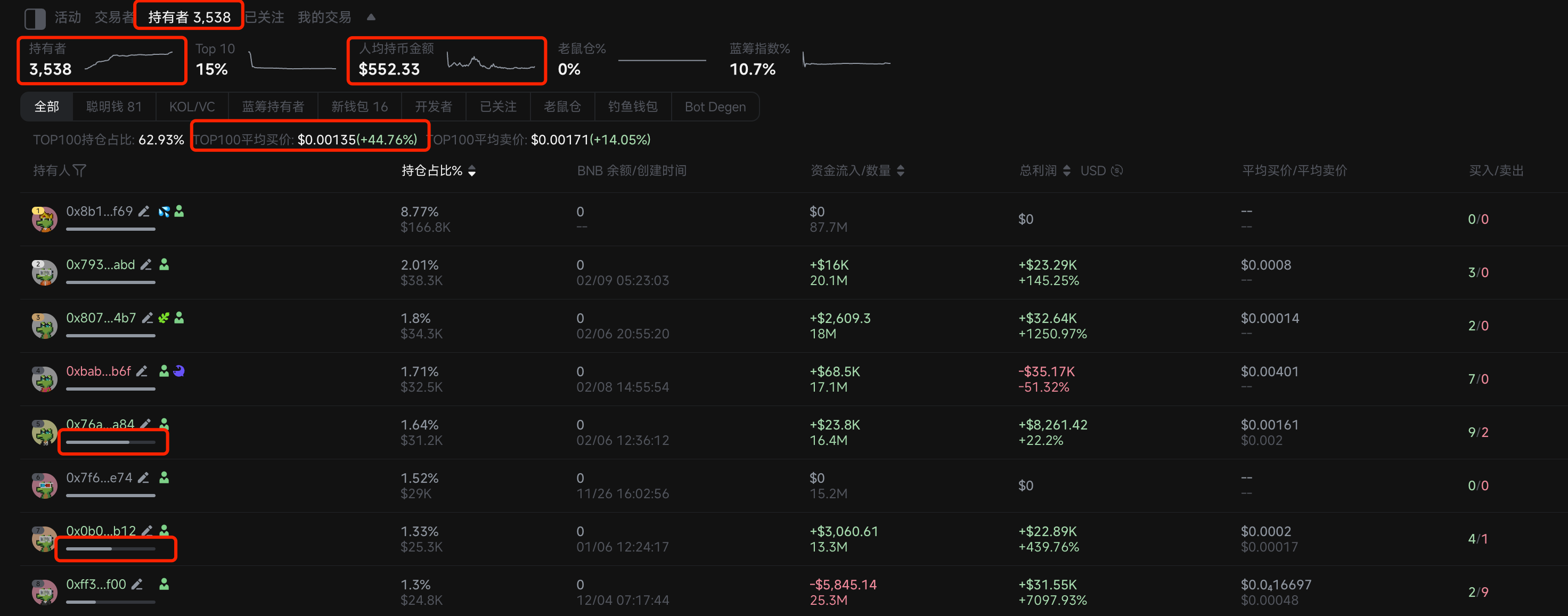

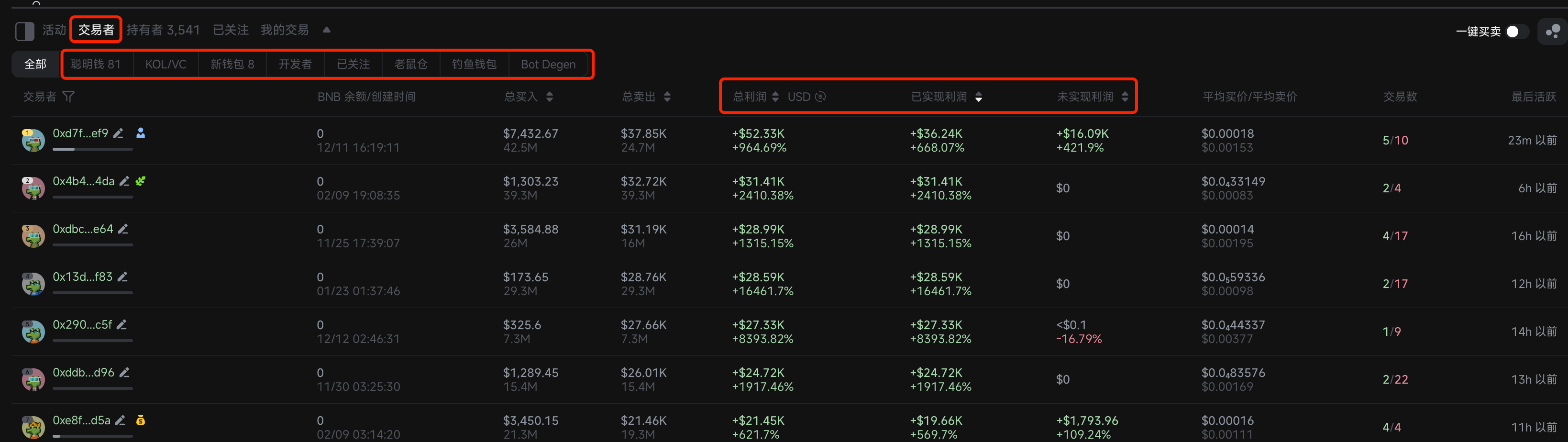

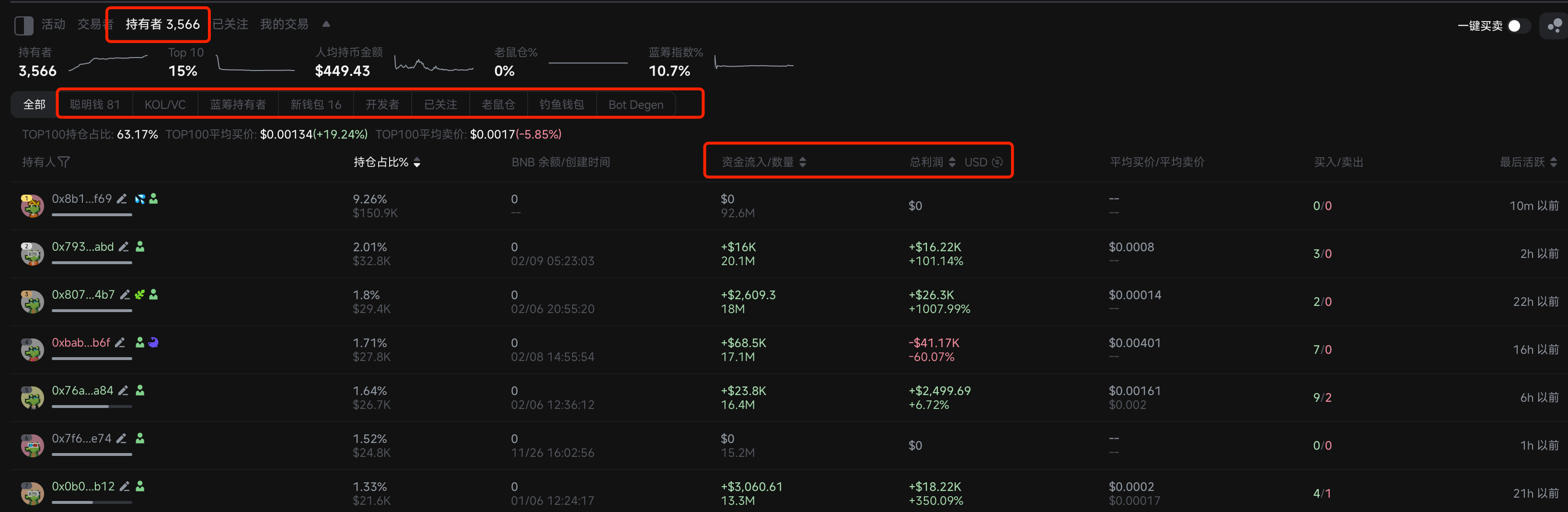

Enter the CA of the analysis coins in gmgn , and the important thing is to look at the [Trader] and [Holder] sections below.

[Trader] is the list of the top 100 most profitable addresses, including "Smart Money", "KOL/VC", "New Wallet", "Developer", "Rat Warehouse", "Fishing Wallet", and "Bot Degen" Make classification. We can sort by indicators such as "total profit", "realized profit", and "unrealized profit" to filter out smart money that meets our standards.

[Holder] is the address list of the top 100 positions, which are listed as "Smart Money", "KOL/VC", "Blue Chip Holder", "New Wallet", "Developer", "Rat Stories", and "Physical Wallet" ”, “Bot Degen” is classified. We can sort by "Fund Injection/Quantity" and "Total Profit" to filter smart money that meets the criteria.

Click any address, and the detailed profit data and transaction records of this address will appear on the right side of the interface.

At present, gmgn does not support analyzing the overall profit situation and historical data of a certain address. I hope gmgn can increase support as soon as possible.

3.ave

Website: https://ave.ai/

ave also analyzed [Position holder] and [Top trader].

[Postal holder] is a list of the top 100 holding addresses, which are also divided into "Smart Money", "DEV", and "Sniper".

When we click the filter button behind the address, we can see the profit and transaction data of this address on this currency.

[Top Trader] Currently, only the top 15 profit addresses are listed, and the data is limited.

