From decentralized GPU to AI Agent, review the narrative evolution of the 2024 encrypted AI track

Reprinted from panewslab

12/30/2024·4MAuthor: Grapefruit, ChainCatcher

Editor: Nian Qing, ChainCatcher

In 2024, the "Crypto+AI" (encrypted AI) field achieved unprecedented breakthrough growth. At the beginning of the year, this field consisted of only a few projects, but now it has become an independent track that cannot be ignored in the encryption market.

According to the latest data compiled by ChainCatcher, the total asset market value of the crypto AI sector has exceeded the US$70 billion mark on December 7, accounting for the highest proportion of 2% in the entire crypto market, and the annual growth rate has reached 400%.

At the same time, the number of encrypted AI projects has also shown explosive growth, currently exceeding 600, covering multiple categories of products such as decentralized AI infrastructure and AI Dapps.

Looking back on 2024, the crypto AI narrative has undergone several major changes. At the beginning of the year, OpenAI launched the Sora project, which ignited a wave of hype for crypto AI infrastructure. Subsequently, the convening of the NVIDIA AI annual conference pushed decentralized GPUs into the focus of market attention, and investors began to pursue AI decentralized infrastructure. In the middle of the year, the crypto AI track ushered in an investment boom. Crypto VC institutions announced their plans one after another. Many crypto projects received financial support, accelerating the development and application of technology. At the end of the year, the outbreak of AI Agent Meme pushed the narrative of encrypted AI to a new climax.

The total market value of encrypted AI assets exceeded US$70 billion this

year, and the number of related projects exceeded 600

According to the latest data from CoinMarketCap, the number of tokens included in the cryptoartificial intelligence (Crypto*AI) sector has reached 355, and its total asset market value has exceeded the US$70 billion mark on December 7, with the peak reaching a peak of US$70.42 billion. Currently, affected by the current correction trend of the overall crypto market, as of December 23, the total market value of the crypto AI sector has fallen back to US$47 billion, and the 24-hour trading volume is still as high as US$5 billion.

Looking back at the beginning of the year, the total market value of assets in the crypto AI sector was only $17 billion. In less than a year, the total market value of assets in this sector has increased by more than 400%, once again demonstrating the vigorous development and huge potential of the crypto AI field.

Daniel Cheung, co-founder of Syncracy Capital, expressed his opinion on December 12, pointing out that although the current encryption AI sector only accounts for about 1% of the total market value of the encryption market, as the market cycle continues to evolve, the strong momentum of AI infrastructure and AI Agents , he predicted that the market value of this sector is expected to increase by 10 times.

It is worth mentioning that despite the current overall decline in the crypto market, the total market value of the entire crypto market reached US$3.4 trillion on December 23, and the market value of crypto AI assets still accounted for nearly 1.4% of the entire market at this time. (The market value accounted for more than 2% at its peak), further proving its future market growth potential.

2024 can be said to be a key turning year for the field of encrypted AI to move from emerging to full-scale explosion. At the beginning of the year, the encrypted AI track was still in its infancy, with only a handful of projects, mainly represented by the decentralized GPU project Render (RNDR), AI infrastructure Fetch.ai (FET), and WorldCoin. However, in less than a year alone, the field of encrypted AI has been divided into multiple subdivided tracks, covering decentralized GPU, AI data platform, AI infrastructure, AI Agent and other branch tracks, with hundreds of projects. indivual.

