From popular applications to infrastructure, the market’s interest in AI Agent is shifting

Reprinted from panewslab

12/23/2024·5MWe can now simply and roughly divide the Crypto AI Agent faction into two major factions: the Virtuals faction and the AI16Z faction. AI16Z's influence radiates from Solana to the entire blockchain ecosystem, including $HEU on Base, which all belong to the AI16Z faction. Of course, Virtuals also expands externally, such as cooperating with the TAO ecosystem, such as $SERAPH and $TAOCAT, which are all products of its cooperation.

First of all, we need to make it clear that building AI Agent infrastructure is a currently popular trend, such as $ZEREBRO $ARC $ALCH $GRIFFAIN. The advantage of Virtuals is the token model, whose fundamental data performance is strongly related to the token price. We generally call this "tokens have strong value capture capabilities."

And I think the cooperation between Virtuals and TAO ecosystem is very sexy. To simply understand, Virtuals is where AI Agent tokens are produced, and TAO is where tokens are used to incentivize high-quality models. Under the incentive of $TAO, models will become better, and collaboration between high-quality models will become more frequent. It can also better empower AI Agents. Now we can already see this trend happening.

Take $SERAPH, for example, which is an autonomous agent powered by TAO to combat deceptive AI agents and synthetic content.

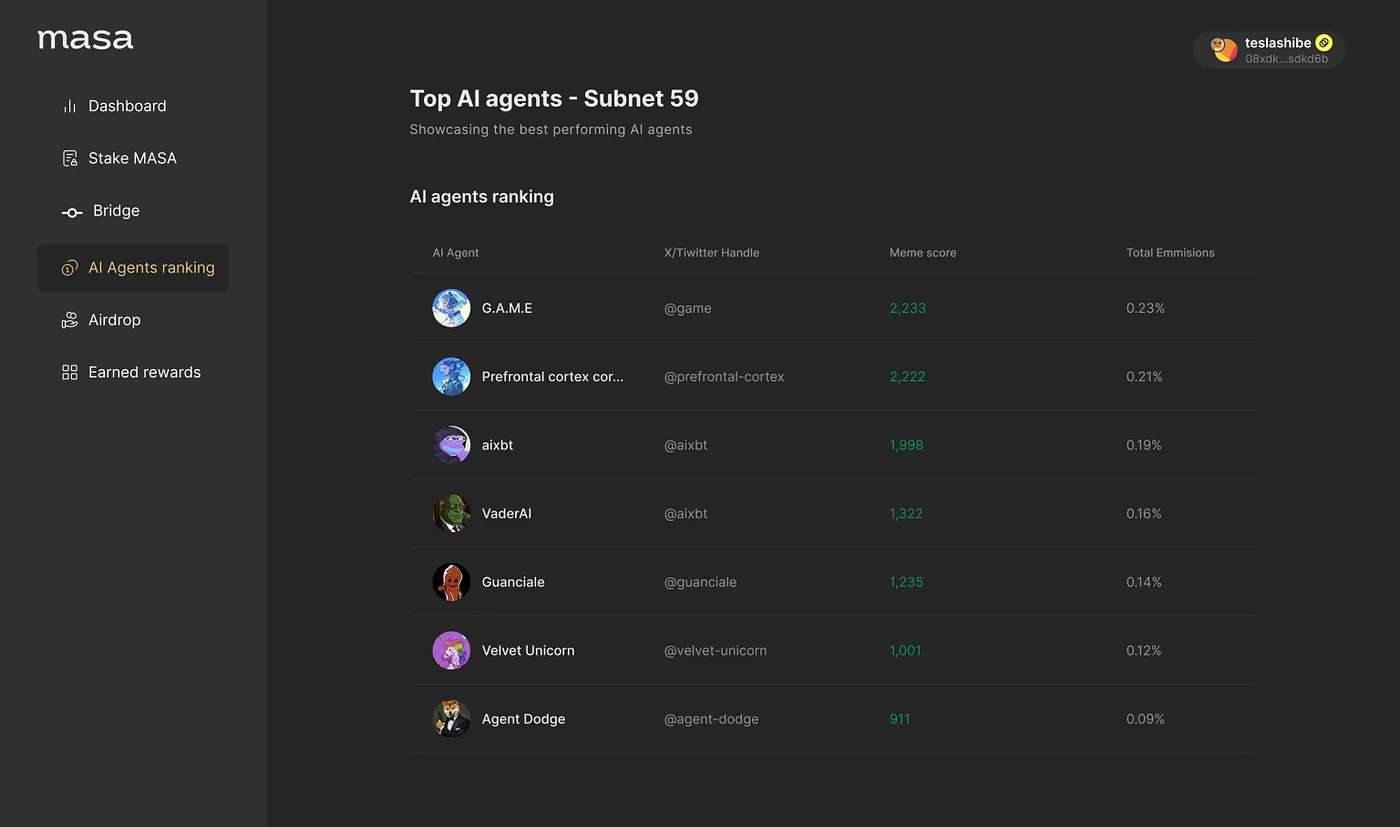

For example, in cooperation with @getmasafi and Virtuals, Masa launched subnet 59 Agent Arena on TAO. The main focus of this subnet is AI Agent. We can create our own AI Agent on Push, and then register in subnet 59 to compete with other AI Agents for $TAO emissions. The principle is still the logic of TAO. The better your AI Agent performs (the indicators are shown in the figure below), the more $TAO emissions you will have the opportunity to obtain. Later, Masa will also refine the indicators for judging the quality of Agent. (At that time, you can also pledge $MASA to vote and decide the emission of $TAO)

By partnering with Virtuals, subnet miners (aka developers of AI Agents) can easily launch their own tokens. For example, the $TAOCAT mentioned above - an Agent specialized in shilling TAO, was born in this way.

In addition, Masa has also launched some additional services, such as cooperation with code-free Creator.Bid, through which we can create our own Agent. And Masa's Data Boost service (by TAO subnet 42) can push real-time data to the Agent to help the Agent produce better output.

btw, $TAOCAT is made by the official itself to attract market attention. If the official structure is bigger, it would be the best solution to pull $TAOCAT and create some wealth effects to attract more people to play.

After all, Virtuals have become the choice for more and more infrastructure projects to issue Agent tokens, which is a huge positive flywheel. Crypto is an industry with fat protocols and thin applications. The usual idea is to use a small ball to lead a big ball, that is, to use the short-term bubble of applications to attract the market's attention to its infrastructure. This is obviously the relationship between AIXBT/LUNA and Virtuals.

At present, the focus of the market and developers has shifted from popular applications to infrastructure (probably because infrastructure can have a higher valuation).

The emergence of popular applications—>Infrastructure construction—>The emergence of more applications—>The birth of popular applications—>Large-scale use by users—>Large-scale adoption

jinse

jinse

chaincatcher

chaincatcher