4.Eagle

Website: https://dexscreener.com/

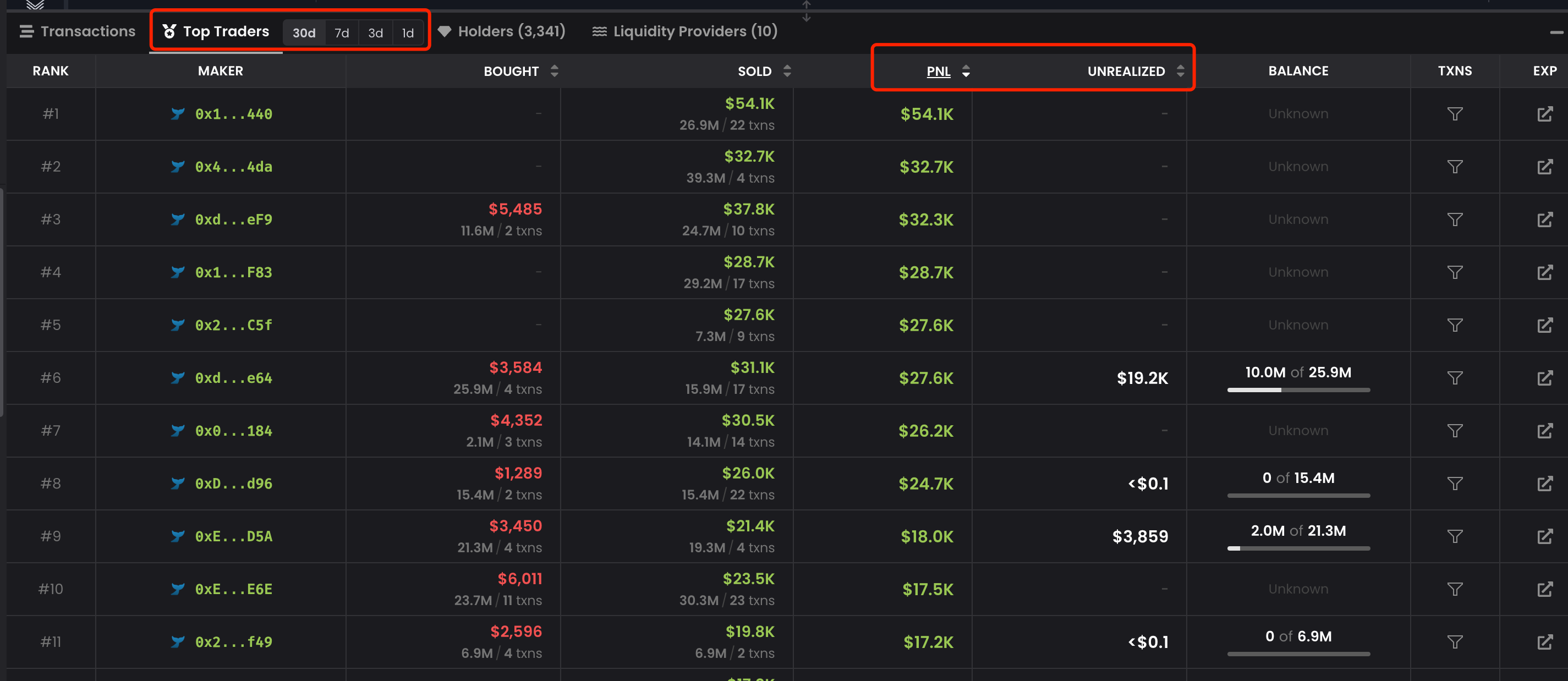

The [Top Traders] section of Eagle lists the top 100 most profitable addresses, which can be sorted by total profit and unrealized profit. The display information is limited, which is not as easy as the debot and gmgn functions.

4. Monitor smart money

With smart money, we need to monitor it so that we can know what coins these powerful people on the chain are playing. When it comes to monitoring, it is recommended to debot . debot is the most functional and finest-grained product that has been used.