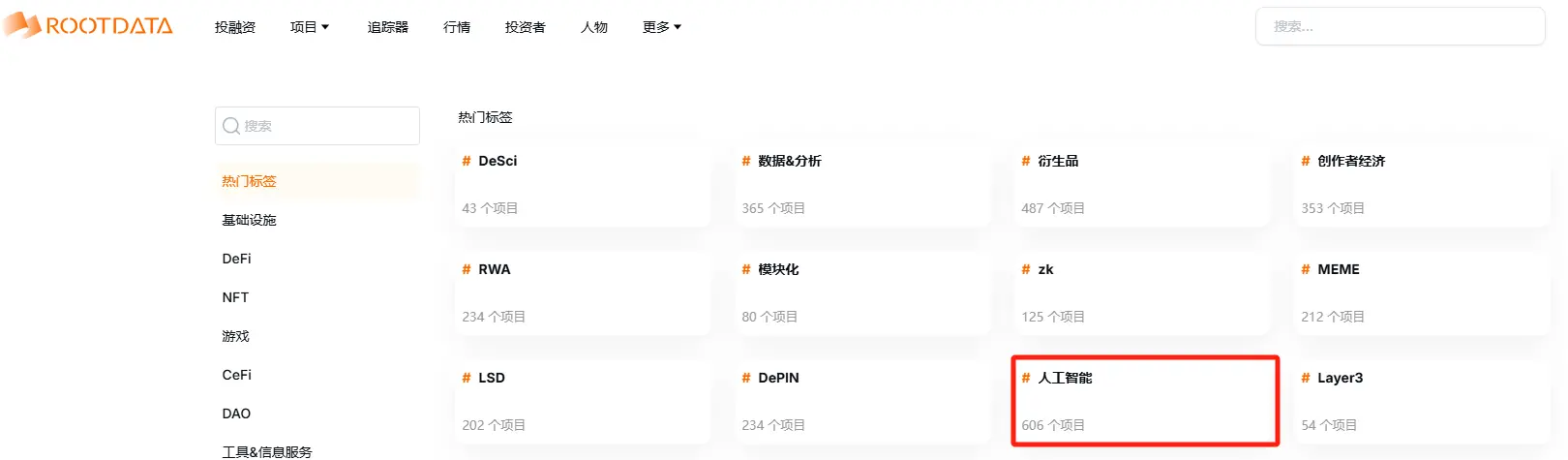

According to the encryption data platform Rootdata, there are currently more than 600 encryption projects containing AI entries, and this number continues to increase.

2024 Crypto AI Catalyst: OpenAI narrative and other external forces, VC

vigorous layout, AI Agent Meme explosion

Judging from the data trend of the total market value of encrypted AI assets, the growth in 2024 will show two significant peaks: the first peak appeared between February and March, and the second peak occurred after October, ushering in a stronger growth trend.

Between February and March, the growth of the crypto AI field was mainly due to the strong stimulation brought by two landmark events in the AI field.

In February, OpenAI shockingly released Sora, a large model of "Vincent Video". This breakthrough achievement set off a disruptive change in the field of AI. At the same time, the incident also greatly promoted the price surge of the token WLD of Worldcoin, an iris authentication encryption project led by OpenAI founder Sam Altman, which in turn led to strong growth in the entire crypto AI asset sector. During this period, high-quality projects such as the AI model incentive platform Bittensor (TAO) and the AI data platform Arkham's ARKM began to receive widespread attention from the market. The rise of these projects further ignited investment enthusiasm in the encrypted AI market and attracted a large number of investors. enter this emerging field full of potential.

Immediately afterwards, the grand convening of NVIDIA's annual AI conference GTC in March once again attracted widespread attention around the world and pushed its market value to soar, triggering a wave of GPU chip speculation. At the meeting, the appearances of crypto industry leaders such as Near co-founder Illia Polosukhin and distributed GPU rendering network Render Network founder Jules Urbach once again injected new vitality into the crypto AI field. This series of events led to the mushrooming of concept projects such as decentralized GPUs. Among them, the once popular decentralized io.net was founded at this time.

Since then, encrypted AI has officially developed into an independent track, and projects such as AI infrastructure, decentralized GPU, and decentralized AI data have sprung up like mushrooms after a rain, bringing more choices and opportunities to the market.

In October, the growth of the encrypted AI field was mainly attributed to the explosion of AI Agent Meme. The emergence of the AI Agent project’s Truth Terminal token GOAT triggered a wave of coin issuance hype for the AI Agent Meme project and promoted the batch issuance of nearly a hundred AI Agent Meme coins. This trend has led to the rapid rise of AI Agent and has grown into an independent segment in the field of encrypted AI. Its products include AI Agent Meme Coin, AI Agent Issuance Platform (IAO) and AI Agent underlying infrastructure, etc. Specific projects can be viewed ChainCatcher released "Systematic Combination of AI Agent Track: AI Meme, Release Platform and Infrastructure" in November. According to Coingecko data, as of December 23, the total market value of AI Agent track tokens has reached US$9.8 billion, accounting for approximately 20% of the total market value of the entire encrypted AI track project (US$47 billion), and the hype continues.