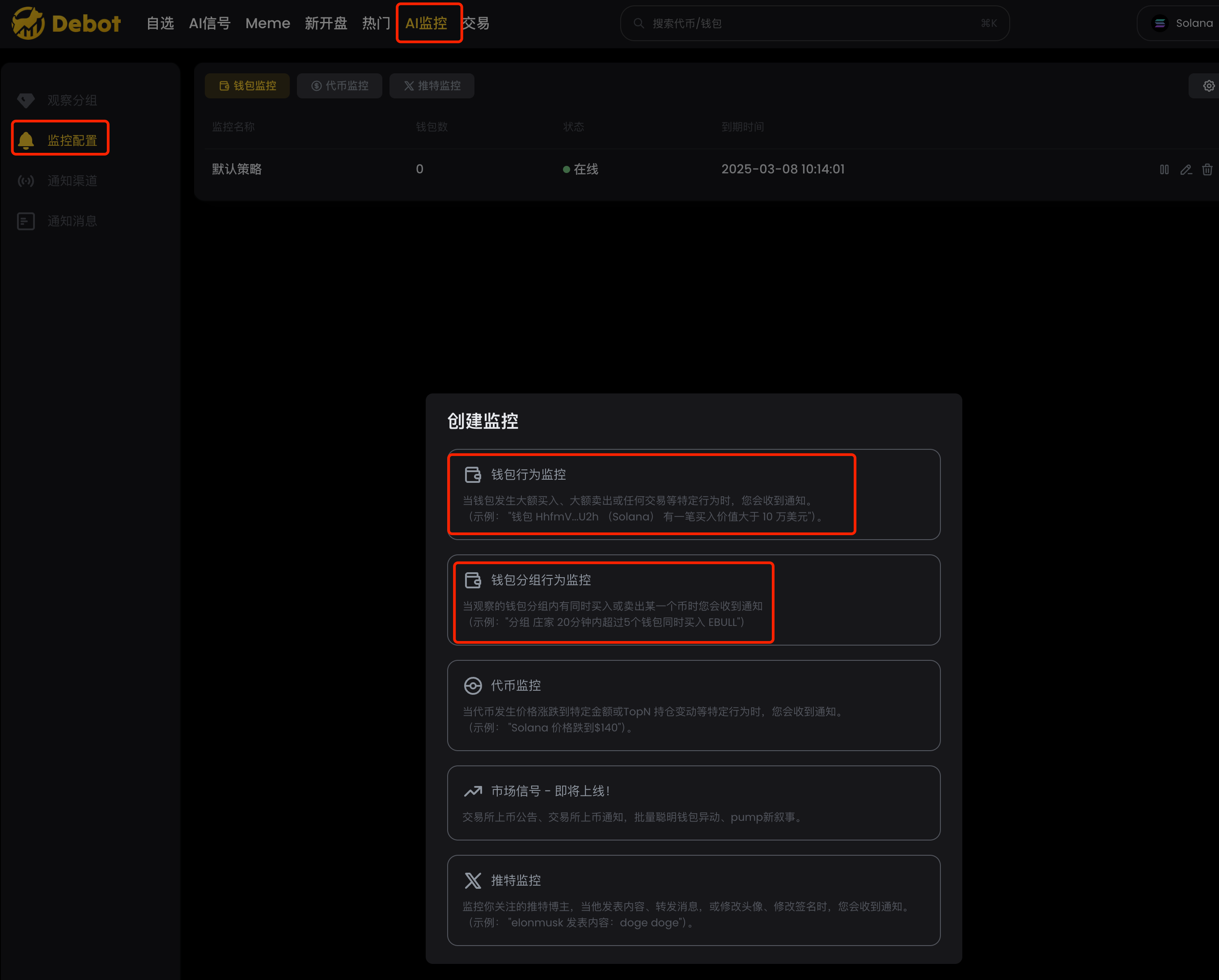

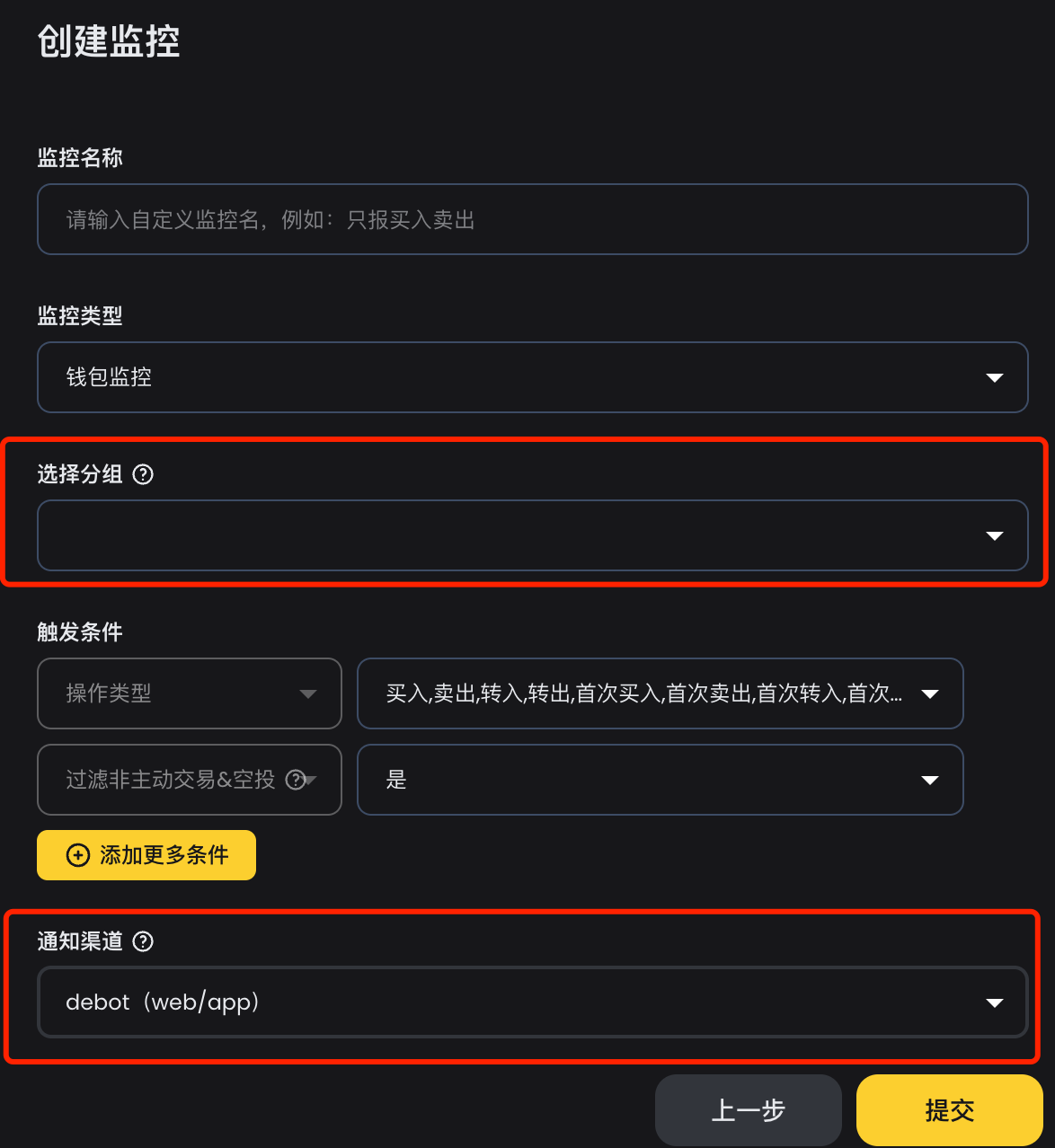

Debot 's wallet monitoring is divided into two types: wallet behavior monitoring and wallet grouping behavior monitoring, as shown in the figure

1. Wallet behavior monitoring

This monitoring is a normal monitoring that all tools have, but the monitoring of other tools is that all addresses are pushed to a tg group. The advantage of debot is that addresses can be grouped and then pushed to different tg groups according to the grouping situation, such as picture.

In this way, different tg groups can be established according to the marking situation and pushed, such as internal disk players, external disk second-level players, key attention addresses, etc. Tools that can rank monitoring information are good tools. When I used abat to monitor before, in order to achieve the effect of group push, I would first mark the address, and then do secondary development after the tg group received the monitoring message, and do secondary distribution based on the marking. Now that you have debot , you don’t need to do secondary development anymore.

2. Monitoring of wallet grouping behavior

If we monitor a lot of addresses, there is a problem that cannot be avoided: too many messages are pushed. If there are too many messages, people will want to make a mistake if they can't handle them, which will lose the meaning of surveillance. For this problem, my previous strategy was to do secondary development of the pushed messages, and set to push them when the number of different addresses reaches a certain number within a certain period of time. For example, if there are 5 different addresses to buy within 30 minutes, then Push. I have used this strategy for about a year and the effect is very good, reducing a lot of news, and not missing out on popular coins.

Debot 's wallet grouping behavior monitoring just implements my strategy, and it is done more finely and has a finer granularity of indicators, as shown in the figure. We can monitor based on buying and selling, and can set monitoring time period, transaction amount, notification frequency, and market value. It can fully meet various monitoring needs, and this feature is highly recommended.

3. Group transactions tokens and recent transactions

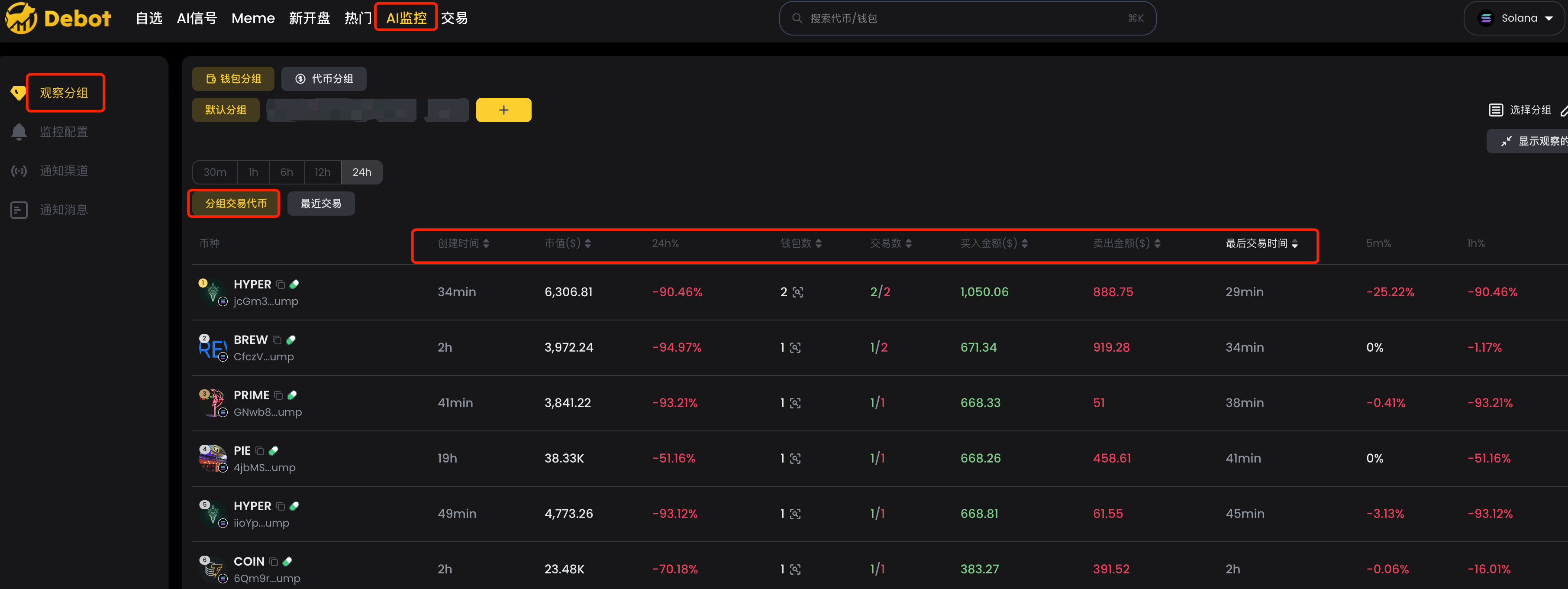

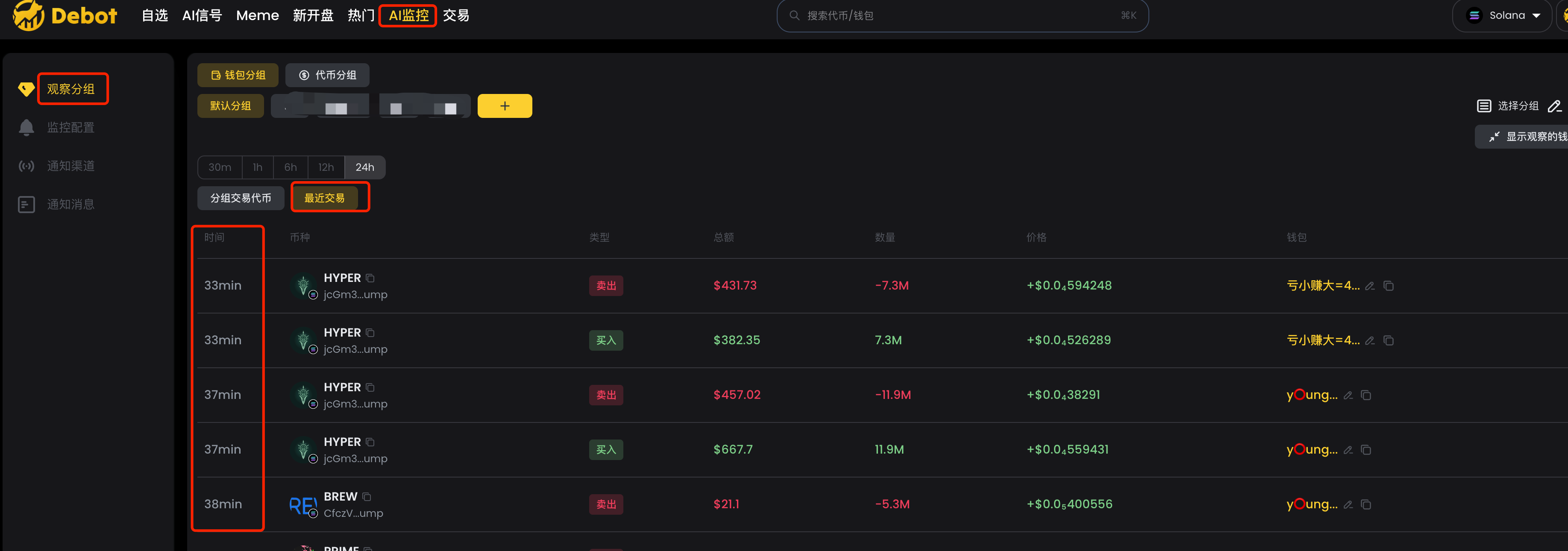

After debot monitoring imports smart money, we can view [group trading tokens] and [recent transactions] by group in [Observation group].

[Translated tokens] lists all coins traded in this group in a certain period of time, such as 24 hours, and can be filtered and sorted according to different indicators. This function is very useful when we do not focus on the real-time monitoring messages of smart money and want to know which coins these smart money have bought.

【Recent Transactions】The transaction records of smart money in this group are listed and displayed in order by time.