If the Vincentian video tool Sora launched by OpenAI, the rise in Nvidia's market value and its AI summit, etc., constitute a strong external driving force for the development of the encrypted AI field, then the explosive growth of AI Agent Meme is undoubtedly a ignition within the encryption market. Setting the fire has accelerated the rise of this field. Under the combined effect of internal and external dual catalytic effects, the crypto AI track has quickly become a key area that cannot be ignored in the crypto world, and its importance is becoming increasingly significant.

In addition, in 2024, the encrypted AI market will usher in an unprecedented investment boom, with major investment institutions rushing in and the amount of investment rising sharply. In this field, top venture capital institutions in the encryption industry such as Grayscale, Delphi Venture, Coinbase Ventures, Binance Labs and a16z have actively deployed "Crypto+AI" projects.

Among them, Delphi Ventures stated at the beginning of the year that it was highly optimistic about the combination of Crypto and AI, and has invested in a number of related projects, such as io.net, OG Labs and Mythos Ventures. a16z has raised a new fund of US$6 billion, focusing on investing in the field of AI, and selected 5 crypto AI projects in its autumn crypto startup accelerator. Entering the second half of the year, institutions such as Pantera Capital, Grayscale, Binance Labs and Coinbase Ventures have also announced their entry into the field of encrypted AI, setting up special funds or increasing investment. According to a report released by Messari, crypto venture capital institutions injected more than $213 million into AI projects in the third quarter of 2024, a 250% month-on-month increase and a year-on-year increase of 340%.

The market prospect of “Crypto for AI” is greater than that of “AI for

Crypto”

Currently, encrypted AI products on the market can be mainly divided into two major forms: "AI for Crypto" and "Crypto for AI".

The former "AI for Crypto" uses AI to empower Crypto, mainly focusing on applying AI technology to encryption products, and integrating AI elements to improve user experience or enhance product performance. For example, using AI code optimization and security auditing: AI technology can automatically detect and analyze the code of Web3 projects, discover potential security vulnerabilities and errors, and improve the security and stability of the project; participate in on-chain revenue strategies: use AI algorithms to analyze market trends and user behavior, develop more efficient on-chain revenue strategies to help crypto users obtain higher returns; integrate AI chatbots to answer user questions and improve user experience; use AI Agent to eliminate obstacles in the on-chain user experience, such as automated transactions , asset management, etc., allowing users to participate in the encryption market more conveniently.

"Crypto for AI" focuses on using encryption technology to empower the AI industry and using the unique advantages of blockchain technology to solve or improve certain aspects of the AI industry. For example, the privacy and transparency of blockchain technology can solve the privacy and security issues of AI models in the process of data collection, processing and storage; through the use of model assetization, the community can own or use AI models in a decentralized manner. ; Aggregate idle computing power resources through blockchain Token technology to form a computing power market, reduce the cost of AI model training, and improve the utilization efficiency of computing power resources.

To sum up, the essence of Web3 technology lies in its decentralized blockchain infrastructure. It relies on the operation of the Token economic system, the autonomous execution of smart contracts and the powerful performance of distributed technology. It not only ensures the precise definition of data ownership, It also uses Token’s incentive model to greatly improve the transparency and efficiency of the business model. This feature is like a good medicine, providing an effective solution to the common problems in the AI industry such as opaque data and ambiguous business models. This fits perfectly with the macro concept of "AI aims to improve production efficiency, while Web3 focuses on optimizing production relationships."

Therefore, people in the industry generally reach a consensus: "Crypto for AI" shows broader prospects and potential at the market application level than "AI for Crypto". This trend has also prompted more and more AI industry insiders to actively seek to use encryption technology to overcome various challenges and problems faced by the AI industry.

Create an encrypted AI ecosystem around the three AI elements of "data,

computing power and algorithms"

Based on the three core elements "data, computing power and algorithms" that drive the development of AI large models, we can further subdivide it into data, computing power and algorithm model products covering infrastructure and applications. Among them, data is the basis for training and optimizing AI models; algorithms refer to the mathematical models and program logic that drive AI systems; computing power refers to the computing resources required to execute these algorithms, and these three elements are also necessary for continuous model updates and iterations. condition.