4. Position details and trading details

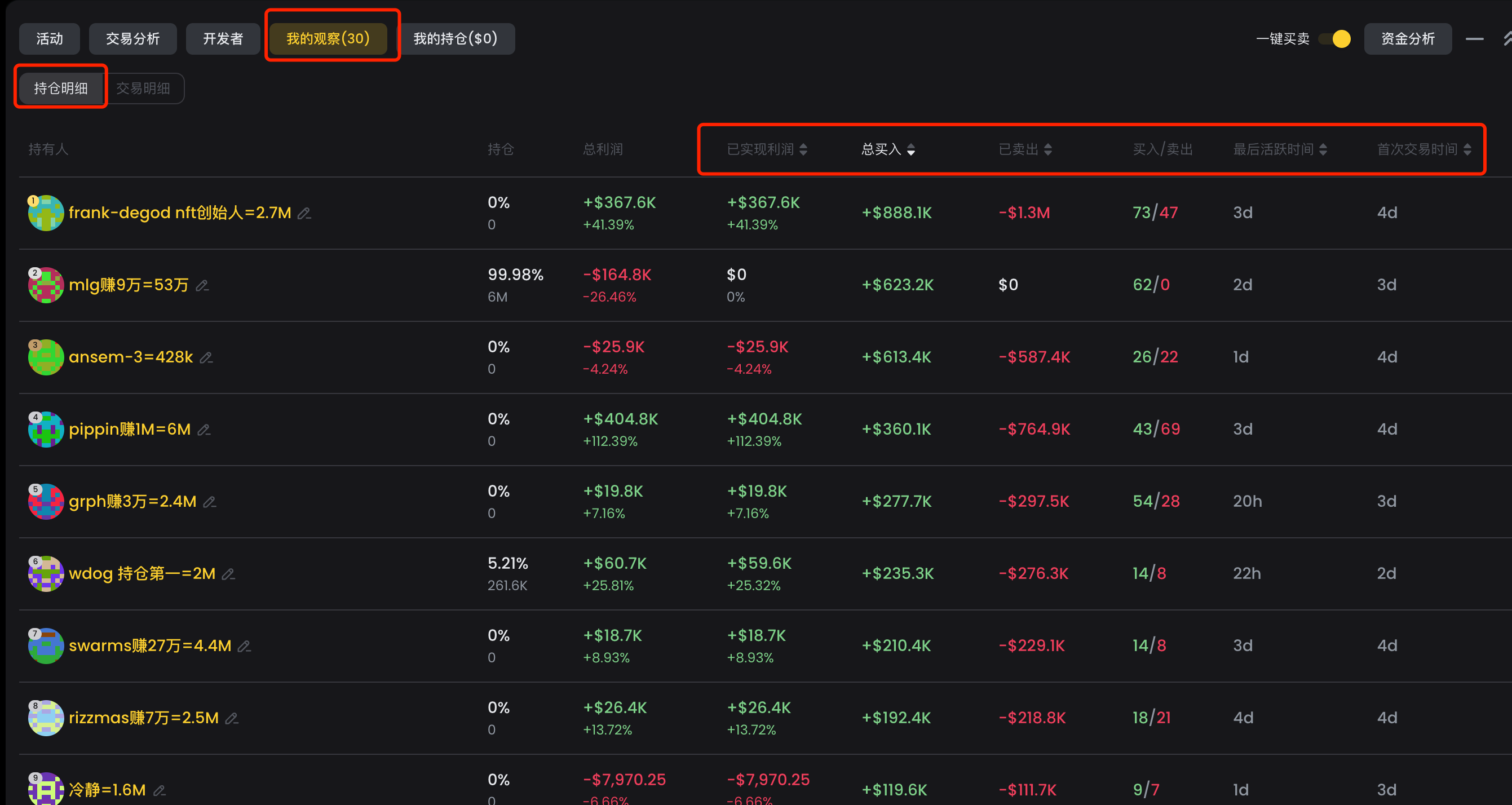

After debot monitoring imports smart money, we can see [Position Details] and [Trading Details] in the K-line page of the coin.

[Position Details] Lists all the smart money data that have been traded in this coin. They can be sorted and filtered by various indicators to facilitate us to see which smart money has been put on the bus.

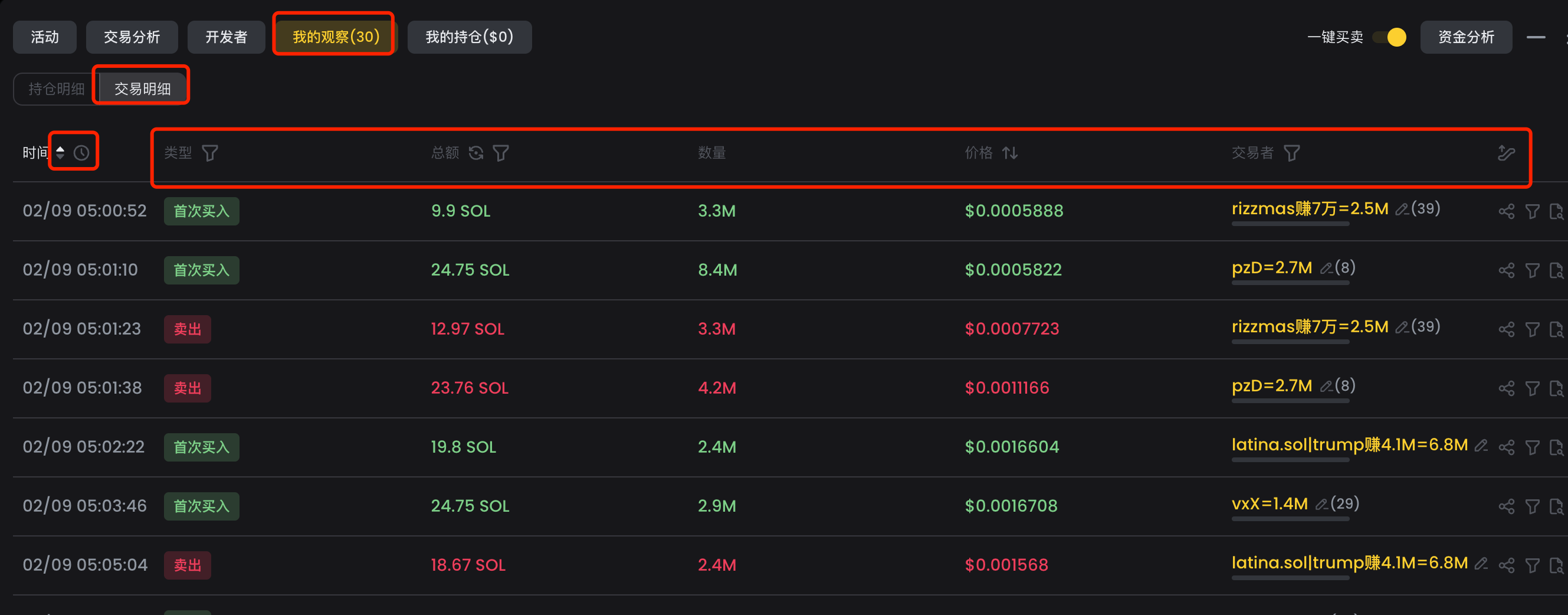

[Transaction Details] Each transaction record of all smart money trading this coin is listed in chronological order, either in a positive order or in reverse order. In this way, when we want to know which address of our smart money is the first to buy this coin, we can sort it in positive order. The first transaction is that this function is very practical and can filter out the fastest smart money.

5. Safety inspection tools

One big problem with EVM chain is that it is easy to encounter Pixiu, and it is a must to perform safety inspections before buying. These are the common safety inspection tools.

1. goplus

Website: https://gopluslabs.io/token-security

goplus is a security check tool that appeared in the last bull market, Binance Labs investment. At present, many tools are connected to the Goplus function, which can be used in the web version or plug-in, and also provides security check APIs to the outside world. If you write scripts and run strategies, you can consider APIs.

2. honeypot.is

Website: https://honeypot.is/

honeypot.is was quite popular in the last bull market and was more accurate in safety inspections. It also has APIs.

3. tokensniffer

Website: https://tokensniffer.com/

tokensniffer is also an old-fashioned security inspection tool.

Because there are many routines on EVM, there are all kinds of pits and variants of Pixiu, and multiple tools can be used together to prevent losses due to the problems of a single tool.

VI. Transaction

BSC Chain was very popular in the last bull market. Many trading tools used at that time have stopped updating now. Fortunately, more trading tools have appeared now. Here are a few popular tools.

URL: https://universalx.app/user/x/0x_zibu?inviteCode=E8LJSP

UniversalX is an on-chain CEX that can be traded with the balances of all chains. You can trade when there are usdt, usdc, eth, btc, and sol in the account. Currently, it supports regular buying and selling, and will add functions such as internal trading and limit orders in the future.

The advantage of UniversalX is that it can trade coins on 15 chains after a chain-independent and basic token, which is particularly useful when other chains do not have coins and exchange cards withdraw cash. In addition, UniversalX 's line-based speed and trading speed are very fast, automatic anti-pinching, and support mobile terminals, making trading on mobile phones very convenient.

In addition, UniversalX 's transaction fee for mainstream coins has been reduced to 1,000, which is consistent with CEX, including $AI16Z, $Fartcoin, $ARC , $AIXBT , $TST, etc.

Because of Binance Labs investment, they expect to issue coins this year. Trading on UniversalX is equivalent to making interactions and there is an expectation of airdrops.

2.debot

Website: https://debot.ai?inviteCode=175623

Debot 's transactions support BSC chains, currently support basic buying and selling, and subsequently prepare for anti-clip function. One advantage of using debot trading is that it can display all the pools of the current currency. This function currently shows the most comprehensive display of debot , which makes it convenient for us to choose different pools for trading.

debot has a mobile terminal, which can facilitate and fast transactions.

3.gmgn

Website: https://gmgn.ai/?ref=sxsy7oyJ

gmgn already supports BSC chains and currently supports basic buying and selling. The advantage of using gmgn is that it can easily utilize its data analysis function, and the basic data of the holder is displayed very clearly.

gmgn supports mobile terminal.

4.OKX

Website: https://www.okx.com/zh-hans/web3

okx is a large platform, which supports basic buying and selling on a regular basis, supports MEV protection, and can be anti-clip. The meme mode supports BSC Qingling pickup, which can be bought and sold quickly, and can also preset parameters. The advantage is that it covers multiple platforms and supports web, plug-in and mobile.

5.PinkPunk

Link: https://t.me/PinkPunkTradingBot?start=ref_8CEB8FBBC7EE9B050033

Pink Pig is an old-fashioned TG bot that supports multiple chains. The advantage is that in addition to achieving basic trading, it also supports orders and sniping, and the speed is relatively fast.

jinse

jinse

chaincatcher

chaincatcher