Specific product forms within the encrypted AI product ecosystem include the following aspects:

At the data level, the encrypted AI data project covers data collection, storage and processing. First of all, in terms of data acquisition, in order to ensure the richness and diversity of data, some encrypted AI projects use the Token economic mechanism to encourage users to share their private or proprietary data. For example, the Grass project encourages data providers through a reward mechanism, and Sahara AI capitalizes AI data and launches a specialized data market. Vana provides specialized or customized data sets for AI applications in the form of data pools; in terms of data processing, the decentralized data annotation platform provides developers with Contributed high-quality training data sets to improve the reinforcement learning and fine-tuning mechanisms of AI models, such as Fraction AI (completed US$6 million in financing on December 18), Alaya AI and Public AI, etc., provide developers with high-quality training data sets, thereby optimizing the reinforcement learning and fine-tuning process of AI models. As for data storage, solutions such as Filecoin and Arweave ensure data security and durability.

In terms of computing power, the training and inference execution of AI models cannot be supported by powerful GPU computing resources. As the complexity of AI models increases, the demand for GPU computing resources is also rising. Faced with challenges such as the shortage of high-quality GPU resources in the market, rising costs and extended waiting times, the decentralized GPU computing network emerged as the times require. By creating an open market and GPU aggregation platform, these networks allow anyone (such as Bitcoin miners) to contribute their idle GPU computing power to perform AI tasks and receive rewards through Tokens. Representative projects include Akash, Render, Gensyn, io .net and Hyperbolic, etc. In addition, projects such as Exabits and GAIB tokenize physical GPUs and convert them into financial digital assets on the chain, further promoting the decentralization and liquidity of computing power.

At the algorithm model level, the decentralized AI algorithm network currently on the market is essentially a decentralized AI algorithm service market, which connects many AI models with different expertise and knowledge. When a user asks a question, the marketplace is able to intelligently select the most appropriate AI model to provide an answer. Representative products such as Bittensor, which brings together various AI models in the form of subnets to output high-quality content for users; and Pond, which selects the best decentralized models through competition points and integrates AI models Tokenization incentivizes each model contributor, thus promoting the innovation and optimization of AI algorithms.

From this point of view, currently, the encryption market has built a flourishing encryption AI ecosystem around the three pillars of AI: "data, computing power and algorithms".

What are the benefits of the encrypted AI track in 2025?

However, since the AI Agent Meme market became popular in October, AI Agent-related products have become the new favorite in the crypto AI market. For example, projects such as Talus Network, which announced in November that it has completed a US$6 million financing with US$150 million, are officially built specifically for AI Agents. Build framework and infrastructure.

In addition, the craze of AI Agent Meme has not only ignited new hot spots of speculation in the encrypted AI track, but also prompted the market to gradually shift the focus from the original decentralized data, GPU and other infrastructure areas of the encrypted AI track to The enthusiasm for AI Agent applications, such as ai16z, has exceeded US$1 billion in market value, and this craze continues to heat up.

In the recent 2025 encryption industry trend outlook released by many institutions, a16z, VanEck, Bitwise, Hashed, Blockworks, Messari, Framework and other institutions have expressed their optimism about the development of the encryption and AI market, and specifically pointed out that AI Agent related products will be launched in 2025. Year of explosive growth.

At the same time, the popularity of the external AI field continues to rise. On December 23, Elon Musk’s AI company xAI announced that it had completed another $6 billion in new financing, and its valuation soared to $40 billion, further promoting the prosperity of the AI market.

At the narrative level, OpenAI is undergoing a transformation from GPT to general artificial intelligence agent AI Agent. It is reported that OpenAI plans to launch a new AI Agent product "Operator" in January 2025. This product can automatically perform complex operations such as writing codes, travel bookings, and e-commerce shopping. It is expected that it will once again detonate AI just like Sora in early 2024. market. In addition, Nvidia’s annual AI Summit will also be held in March 2025, which is also the focus of the encryption and AI industries.

Every major model upgrade by Web2 companies in the AI field such as NVIDIA and OpenAI will ignite the hot spot in the AI track, attract an influx of new funds, and further detonate the encrypted AI track.

At the policy level, U.S. President-elect Trump has announced the appointment of former PayPal executive David O. Sacks as the White House head of artificial intelligence and cryptocurrency affairs, responsible for guiding the government’s formulation of artificial intelligence and cryptocurrency. policy in the field. This person has dual investment experience in the encryption and AI industries, and has participated in investments in many encryption companies and AI companies such as Multicoin. Naturally, it is believed that the policies he formulates will promote the integration of encryption and AI.

chaincatcher

chaincatcher